By Giles Coghlan, Chief Currency Analyst at HYCM

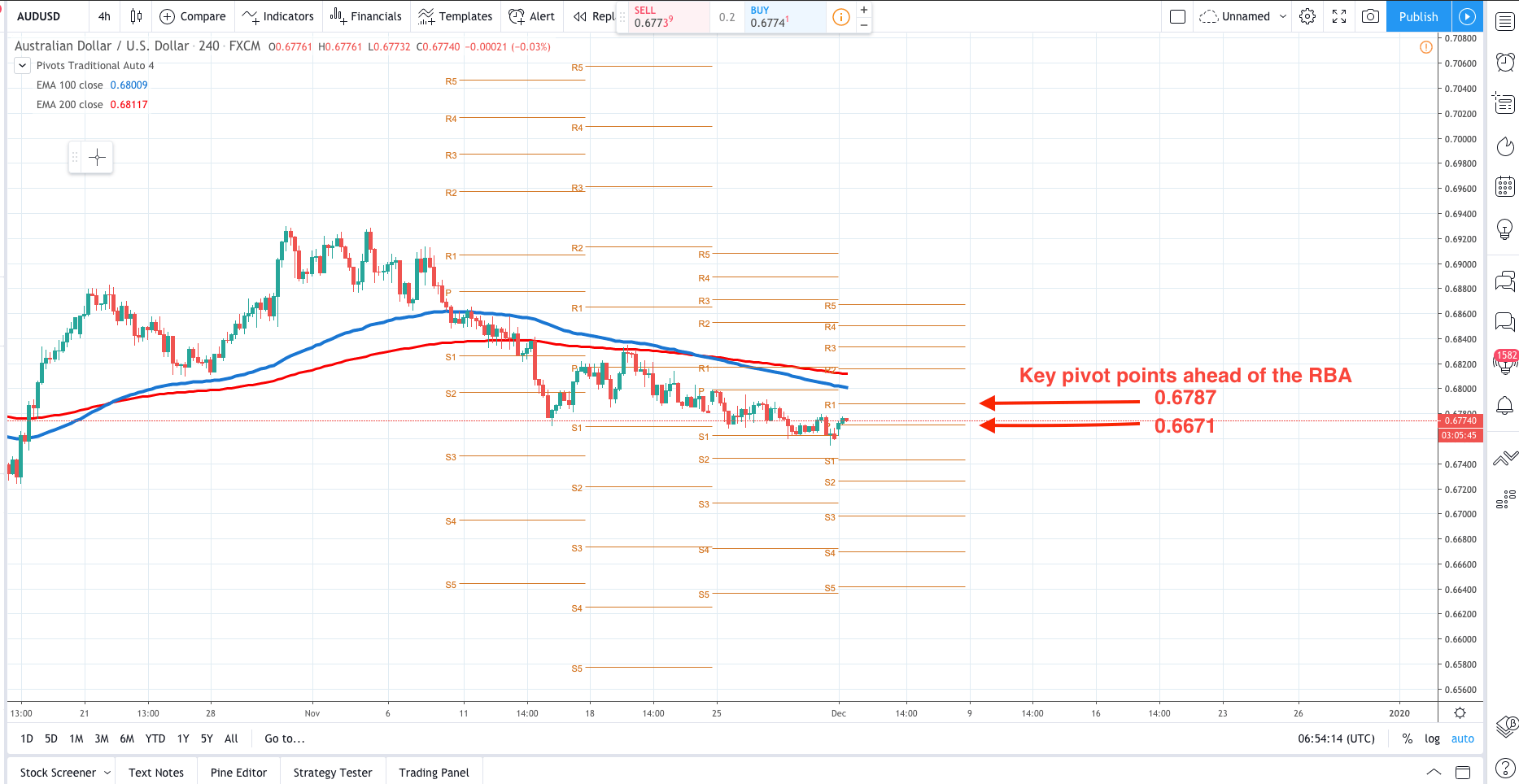

The AUD has whipsawed around lately after Governor Lowe's latest speech on unconventional policy on Tuesday of this week. Although Governor Lowe said that the RBA's lower rate level was 0.25% and QE would not be even considered before rates hit that level, the market has taken a bearish outlook on his view. The investment banks Westpac and RBC forecast that the RBA will cut the cash rate to 0.25% by June 2020 and follow that up with QE. So, as the market starts to price in additional cuts from the RBA the focus will be on economic data and speeches that confirm or deny this outlook. A rate cut is not expected for tomorrow’s rate meeting, but the market will be looking for any signals from the RBA about a coming rate cut for 2020. One final aspect to mention is that the Australian economy is closely tied to China's fortunes with around 30% of its GDP coming from trade with China. Therefore, AUD will be pushed or pulled along with the US-China trade sentiment too.

Learn more about HYCM