Preview Mode

- SEE LESS

- B2B Categories

- Industry Executives (287)

- Industry Websites (59)

- Regulators (23)

- Liquidity Provider (4)

- Payment Processors (3)

- Platforms (3)

- KYC (2)

- Regulation Consulting (2)

- Cryptocurrency Trading Solutions (1)

- CRM (1)

- Tools for Brokers (1)

- SaaS Provider (1)

- MT4/MT5 Bridge Providers (1)

- White Label Solutions

- Affiliate Programs

- Platform Providers

- Cryptocurrency Liquidity Providers

- Translation Services

- Trading Categories

- Subscribe to our Newsletter

- Suggest a company

- Contact Us

- Companies Home

- Company News

- Categories

- Trading News

- Company News

- Videos

- Search

- Add

Company

Support

24/7 Support, Onboarding & Training, Dedicated Account Manager, Technical Support, Live Monitoring Alerts

Languages

- Russian

- Spanish

- English

- Portuguese

Full Breakdown Filters

Full Breakdown

Full BreakdownCompany Review

Brokerpilot Review: Scalable Risk Management for Brokers

Introduction

The Problem We Solve

Running a brokerage without live, actionable risk data is expensive.Toxic flow, latency arbitrage, and delayed reaction to abnormal trading activity can wipe out weeks of profit in hours. One wrong swap can cost more than a full year of Brokerpilot.

Brokerpilot ends blind risk management. We bring instant transparency to your books, so you can see, decide, and act before losses scale.

Who It’s For

- Dealing Desks — monitor toxic flow and exposures minute by minute.

- Risk & Compliance Teams — get alerts before breaches or fraud escalate.

- Executives / CFO / COO — one dashboard to understand P&L drivers and protect revenue.

- Brokerage Startups — enterprise-grade risk control from day one, no in-house dev required.

What You Get

- Full P&L Transparency

Track profit & loss by accounts, symbols, trade reasons in real time.

- Live Toxic Flow & Arbitrage Alerts

See sharp deals and latency strategies as they happen, not after they hurt your book.

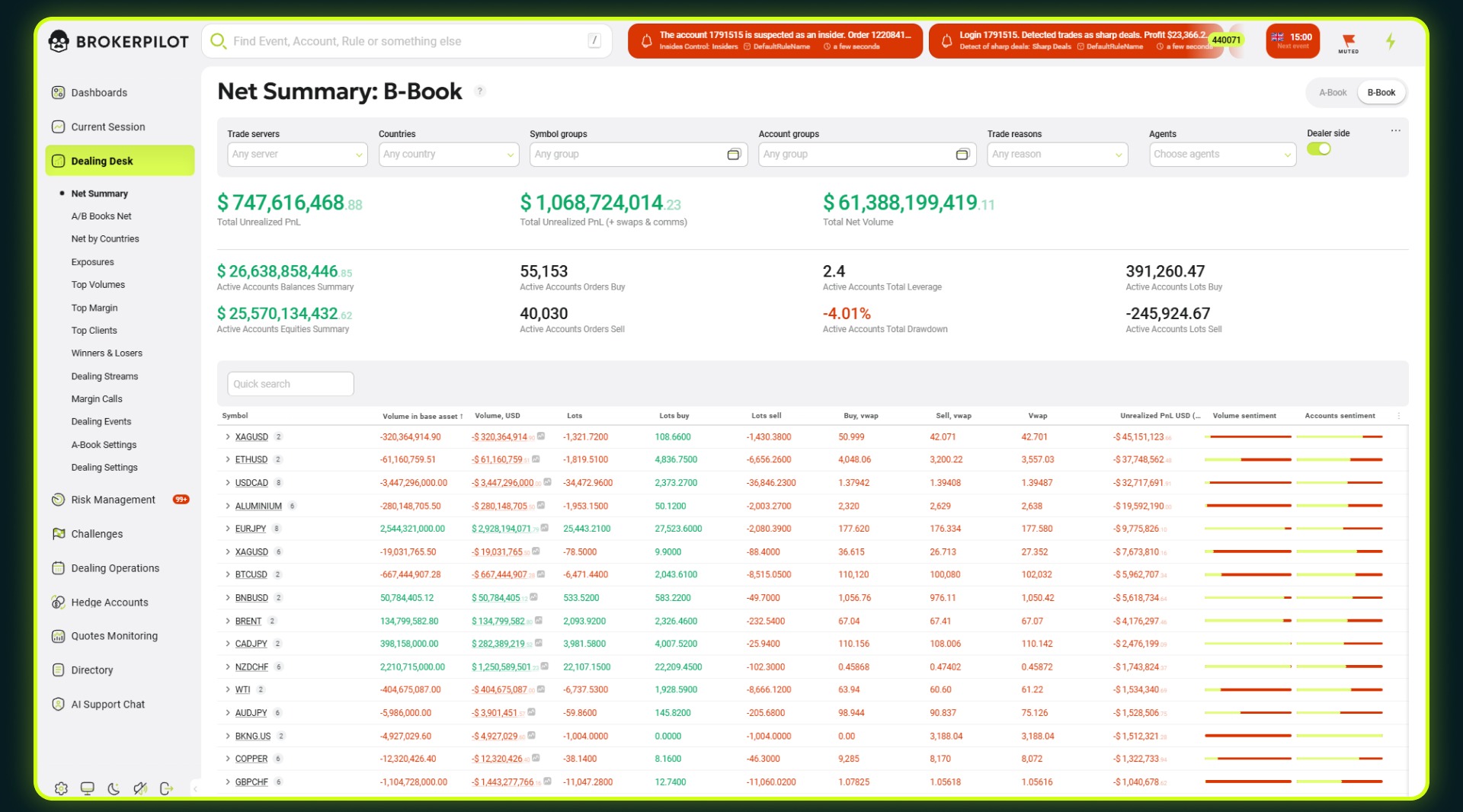

- B-Book & A-Book Control

Drill down into exposure by server, country, instrument — rebalance instantly.

- Operational Efficiency

Replace spreadsheets with dynamic dashboards. Less manual work, faster reactions.

- Scalable, Secure Architecture

Built for high-volume brokers, deployed in secure cloud or on-prem.

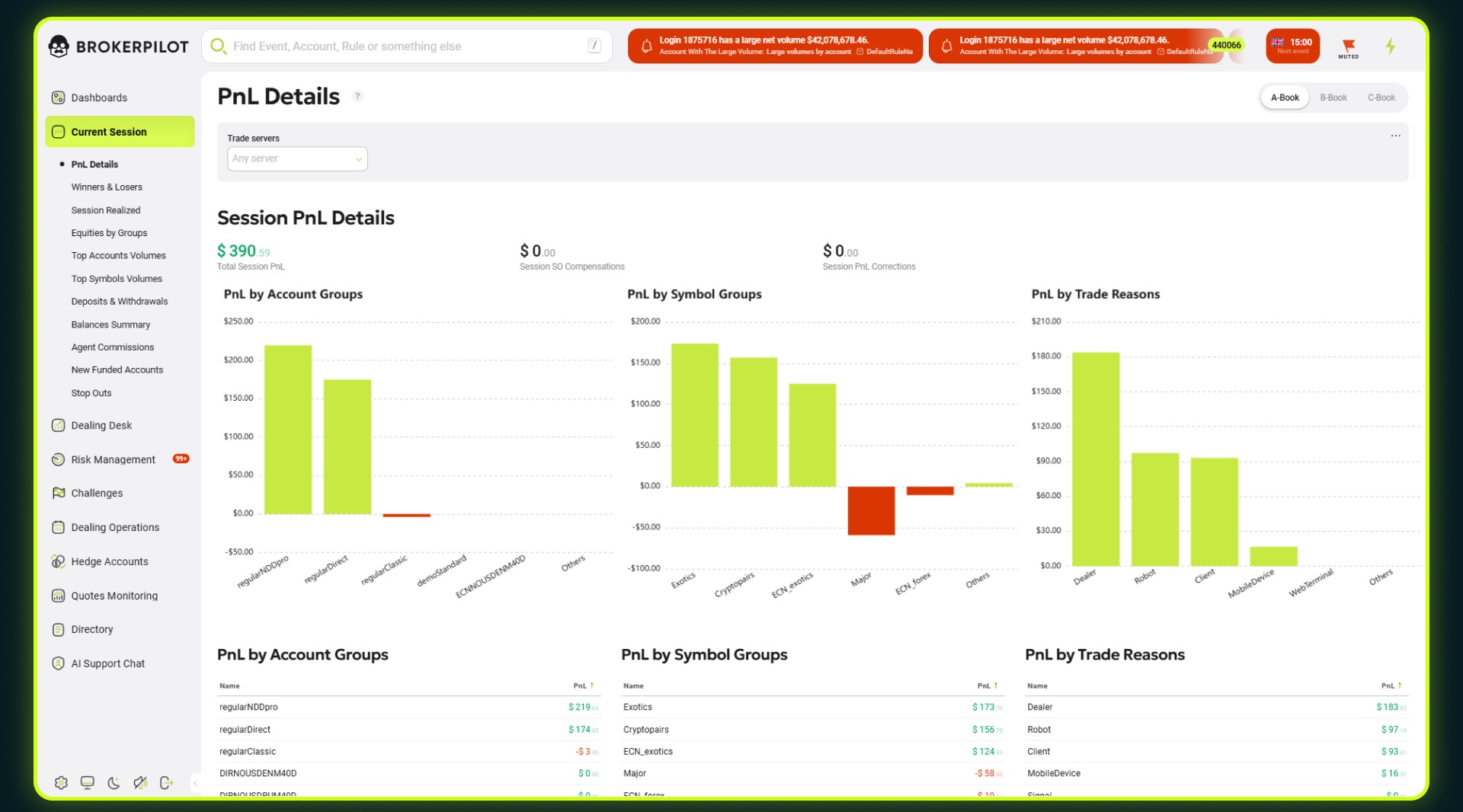

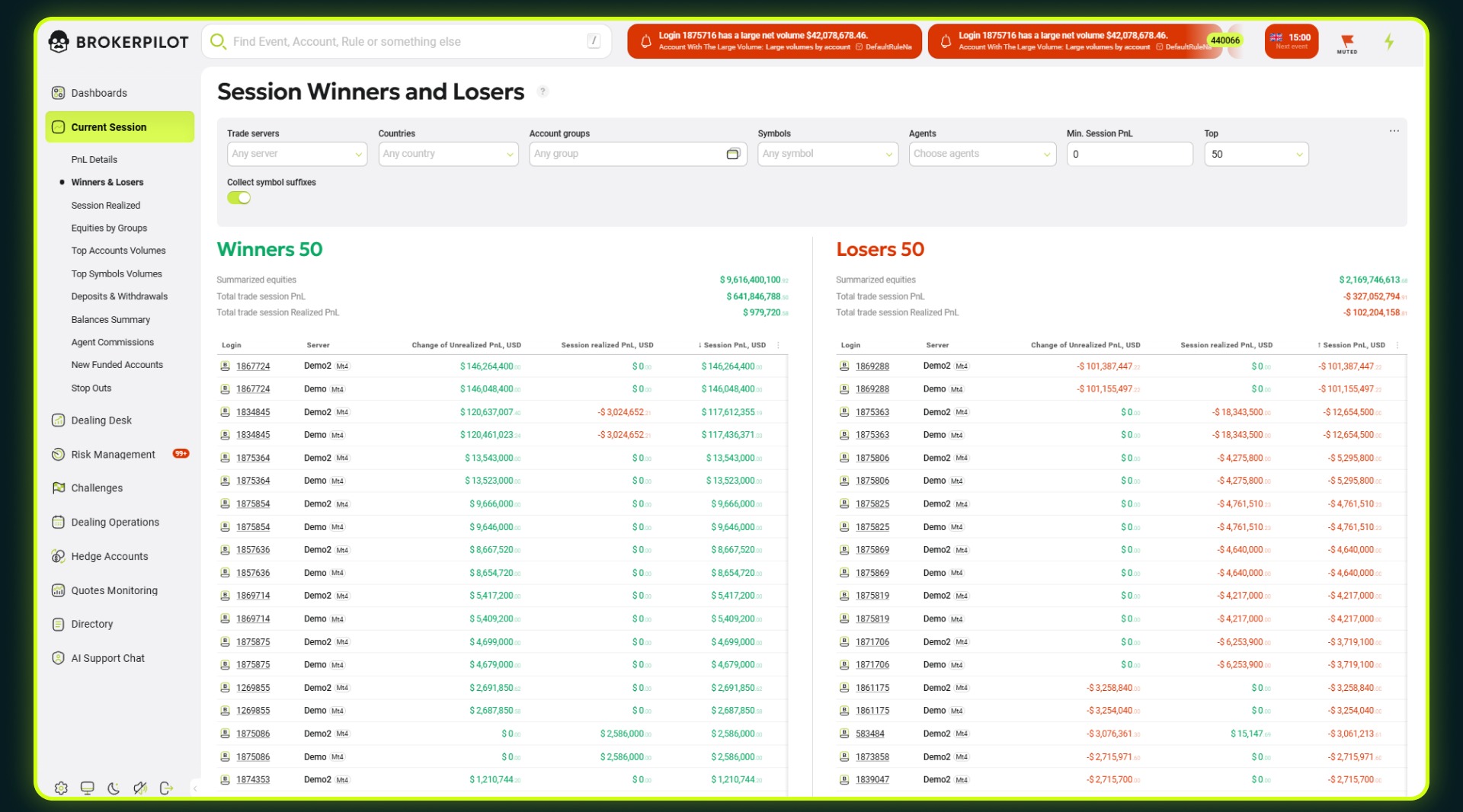

Screenshots Explained

A single view of total session P&L with breakdown by accounts, symbols, and trade reasons — instantly see where risk and profit concentrate.

Live ranking of top profitable and loss-making accounts — know exactly who drives or drains your P&L.

Comprehensive exposure control: realized/unrealized P&L, leverage, drawdown, and open lots per symbol — actionable in real time.

Trusted by Leading Brokers

Used by, Libertex, Deriv, INGOT and other regulated global players. Brokerpilot protects billions in daily trading volume.

“We stopped flying blind. Our dealing desk now sees toxic flow before it costs us.”

— Head of Risk, Global FX Broker

Return on Investment

- Cheaper than one toxic flow leak

- Less than a single day’s delay in catching arbitrage

- One wrong swap can cost more than a year of Brokerpilot

Your first prevented loss often covers the subscription.

Get Started

No obligations. Quick deployment. ROI from the first prevented loss.

Technology & Compliance

- Integration with MT4 / MT5 / cTrader, major liquidity providers, and CRMs

- Cloud or on-premise deployment

- Enterprise-grade security, GDPR compliant

- Global support and onboarding for dealing desks & risk teams

Full Breakdown Filters

Full Breakdown

Full BreakdownDisclaimer: The contents or products outlined on this page are provided by third parties and do not constitute an endorsement or any opinion by Finance Magnates. Finance Magnates has no control of the contents of this page, nor is responsible for its accuracy or legality and hereby waives any responsibility for this content. Any transactions, investments, or engagement that you enter into with a third party listed on this page or linked from this page are solely between you and such third party and are performed at your own risk. Finance Magnates holds no responsibility for any liability, damages, or losses caused in connection with the use of any content on this page.