- Equity markets stay green as Chinese data keep the positive mood going

- Dollar back on the chopping block, other currencies rejoice

- Sterling barely reacts to Parliament vote, but lots of drama ahead

Is the correction over already?

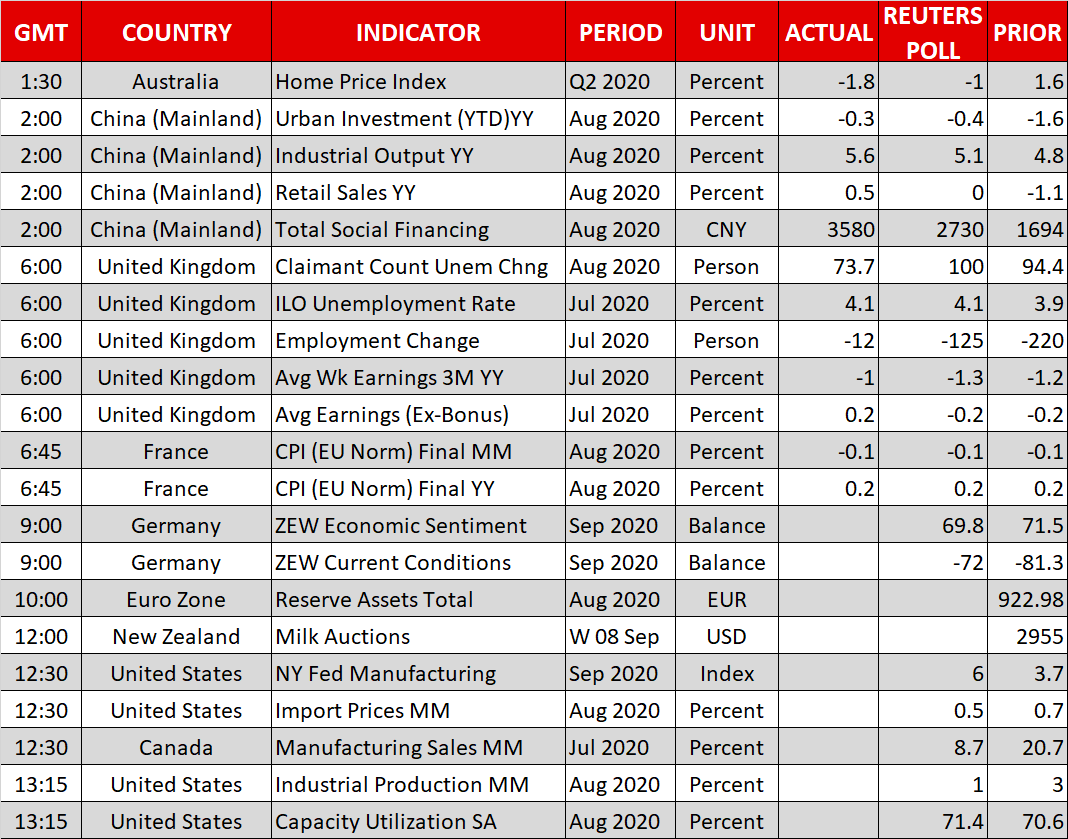

Global markets continue to dance to a risk-on beat, with US stock indices riding the vaccine hype train higher and the defensive dollar staying under fire. The positive mood was reinforced by the latest batch of data out of China overnight, which showed that the world’s second-largest economy continues to lick its pandemic-inflicted wounds.

Retail sales unexpectedly crossed into positive territory on a yearly basis in August, raising hopes that consumers are finally starting to regain confidence that will hopefully sustain the recovery. The yuan jumped in the aftermath, climbing to levels last seen in mid-2019 against the greenback.

The raging question facing investors now is whether the equity market correction is over, or whether this is another calm before the next storm. Admittedly, there are strong arguments on both sides. Arguing for another leg lower are the still-exorbitant valuations in the tech sector, tax risks linked to the US election, and the fact that fiscal support is running on fumes now that crucial benefits have not been renewed, cutting off a vital lifeline for millions of consumers.

On the other hand, there is simply no real alternative to stocks in a world where bonds yield almost nothing and the Fed has committed to letting the economy run hot, so any deeper correction from here should be relatively shallow. Of course, a lot will depend on whether the Fed unveils new easing measures tomorrow or takes the sidelines for now.

Dollar bleeds, gold glitters

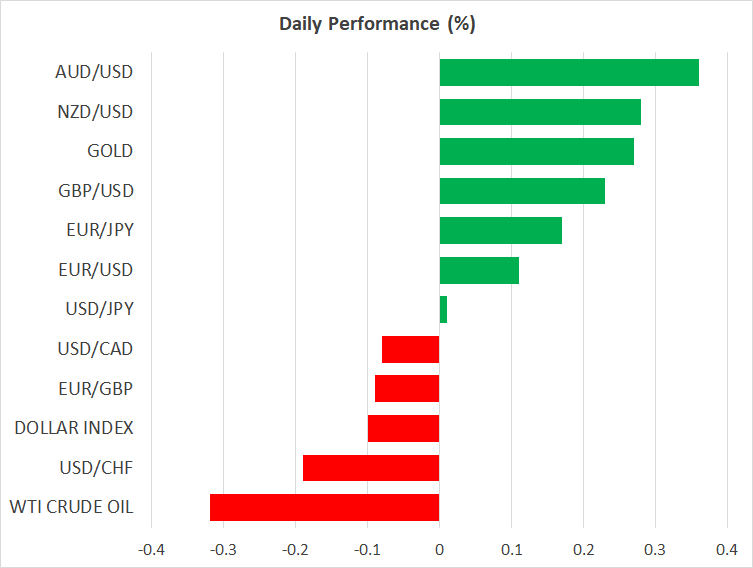

What is bad for the dollar is naturally good for every other major currency, and that is precisely what is playing out on Tuesday, with the greenback losing ground against all its G10 rivals except the safe-haven Japanese yen. That said, the dollar index remains trapped in a range overall.

What stands out is dollar/franc, which is grinding towards its 5-year lows once more. This might be a ‘line in the sand’ for the SNB, as the central bank has seemingly stepped into the market around these levels before to fight the upward pressure on the franc. The SNB is unlikely to sit on its hands for long if this trend persists, implying that dollar/franc shorts may be at increasing risk from here.

In precious metals, gold prices got a small shot in the arm from the sinking dollar yesterday. Yet, bullion remains confined in a range overall, mirroring the sideways movement in the dollar and likely waiting for the next ‘big move’ in the reserve currency. Technically, a consolidation pattern instead of a deeper correction after such a massive rally is encouraging in itself.

Pound yawns after Parliament vote

Over in Britain, the pound barely reacted to the controversial Internal Market Bill passing through Parliament with a solid majority yesterday. Of course, this was only an initial vote and there will be plenty more chances for MPs to vote down the more divisive aspects of this bill in the coming weeks, setting the stage for more turbulence.

For now, Boris Johnson seems to have stopped this parliamentary mutiny right in its tracks, which allow him to continue playing hardball in the Brexit negotiations, hoping the EU will bend under pressure. The pound is trading mainly as a function of global risk sentiment and the dollar so far this week, but that could change quickly if the brinkmanship goes any further.