- RBNZ plays down negative rates, kiwi flies

- Sterling leaps after divisive bill suffers crushing defeat in Lords

- Markets in a cheerful mood overall, but watch the Fed

Kiwi charges higher after RBNZ ‘disappoints’

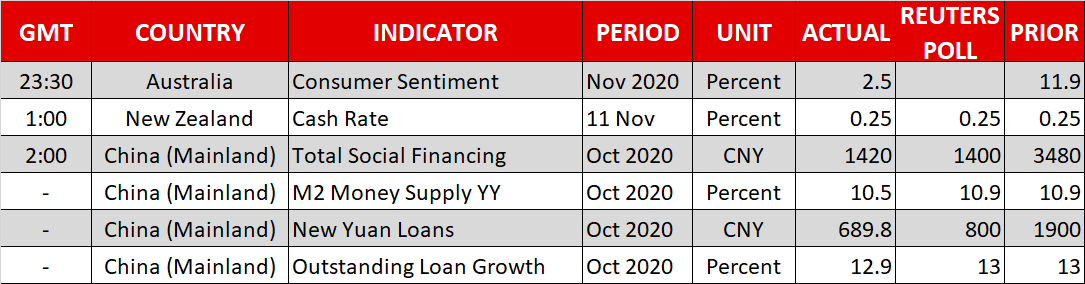

The kiwi dollar took off like a rocket on Wednesday, extending the gains it recorded amid all the vaccine enthusiasm, after the Reserve Bank of New Zealand poured cold water on speculation for negative rates. While the Bank maintained a cautious tone and even introduced a new lending program, it also highlighted the improvement in economic data and most importantly, revised its interest rate projections much higher.

This came as a shock considering that the RBNZ previously signaled negative rates were on the menu for next year, sparking a serious repricing in money markets. Overnight index swaps now suggest a 60% probability for a quarter-point rate cut by October next year, which is a far cry from the two cuts that were fully priced in ahead of this meeting.

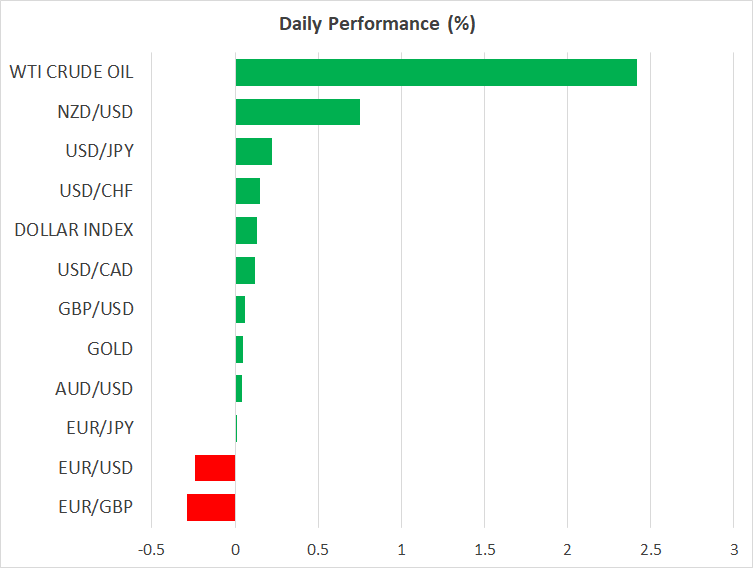

As for the kiwi, this is a colossal development. The RBNZ went from being one of the most dovish central banks in the developed world to being one of the more moderate ones, all in a single meeting. The QE program is still absolutely enormous for the size of New Zealand’s tiny bond market, but if negative rates are now off the table, the kiwi could shine against currencies of nations whose central banks will remain aggressive, like the euro and Swiss franc.

Sterling soars after Lords reject Internal Markets Bill

The British pound was the star performer in an otherwise quiet session on Tuesday, after the government’s notorious Internal Markets Bill suffered a crushing defeat in the House of Lords. The upper house of Parliament overwhelmingly voted to remove the section that would allow the government to violate international law, diminishing the prospect of another round of Brexit drama.

The trade talks will continue this week, and even though disagreements remain on the usual issues – fisheries, competition rules, and the governance of any deal – both sides have struck a more optimistic tone lately. That is also reflected in the pound, which has been on the ascent lately despite the country’s shutdown.

Investors seem to be calculating that the latest lockdowns in the UK and most of the EU have paradoxically raised the chances of a Brexit agreement, because neither side can afford to throw their economy into an even deeper recession. As for sterling, while one last round of brinkmanship cannot be ruled out considering that the final stages of a negotiation are always the hardest, the broader outlook looks increasingly bright.

Markets in a good mood, but mind the Fed

The Pfizer vaccine news hit markets like an earthquake this week, and the aftershocks continue to reverberate through many assets. Crude oil continues its relentless rally, the exodus from tech stocks is in full swing, and sovereign bond yields are marching higher, keeping the broader stock market on a tight leash.

Things are calmer in the FX spectrum, with the yen nursing its losses and the dollar being undecided about what’s next, as fading safe haven demand and rising Treasury yields pull it in opposite directions. Essentially, the market is looking through the short-term pain of partial lockdowns in Europe and rising infection rates in America, focusing instead on the post pandemic world once a vaccine is up and running.

In times like this, when euphoria is the name of the game, it is fruitful to ask what can go wrong. In this sense, perhaps the single greatest risk now is central banks (over)reacting to the vaccine news by taking their foot off the accelerator. This entire rally since March has been founded at the altar of cheap money policies, so if the likes of the Fed start getting cold feet now that things look better, similar to the RBNZ today, markets could throw a tantrum.