Preview Mode

- SEE LESS

- B2B Categories

- Industry Executives (287)

- Industry Websites (59)

- Regulators (23)

- Liquidity Provider (4)

- Payment Processors (3)

- Platforms (3)

- KYC (2)

- Regulation Consulting (2)

- Cryptocurrency Trading Solutions (1)

- CRM (1)

- Tools for Brokers (1)

- SaaS Provider (1)

- MT4/MT5 Bridge Providers (1)

- White Label Solutions

- Affiliate Programs

- Platform Providers

- Cryptocurrency Liquidity Providers

- Translation Services

- Trading Categories

- Subscribe to our Newsletter

- Suggest a company

- Contact Us

- Companies Home

- Company News

- Categories

- Trading News

- Company News

- Videos

- Search

- Add

Company

Minimum Deposit

- 0-50

Leverage

- 2000:1

Regulation

- FSC

Full Breakdown Filters

Full Breakdown

Full BreakdownCompany Review

MH Markets Broker Review 2025 – Introduction

MH Markets is an online brokerage headquartered in Mauritius. Founded and fully operational back in 2014, MH Markets later secured its Mauritius license in 2021. Operated by Mohicans Markets Ltd, the broker offers access to a diverse range of financial instruments including forex, commodities, indices, stocks, metals, cryptocurrencies, and futures. It is regulated by the Financial Services Commission (FSC) of Mauritius.

Traders using MH Markets can choose from multiple trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and a WebTrader interface. The broker accommodates a wide range of trading strategies and experience levels with leverage up to 1:2000 and a low minimum deposit of just $50.

Key features include:

- Access to over 100 tradable instruments

- Islamic account options (swap-free)

- 24/7 customer support

- Multiple funding options including credit/debit cards, bank transfers, and QR code payments

MH Markets also maintains a growing international presence and has recently engaged in promotional partnerships to expand its visibility. As an FSC-regulated broker, MH Markets emphasizes standard trading conditions commonly expected in retail-focused online trading platforms.

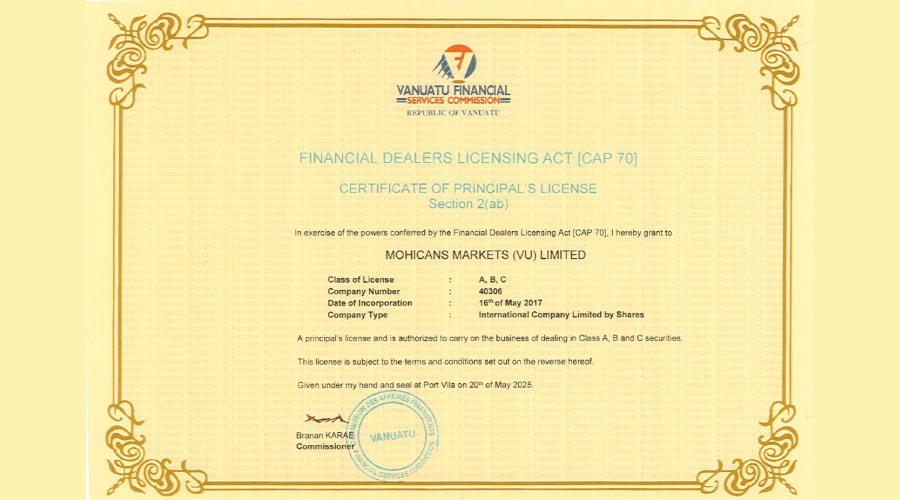

Regulation and Safety at MH Markets

MH Markets operates under the legal entity Mohicans Markets Ltd, which is authorized and regulated by the Financial Services Commission (FSC) of Mauritius. The firm holds an Investment Dealer License (Full Service Dealer, excluding underwriting) under license number GB20026131, in accordance with the Mauritius Securities Act 2005.

Key Regulatory Features:

- Regulatory Oversight: Supervised by the FSC of Mauritius, an offshore regulatory authority

- Client Fund Segregation: Trader funds are held in separate accounts from company capital

- Regular Audits: The firm is subject to financial and operational audits to ensure compliance

- Negative Balance Protection: Retail accounts are protected from going below zero

- Recent License: The broker recently obtained their Vanuatu Financial license

Security Measures:

MH Markets employs industry-standard protective measures to ensure client data and funds are secure:

- SSL encryption for secure data transmission

- KYC (Know Your Customer) and AML (Anti-Money Laundering) protocols

- Secure client verification for identity protection and fraud prevention

Regulatory Limitations:

While MH Markets is regulated, it is important to note that the FSC of Mauritius is not considered a tier-1 regulator. The broker is not licensed by major global authorities such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus). Traders who prioritize top-tier regulatory oversight should weigh this factor when assessing the broker’s credibility and legal protections.

Trading Platforms and Tools at MH Markets

MH Markets offers access to three major trading platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and a browser-based WebTrader. These platforms cater to a wide range of traders, from beginners to professionals, and are compatible with both desktop and mobile devices.

MetaTrader 4 (MT4)

The MT4 platform remains a favorite among forex and commodity traders due to its simplicity and robust trading features.

- Advanced charting tools and over 30 built-in technical indicators

- Automated trading with Expert Advisors (EAs)

- Multiple order types and one-click trading

- Available on desktop, mobile, and tablet

MetaTrader 5 (MT5)

An evolution of MT4, MT5 expands the trading possibilities with enhanced features:

- More order types and timeframes

- Integrated economic calendar and financial news

- Supports trading in stocks and cryptocurrencies

- Multi-threaded strategy tester and compatibility with hedging/netting systems

WebTrader

For traders who prefer a no-download experience, WebTrader offers full trading functionality via any web browser:

- Real-time pricing and charting tools

- Access to trading history, pending orders, and open positions

- Ideal for on-the-go access and quick trade execution

Platform Tools and Add-ons

While MH Markets supports the full range of features offered by MT4 and MT5, it currently lacks proprietary tools such as:

- Copy trading platforms

- Integrated trading signals

- Advanced market analytics or sentiment tools

A branded mobile app is reportedly under development, though no official launch date has been confirmed as of this review.

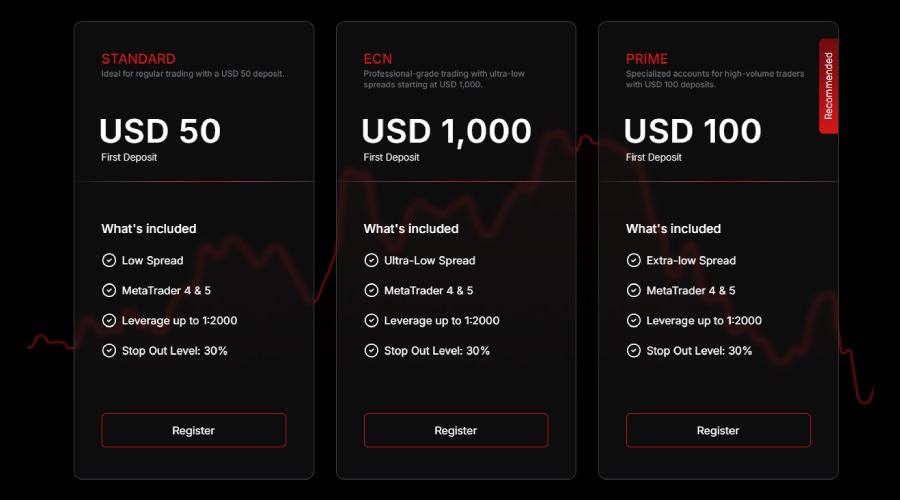

Account Types and Trading Conditions at MH Markets

MH Markets offers a tiered account structure to accommodate traders of varying experience levels and capital sizes. The three main account types—Standard, Prime, and ECN—feature different spreads, commission models, and deposit requirements.

Standard Account

Designed for beginner and low-volume traders:

- Minimum Deposit: $50

- Spreads: Variable, starting from ~1.5 pips

- Commission: None

- Leverage: Up to 1:2000

This entry-level account is ideal for traders looking to start with minimal capital and zero commissions.

Prime Account

A step up in pricing efficiency for active traders:

- Minimum Deposit: $100

- Spreads: Often below 1 pip

- Commission: None

- Leverage: Up to 1:2000

This account suits traders who seek tighter spreads without incurring commission costs.

ECN Account

Targeted at professional traders and high-volume strategies:

- Minimum Deposit: $1,000

- Spreads: Starting from 0.0 pips

- Commission: $6 per round-turn lot ($3 per side)

- Leverage: Up to 1:2000

The ECN account offers direct market access, ideal for scalping, algorithmic trading, and institutional-level execution.

Trading Conditions Overview

Feature | Details |

Minimum Trade Size | 0.01 lots |

Maximum Lot Size | 50 lots |

Islamic Account | Swap-free option available on request |

Negative Balance Protection | Included on retail accounts |

Margin Call / Stop-Out | Not publicly disclosed |

Spreads vary depending on market conditions and account type. No inactivity fees are applied. Only the ECN account incurs trading commissions.

Tradable Instruments at MH Markets

MH Markets provides access to a diverse range of over 100 financial instruments across multiple asset classes, all available through Contracts for Difference (CFDs). This allows traders to speculate on price movements using leverage and short-selling, without owning the underlying assets.

Forex Trading

Trade a wide selection of currency pairs including:

- Major pairs (e.g., EUR/USD, GBP/USD)

- Minor pairs

- Exotics (for those seeking volatility)

- Leverage: Up to 1:2000

- Spreads: Vary by account type (from 0.0 pips on ECN)

Commodities

Diversify your strategy with energy and agricultural markets:

- Crude oil, natural gas

- Agricultural CFDs such as wheat or corn

Commodity prices tend to respond to geopolitical events and seasonal trends.

Precious Metals

- Gold and Silver CFDs

- Popular as hedging tools against inflation or market volatility

- Available with high leverage and competitive spreads

Indices

Speculate on the performance of major stock market indices:

- U.S. (e.g., S&P 500, NASDAQ)

- Europe (e.g., DAX, FTSE)

- Asia (e.g., Nikkei, Hang Seng)

Index trading offers broad market exposure with a single position.

Stocks (Equities)

Trade CFDs on individual company shares without owning them.

Note: A public list of available stocks is not provided, so traders may need to check within the trading platform for specific listings.

Cryptocurrencies

Get exposure to popular digital assets through CFDs:

- Bitcoin (BTC), Ethereum (ETH), and more

- Includes leverage-based exposure and short-selling options

- Ideal for traders looking to capitalize on crypto volatility

Futures

MH Markets includes a selection of futures-based instruments, though detailed product specifications are not publicly disclosed.

Fees and Commissions at MH Markets

MH Markets uses a transparent and competitive pricing model that varies depending on the account type. The broker primarily operates on a spread-based model for its Standard and Prime accounts, while its ECN account includes low raw spreads plus fixed commissions.

Spreads

Account Type | Typical Spread |

Standard | From ~1.5 pips (variable) |

Prime | Often below 1 pip (variable) |

ECN | From 0.0 pips (raw spreads) |

Spreads fluctuate based on market conditions, trading sessions, and liquidity.

Commissions

- Standard & Prime: No trading commissions

- ECN: $6 per round-turn lot (i.e., $3 per side)

This fixed commission on the ECN account is considered competitive for high-volume or professional traders.

Swap & Overnight Fees

MH Markets applies standard overnight swap charges on positions held past rollover time. These are:

- Calculated daily based on instrument, position size, and prevailing interest rates

- Viewable inside the trading platform

Islamic (swap-free) accounts are available upon request and may include administrative fees instead of interest-based swaps.

Deposit & Withdrawal Fees

- Broker Fees: $0 – No internal fees on deposits or withdrawals

- Third-Party Fees: May apply (e.g., bank charges, currency conversion, processor fees)

Inactivity Fees

MH Markets does not charge inactivity fees. This means you can leave your account dormant without risk of penalty.

Deposit and Withdrawal Options at MH Markets

MH Markets offers a diverse range of funding methods to support clients worldwide. The broker prioritizes convenience, speed, and flexibility with zero internal fees for both deposits and withdrawals.

Accepted Payment Methods

- Credit/Debit Cards: Visa, Mastercard

- Bank Transfers: Local and international options

- Local Payment Gateways: Region-specific providers

- QR Code Payments: Available in selected countries

These options ensure accessibility for traders in emerging and established markets.

Processing Times

Transaction Type | Timeframe |

Deposits | Instant to a few hours (depending on method) |

Withdrawals | Typically processed within 24–48 hours |

Note: Bank holidays, weekends, and intermediary delays may affect final settlement time.

Minimum Requirements

- Minimum Deposit:

- $50 for Standard

- $100 for Prime

- $1,000 for ECN

- Minimum Withdrawal:

- Not clearly stated; often mirrors deposit minimums based on method

Fees

- MH Markets Fees: $0 deposit and withdrawal fees

- Third-Party Charges: May apply based on payment provider, bank, or currency conversion

Currency Support

Trading is denominated in USD, but the availability of multi-currency deposit options depends on the chosen payment method and your location. Always verify options inside the client portal or with support before initiating a transfer.

Customer Support and Education at MH Markets

MH Markets provides 24/7 multilingual customer support, catering to traders across different regions and time zones. While the broker’s primary strength lies in its responsive service channels, its educational offerings remain basic compared to more education-focused platforms.

Customer Support Channels

Traders can reach MH Markets support through several platforms:

- Email Support

- Live Chat on the official website

- WhatsApp Messaging

- Phone Assistance (availability may vary by country)

The broker claims to offer a dedicated support team capable of resolving both technical and account-related queries. Response times may vary depending on the region and complexity of the issue.

Educational Resources

MH Markets provides introductory-level materials geared toward beginner traders. While sufficient for those new to trading, advanced traders may find the resources limited.

Available Resources:

- Weekly Market Analysis Reports

- Basic Trading Guides

- Risk Management Tips

There is currently no structured learning hub, video library, or in-depth certification course. MH Markets appears to prioritize platform functionality and trading conditions over educational development.

Pros and Cons of MH Markets

Advantages✅ | Disadvantages⚠️ |

Regulated by the FSC (Mauritius) | Not licensed by Tier-1 regulators (e.g., FCA, ASIC, CySEC) |

24/7 multilingual customer support | Limited educational resources |

No deposit or withdrawal fees | No proprietary tools (e.g., copy trading or in-depth analytics) |

Offers Standard, Prime, and ECN account types | Lacks advanced platform enhancements |

Supports Islamic (swap-free) accounts | Public list of tradable stocks not available |

MH Markets Review 2025: Conclusion and Verdict

MH Markets presents itself as a globally accessible, multi-asset CFD broker, regulated by the Financial Services Commission (FSC) of Mauritius. With access to over 100 tradable instruments, support for MetaTrader 4, MetaTrader 5, and WebTrader, and leverage up to 1:2000, it caters to a wide range of traders—from beginners starting with $50 to professionals utilizing ECN conditions.

The broker’s account structure, fee transparency, and multilingual customer support make it a competitive option for those comfortable with offshore-regulated platforms.

Final Verdict

MH Markets is a strong fit for:

- Traders seeking high leverage and low capital entry

- Those who prefer a choice between commission-free or ECN-style accounts

- Clients who value 24/7 multilingual support and Islamic (swap-free) options

However, MH Markets may not suit:

- Traders who require Tier-1 regulatory oversight (e.g., FCA, ASIC, CySEC)

- Users looking for advanced educational programs or proprietary trading tools

Overall, MH Markets offers flexible and cost-efficient trading conditions for self-directed traders. Those who are aware of the trade-offs in regulation and platform features will find it a capable and accessible broker in 2025.

Full Breakdown Filters

Full Breakdown

Full BreakdownDisclaimer: The contents or products outlined on this page are provided by third parties and do not constitute an endorsement or any opinion by Finance Magnates. Finance Magnates has no control of the contents of this page, nor is responsible for its accuracy or legality and hereby waives any responsibility for this content. Any transactions, investments, or engagement that you enter into with a third party listed on this page or linked from this page are solely between you and such third party and are performed at your own risk. Finance Magnates holds no responsibility for any liability, damages, or losses caused in connection with the use of any content on this page.