- Dollar edges sideways in thin summer trading, eyes weekly gains

- Dow and S&P post third straight day of record closes, Nasdaq plays catch up

- But Delta concerns weigh on Asian markets and oil

Dollar stands tall amid summer doldrums and Fed taper fixation

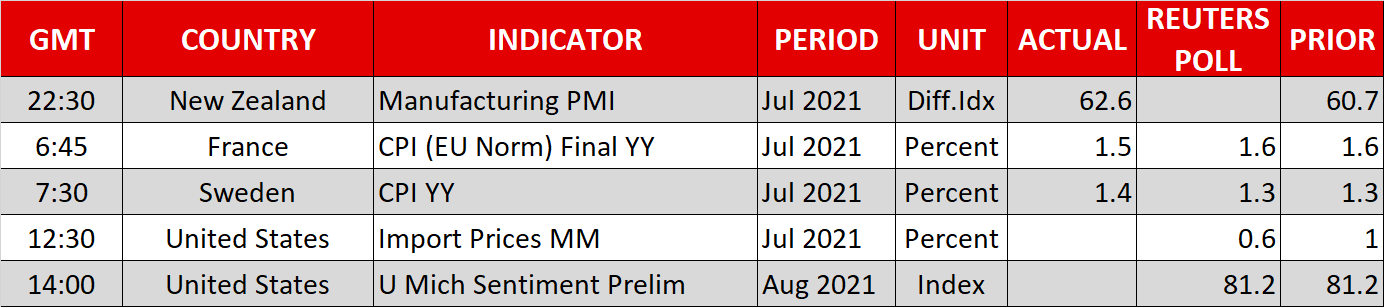

Speculation that the Federal Reserve is on the verge of announcing its plans on how and when it will begin to unwind its pandemic stimulus propped up the US dollar near four-month highs on Friday. Trading ranges have been narrowing and volumes thinning towards the end of the week as more traders set off for their summer breaks. But the greenback has been able to maintain its posture, keeping the pressure on its rivals, as investors are more certain than ever that tapering will come at one of the next three meetings.

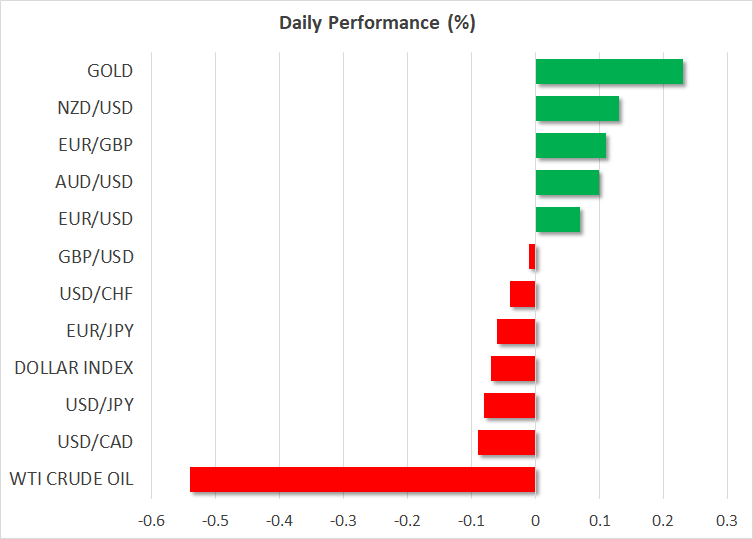

The dollar index has been hovering around 92.95 since Wednesday when it got knocked down by not-so-worrying CPI data, having scaled a high of 93.19 earlier that day. However, there was little boost for the currency from yesterday’s stronger-than-expected rise in producer costs and solid weekly jobless claims, suggesting that the current rally has gone as far as it can for now.

Investors will most likely want to wait for the gathering of central bankers at Jackson Hole on August 26-28 for further signals from the Fed before placing fresh taper bets. However, there could be some clues from the minutes of the July FOMC meeting due next Wednesday amid a potentially divisive debate about whether or not a few more months of data are needed before starting the tapering process.

US and European stocks are on a roll

As taper speculation continues to be the main driver in FX markets, there were few signs of stress in equity markets about the prospect of reduced Fed stimulus in the next few months. The S&P 500 and Dow Jones Industrial Average notched up another record close on Thursday – their third in a row. Even the Nasdaq joined in this time, with the composite and 100 indices both snapping two days of losses to close about 0.4% higher.

Strong earnings and progress in Congress on the Biden administration’s ambitious infrastructure spending plan have helped Wall Street weather the tapering storm, even as daily virus cases and hospitalizations have risen substantially lately across the United States.

Investors are not panicking just yet about the Fed’s massive stimulus being scaled back soon because they don’t think the Fed will move very aggressively and see limited scope for rate hikes even if the timeline has been brought forward somewhat.

Traders in Europe also appear to be sticking to the optimistic scenario, with the continent’s main bourses opening in record territory today. Although the Delta variant has been pushing up infection rates throughout Europe, there are no plans yet to reintroduce strict curbs. The EU’s vaccination rate has now surpassed America’s, helping to keep hospital admissions manageable for the time being. Plus, ultra-accommodative monetary policy looks set to last even longer in the Eurozone thanks to the ECB’s recent policy strategy overhaul.

No respite from Delta surge in Asia, oil takes demand hit

However, the mood has been notably more downbeat in Asia this week as virus cases continue to escalate in the region, forcing tighter restrictions to be imposed. Countries in Southeast Asia and the Pacific have been hit especially hard by the Delta variant. A slow vaccine rollout in many of those countries combined with China’s recent crackdown on tech and education firms has further undermined investor confidence. The MSCI Asia Pacific Index excluding Japan is headed for weekly losses, while oil prices are close to wiping out their gains from earlier in the week.

The International Energy Agency on Thursday downgraded its forecast for oil demand for the second half of this year due to the worsening impact from the Delta strain.

WTI and Brent futures were last trading between 0.5% and 0.7% lower.