Preview Mode

- SEE LESS

- B2B Categories

- Industry Executives (287)

- Industry Websites (59)

- Regulators (23)

- Liquidity Provider (4)

- Payment Processors (3)

- Platforms (3)

- KYC (2)

- Regulation Consulting (2)

- Cryptocurrency Trading Solutions (1)

- CRM (1)

- Tools for Brokers (1)

- SaaS Provider (1)

- MT4/MT5 Bridge Providers (1)

- Platform Providers (1)

- White Label Solutions

- Affiliate Programs

- Cryptocurrency Liquidity Providers

- Translation Services

- Trading Categories

- Subscribe to our Newsletter

- Suggest a company

- Contact Us

- Companies Home

- Company News

- Categories

- Trading News

- Company News

- Videos

- Search

- Add

Company

Minimum Deposit

- 50-500

Leverage

- 400:1

- 100:1

- 200:1

Regulation

- CySec

- MiFiD

- FSC

- SCA

- FCA

- ASIC

Full Breakdown Filters

Full Breakdown

Full BreakdownCompany Review

ATFX Broker Review: Is It the Right choice For You?

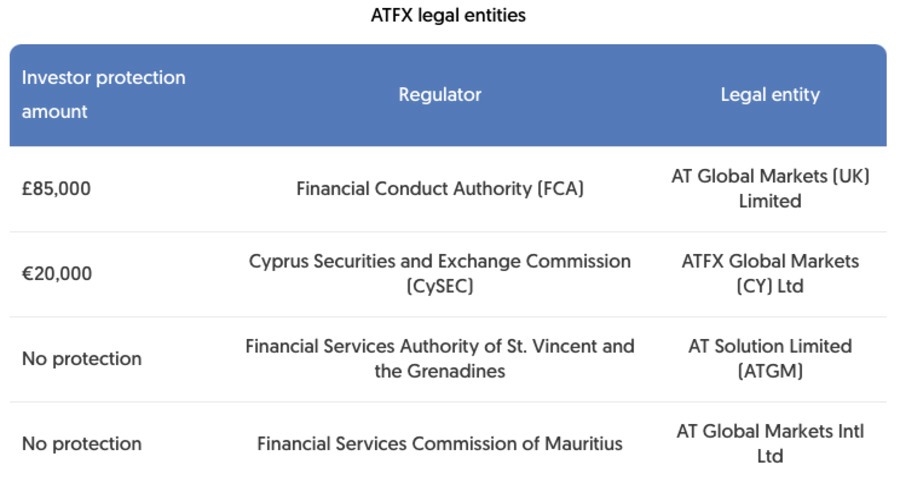

| Regulation and License | FCA, ASIC, CySEC, SCA, SFC, FSCA, FSC, FSA, SERC |

| HQ | UK |

| Founding year | 2017 |

| Leverage range | Up to 1:1000 |

| Min deposit | $50 |

| Platforms | MT4, MT5, AT GO |

| Tradable Instruments | Stocks, Indices, Commodities, Energies, CFDs, Precious Metals, ETFs, Share CFDs, Forex |

| Demo account | Yes |

| Base Currencies | Support multiple currencies |

| Customer support | 24/5 |

| Active clients | Not known |

| publicly traded | No |

| Crypto | Yes |

| Website | https://www.atfx.com |

ATFX Broker Review

ATFX is among the leading CFD brokers offering various trading options to its clients. The company is regulated by CySEC, and FCA and provides a good range of tradable assets, including forex, cryptocurrency, CFDs on indices, stocks, and commodities.

Founded in 2017, the broker has gained a good reputation in the industry and is preferred by many traders for its excellent leverage options, fast order execution, and 24/5 customer support. With a maximum leverage of 1:400 and a minimum deposit of $500, ATFX is a good choice for both beginner and experienced traders. The broker also offers a free demo account to help traders learn and practice their trading strategies before investing real money.

| Pros | Cons |

| Offers multiple accounts | No fundamental data support |

| Lower forex fees | Email support is slightly slower |

| Leverage up to 1:400 | |

| Offers popular MT4 platform | |

| 24/5 customer support |

ATFX supports multiple currencies and offers a variety of trading platforms, including MT4 Desktop, Mobile, and WebTrader. The broker also provides a good range of educational resources to help traders improve their trading skills. ATFX is a good choice for those looking for a reliable and regulated CFD broker with a good range of tradable assets and competitive fees. ATFX has not mentioned anything about its total active clients, but it's a top-rated broker among global customers.

Along with forex pairs, ATFX also offers to trade in various CFDs, including cryptocurrencies, stocks, indices, and commodities. In addition, ATFX offers multiple trading accounts that make it convenient for traders to choose an account type that suits their trading style and investment goals. The Standard ATFX account requires a minimum deposit of $500.

ATFX broker safety information

ATFX is a genuine and regulated broker licensed by CySEC and FCA. This CFD broker has taken all the security measures to protect the client's fund. Starting from the segregation of client funds to negative balance protection, they have put all the safety nets in place.

They've also implemented the necessary technical advancements to improve the security, including SSL certificates and Two-Factor Authentication (2FA). The two-factor authentication offers an additional layer of protection to the client's account. In addition, ATFX also offers PAMM account services to its clients. PAMM account is a managed service that allows investors to entrust their funds with experienced money managers.

Moreover, ATFX has also implemented Know Your Customer (KYC) and Anti-Money Laundering (AML) policies to ensure that only legitimate clients are allowed to open an account and trade with this broker. They also follow regulations from the European Securities and Markets Authority (ESMA), which means clients' data is well-protected. As a result, you can be sure that they will never liquidate your position unfairly. In addition, they offer 24/5 customer support that you can reach out to via live chat, email, or telephone.

Due to the safety features, ATFX is quite popular among clients from all over the world. With flexible leverage options, fast order execution, and a good range of tradable assets, ATFX is suitable for beginners and experienced traders.

ATFX fees structure information

They offer different accounts, and the fee for each account type is different. The minimum deposit for the Standard account is $500, and the leverage offered is up to 1:400. They offer tight spreads from 0.1 to 0.6 pips which are considered average compared to other brokers. The margin call/stop-out information is not available on the ATFX website.

There are multiple deposit and withdrawal options available for customers of ATFX. The deposit methods include bank wire transfer, credit/debit card, and e-wallets such as Neteller and Skrill. The withdrawal process takes 1-3 days, depending on the method used. The withdrawal fees are applicable if the amount is less than $100, around $5.

ATFX does not charge for deposits, and the majority of the withdrawals are also free. The only time a fee is incurred is when the amount withdrawn is less than $100, in which case, a flat fee of $5 is charged. Overall, ATFX has competitive fees with a transparent pricing structure.

| Fees Type | ATFX |

| Deposit fee | No |

| Withdrawal fee | No |

| Inactivity fee | No |

| Fee ranking | Low/Average |

Spreads fee information

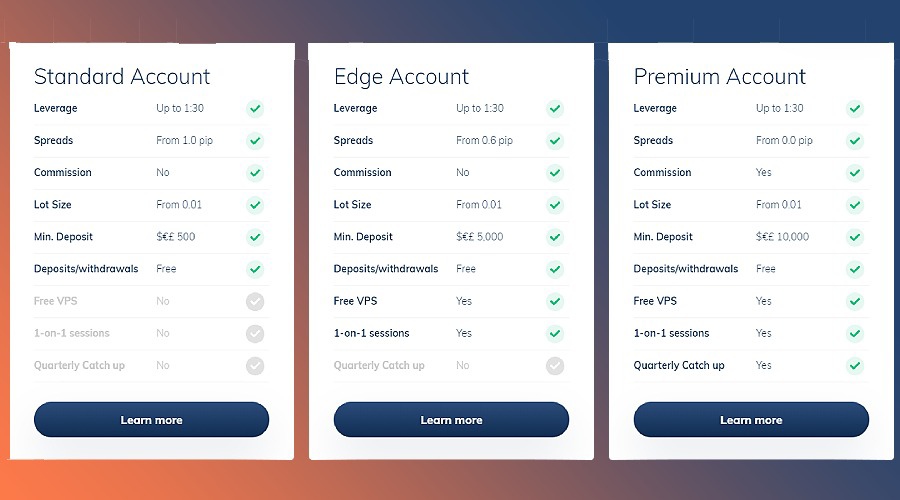

The spread fee varies with account type and starts from 0.1 pips for the Standard account. ATFX does not charge any deposit or withdrawal fees which is considered an advantage over other brokers who charge a fee for these services. Overall, the broker has competitive spreads and transparent pricing. The spread information for every ATFX account is as below:

- Standard: High spreads, from 1.0 pips.

- Edge: Low spreads, from 0.6 pips.

- Premium: Raw spreads, from 0.0 pips.

- Professional: Low spreads, from 0.6 pips.

ATFX has not mentioned whether the spreads are fixed or floating. However, the spreads are pretty tight compared to other brokers in the industry. For those who don't know, floating spreads are variable and change according to the market conditions. On the other hand, fixed spreads are not impacted by the market volatility and remain the same even during high market volatility.

Swap fee

The broker charges a swap fee for holding a position overnight. This fee is either positive or negative and is calculated based on the interest rate differential of the currencies involved in the trade. ATFX swap fee information is not available on the website. However, while holding positions overnight, you need to be aware of the swap fees as they can impact your profits or losses.

Deposit and withdrawal options available at ATFX broker

ATFX is among the popular brokers that offer multiple deposit and withdrawal options to its clients. The deposit methods available at ATFX include Credit/Debit Card, Bank Wire Transfer, Neteller, Skrill, UnionPay, WebMoney, and more. The minimum deposit amount is $500, and the broker charges no deposit fees.

Withdrawal requests are processed within 24 hours, and the funds are transferred to the trader's account within 3-5 business days. The broker charges a withdrawal fee of 5% if the amount is $100 or less than that. Otherwise, they don't charge any withdrawal fee. However, you need to check with your bank for any charges they might levy. Deposits and withdrawals are safe as the platform uses SSL encryption to protect the client's personal and financial information.

You can manually request the withdrawal process in your Client Area. The overall deposit and withdrawal methods are convenient, and the process is fast. As they're regulated, they need to comply with the anti-money laundering policies and thus require you to submit your KYC documents before processing your withdrawal request. It's only a one-time process when you open your account with them. Below are the details of the minimum deposit for every account:

- Standard: $500.

- Edge: $5,000.

- Premium: $10,000.

- Professional: $5,000 (You need to meet certain criteria for opening this account and you can have more information about it by contacting their support team).

The minimum amount is decent when compared to the features and account types offered by other CFD brokers.

Tradable markets and products

As we have already mentioned, ATFX is a CFD broker that offers its clients to trade in forex pairs and other instruments like stocks, indices, cryptocurrencies, and commodities. In addition, the broker provides a good range of tradable assets that allows traders to diversify their portfolios.

It offers around 70 currency pairs, including major, minor, and exotic currency pairs. Some popular currency pairs you can trade on ATFX are EUR/USD, GBP/USD, USD/JPY, and AUD/USD. ATFX also offers CFDs on a good range of commodities like gold, silver, oil, and gas. You can also trade in CFDs on popular indices like Dow Jones, S&P 500, NASDAQ 100, and FTSE 100. When it comes to cryptocurrencies, they offer four options, including bitcoin.

When it comes to commissions on tradable products, ATFX charges a commission when you execute a trade, and they can be volume-tiered or flat fees. For exact commission information, you need to contact their customer support. With. Leverage of up to 1:400, ATFX offers good leverage options for both beginner and experienced traders.

As they support MT4, they have a good user base as MT4 is the most popular trading platform in the industry. The broker offers three different types of MT4 platforms, including MT4 Desktop, Mobile, and Webtrader. All these platforms are available for both demo and live accounts. With spreads from 0.0 pips, they offer tight spreads on major currency pairs. They've not mentioned any details about the maximum trade you can do with them.

leverage information

ATFX offers leverage between 1:30 and 1:400, which is a good range for beginners and experienced traders. There is no information available about margin requirements. While dealing with leverage, you need to keep in mind that it can increase your profits and losses. So, it is always advisable to use leverage cautiously. ATFX also offers a free demo account that you can use to practice your trading strategies without risking any real money. The stop-out information is not available on their website.

Trading platforms for traders

ATFX is a leading CFD platform that offers three different types of trading platforms, including MT4 Desktop, Mobile, and Webtrader. All these platforms are available for both demo and live accounts. With spreads from 0.0 pips, the broker offers tight spreads on major currency pairs.

MT4 is a powerful and popular trading platform preferred by most traders in the industry. The MT4 is available for both desktop and mobile devices. With the MT4 platform, you can trade in forex pairs and other instruments like stocks, indices, cryptocurrencies, and commodities. The MT4 platform is available in multiple languages, which makes it convenient for traders from all over the world.

MetaTrader4

MetaTrader 4 is a world-renowned trading platform and is the choice of hundreds of thousands of traders around the globe. The MT4 is available on a range of devices, including PCs, Macs, smartphones, and tablets. The desktop version can be downloaded from the ATFX website, while the mobile versions of MT4 are available on the App Store and Google Play. Some of the key features of MT4 include advanced charting tools, a wide range of technical indicators, and support for automated trading. Moreover, the MT4 is available in multiple languages, making it convenient for traders from all over the world.

MT4 mobile app

MetaTrader 4 is also available as a mobile app for Android and iOS devices. The mobile app of MT4 offers all the features and functionalities of the desktop version. With the mobile app, you can access your trading account from anywhere. You can also monitor your open positions and check your account balance on the go.

ATFX also offers you a demo account which is a great way to practice your trading strategies without risking real money. The demo account is identical to the live account, except that you trade with virtual money. You can use their demo account once you have opened a live account with them. The live account takes around 24 hours to be activated.

Account types

There are four types of accounts available on ATFX, which are:

Standard account

The Standard account is the most basic account type suitable for beginner traders. The minimum deposit for this account is $500. The spreads on this account start from 1.0 pip. There is no commission charged on this account type. The leverage offered on this account type is up to 1:30. Moreover, there are no additional premium resources when you open the standard account.

Edge account

The Edge account is the next level up from the Standard account and is suitable for experienced traders. The minimum deposit for Edge account is $5,000. The spreads on this account start from 0.6 pip. There is no commission charged on this account type. The leverage offered on this account type is up to 1:30. Moreover, when you opt for the Edge account, you get access to premium resources such as a trading education and more advanced research tools.

Premium account

The Premium account is the top-tier account type suitable for professional traders. The minimum deposit for this account is $10,000. The spreads on this account start from 0.0 pip. A commission of $25 is charged per 10 lots traded on this account. The leverage offered on this account type is up to 1:30. In addition, when you opt for the Premium account, you access premium resources such as a trading education allowance and plenty of research tools.

Professional account

The Professional account is the highest account type and is only available to those who meet certain criteria, such as holding a minimum €500,000 portfolio or working experience in the financial sector. The spreads on this account start from 0.0 pip. The minimum deposit for the Professional account is $5,000.

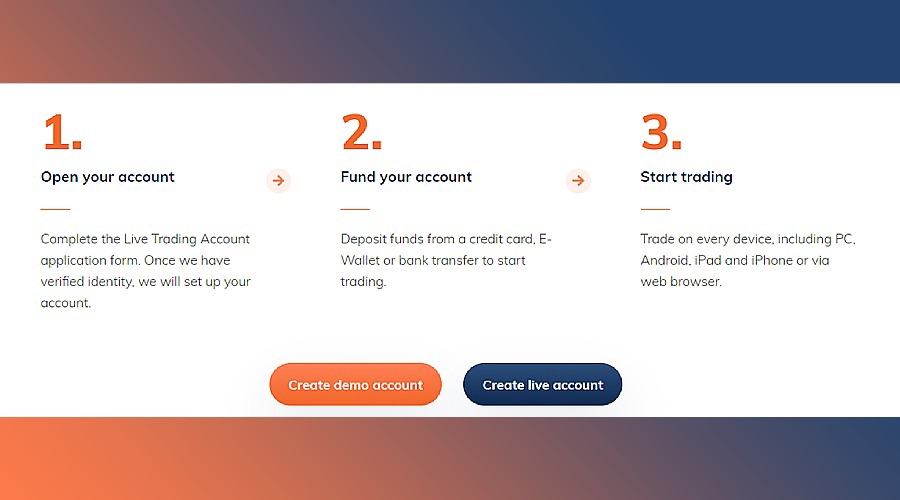

Steps to open your account with ATFX

To open an account, you need to follow these steps:

- Go to the ATFX website and click on the "Join Now"’ button.

- Fill in your personal details like name, email address, and phone number.

- Choose your account type and currency.

- Upload the documents required for account verification.

- Make a deposit and start trading.

Customer support

ATFX offers 24/5 customer support from Monday to Friday between 9 am and 5 pm, London time. You can contact them via telephone, email, or live chat. The customer support team is friendly and helpful.

- Phone: +44 20 3769 2269

- International phone: +971 4 875 4100

- Email: cs.uae@atfxgm.com

Research tools

The broker offers a wide range of research tools and resources that you can use to make better-informed trading decisions. Some of the research tools available at ATFX include:

Trading strategies: the broker offers a range of trading strategies that you can use to trade in different market conditions.

Economic calendar

The economic calendar at ATFX provides you with the latest information and updates about the major economic events that can impact the financial markets.

Market analysis and news

ATFX offers daily, weekly, and monthly market analysis reports that provide you with an in-depth analysis of the financial markets. You can also access the latest news and updates about the financial markets from ATFX.

Financial events

ATFX also provides you with information about the major financial events that can impact the markets. So, you can stay updated with ATFX about the latest economic news and events.

Trader Magazine

ATFX also offers a monthly trader magazine that provides you with the latest news, analysis, and insights about the financial markets. Moreover, the trader magazine also includes interviews with successful traders and tips to help you become a better trader.

Educational content

ATFX offers a wide range of educational content for both beginner and experienced traders. ATFX offers:

Trading webinars

ATFX regularly organizes trading webinars which are conducted by experienced trainers. These webinars cover a wide range of topics like risk management, technical analysis, and market overview.

Trading seminars

ATFX also organizes trading seminars that are conducted by experienced traders. These seminars cover a wide range of topics like risk management, technical analysis, and market overview.

Trading central

Under this, you will get a lot of information about market analysis and research, technical analysis, and market overview.

ATFX review in a nutshell

ATFX is a leading CFD platform that offers excellent trading conditions and a wide range of tradable instruments. With the MT4 platform, you can trade in forex pairs and other instruments like stocks, indices, cryptocurrencies, and commodities. As ATFX is a regulated broker, you can trade with them with complete peace of mind. The broker also offers a free demo account that you can use to practice your trading strategies without risking any real money.

FAQs

What is the minimum deposit at ATFX?

The minimum deposit at ATFX is $500 for the Standard account. Other accounts have different minimum deposit amounts.

What is the maximum leverage offered by ATFX?

The maximum leverage offered by ATFX is 1:400.

Does ATFX offer a demo account?

Yes, ATFX offers a demo account which is a great way to practice your trading strategies without risking any real money.

Is ATFX a regulated broker?

Yes, ATFX is a regulated broker. ATFX broker is regulated by the Cyprus Securities and Exchange Commission (CySEC).

What are the deposit methods at ATFX?

The deposit methods at ATFX include bank transfer, credit/debit card, and e-wallets like Skrill and Neteller.

What are the withdrawal methods at ATFX?

The withdrawal methods at ATFX include bank transfer, credit/debit card, and e-wallets like Skrill and Neteller.

How do I open an account with ATFX?

To open an account, click on the Join Now button, fill in your personal details, and upload the required documents. Your ATFX account will be activated within 24 hours.

Does ATFX support MT4?

Yes, ATFX supports MT4 which is a world-renowned trading platform and is the choice of hundreds of thousands of traders around the globe.

What are the spreads at ATFX?

The average spread at ATFX is 0.6 pips on the EUR/USD pair.

What is the minimum trade size at ATFX?

The minimum trade size at ATFX is 0.01 lots.

How to contact ATFX customer support?

You can contact ATFX customer support via telephone, email, or live chat.

Does ATFX offer educational content?

Yes, ATFX offers educational content in the form of video tutorials, seminars, and webinars.

Can US residents open accounts at ATFX?

No, US residents cannot open accounts at ATFX.

How can I change my password at ATFX?

You can change your ATFX password by logging into your account and going to the "Settings" tab.

What account types do ATFX offer?

ATFX offers Standard, Edge, Premium, and professional.

Full Breakdown Filters

Full Breakdown

Full BreakdownCompany Updates

Disclaimer: The contents or products outlined on this page are provided by third parties and do not constitute an endorsement or any opinion by Finance Magnates. Finance Magnates has no control of the contents of this page, nor is responsible for its accuracy or legality and hereby waives any responsibility for this content. Any transactions, investments, or engagement that you enter into with a third party listed on this page or linked from this page are solely between you and such third party and are performed at your own risk. Finance Magnates holds no responsibility for any liability, damages, or losses caused in connection with the use of any content on this page.