- White House bumps stimulus offer to $1.8 trillion, stock market cheers

- Kudlow hints this offer could be raised further, keeping optimism alive

- Dollar slides amid renewed deficit concerns, gold capitalizes

- ECB chief economist prepares the ground for more easing

Markets cheerful as stimulus negotiations resume

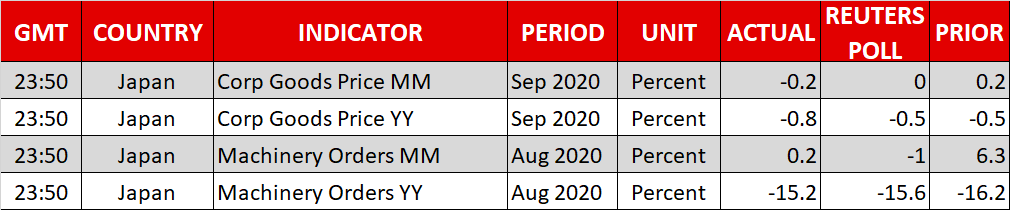

In an epic reversal after pulling out of the stimulus talks last week, Donald Trump came back to the negotiating table on Friday with a counteroffer of $1.8 trillion, sparking hopes that a deal is still possible on this side of the election. This is still some distance from the $2.2 trillion the Democrats insist on but quite encouraging nevertheless, as the gap between the two camps is clearly narrowing.

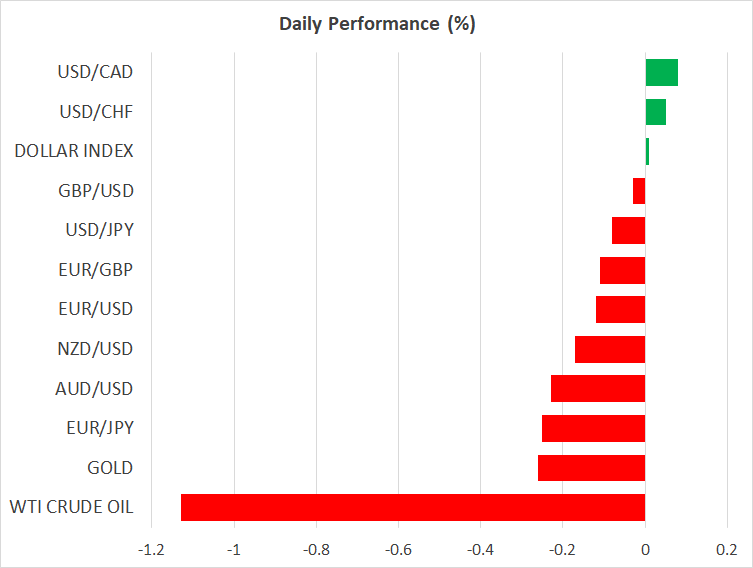

Global markets responded in typical risk-on fashion to the rising odds of an agreement. The major US stock indices climbed to their best levels since early September, commodity currencies rallied furiously, and the dollar sank as deficit worries returned to haunt the reserve currency. But a weaker greenback and massive government deficits are a magical elixir for gold, which stormed back above the $1900 region.

The Democrats have already shot Trump’s proposal down as ‘insufficient’, yet investors are keeping their hopes up for a breakthrough after White House economic adviser Larry Kudlow suggested that the President could raise his offer even further. Senate Republicans blasted this proposal too, but if the White House and the Democrats reach a deal, all it would take is a handful of Republican senators to pass the bill.

Overall, financial markets are increasingly saying this is a win-win game. Trump is falling behind in opinion polls and seems desperate for a deal, so either some agreement will be hammered out soon or the Democrats could win a decisive victory at the ballot box and ultimately deliver an even greater stimulus package. At this stage, the biggest risk for markets may be new polls showing Trump and the Republicans staging a comeback, which could pour cold water on hopes for heavy spending.

China puts brakes on yuan, UK prepares lockdowns

Elsewhere, Chinese regulators eased some rules overnight that made it difficult to short the yuan. The move is intended to put the brakes on the currency’s recent rally, as a strengthening currency could cool the nation’s exports and eventually dampen growth.

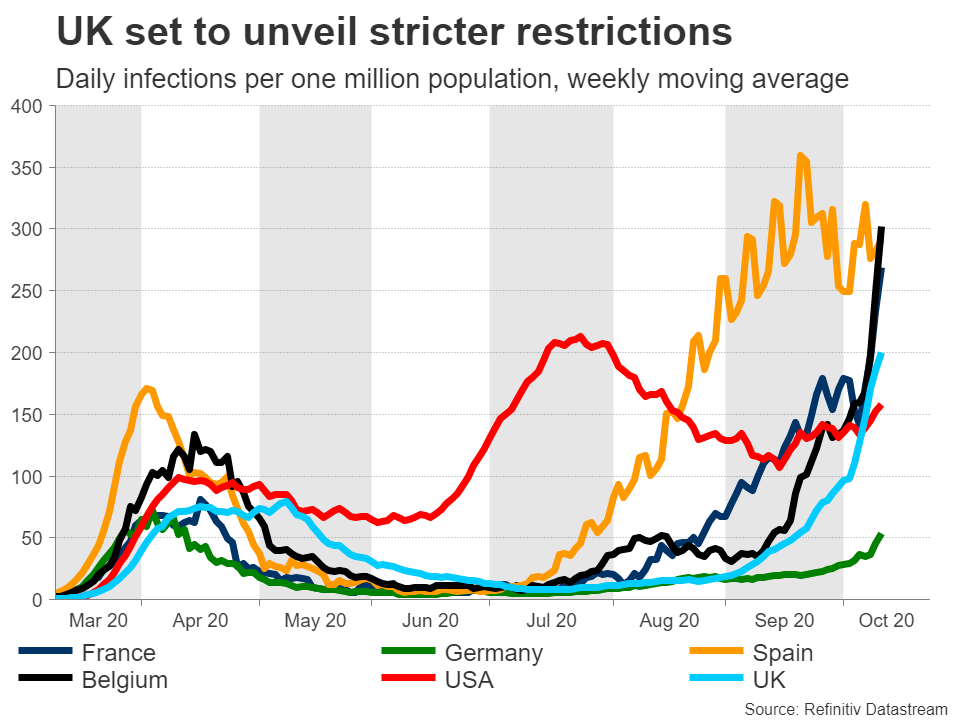

In the UK, Prime Minister Johnson is expected to unveil tighter measures to bring the nation’s covid outbreak back under control, after daily infections exploded higher lately. The new restrictions will be targeted at areas with high cases.

The news spells trouble for the UK economy, especially now that unemployment aid will be scaled back. And yet the pound hasn’t reacted much, perhaps because it has even bigger fish to fry – Brexit. Some progress has apparently been made in those negotiations, but differences remain on hot issues like limits on state aid, fisheries, and a dispute resolution mechanism to police any deal.

The UK has given an ultimatum that if a deal doesn’t seem imminent by Thursday, it will walk away. Hence, we may see more drama this week as the ‘deadline’ is likely to pass without an agreement. Ultimately though, an eleventh-hour deal is still the most likely conclusion as neither side can afford to throw its economy into an even deeper recession.

ECB’s Lane opens door for more easing

The euro is under some pressure today after the ECB’s chief economist warned that the latest surge in infections could derail the economic rebound. The Eurozone's core inflation rate hit a record low in September, almost ensuring the ECB will have to expand its stimulus offering soon.

Lane’s remarks hint at a more dovish tone at the ECB’s late-October meeting, which combined with the risk of partial lockdowns across Europe, argue for another wave lower in euro/dollar. That said, the main drivers for the pair might be US stimulus and election expectations.