- Wall Street set for new record highs as California lifts stay-at-home order

- Dollar stable as traders look to Fed meeting, sterling near recent peaks

- But geopolitics, virus mutations, and stimulus talks threaten a reality check

Stocks sail higher as investors focus on the positives

American equity markets continue to trade like a runaway train, setting the tone for most other assets. Expectations for a massive spending package from Congress are riding high, and with the Fed chief recently reaffirming that his central bank will keep its foot on the QE gas, investors are happily turning a blind eye to a growing list of risks.

The good news first. Reports suggest California is about to lift its stay-at-home order, allowing America’s economic growth engine to fire up. And that engine already looks to be firing on most cylinders, judging by the Markit PMIs for January that were released on Friday. The manufacturing index reached a new series high and the services PMI shot higher too, reinforcing the narrative that the US economy is healing its economic wounds at a rapid pace.

Risks galore

Now for the bad news. Biden’s relief package is likely to be watered down to secure the support of conservative Democrats and some Republicans. The size of the final proposal could ultimately be in the ballpark of $1 trillion, almost half of the initial $1.9 trillion.

Then there’s the simmering geopolitical arena. Chinese bombers flew near Taiwan lately, resulting in a US aircraft carrier being dispatched to the South China Sea, which in turn drew fury from Beijing that has authorized its coastguard to open fire on foreign vessels in that region. Is Beijing telling Biden that the Trump-era ‘freedom of navigation’ operations won’t be tolerated anymore?

But perhaps the biggest risk for markets is whether the existing vaccines are effective against all the new mutations of covid. Several strains have been discovered recently across the globe, and there is no guarantee that the vaccines are effective against all of them. All it takes is for a single strain to be resistant and the entire timeline for reopening the global economy could be pushed back by several months.

Of course, the overall trajectory in equities and other risk-linked assets is probably higher even if such risks materialize. Markets have shown an uncanny ability to absorb bad news without even a scratch this past year, as any trouble simply means more government spending and tremendous central bank liquidity for longer. That said, with so much optimism already baked into the cake and valuations this stretched, a corrective pullback is more than possible.

Dollar stable, sterling near recent peaks

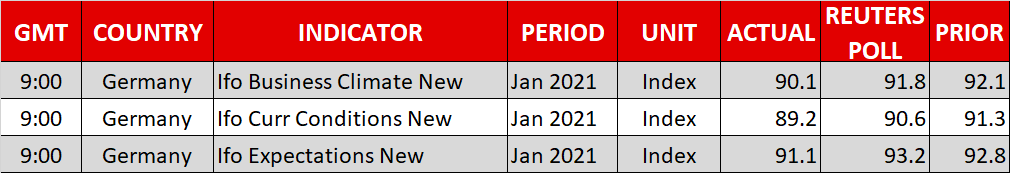

In the FX complex, things are quiet on Monday. Commodity currencies are a touch higher, the dollar is stable, while the euro is under some pressure. News that France is preparing for a national lockdown haven’t done the single currency any favors. From a purely economic perspective, the risks surrounding euro/dollar seem tilted to the downside.

Most of Europe is still in a harsh lockdown, is far behind America in the vaccination race, its economy will inevitably suffer a double-dip recession, and there isn’t any impressive stimulus coming either. The narrative of economic divergence between Eurozone and America could be the next ‘big theme’ in the FX market. That said, this may not be the week this narrative takes hold, as Powell is likely to push back on the idea of tapering at Wednesday’s Fed meeting.

Meanwhile, investors have gotten excited with the pound lately, as Britain is leading the G10 pack in the vaccination race. If this robust pace of immunization continues, even better days might lie ahead for sterling.

As for today, traders will tune in for a speech by President Biden at 20:45 GMT.