- Equity party continues to rage amid whispers of $3 trillion infrastructure bill

- Yen and gold suffer as global bond yields climb

- Dollar extends rebound ahead of nonfarm payrolls – an asymmetric event?

Stock market freight train keeps on rolling

Global markets remain in an ecstatic mood, with US equities powering to new record highs and defensive plays falling apart, as expectations for gargantuan stimulus packages in America continue to be baked in. The Democrats taking full control of Congress has convinced investors that we are entering a new era of runaway deficit spending, without any real threat of significant tax increases given how slim their majority in the Senate will be.

Those hopes have already been vindicated in a sense. Media reports suggest that president-elect Joe Biden is considering a ‘one-two stimulus punch’ to juice up the economy, first by providing new $1400 payments to help suffering Americans and then by unleashing a supermassive $3 trillion infrastructure package.

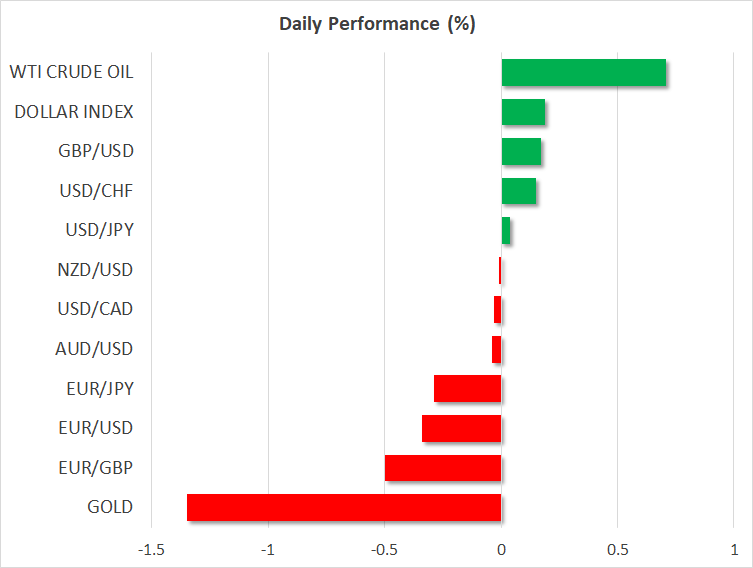

Coming on top of a surprisingly strong ISM non-manufacturing survey yesterday, the stimulus signals ignited a new fire under the ‘reflation theme’, pushing investors towards stocks and away from bonds amid fears of exploding deficits. Crude oil edged higher too, with WTI almost recovering all its pandemic-related losses.

Can the rally keep going?

Admittedly, pushing such massive spending bills through Congress won’t be a picnic as there are several ‘conservative Democrats’ that might oppose them. But it is not impossible either, and the good news for markets is that those conservatives would likely veto any accompanying tax increases on businesses.

Overall, investors are sensing that both Washington D.C and the Fed now have their backs, which suggests that the ‘risk party’ may be far from over. The lesson from last year was that when cheap money meets massive government relief, markets are happy to ignore any grim developments and instead focus on the light at the end of the tunnel.

As long as there isn’t any catastrophic development, like a new virus mutation that is immune to the existing vaccines, it is difficult to argue for any significant setbacks in risk appetite.

Yen and gold demolished by higher bond yields

In the safe-haven spectrum, both the yen and gold are under duress, pressured by the spike higher in global bond yields. The Bank of Japan has a yield curve control strategy in place, so when global yields rise, Japanese yields cannot participate. This mechanically makes the yen less attractive from an interest rate perspective.

Likewise, gold pays no interest to hold, so the higher yields go, the less appealing it is. The yellow metal has now fallen back below the $1900 region to turn negative for the week, with fading demand for defensive assets and a resurgent US dollar also contributing. In the bigger picture though, it is difficult to envision any lasting downtrend for gold, in an environment of still deeply negative real rates and runaway deficit spending.

Dollar comes back to life ahead of US jobs report

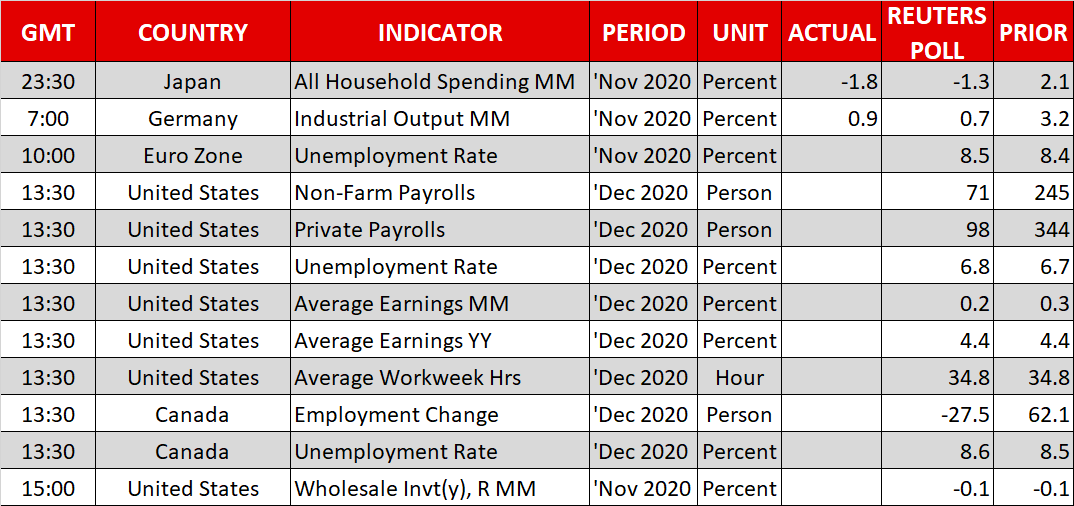

Yet, the spike in US Treasury yields has been a blessing for the beleaguered dollar, which has rebounded off its recent lows. The next event for the reserve currency will be the US employment report today. The forecast is for nonfarm payrolls to have risen by only 71k in December, far lower than the 245k registered in November.

There is a clear risk that the numbers might fall short of this already low bar, as the ADP jobs print turned negative in December while the employment sub-index of the ISM non-manufacturing PMI fell into contraction territory.

For stocks, this seems like a one-sided upside risk. If the numbers surprise positively, then the rally may continue. If they disappoint, that could cement expectations for a new stimulus package from Congress, giving equities another excuse to climb. As for the dollar, NFP reports tend to be just an intraday volatility event nowadays, not a trend-setter.