Preview Mode

- SEE LESS

- B2B Categories

- Industry Executives (287)

- Industry Websites (59)

- Regulators (23)

- Liquidity Provider (4)

- Payment Processors (3)

- Platforms (3)

- KYC (2)

- Regulation Consulting (2)

- Cryptocurrency Trading Solutions (1)

- CRM (1)

- Tools for Brokers (1)

- SaaS Provider (1)

- MT4/MT5 Bridge Providers (1)

- White Label Solutions

- Affiliate Programs

- Platform Providers

- Cryptocurrency Liquidity Providers

- Translation Services

- Trading Categories

- Subscribe to our Newsletter

- Suggest a company

- Contact Us

- Companies Home

- Company News

- Categories

- Trading News

- Company News

- Videos

- Search

- Add

Company

Full Breakdown Filters

Full Breakdown

Full BreakdownCompany Review

Versus Trade Review 2025: All You Need to Know!

Introduction

Founded in 2024, Versus Trade is a multi-asset broker offering CFD trading on more than 200 instruments across forex, cryptocurrencies, indices, commodities, and stocks. The company operates under Versus Trade Ltd, registered in St. Lucia, and provides trading via the industry-leading MetaTrader 5 platform, available on web, desktop, and mobile.

Versus Trade emphasizes a secure and transparent trading environment, employing advanced anti-fraud systems, encryption protocols, and client fund segregation policies to protect traders. The broker caters to both retail and professional traders worldwide, offering swap-free Islamic accounts, multiple account configurations, and a range of funding methods with no deposit fees and unique asset-vs-asset Versus Pairs.

In this 2025 review of Versus Trade, we will examine its regulation and safety, trading platforms, account types, tradable markets, fees and commissions, leverage, funding methods, customer support, and overall pros and cons, so you can evaluate whether this broker aligns with your trading goals.

Regulation and Safety

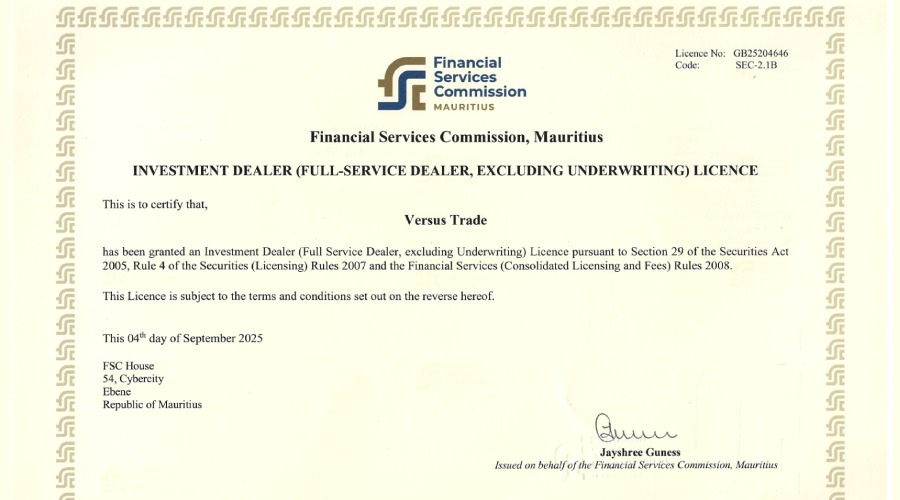

Versus Trade Ltd is a registered company in St. Lucia. The broker states compliance with its local financial service regulations while operating as an international provider of CFD trading services. The broker also hold FSC Mauritius license with a No: GB25204646

Security Measures

Versus Trade implements multiple safeguards to protect client accounts and funds:

Advanced Anti-Fraud Systems: Continuous monitoring to detect and prevent suspicious activity.

Secure Data Encryption: All data transmitted between clients and the broker’s servers is protected by industry-standard encryption protocols.

Segregated Client Funds: Client deposits are held in separate accounts from the company’s operational funds, ensuring they cannot be used for corporate purposes.

Negative Balance Protection: Retail clients are protected from losing more than their deposited funds.

Through its registration and operational safeguards, Versus Trade aims to provide a safe and compliant trading environment for clients worldwide.

Trading Platforms

Versus Trade offers trading exclusively through the MetaTrader 5 (MT5) platform, available on web, desktop, and mobile. MT5 is widely regarded for its versatility, speed, and advanced analytical tools, making it suitable for both beginners and experienced traders.

Key Features of MT5 with Versus Trade

Multi-Asset Access: Trade CFDs on forex, cryptocurrencies, indices, commodities, stocks and asset-vs-asset Versus Pairs from one platform.

Advanced Charting: Includes 21 timeframes, multiple chart types, and over 80 built-in technical indicators.

Automated Trading: Supports Expert Advisors (EAs) for strategy automation.

Depth of Market (DOM): View real-time market liquidity for better trade execution decisions.

One-Click Trading: Execute trades instantly from the chart.

Cross-Device Compatibility: Available on Windows, macOS, iOS, Android, and directly in browsers without downloads.

By leveraging MT5’s capabilities, Versus Trade delivers a professional-grade trading environment with powerful tools for analysis, execution, and risk management.

Economic Calendar and Market News

Versus Trade has integrated a built-in Economic Calendar and real-time Market News feed into its platform environment. Traders can follow key macroeconomic events, such as interest rate decisions, employment data, and inflation releases, without leaving their trading workspace. The news stream is designed to highlight market-moving developments in real time, helping users connect price action with underlying events and sentiment.

From a technical standpoint, these tools are powered by TradingView widgets embedded via iframe and adapted to match the platform’s interface. Localization is applied for language and date formats, so users can view events and news in a format that matches their region. This combination of charting, calendar and news inside a single environment helps traders keep research and execution in one place, rather than switching between multiple external resources.

Tradable Instruments

Versus Trade gives clients access to 200+ Contracts for Difference (CFDs) across a balanced mix of asset classes, enabling traders to diversify their strategies and take advantage of market opportunities worldwide. All instruments are available through the MetaTrader 5 platform, with flexible contract sizes and competitive trading conditions.

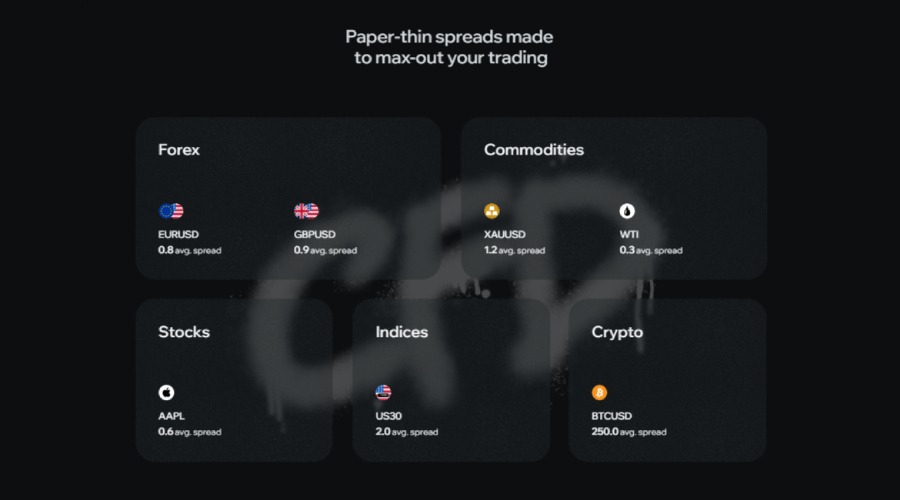

Forex

Versus Trade offers more than 70 currency pairs, including major pairs such as EUR/USD, GBP/USD, and USD/JPY, along with minor and exotic pairs for traders seeking higher volatility. Tight spreads and fast execution make the forex market suitable for scalping, swing trading, and algorithmic strategies.

Shares

Clients can trade CFDs on thousands of global shares from markets including the US, UK, Germany, and France. These allow traders to speculate on price movements without owning the underlying asset, with the flexibility to take both long and short positions.

Indices

The broker provides CFDs on leading global indices such as the S&P 500, FTSE 100, DAX 40, and Nikkei 225, offering exposure to the performance of entire economies or sectors, often with lower margin requirements than trading individual stocks.

Commodities

It's commodity offering includes precious metals such as gold, silver, and platinum, as well as energy products like WTI Crude Oil, Brent Crude Oil, and natural gas. These instruments enable traders to diversify their portfolios and take advantage of global market trends.

Futures

Futures-based CFDs allow traders to speculate on the future prices of commodities, indices, and energy markets without dealing with the complexities of contract expiry and physical delivery.

Cryptocurrencies

The broker offers CFDs on major cryptocurrencies, including Bitcoin, Ethereum, and Litecoin, enabling traders to go long or short without the need for a digital wallet and to profit from both rising and falling crypto prices.

Versus Pairs

A unique product available exclusively at Versus Trade, Versus Pairs let traders pit one asset directly against another — for example, Bitcoin vs Gold, Tesla vs Ford, or NASDAQ vs WTI Oil. Instead of following the market in isolation, this format highlights relative strength between two instruments, creating new ways to view correlations and trends. All Versus Pairs are 100% swap-free, allowing traders to keep their full profit potential while exploring a fresh, innovative trading mechanic not found at traditional brokers.

New Basket Symbols and Versus Pairs Expansion

Alongside its existing Versus Pairs concept, Versus Trade has added several new basket symbols that group related assets into a single tradable CFD. These include FAANG (Facebook, Amazon, Apple, Netflix, Google), AUTOX4 (General Motors, Ford, Toyota, Tesla), and USDX4 (a basket of EUR/USD, GBP/USD, AUD/USD, and NZD/USD). Each basket is designed to reflect the combined performance of its underlying components, allowing traders to take a view on a segment or theme rather than a single instrument.

All new basket symbols are available on Standard, Pro, and Raw Spread accounts, and they sit alongside the existing Versus Pairs such as asset-vs-asset matchups (e.g., Bitcoin vs Gold or different stock comparisons). This expansion broadens the broker’s thematic and relative-value trading offering, giving traders more ways to express views on technology stocks, the automotive sector, or USD-related currencies through a single position rather than building multiple legs manually.

By offering this diverse range of instruments, Versus Trade enables traders to balance risk, explore different market correlations, and build multi-asset strategies, all from a single trading account.

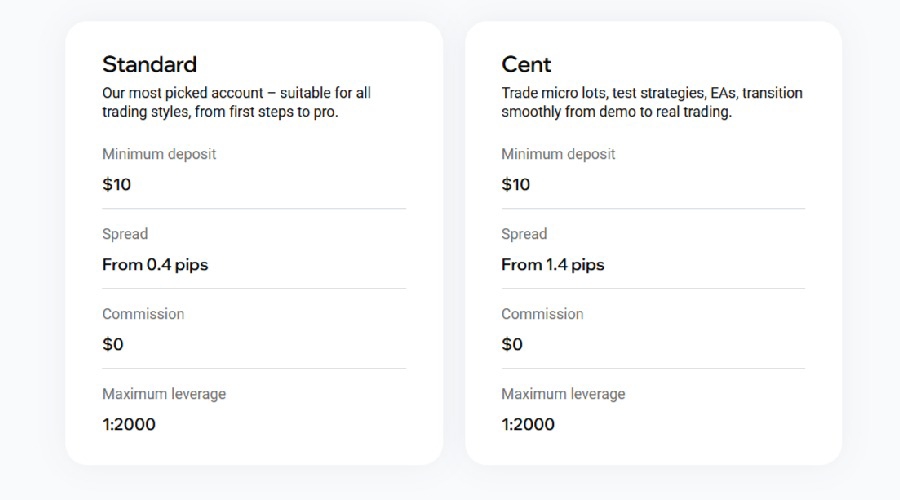

Account Types

Versus Trade offers multiple account configurations to accommodate different trading styles, experience levels, and funding preferences. All accounts provide access to the MetaTrader 5 platform, over 200+ CFDs, and the broker’s full suite of trading tools.

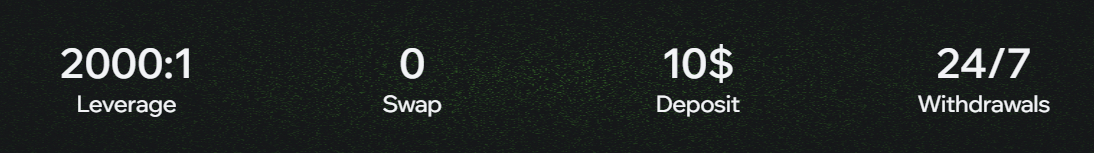

Standard Accounts (Standard, Cent)

Spreads: Competitive variable spreads (commission-free) starting from 1.2 pips

Minimum Deposit: 10$.

Best For: Beginner and intermediate traders seeking a straightforward cost structure without separate commission charges.

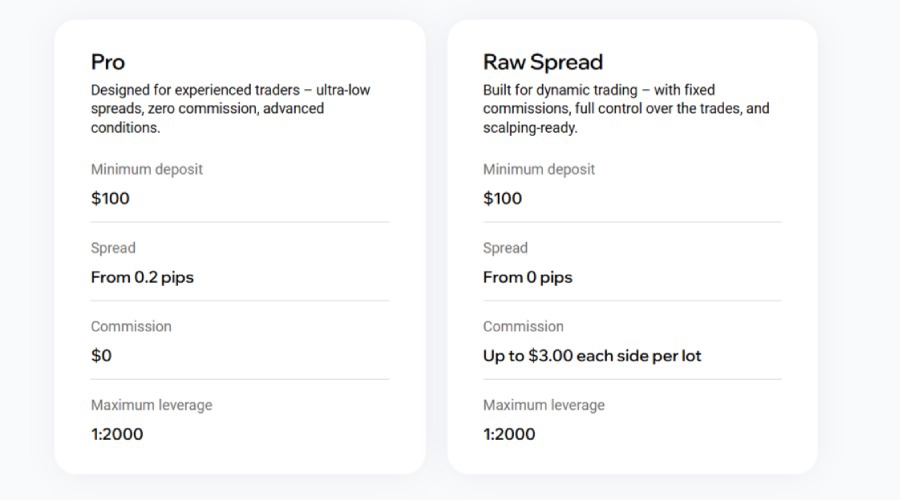

Professional Account

Spreads: Competitive variable spreads (commission-free) starting from 0.2 pips.

Minimum Deposit: 100$

Best for: Experienced and active traders who prioritize tighter spreads, lower margin call thresholds, and a pricing model designed for frequent intraday trading and higher-volume strategies, rather than passive holding.

Commission-Based Account (Raw)

Spreads: From 0.0 pips.

Commission: Applied per lot per side (varies depending on instrument) - 3$ max.

Best For: Scalpers and high-volume traders requiring ultra-tight pricing and transparent costs.

Swap-Free (Islamic) Account

Availability: Swap-free accounts are automatically provided to Versus Trade users residing in Islamic countries, while a conditional swap-free program exists for non-Islamic country residents.

Features: No overnight swap/rollover charges.

Best For: Traders who cannot receive or pay interest due to religious reasons.

Demo Account

Features: Unlimited practice trading with virtual funds.

Purpose: Ideal for testing strategies, learning platform features, and gaining familiarity with Versus Trade’s conditions without financial risk.

All account types benefit from:

Negative Balance Protection

Swap-free trading is automatically available on all cryptocurrencies, Versus Pairs, Indices, selected majors, minors and commodities for all clients.

Advanced trade execution infrastructure

Access to all supported asset classes

Copy Trading

Versus Trade has also rolled out a proprietary Copy Trading system integrated into its client cabinet. This feature allows strategy providers to run multiple offers under a single provider account, each with separate conditions, and enables followers to copy trades using different models such as Multiplier, Fixed Volume, Auto-Scale, and Lot-Proportional. Pending orders, stop-loss/take-profit and market execution are fully supported, so copied strategies can mirror real trading conditions rather than simplified signal mirroring.

Risk management is a core focus of the Copy Trading module. Followers can set drawdown limits, enable auto-unsubscribe rules, apply volume filters, and even use take-profit on the overall subscription to cap profits at a predetermined point. On the provider and partner side, the system supports flexible commission structures on a daily, weekly, or monthly basis, with built-in support for agent assignments and commission splits. Administrative controls allow offers to be limited, suspended, or archived where necessary. This makes the Copy Trading environment suitable for both individual strategy providers and white-label or IB/agent setups, although performance and risk still depend on the strategies chosen by each client.

Fees and Commissions

Versus Trade maintains a competitive and transparent fee structure, with costs varying depending on the account configuration and instrument traded.

Trading Costs

Standard Accounts: Commission-free trading with costs included in variable spreads.

Commission-Based Accounts: Spreads from 0.0 pips plus a fixed commission per lot per side (amount varies by instrument and account type - up to 3$).

Overnight Swap/Rollover Fees

Applied to positions held overnight.

Rates vary by instrument and trade direction.

Swap-free trading is automatically available on all cryptocurrencies, Versus Pairs, Indices, selected majors, minors and commodities for all clients.

Swap-Free (Islamic) Accounts: No overnight swaps.

Deposit and Withdrawal Fees

No deposit fees charged by Versus Trade.

No withdrawal fees from the broker’s side.

Third-party or bank charges may apply, especially for international transactions.

Inactivity Fees

No inactivity fees.

With commission-free and low-spread options, swap-free account availability, and no internal funding fees, Versus Trade aims to keep trading costs competitive across all account types.

Bonuses and Promotions – 100% Deposit Bonus

Versus Trade currently offers a 100% Deposit Bonus that effectively doubles the available margin by matching the client’s deposit with a bonus of equal nominal value. The bonus is credited instantly and can be used to open larger positions or maintain existing ones with more margin headroom, which may be particularly relevant for traders using higher leverage or holding multiple positions at once.

However, the structure of the promotion includes several important conditions. The bonus itself is non-withdrawable and does not cover drawdown; only profits generated from trading activity can be withdrawn. If a client withdraws part of their initial deposit, the bonus is reduced proportionally. The offer is also time-limited, remaining valid for 60 days from activation. While this promotion can enhance short-term margin flexibility, traders should carefully review the full bonus terms and understand the implications for risk and withdrawals before opting in.

Leverage

Versus Trade offers flexible leverage to suit different trading styles, instruments, and risk preferences.

Maximum Leverage

Varies by asset class and account type - Up to 1:2000.

Designed to provide traders with the ability to maximize market exposure while maintaining appropriate risk controls.

Typical Leverage by Asset Class

Forex Majors: Higher leverage available due to greater liquidity - Up to 1:2000

Minor & Exotic Forex Pairs: Lower maximum leverage to account for increased volatility - Up to 1:2000.

Indices: Moderate leverage for balanced exposure to stock markets - Up to 1:500.

Commodities: Leverage adjusted according to the volatility of each product (e.g., gold vs. oil) Up to 1:2000.

Cryptocurrencies: Typically lower leverage due to high price volatility - Up to 1:500

Risk Management

Negative Balance Protection ensures clients cannot lose more than their deposited funds.

Margin requirements are calculated dynamically based on instrument type, trade size, and market conditions.

By combining flexible leverage settings with strong risk controls, Versus Trade allows traders to manage position sizing effectively while pursuing diverse market opportunities.

Deposit and Withdrawal Methods

Versus Trade supports a variety of secure and convenient funding options to accommodate traders from different regions.

Supported Payment Methods

Bank Transfers: Suitable for larger deposits and withdrawals.

Credit/Debit Cards: Instant funding for Visa and Mastercard holders.

E-Wallets: supported digital payment solutions.

Local Payment Options: Available in select regions for faster processing - DANA, TNG, MOMO, ViettelPay, ZaloPay etc.

Processing Times

Deposits: Instant for most e-wallets and cards; bank transfers typically take 1–3 business days.

Withdrawals: Processed by Versus Trade within one business day; actual receipt time depends on the payment provider.

Fees

No deposit fees charged by Versus Trade.

No withdrawal fees from the broker’s side.

Any applicable third-party bank or payment provider fees are the responsibility of the client.

Security Measures

All transactions are encrypted and processed under strict AML (Anti-Money Laundering) and KYC (Know Your Customer) protocols, ensuring compliance and client fund protection.

Versus Trade’s no-fee policy for deposits and withdrawals, combined with multiple fast and secure payment methods, provides traders with a seamless account funding experience.

Customer Support

Versus Trade provides 24/7 multilingual customer support, ensuring traders have access to assistance whenever they need it.

Availability

24/7 service: available during and outside of global market hours, catering to international clients in all time zones.

Contact Channels

Live Chat: Instant support via the Versus Trade website and client portal.

Email Support: For detailed inquiries, with fast response times.

Social Media: Additional contact via social channels.

Languages Supported

Multilingual service to accommodate a diverse international client base.

Support Quality

Staff trained to assist with account setup, platform navigation, funding queries, and technical issues.

Dedicated approach for both beginner and advanced traders, ensuring a tailored support experience.

With 24/7 availability, multiple communication channels, and multilingual service, Versus Trade positions itself as a client-focused broker prioritizing accessibility and responsiveness.

Versus Academy and Educational Resources

In addition to its trading platform, Versus Trade supports education through Versus Academy, a dedicated learning hub aimed at both new and existing clients. The Academy provides structured modules that cover chart basics, technical and fundamental analysis, risk management, trading tools and widgets, and introductory strategies. New users can also request a free Trading Guide via the Academy’s landing page, giving them an entry-level overview of key trading concepts.

Versus Academy is linked to the broker’s live environment through automatic demo account creation for users who join via partner links or marketing campaigns. Existing clients can request the Guide and open a demo account from their Client Area if they prefer to practice before committing real funds. While this does not replace independent education or professional advice, it does provide an internal learning route for those who want to better understand market mechanics and the tools available on the platform.

Advantages and Disadvantages

Pro | Con |

Multi-asset broker offering 200+ CFDs across forex, crypto, indices, commodities, stocks and unique asset-vs-asset Versus Pairs | No MetaTrader 4 or alternative platform options |

Uses the advanced MetaTrader 5 platform (web, desktop, mobile) | Leverage details not extensively disclosed on public site |

Swap-free Islamic accounts available for eligible clients | Educational resources could be expanded further |

No deposit or withdrawal fees charged by the broker | |

24/7 multilingual customer support |

Conclusion

Versus Trade is a relatively new entrant to the multi-asset brokerage industry, established in 2024, but it has positioned itself as a modern, technology-driven platform for CFD trading. With over 200 instruments spanning forex, cryptocurrencies, indices, commodities, stocks and it’s unique asset-vs-asset Versus Pairs (e.g. Bitcoin versus Gold, Pepsi versus Cola Amazon versus Alibaba) the broker caters to traders seeking a focused yet diverse product offering.

The choice of MetaTrader 5 as its sole platform ensures clients have access to advanced charting, algorithmic trading capabilities, and a seamless multi-device experience. Traders also benefit from features such as swap-free Islamic accounts, Negative Balance Protection, no internal deposit or withdrawal fees, and 24/7 multilingual support.

While Versus Trade lacks regulation from top-tier financial authorities like CySEC or FCA this hold a FSC Mauritius license, and its combination of competitive pricing, accessible funding methods, and a secure trading environment makes it a viable option for traders who value platform performance, cost transparency, and around-the-clock support.

For those seeking a broker that blends modern technology with client-focused features, Versus Trade offers a promising and growing platform in the global CFD market.

Full Breakdown Filters

Full Breakdown

Full BreakdownDisclaimer: The contents or products outlined on this page are provided by third parties and do not constitute an endorsement or any opinion by Finance Magnates. Finance Magnates has no control of the contents of this page, nor is responsible for its accuracy or legality and hereby waives any responsibility for this content. Any transactions, investments, or engagement that you enter into with a third party listed on this page or linked from this page are solely between you and such third party and are performed at your own risk. Finance Magnates holds no responsibility for any liability, damages, or losses caused in connection with the use of any content on this page.