Preview Mode

- SEE LESS

- B2B Categories

- Industry Executives (287)

- Industry Websites (59)

- Regulators (23)

- Liquidity Provider (4)

- Payment Processors (3)

- Platforms (3)

- KYC (2)

- Regulation Consulting (2)

- Cryptocurrency Trading Solutions (1)

- CRM (1)

- Tools for Brokers (1)

- SaaS Provider (1)

- MT4/MT5 Bridge Providers (1)

- Platform Providers (1)

- White Label Solutions

- Affiliate Programs

- Cryptocurrency Liquidity Providers

- Translation Services

- Trading Categories

- Subscribe to our Newsletter

- Suggest a company

- Contact Us

- Companies Home

- Company News

- Categories

- Trading News

- Company News

- Videos

- Search

- Add

Company

Platforms

- ST Trader

- Web Trading

Full Breakdown Filters

Full Breakdown

Full BreakdownCompany Review

While the stock market has been on fire recently there is another asset class that has been growing by leaps and bounds. That asset class is cryptocurrencies. In addition to the increasing acceptance among institutional investors, cryptocurrencies are also seeing massive interest from other business traders. This has led to the growth of many crypto exchanges, designed to give traders access to this exciting new asset class.

These new exchanges have taken many forms, but one that is preferred by organizations is the B2B peer-to-peer exchange. This type of exchange is decentralized and provides a number of benefits for businesses. One of the new entrants into this space is Finery Markets, and they have taken this peer-to-peer approach and added their own spin, aggregating liquidity and creating more competitive prices for traders.

Quick Look

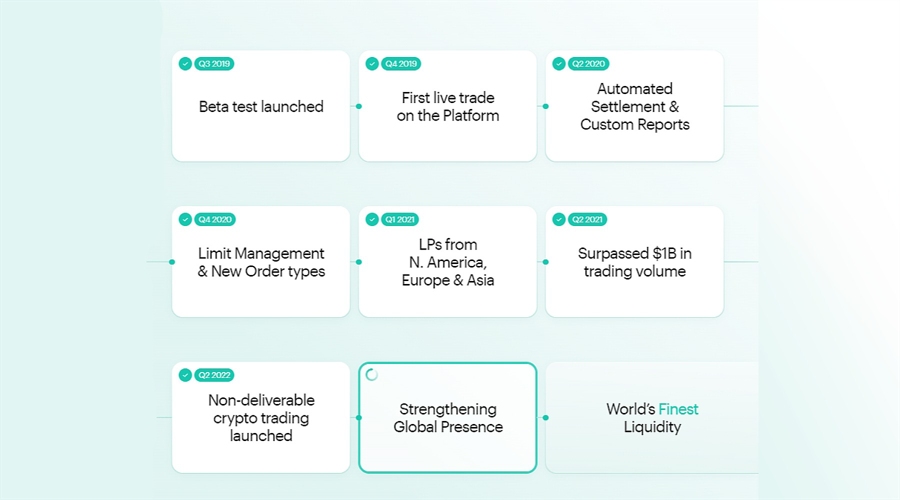

Finery Markets is a fairly new B2B marketplace for the cryptocurrency asset class. It is a registered as Finery Markets (BVI) Limited in the British Virgin Islands that was formed on January 29, 2019.

Finery Markets is specifically a B2B Digital asset marketplace. They do not offer trading in any other assets and they do not offer trading to individual retail traders. Their platform uses the maker / taker concept and takers are not subject to any fees on the platform which allows them to offer more competitive prices than other venues and more efficient allocation of resources since the platform is non-custodial. Makers are the liquidity providers on the platform, with offered trades being added to the order book as limit or post only order types.

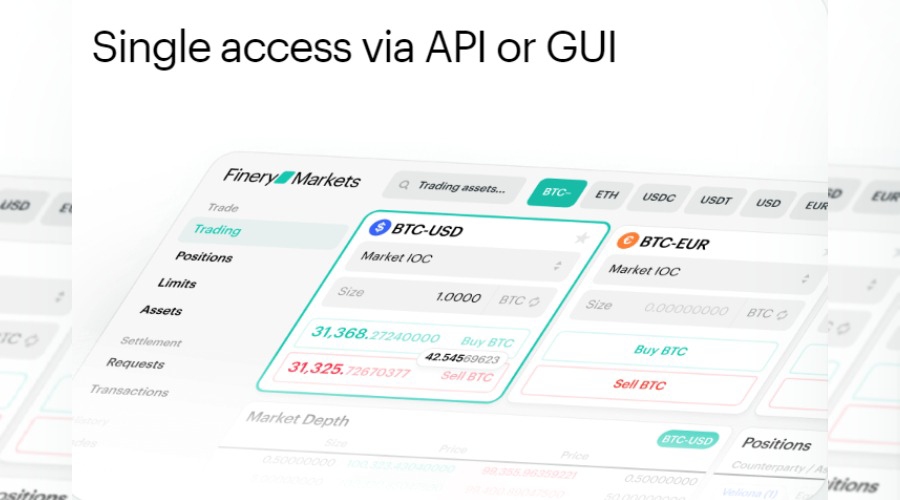

The trading platform used is a proprietary platform that gives traders access to the full order book and multiple Liquidity Providers via only one IT connection. The platform is available 24/7 and support is available by filling in the online form provided on the Finery Markets website, or by sending an email to info@finerymarkets.com.

FineryMarkets.com Pros and Cons

Pros

- Peer-to-peer trading platform

- Aggregated trades for excellent liquidity

- Trading available 24/7

- Secure post-trade settlement

Cons

- Must request access to demo platform

- No educational or research materials

- Information on the website is sparse

Cryptocurrency Products

While the large cryptocurrency exchanges can often provide hundreds of different cryptocurrencies, many of these have very thin liquidity and are lightly traded at best. In addition, the exchanges themselves can be troublesome, either because they are centralized or due to the fees charged on transactions.

Finery Markets has taken the course of focusing on the top cryptocurrencies, where they are able to aggregate sufficient liquidity to offer the best pricing. Plus, there are no fees charged to takers. The price you see in the platform is the price you get.

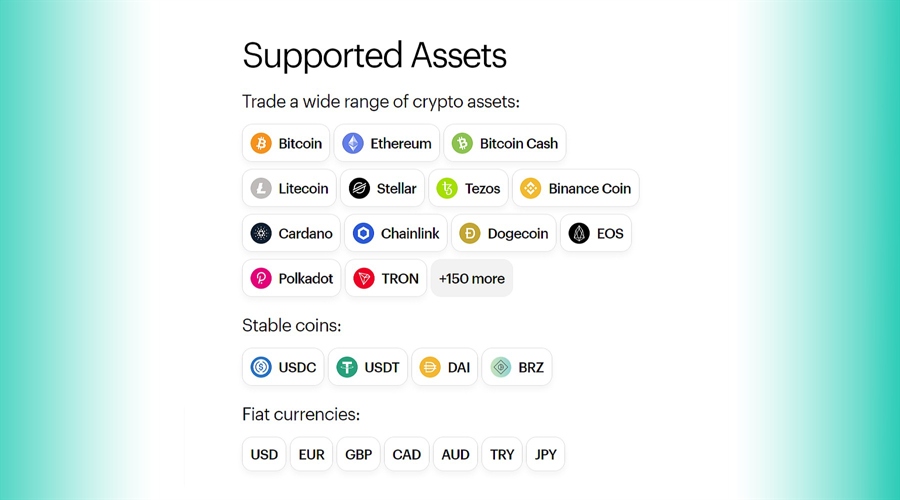

These are the most liquid and most in demand cryptocurrencies. The platform supports over 200 crypto and fiat pairs some of them are the following:

- Bitcoin (BTC)

- Ethereum (ETH)

- Bitcoin Cash (BCH)

- Litecoin (LTC)

- Stellar (XLM)

- Tezos (XTZ)

- EOS (EOS)

- Polkadot (DOT)

- Chainlink (LINK)

- Cardano (ADA)

- U.S. Dollar Coin (USDC)

- Tether (USDT)

- Dai (DAI)

In addition to the cryptocurrencies and stablecoins available on the platform there also a number of fiat currencies supported on the platform as trading pairs to the cryptocurrencies. These fiat currencies are the U.S. dollar (USD), British pound sterling (GBP), euro (EUR), Canadian dollar (CAD), and Japanese yen (JPY).

That gives traders’ unparalleled flexibility when trading these digital currencies. And because there are no market hours for cryptocurrencies it is possible to trade them 24 hours a day and 7 days a week.

Trading Platforms

The proprietary trading platform used by Finery Markets has a number of benefits for the traders. For one thing it is completely non-custodial, meaning traders maintain ownership and control of their assets at all times. And the maker / taker model used by the platform gives everyone full, transparent access to the order book, with real-time filtered displayed and accessible liquidity. Furthermore, all trading is conducted within counterparty limits, further removing potential risks.

The platform is available to trade around the clock, 24 hours a day, seven days a week, and 365 days a year. Uptime is expected to be 99.99% consistently and the team behind Finery Markets fully understands the critical importance of uptime for trading platforms. This platform has been proven in production since 2019.

Organizations will also appreciate the integrated post-trade settlements that avoids counter-party risk, as well as the robust APIs (REST and WebSockets). And it all comes in an intuitive GUI that is easy to understand and use.

For Hedge Funds and Brokers

The full production platform offered by Finery Markets will benefit brokers and hedge fund managers in a number of ways outside the solid uptime and support, and the safe post-trade settlements. For example, the platform uses smart order routing to find the best matches, and also comes with customizable execution logic.

The Finery Markets platform gives access to more than 5 different liquidity sources, with more being added to increase liquidity as much as possible. Professional brokers and fund managers will appreciate the real-time market quotes and visualization, and the three types of market making that are offered.

And there should be no worries over missing out on trades since the platform offers 99.99% uptime, and it is available 24/7/365. Technology is also built right into the platform, with low-latency APIs (FIX, WebSockets) providing solid connectivity.

In Conclusion

Those businesses that require cryptocurrency trading services can definitely benefit from what Finery Markets is offering. Whether it is an asset manager, payment service, liquidity provider, crypto wallet, other exchanges, brokers, and banks, all can take advantage of the institutional grade technology that is used in the Finery trading platform. Trading with Finery makes cryptocurrencies easier and less expensive due to the better prices and lower IT costs. Unlimited liquidity, efficient liquidity management and no fees for takers, with regulated liquidity providers from the global financial hubs. That is what Finery Markets offers each and every business using its service.

Full Breakdown Filters

Full Breakdown

Full BreakdownDisclaimer: The contents or products outlined on this page are provided by third parties and do not constitute an endorsement or any opinion by Finance Magnates. Finance Magnates has no control of the contents of this page, nor is responsible for its accuracy or legality and hereby waives any responsibility for this content. Any transactions, investments, or engagement that you enter into with a third party listed on this page or linked from this page are solely between you and such third party and are performed at your own risk. Finance Magnates holds no responsibility for any liability, damages, or losses caused in connection with the use of any content on this page.