Preview Mode

- SEE LESS

- B2B Categories

- Industry Executives (287)

- Industry Websites (59)

- Regulators (23)

- Liquidity Provider (4)

- Payment Processors (3)

- Platforms (3)

- KYC (2)

- Regulation Consulting (2)

- Cryptocurrency Trading Solutions (1)

- CRM (1)

- Tools for Brokers (1)

- SaaS Provider (1)

- MT4/MT5 Bridge Providers (1)

- Platform Providers (1)

- White Label Solutions

- Affiliate Programs

- Cryptocurrency Liquidity Providers

- Translation Services

- Trading Categories

- Subscribe to our Newsletter

- Suggest a company

- Contact Us

- Companies Home

- Company News

- Categories

- Trading News

- Company News

- Videos

- Search

- Add

Company

Mobile platforms

Yes

Integration

Yes

Full Breakdown Filters

Full Breakdown

Full BreakdownCompany Review

FYNXT — The Brokerage Operating System for Modern Multi-Asset Brokers

In a global market where competition increases by the day and client expectations change overnight, brokers can no longer depend on fragmented systems and manual processes. Speed, automation, compliance readiness, and scalability now determine who wins. FYNXT — a Singapore-headquartered fintech is redefining this future with a low-code, modular digital front office platform designed specifically for FX/CFD brokers, multi-asset players, and new-age brokerage entrants.

Backed by ISO 27001 discipline, 100+ ecosystem integrations, and clients across Asia, MENA, Europe, and Australia, FYNXT enables brokers to launch faster, modernize operations, and scale globally with a unified suite of purpose-built tools. Its recent recognition as the Best Broker Infrastructure Provider at the Finance Magnates Awards 2025 further reinforces the platform’s leadership in delivering secure, resilient, and revenue-driven infrastructure for the brokerage industry.

Today, FYNXT powers more than just client management it delivers an end-to-end digital ecosystem covering onboarding, compliance, client servicing, IB growth, investor products, copy trading, contests, and turnkey white-label brokerage. With proven outcomes such as 10× faster onboarding, 70% operational time savings, +92% IB retention, and month-on-month growth across key clients, FYNXT positions itself as the next-generation operating system for global brokers.

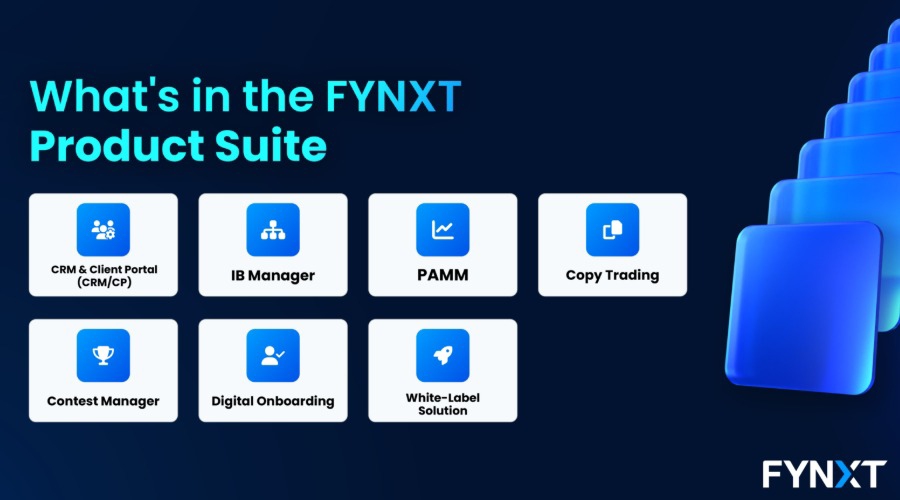

A Modular Digital Front Office Designed for Speed, Scale & Efficiency

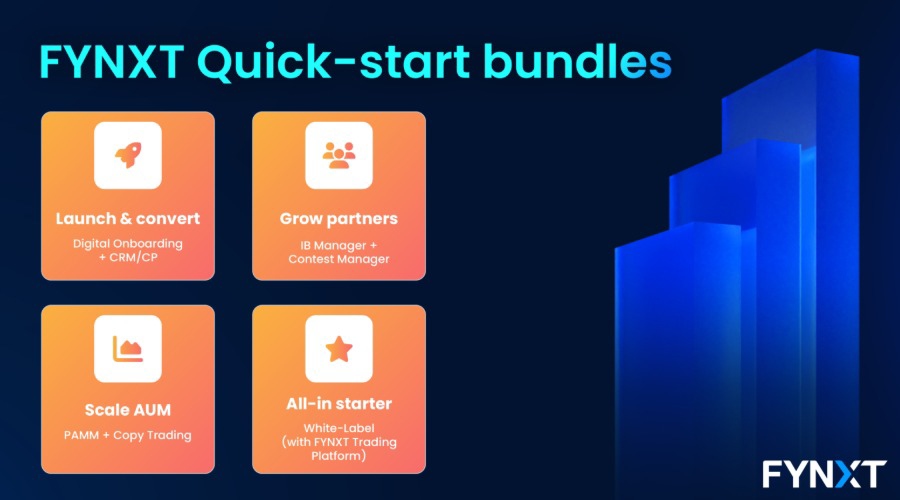

At its core, FYNXT is built on a principle brokers desperately need today: adopt only what you need, expand whenever you’re ready. The modular architecture allows brokers to implement one product — such as CRM, PAMM, IB Manager, or Copy Trading — and integrate it into their existing stack. As the business grows, new modules can be activated with minimal disruption.

This design offers three immediate advantages:

1. Faster Time-to-Market

Most brokers go live within 10–14 days, far faster than traditional vendors that require months of implementation.

2. Operational Automation

KYC, onboarding, client actions, commission calculations, settlements, and reporting workflows run automatically — cutting manual work by up to 70%.

3. Global-Ready Scalability

From multi-language support and multi-currency handling to multi-tier IB networks and scalable PAMM architecture, FYNXT is engineered for brokers entering or expanding across global markets.

The result is a platform that does more than automate tasks — it becomes a revenue engine, improving conversion rates, lifting client engagement, optimizing IB performance, and enabling brokers to expand without increasing operational overhead.

Deep Dive Into FYNXT’s Core Modules

Forex CRM — The Operational Heart of Every Modern Brokerage

FYNXT’s Forex CRM is built to replace outdated general-purpose CRMs that struggle to support trading workflows. The platform centralizes everything — leads, onboarding, compliance checks, client actions, trading account management, and communication — into a single operational hub.

Key advantages include:

45% faster onboarding with automated KYC/AML workflows

Streamlined sales pipelines with clear lead → client conversions

Integrated account management for MT4/MT5, cTrader, and multiple platforms

Regulated-market readiness with full audit trails and permission controls

For brokers, the impact is immediate: lower acquisition cost, faster activation, and higher lifetime value per client.

Client Portal — Engagement, Transparency & Self-Service at Scale

In most brokerages, client support teams are overloaded with repetitive requests — deposit issues, document uploads, account changes, KYC clarifications. FYNXT solves this with its modern Client Portal, giving traders everything they need in one secure, branded interface.

Clients can:

Upload KYC documents

View balances, transactions & statements

Manage trading accounts

Deposit & withdraw via integrated PSPs

Track portfolio performance

Access contests, copy trading, PAMM, and more

By enabling 24/7 self-service, brokers report:

Higher engagement

Faster funding cycles

Lower support costs

Improved client satisfaction

Stronger brand loyalty

The Client Portal becomes the digital home for every trader, increasing both trading volume and retention.

IB Manager — Build, Grow & Monetize Your Partner Network Globally

With partner networks driving more than 60% of volume for many FX/CFD brokers, the ability to recruit, manage, and scale IBs is critical. FYNXT’s IB Manager offers one of the most advanced multi-tier systems in the industry, built to handle everything from payouts to performance analytics.

Core capabilities include:

Multi-level IB hierarchies (unlimited structure depth)

Automated real-time rebate and commission calculations

Configurable reward schemes for different regions and segments

Partner dashboards with analytics, reporting & downline visibility

Integrated KYC, approvals & account linking

Brokers using FYNXT IB Manager have recorded:

+92% IB retention

3× increase in partner-driven revenue

11× higher LTV:CAC ratio

This transforms the IB network from an operational burden into a predictable, scalable revenue engine.

PAMM — Modern Managed Accounts Built for Scale, Transparency & AUM Growth

As investor-driven trading products regain momentum across global markets, brokers need a PAMM system that is transparent, stable under high load, and easy for both managers and investors to operate. FYNXT’s next-generation PAMM delivers exactly that — a modern managed accounts framework designed to grow AUM and attract high-performing portfolio managers.

Key advantages include:

Multiple allocation models for fair, precise distribution

Real-time manager performance metrics

Transparent investor reporting and statements

Automated fee, commission, and profit allocation

Scalable architecture for thousands of simultaneous allocations

For brokers, PAMM is no longer a “nice-to-have.” When implemented correctly, it becomes a high-margin, long-term retention product — driving recurring volume and attracting serious traders. FYNXT enables brokers to launch a fully branded, multi-asset PAMM solution without complex development or heavy operational dependencies.

Copy Trading — Empowering Traders & Expanding Revenue Through Social Investing

Copy Trading remains one of the fastest-growing investment tools for retail and emerging markets. FYNXT’s Copy Trading module is designed to give traders instant access to strategies, while enabling managers to monetize performance transparently and compliantly.

The system offers:

Seamless manager → follower trade mirroring

Independent risk controls to protect follower accounts

Transparent performance analytics and track records

Multi-asset support with tight integrations

Real-time copy allocation with minimal latency

For brokers, this translates into:

Higher engagement

Longer account lifespan

Increased deposit and funding cycles

Stronger trader acquisition via strategy discovery

Copy Trading amplifies both retention and revenue, turning trader activity into a social, community-driven growth engine.

Contest Manager — Activate, Engage & Acquire Traders on Demand

FYNXT’s Contest Manager is built for brokers who want to boost short-term volume, drive engagement, and create competitive communities. Whether it’s a deposit contest, trading competition, or IB challenge, the system handles everything in real time.

Features include:

Dynamic, real-time leaderboards

Tiered reward structures

Automated payouts & settlements

Pre-configured contest templates

Integrated marketing links for lead generation

For brokers, contests are not just engagement tools — they unlock:

Higher monthly active traders

Viral marketing & referrals

Massive top-of-funnel lead acquisition

Seasonal or event-driven volume spikes

With full automation and deep integration into the Client Portal and CRM, brokers can launch, manage, and settle contests in minutes — not days.

White-Label Brokerage Solution — Go Live in ~14 Days with a Fully Integrated Stack

For new entrants or existing brokers expanding into new regions, speed matters. FYNXT’s Forex white-label package allows brokerage operators to go live in as little as 14 days, complete with a fully branded front-office stack.

Included modules:

Forex CRM

Client Portal

IB Manager

PAMM / Copy Trading

Contest Manager

Website & integrations

Multi-PSP gateway (via FYNXT Nexus)

KYC, onboarding & compliance workflows

Why brokers choose the white-label:

Fastest time-to-market in the industry

Low-code rollout = minimal reliance on internal teams

Enterprise security and compliance controls

Scalable foundation for future growth

Whether it’s a startup broker or a licensed entity expanding across regions, FYNXT reduces launch complexity and operational overhead — without compromising flexibility.

Industry Recognition, Awards & Global Footprint

FYNXT’s momentum in the FX/CFD industry is backed by consistent innovation, disciplined security practices, and recognition from global award bodies. In 2025, FYNXT was named the Best Broker Infrastructure Provider at the Finance Magnates Awards — a major milestone that reinforces its position as a trusted technology partner for fast-growing brokerages worldwide.

Beyond this flagship win, FYNXT has earned multiple regional and international awards across 2023, 2024, and 2025 for its excellence in CRM technology, IB management, and turnkey brokerage infrastructure.

Highlights from FYNXT’s Award Portfolio

2023

Best CRM Software Provider (Global) — iFX Expo International

Best All-in-One Multi-Asset Broker CRM — Money Expo India

2024

Best All-in-One Brokerage Solution — iFX Expo Dubai

Best CRM Software Provider — iFX Expo Latam

Best All-in-One Brokerage Solution — iFX Expo International

2025

Best Technology Provider Singapore — International Business Magazine Awards

Best IB Management Platform Singapore — International Business Magazine Awards

Best Technology Provider for FX/CFD Brokers — Forex Traders Summit

Best IB Management Platform Provider — B2B Global Forex Awards

Collectively, these awards highlight FYNXT’s strength across CRM, IB networks, multi-asset brokerage infrastructure, and next-generation client management technologies. This recognition is supported by the platform’s enterprise-grade capabilities, including:

ISO/IEC 27001:2022 certification

More than 100+ integrations across trading, payments, KYC, and communications

A global client footprint covering Asia, MENA, Europe, and Australia

Over $4M in monthly settlements processed through connected modules

Verified broker outcomes such as:

10× faster onboarding

70% reduction in manual operations

+92% IB retention improvement

3× ROI from IB networks

83% faster PSP integration via FYNXT Nexus

For brokers evaluating technology partners, these milestones represent a clear signal:

FYNXT is not just keeping pace with industry standards — it is defining them.

Why Brokers Choose FYNXT — The Differentiators That Matter

In an industry crowded with legacy vendors and fragmented tools, FYNXT stands apart through a combination of speed, flexibility, security, and measurable ROI.

1. Low-Code, Modular Architecture

Adopt one module or deploy the full ecosystem. Scale on your terms.

2. Enterprise-Grade Security & Compliance

ISO-certified, secure access controls, audit trails, monitoring, and encrypted flows.

3. Faster Time-to-Market

Deploy CRM or Client Portal in 10–14 days; launch an entire white-label brokerage in ~14 days.

4. Deep Globalization Tools

Multi-language, multi-currency, multi-asset, and region-specific configurations.

5. 100+ Integrations

PSPs, KYC, communication tools, trading platforms — all API-first and future-ready.

6. Proven Revenue Impact

Brokers grow faster with higher LTV, better IB performance, and stronger retention.

FYNXT isn’t just a software provider — it is the digital operating system that modern brokers use to reduce cost, accelerate growth, and scale globally with confidence.

To learn how leading brokers modernize operations, launch faster, and scale globally with FYNXT’s modular digital front office, visit www.fynxt.com or request a product demo.

Frequently asked Questions(FAQs):

What is FYNXT?

A modular brokerage operating system with CRM, CP, IB, PAMM, copy trading, contests, PSP orchestration, and white-label tech.

Is FYNXT a CRM?

It is a full front-to-middle office platform with CRM as a core module.

How fast can a broker go live with FYNXT?

10–14 days for core modules; 4–6 weeks for full IB Manager deployments.

Does FYNXT integrate with MT4/MT5/cTrader?

Yes—native high-speed integrations.

Does FYNXT support multi-tier IB networks?

Yes—unlimited tiers with automated rebates and incentives.

Does FYNXT support payments?

Yes—via FYNXT Nexus with 100+ connectors.

Who Is FYNXT Best For?

• Enterprise Brokers

• MT4/MT5 Brokers

• Startup Brokers

• Small financial institutions

What Problems Does FYNXT Solve for Brokers?

• Manual onboarding processes

• Fragmented CRM, IB, and client portal systems

• Limited MT4/MT5/cTrader integration flexibility

• Slow go-live timelines with traditional vendors

• High overhead due to repetitive operational work

• IB payout complexity and multi-tier management

• Lack of automation across compliance, client management, and settlements

Full Breakdown Filters

Full Breakdown

Full BreakdownDisclaimer: The contents or products outlined on this page are provided by third parties and do not constitute an endorsement or any opinion by Finance Magnates. Finance Magnates has no control of the contents of this page, nor is responsible for its accuracy or legality and hereby waives any responsibility for this content. Any transactions, investments, or engagement that you enter into with a third party listed on this page or linked from this page are solely between you and such third party and are performed at your own risk. Finance Magnates holds no responsibility for any liability, damages, or losses caused in connection with the use of any content on this page.