· Tech stocks slump as higher yields bite, but FX and commodities calm

· Dollar lags despite equity selloff, highlighting recent shift in dynamics

· All eyes on Chairman Powell's testimony today, and RBNZ decision afterward

Nasdaq gets smoked as value outshines tech

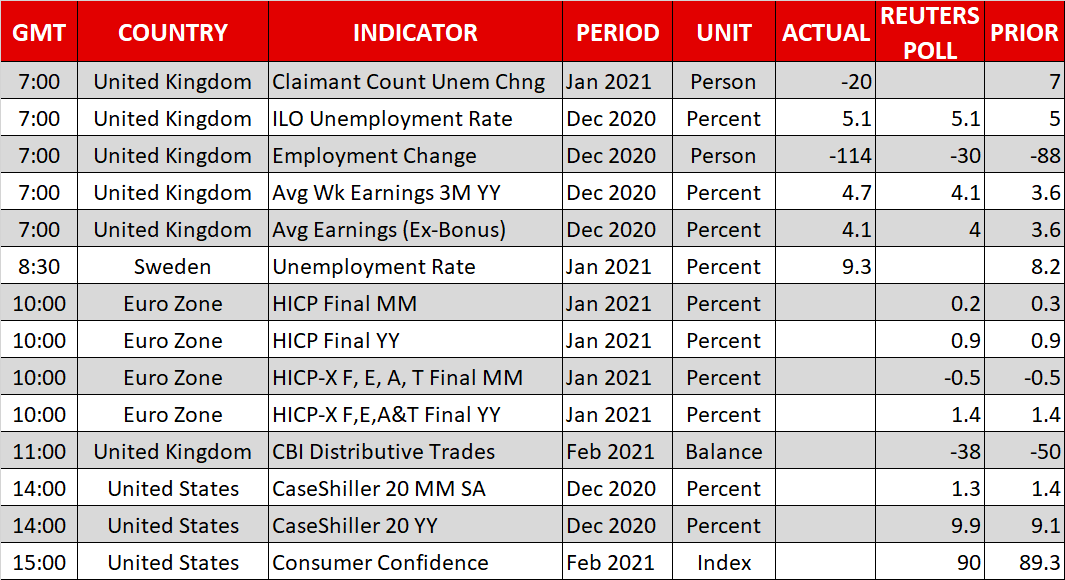

It was a particularly strange session on Monday, with many of the familiar relationships between asset classes breaking down thanks to the pandemonium in bonds. US stock markets retreated for a fifth consecutive day, with the Nasdaq leading the decline as the spike in real rates illuminated the stretched valuations in the tech sector.

Rising yields can spell trouble for stocks because the opportunity cost of holding equities increases as bonds begin to offer better returns, and because higher borrowing costs can exacerbate debt burdens and limit the ability of companies to buy back their own shares. This effect is amplified if valuations are elevated, hence why several high-flying tech names got smoked yesterday and why value plays held their ground.

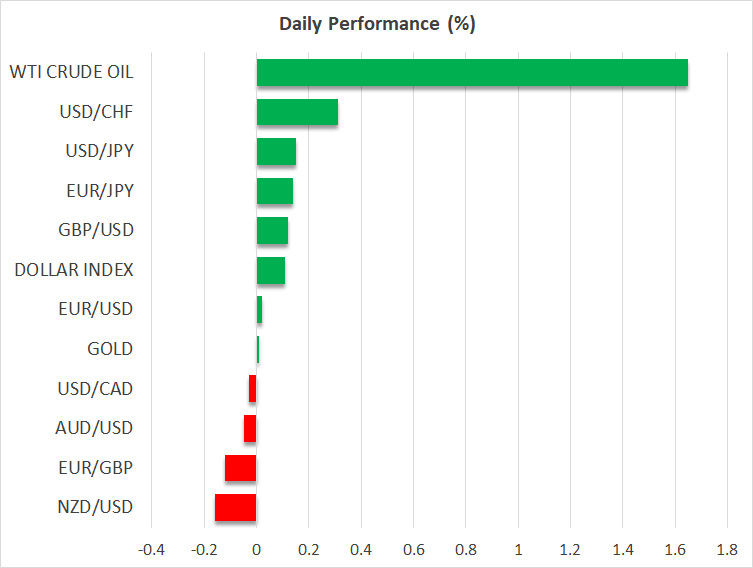

But in a rare twist, the selloff did not infect other asset classes. Crude oil continued to march higher, the defensive US dollar tanked alongside stocks, and gold came roaring back despite the spike in yields that is typically a bane for the yellow metal.

This break in the usual relationships highlights the recent shift in market dynamics. The dollar is no longer behaving solely as a safe haven and is turning into the US currency again. And with the greenback no longer acting like a haven, gold has reclaimed that role. Meanwhile, crude oil has its gaze locked on the global recovery and the prospect of higher inflation, which is wildly beneficial for commodity prices.

Ravaged dollar awaits Powell testimony

A major element behind the latest bout of weakness in the dollar is that some foreign bond yields have risen even faster than American ones. Long-dated yields in Australia, New Zealand, Canada, and even the UK have all matched or exceeded the surge in US borrowing costs.

This implies that the greenback is no longer the only game in town as far as carry strategies go. Markets increasingly believe that the benefits from the overwhelming US spending packages may spill over abroad and perhaps allow these economies to recover faster than America itself.

The main event today is Fed Chairman Powell's semi-annual testimony before the Senate at 15:00 GMT. Markets will be looking for hints around whether a withdrawal of QE purchases is on the horizon, but are unlikely to find any. Powell has been adamant that it is too early to be having this conversation.

If anything, he will reaffirm the need for ultra-loose policy and encourage lawmakers to 'go big' on the spending package they are preparing. Of course, this would be old news for markets, and the risk may be investors over-interpreting any comments about normalization being possible down the road.

Pound flexes muscles, kiwi looks to RBNZ

Elsewhere, the British pound continues its impressive bull run, displaying an uncanny ability to absorb both soft data and a delayed timeline for re-opening the economy, as the swift pace of vaccinations implies this is the final lockdown.

In New Zealand, the Reserve Bank will conclude its meeting early on Wednesday. The economy has made a stunning recovery from the pandemic, with growth, inflation, unemployment, and commodity prices all being much stronger than what the RBNZ projected in its latest forecasts.

Hence, a more cheerful tone seems warranted. That said, policymakers cannot sound too optimistic, as that could lead to an unwelcome surge in the exchange rate. Even if the RBNZ tries to 'talk down' the kiwi though, the currency's overall outlook seems clearly positive.