Preview Mode

- SEE LESS

- B2B Categories

- Industry Executives (287)

- Industry Websites (59)

- Regulators (23)

- Liquidity Provider (4)

- Payment Processors (3)

- Platforms (3)

- KYC (2)

- Regulation Consulting (2)

- Cryptocurrency Trading Solutions (1)

- CRM (1)

- Tools for Brokers (1)

- SaaS Provider (1)

- MT4/MT5 Bridge Providers (1)

- White Label Solutions

- Affiliate Programs

- Platform Providers

- Cryptocurrency Liquidity Providers

- Translation Services

- Trading Categories

- Subscribe to our Newsletter

- Suggest a company

- Contact Us

- Companies Home

- Company News

- Categories

- Trading News

- Company News

- Videos

- Search

- Add

Company

Support

.

Full Breakdown Filters

Full Breakdown

Full BreakdownCompany Review

FinxProp Review: How the Finx Challenge Works & Funding Details

Introduction

FinxProp is a proprietary trading firm that empowers skilled traders to access significant capital through a structured evaluation known as the Finx Challenge. By simulating live market conditions, FinxProp allows participants to demonstrate their trading abilities before receiving funded accounts.

Key aspects of FinxProp’s offering include:

Two challenge formats, Classic and Quick, tailored to different trading styles and timelines

Initial funding up to $400,000, with potential scaling to $2 million

Profit splits up to 90% upon successful completion of the evaluation

Clear risk controls such as daily loss limits and trailing drawdown thresholds

In this detailed FinxProp review, we will examine how regulation, evaluation procedures, trading platforms, fee structures, risk management rules, and support services combine to create a transparent path from challenge enrollment to professional-level trading.

Regulation & Licensing

Unlike retail brokers or fund managers, proprietary trading firms including FinxProp operate on a model that does not require a financial services license. All trading occurs on simulated, firm-funded accounts, and no client funds are held or managed. As a result, FinxProp is not subject to the same licensing regimes that govern brokers or investment advisors.

Standard Industry Practice

Most prop firms worldwide provide simulated or firm-capital trading without taking client deposits. By focusing on education and skill assessment rather than fund management, they fall outside typical regulatory scope.

Global Accessibility & Restrictions

FinxProp welcomes traders from jurisdictions where prop-trading challenges are permitted. In regions with local restrictions, participation may be limited—traders should verify eligibility based on their country of residence.

Integrity via KYC

To maintain fairness and prevent duplicate or fraudulent accounts, FinxProp applies a Know-Your-Customer (KYC) check after the evaluation phase. This identity verification helps uphold challenge integrity without implying broker-level regulation.

This approach allows FinxProp to offer a streamlined, cost-effective evaluation process focused on trading performance, while traders seeking fully regulated brokerage services can compare options that involve live capital and statutory client protections.

Evaluation Process

FinxProp’s evaluation is structured into three clear stages: Challenge, Verification, and Funding designed to assess both profitability and risk discipline before traders access live capital.

Accept the Challenge

Participants begin by choosing one of two challenge formats on the FinxProp “Challenges” page:

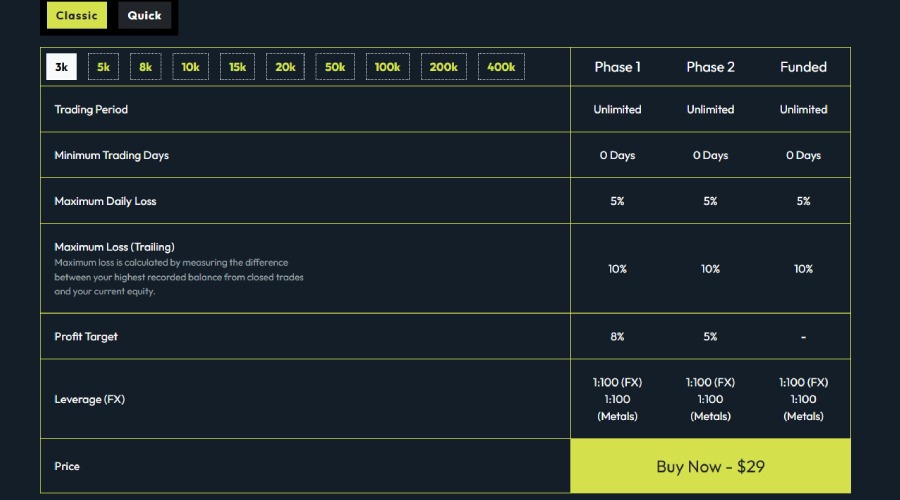

Classic Challenge

Trading Period: Unlimited

Minimum Trading Days: 2

Profit Target: 10%

Maximum Daily Loss: 4%

Maximum (Trailing) Drawdown: 6%

Leverage (FX & Metals): 1:100

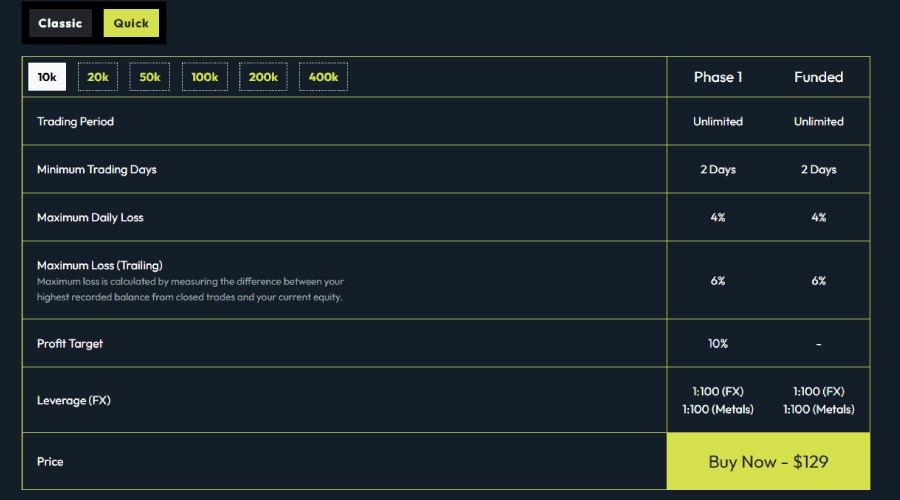

Quick Challenge

Trading Period: Unlimited

Minimum Trading Days: 0

Profit Targets: 8% (Phase 1) and 5% (Phase 2)

Maximum Daily Loss: 5%

Maximum (Trailing) Drawdown: 10%

Leverage (FX & Metals): 1:100

Each challenge tier corresponds to a specific account size (ranging from $3,000 to $400,000), with fees varying by level. Traders may attempt the challenge as many times as needed within the unlimited trading period, provided they adhere to the risk parameters.

Complete Verification

Upon meeting the profit targets without breaching loss limits, successful participants proceed to a mandatory Know-Your-Customer (KYC) verification. This step confirms identity, prevents duplicate or fraudulent accounts, and ensures only legitimate traders receive funded accounts.

Become a Funded Trader

After KYC approval, traders receive login credentials for their funded account. Initial capital allocations mirror the challenge tier selected (up to $400,000), and a scaling plan allows growth to $2 million as performance and consistency are demonstrated. FinxProp offers profit splits starting at 80% and scaling up to 90%, ensuring traders retain the majority of their gains.

This three-step evaluation balances flexibility through multiple challenge formats and unlimited time with stringent risk controls, giving traders a transparent, merit-based path to professional-level funding without exposing personal capital to live-market risk.

Platform & Technology

FinxProp provides a fully simulated trading environment built on proprietary infrastructure and real-time market data feeds. The platform is designed to mirror live market conditions while enforcing the firm’s strict risk rules, allowing traders to focus on developing robust strategies without risking personal capital.

Simulated Trading Environment

Real-Time Data Feeds: All price and volume data are sourced from third-party liquidity providers, ensuring that virtually every tick and fill matches the depth and volatility of live markets. Traders experience genuine market dynamics spreads, slippage, and order execution latencies as if they were trading with real capital.

Unlimited Access: There are no time restrictions on the challenge period. Whether using Classic or Quick evaluation, traders can execute as many trades as needed to meet profit targets, with the platform continuously tracking daily loss and drawdown limits in real time.

Proprietary Execution & Risk Engine

Order Matching & Execution: The platform’s execution engine routes simulated orders through a matching algorithm that replicates interbank and ECN pricing structures. This ensures that order fills reflect market liquidity and that larger orders may experience partial fills or price impact consistent with real-world conditions.

Risk Management Integration: Built-in enforcement of maximum daily loss and trailing drawdown thresholds automatically monitors each position. Exceeding any risk parameter triggers challenge termination, reinforcing strict discipline and real-time accountability.

Analytics, Reporting & Feedback Tools

Account Analysis Dashboard: After every trading session, traders can review detailed performance metrics win rate, average profit per trade, volatility measures, and risk-adjusted returns to pinpoint strengths and weaknesses in their approach.

Trader’s Analysis Reports: FinxProp’s team generates periodic reports with deeper insights into trade execution quality, adherence to risk rules, and behavioral patterns (e.g., time-of-day biases) to help traders refine their tactics and risk management practices.

Scalability Tracker: Once funded, traders can monitor progress toward higher funding tiers through a dedicated scaling interface that displays cumulative profits, drawdowns, and eligibility criteria for increasing capital up to $2 million.

Fees & Profit Split

FinxProp’s fee structure and profit-sharing model are transparent and designed to align trader success with rewards. This section details the cost of each challenge tier and the payout terms once funded.

Challenge Fees

Participants pay a one-time fee to enter a Classic or Quick Challenge. All fees grant unlimited trading time until either the profit target is reached or a risk limit is breached.

Challenge Type | Account Size | Entry Fee (USD) |

Quick Challenge | $10,000 | $129 |

$20,000 | $199 | |

$50,000 | $399 | |

$100,000 | $659 | |

$200,000 | $1,299 | |

$400,000 | $2,199 |

Challenge Type | Account Size | Entry Fee (USD) |

Classic Challenge | $3,000 | $29 |

$5,000 | $49 | |

$8,000 | $79 | |

$10,000 | $99 | |

$15,000 | $119 | |

$20,000 | $159 | |

$50,000 | $299 | |

$100,000 | $499 | |

$200,000 | $899 | |

$400,000 | $1,799 |

Profit Split & Payout Terms

Profit Split: Traders keep 80% of net profits by default, scaling up to 90% under the platform’s scaling plan. Each incremental funding tier increases the trader’s share, rewarding consistent performance.

Payout Speed: Withdrawals are typically processed within 48 hours, offering rapid access to earnings via bank transfer or cryptocurrency options.

Payout Flexibility: Traders may request payouts as frequently as every 14 days after their first funded trade, up to a maximum of 60 days between withdrawals, enabling adaptable cash-flow management.

Fee Refund: Upon completion of the third successful withdrawal, FinxProp refunds the original challenge fee as a further incentive for long-term engagement (terms apply).

By combining competitive entry fees with a high profit split and fast, flexible payouts, FinxProp structures its funding model to maximize trader incentives while maintaining clear cost expectations.

Risk Management Rules

FinxProp enforces strict risk parameters to ensure capital preservation and consistent trading discipline. Breaching any of these limits during the evaluation or funded phases results in immediate challenge termination or account suspension.

Daily Loss Limit

Traders may lose no more than a fixed percentage of their starting equity in a single calendar day.

Classic Challenge: 4% of starting balance.

Quick Challenge: 5% of starting balance.

Exceeding the daily loss threshold automatically closes all open positions and ends the challenge or funded account for that period.

Trailing (Maximum) Drawdown

This limit tracks the peak equity achieved and enforces a maximum allowable decline from that peak at any time.

Classic Challenge: 6% trailing drawdown

Quick Challenge: 10% trailing drawdown.

If the account equity falls below the peak minus the drawdown percentage, the challenge is terminated immediately.

Position Sizing & Leverage

Leverage Cap: 1:100 on forex and metals across all evaluation tiers.

Position Limits: While there’s no explicit minimum or maximum number of contracts or lots per trade, implied position sizing must respect the daily loss and drawdown limits at all times.

Enforcement & Automation

All risk rules are enforced by FinxProp’s proprietary risk engine in real time. Traders receive notifications of limit breaches, and any violation whether during the challenge or in live funded accounts triggers an automatic halt to further trading activity for that cycle.

Support & Education

FinxProp combines responsive customer support with a suite of educational materials to help traders navigate the evaluation process and refine their strategies.

Customer Support Channels

Email Support: Traders can reach the support team at support@finxprop.com or info@finxprop.com for queries related to challenges, funding, or account issues.

Contact Form: A “Contact Us” form on the FinxProp website allows users to submit detailed questions directly from their dashboard or homepage.

Office Address: For formal correspondence, FinxProp’s headquarters are listed at 10–12 Bourlet Close, London, W1W 7BR, United Kingdom.

Educational Resources

Frequently Asked Questions (FAQ): A dedicated FAQ section addresses common inquiries about account tiers, risk rules, fee structures, and payout procedures, enabling self-service troubleshooting.

Tutorials & Guides: Step-by-step challenge walkthroughs, platform navigation videos, and strategy primers are available to help traders understand order types, risk parameters, and performance analytics (accessed via the “Challenges” and “Partner” quick links).

Performance Reports: After each trading session, the platform generates detailed analytics win rates, drawdown profiles, and execution metrics so participants can pinpoint strengths and improve weaknesses before attempting the next challenge.

Community & Partnership Program

Partner Referrals: FinxProp offers a Partner Program through which community members can earn commissions by referring new traders. Program details and sign-up links are available under the “Partner” quicklink on the website.

Social Media & Forums: While FinxProp maintains a presence on platforms like Facebook, traders often share insights and strategies in independent forums and social-media groups, fostering peer-to-peer learning and support.

Pros & Cons

Below is an objective summary of FinxProp’s key advantages and drawbacks based on its challenge structure, funding model, and operational framework.

Pros | Cons |

Fast, Transparent Payouts: Withdrawals processed within 48 hours, with payout requests available as often as every 14 days. | Leverage Cap: Maximum leverage is set at 1:100 for FX and metals, which may limit strategies that rely on higher leverage. |

Scalable Funding: Consistent performers can grow from an initial $400K funded account to up to $2 million in capital. | Strict Risk Enforcement: Breaching any daily loss or drawdown limit leads to immediate challenge or account termination. |

No Time Constraints: Unlimited trading period for challenges, allowing traders to proceed at their own pace and refine strategies without pressure. |

Conclusion

FinxProp delivers a structured, merit-based pathway for traders to access substantial capital without risking personal funds. Through its two evaluation formats Classic and Quick traders can select the approach that best aligns with their strategies and timeframes. The platform’s simulated environment, powered by real-time liquidity feeds and a proprietary risk engine, ensures that challenge conditions closely replicate live-market dynamics.

With transparent entry fees, unlimited trading periods, and profit splits scaling up to 90%, FinxProp aligns trader incentives with firm objectives while maintaining clear cost expectations. Its rigorous risk management rules daily loss limits and trailing drawdowns instill disciplined trading habits that carry over into funded accounts.

Although FinxProp operates without broker licensing limiting it to simulated trading it compensates with rapid payouts, comprehensive support channels, and robust educational resources designed to help traders refine their performance. For traders focused on skill development, structured feedback, and accessing institutional-style capital, FinxProp presents a compelling, low-risk avenue for professional growth.

FAQ

What is FinxProp and how does its challenge work?

FinxProp is a proprietary trading firm offering simulated “Finx Challenges” in two formatsClassic and Quick to assess trading skill under real-time market conditions. Traders choose an account size, meet profit targets (10% for Classic; 8% + 5% phases for Quick), and adhere to strict daily loss and drawdown limits before advancing to verification and funding.

What are the entry fees for FinxProp’s challenges?

Entry fees vary by challenge format and account size. Quick Challenge fees range from $129 ( $10,000) to $2,199 ( $400,000), while Classic Challenge fees start at $29 ( $3,000) and go up to $1,799 ( $400,000).

How much funding can traders receive and what is the profit split?

Upon passing the challenge and KYC verification, traders receive up to $400,000 in initial funded capital, with the opportunity to scale to $2 million. Profit splits begin at 80% and increase up to 90% as traders advance through scaling milestones.

What risk management rules must I follow?

Daily Loss Limit: 4% (Classic) or 5% (Quick) of starting equity.

Trailing Drawdown: 6% (Classic) or 10% (Quick) from peak equity.

Breaching any limit results in automatic challenge termination or account suspension.

Which trading platforms and data feeds does FinxProp use?

FinxProp’s proprietary platform replicates live-market conditions using third-party liquidity feeds, offering realistic spreads, slippage, and order execution. Traders access detailed analytics dashboards and periodic performance reports to refine their strategies.

How and when can I withdraw profits?

Once funded, traders can request payouts every 14–60 days. Withdrawals are processed within 48 hours via bank transfer or cryptocurrency. After the third successful withdrawal, the original challenge fee is refunded as part of the firm’s fee-refund policy.

Full Breakdown Filters

Full Breakdown

Full BreakdownDisclaimer: The contents or products outlined on this page are provided by third parties and do not constitute an endorsement or any opinion by Finance Magnates. Finance Magnates has no control of the contents of this page, nor is responsible for its accuracy or legality and hereby waives any responsibility for this content. Any transactions, investments, or engagement that you enter into with a third party listed on this page or linked from this page are solely between you and such third party and are performed at your own risk. Finance Magnates holds no responsibility for any liability, damages, or losses caused in connection with the use of any content on this page.