- Dollar trades quietly as traders brace for nonfarm payrolls week

- Wall Street powers higher, oil takes a hit after soft Chinese PMI

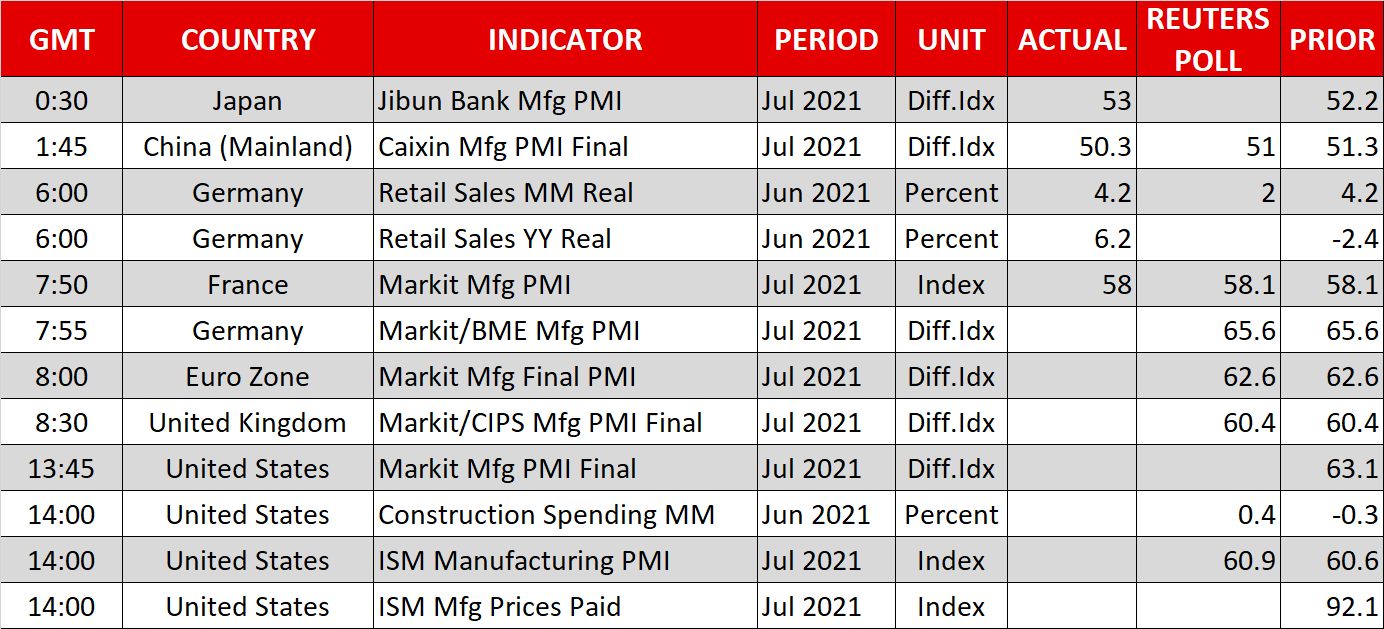

- ISM manufacturing index and RBA rate decision coming up

Dollar stabilizes as Fed aftershocks fade

The world’s reserve currency took a hit last week after the Fed chief reassured investors that rate increases were still far away and that the labor market still hasn’t recovered properly. Markets interpreted Powell’s patient tone as diminishing the chances for a tapering announcement in August, with real US yields melting down to new record lows in the aftermath.

That said, the overall message wasn’t as dovish as the market reaction would lead someone to believe. The Fed highlighted that the economy has made progress towards its goals and Powell even said that “we are clearly on a path to a very strong labor market”. He also played down the Delta variant as being a major risk.

The bottom line is that August may be too early for a tapering announcement but the Fed is still on track to deliver that shift soon, perhaps by September. By then, the central bank will be able to examine another two employment reports and Congress could deliver a new round of infrastructure spending.

This narrative will be put to the test this week, when the latest US jobs numbers hit the markets Friday.

US back to full employment this year?

The US economy is missing some 6.7 million jobs for a full recovery but almost 3 million people have retired because of the pandemic by some estimates. Those are probably not coming back, so in reality, the American labor market might only be missing around 4 million jobs for a complete recovery.

Almost one million of those jobs are expected to have returned in July as the generous unemployment benefits started to roll off. Therefore, if this incredible pace of gains persists for a few months, the US could be back to full employment by the end of the year! Of course, that would argue for a more fearless Fed and a mightier dollar. It’s all about jobs now.

Wall Street storms higher, RBA in focus

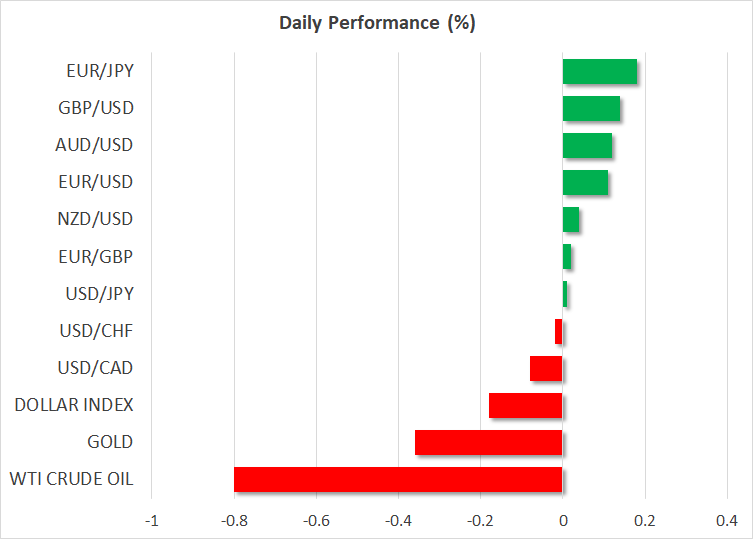

The FX market is trading quietly on Monday, with most major pairs confined to narrow ranges. Fortunately, things are more exciting in the equity arena. Wall Street is set for a higher open that would bring the S&P 500 just a shade away from its record highs.

The stars have aligned for stock markets, with a stellar earnings season being complemented by record-low real yields and hopes that Congress will deliver more fiscal juice soon. Senators have finally introduced the bipartisan bill on ‘hard’ infrastructure, which entails around half a trillion dollars in new spending.

Oil prices were not so cheerful though, with a disappointing manufacturing survey out of China overnight sapping confidence in the demand outlook. Even some renewed tensions with Iran in the Middle East were unable to lift crude.

The main release today will be the US ISM manufacturing index for July. Beyond that, all eyes will turn to the RBA rate decision early on Tuesday. The Australian economy is being plagued by prolonged virus-fighting lockdowns, which will likely hamper the recovery. It therefore seems that the RBA will abandon its recent tapering plans, which is bad news for the Australian dollar.

Aside from the RBA and the US employment report this week, there's also a Bank of England policy meeting on Thursday to keep traders busy.