Preview Mode

- SEE LESS

- B2B Categories

- Industry Executives (287)

- Industry Websites (59)

- Regulators (23)

- Liquidity Provider (4)

- Payment Processors (3)

- Platforms (3)

- KYC (2)

- Regulation Consulting (2)

- Cryptocurrency Trading Solutions (1)

- CRM (1)

- Tools for Brokers (1)

- SaaS Provider (1)

- MT4/MT5 Bridge Providers (1)

- Platform Providers (1)

- White Label Solutions

- Affiliate Programs

- Cryptocurrency Liquidity Providers

- Translation Services

- Trading Categories

- Subscribe to our Newsletter

- Suggest a company

- Contact Us

- Companies Home

- Company News

- Categories

- Trading News

- Company News

- Videos

- Search

- Add

Company

Minimum Deposit

- 0-50

Leverage

- 30:1

- 3000:1

- 300:1

Regulation

- FSCA

- FSA Seychelles

- CySec

- FSC

Full Breakdown Filters

Full Breakdown

Full BreakdownCompany Review

JustMarkets Review 2025: A Close Look into Its Features

| Category | Details |

| Registered in | Limassol, Cyprus |

| Regulated by | CYSEC, FSA, FSCA, FSC |

| Year(s) of Establishment | 2012 |

| Trading Instruments | 100+, currency pairs, precious metals, energies, indices, and shares |

| Demo Account | Available |

| Islamic Account | Available |

| Maximum Leverage | 1:3000 |

| EUR/USD Spread | From 0.0 pips |

| Trading Platforms | MetaTrader 4, MetaTrader 5, WebTrader, Mobile Apps |

| Minimum Deposit | $10 for Standard, $100 for Pro and Raw Spread |

| Payment Method | MasterCard, Visa, Google Pay, Bank Transfer, Skrill, Neteller |

| Customer Service | Live chat, Phone: +248 4632027, +230 52970330, Email: support@justmarkets.com |

Introduction

JustMarkets is a well-known multi-asset broker that offers a diverse selection of trading options, including forex, commodities, stocks, indices, and cryptocurrencies. They offer a variety of account types aimed to the needs of traders ranging from beginners to professionals, as well as powerful trading platforms such as MetaTrader 4 and MetaTrader 5. The broker takes pride in offering competitive trading conditions, including low spreads, quick execution, and dependable customer service.

This review of JustMarkets aims to thoroughly evaluate the broker's offerings, including trading conditions, user interface, customer support efficiency, and overall value proposition.

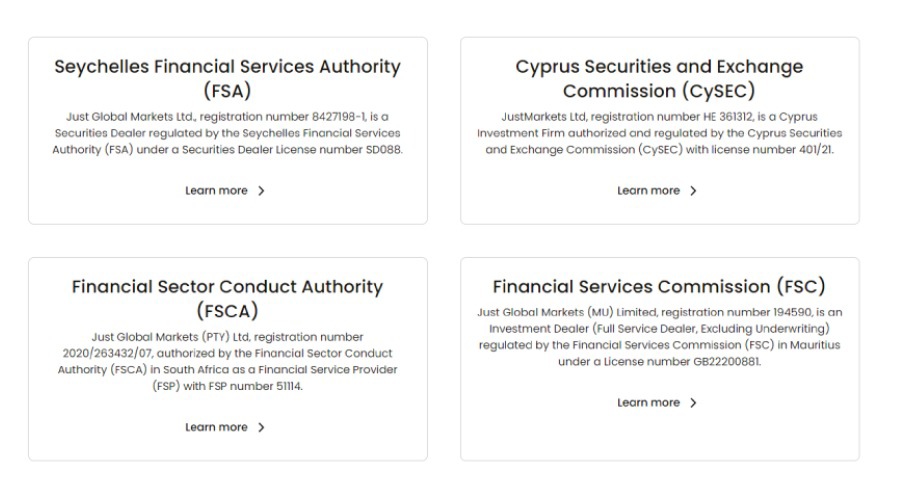

Regulatory Oversight and Safety at JustMarkets

JustMarkets is strictly supervised by many important financial regulators in several jurisdictions, offering a secure and transparent trading environment for its clients. The broker's operating entities include Just Global Markets Ltd., which is regulated by the Seychelles Financial Services Authority (FSA) under Securities Dealer License number SD088. Furthermore, JustMarkets Ltd is licensed by the Cyprus Securities and Exchange Commission (CySEC) with license number 401/21, demonstrating adherence with severe European financial rules.

Just Global Markets (PTY) Ltd is recognized as a Financial Service Provider by the Financial Sector Conduct Authority (FSCA) in South Africa, with FSP number 51114, enhancing its local compliance. Just Global Markets (MU) Limited is licensed as a Full Service Dealer (Excluding Underwriting) in Mauritius by the Financial Services Commission (FSC) under the number GB22200881.

To protect client funds and personal information, the broker employs strong security procedures. These include using modern encryption technologies and maintaining segregated client accounts, which ensure that clients' funds are kept separate from the company's operating funds. This strict regulatory adherence and security methodology offers its clients a high level of protection and peace of mind while trading.

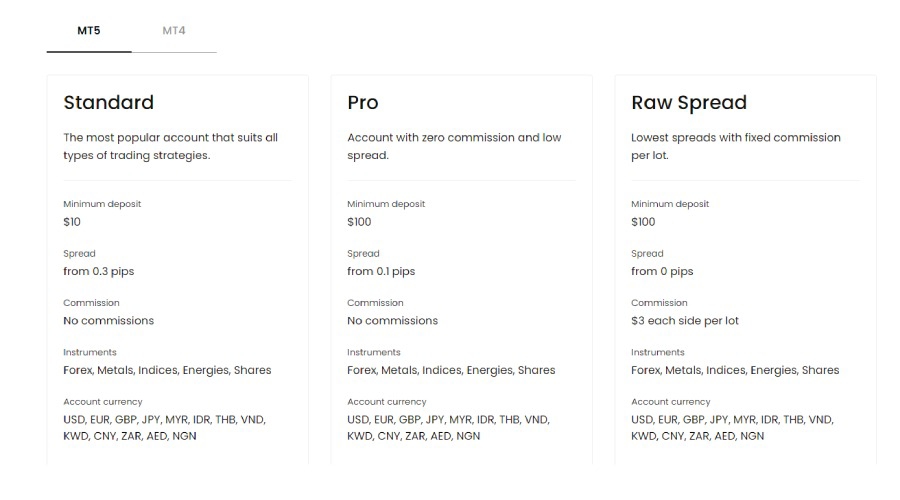

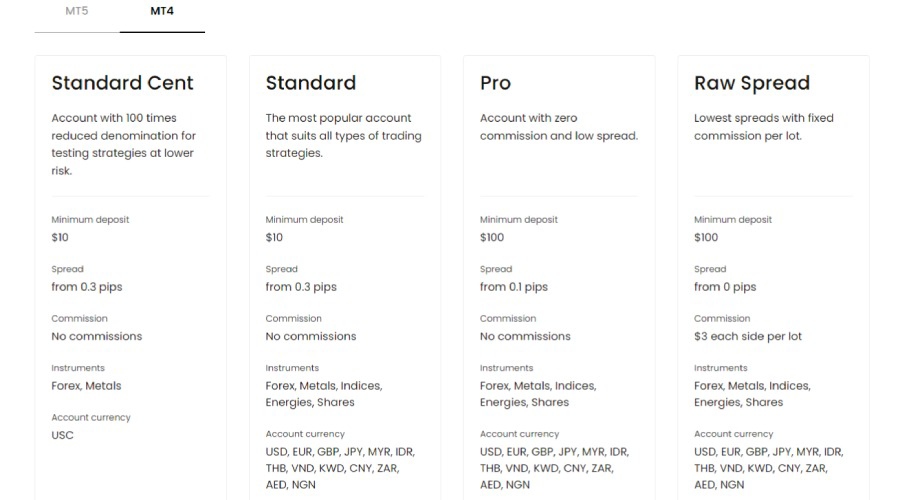

Account Types at JustMarkets

JustMarkets caters to a wide spectrum of traders by providing multiple account types, each tailored to individual trading requirements and methods. Here's a more extensive look at each of the account types:

Standard Cent Account:

Purpose: Ideal for beginner traders starting with tiny amounts.

Minimum Deposit: $10, making it highly accessible for beginners.

Leverage: Up to 1:3000, providing substantial buying power.

Spreads: Starting from 0.3 pips.

Commissions: None, reducing transaction costs for new traders.

Trading Instruments: Offers a range of instruments, though primarily focused on forex and metals.

Features: Allows micro lot trading (0.01 cent lot), which minimizes risk exposure while learning trading dynamics

Standard Account:

Purpose: Suits a broad audience, from beginners to more experienced traders.

Minimum Deposit: $10.

Leverage: Up to 1:3000.

Spreads: From 0.3 pips.

Commissions: None, appealing to traders looking to minimize trading costs.

Trading Instruments: Extensive range including forex, metals, indices, energies, shares, and cryptocurrencies.

Features: Supports standard lot sizes, with no maximum number of open positions, offering flexibility in trading strategies

Pro Account:

Purpose: Targeted at experienced traders who require tighter spreads for large volume trading.

Minimum Deposit: $100.

Leverage: Up to 1:3000.

Spreads: Starting from 0.1 pips.

Commissions: No commissions charged, enhancing the appeal for high-volume traders.

Trading Instruments: Same as the Standard account but with the added benefit of lower spreads.

Features: Market execution method, allowing for rapid execution of trades at the best possible prices

Raw Spread Account:

Purpose: Best for scalpers and high-frequency traders who benefit from the lowest possible spreads.

Minimum Deposit: $100.

Leverage: Up to 1:3000.

Spreads: From 0.0 pips.

Commissions: $3 per side per lot, necessary to accommodate the ultra-low spread.

Trading Instruments: Comprehensive coverage including forex, metals, indices, energies, shares, and cryptocurrencies.

Features: Offers the tightest spreads for aggressive trading strategies, with a clear commission structure. Suitable for traders using complex algorithms and fast execution

Islamic Account:

Purpose: Provides a swap-free option for traders following Sharia law.

Features: Converts any of the mentioned account types to an Islamic format, exempting them from swap or interest fees on overnight positions, aligning with Islamic finance principles

Demo Account:

Purpose: Facilitates practice and strategy testing without financial risk.

Features: Simulates real market conditions with virtual money, ideal for both beginners to learn and experienced traders to test new strategies. It mirrors live market conditions with real-time data and performance metrics.

JustMarkets Account Types Overall

Each trading account type is fully linked with the MetaTrader 5 platform and the Standard Cent account with both MT4 and MT5 trading platform, giving traders access to strong trading tools and information. Their structured account choices allows users to find the best fit based on their trading style and financial goals.

Spreads, Commissions, and Fees at JustMarkets

Spreads Overview

JustMarkets offers variable spreads that fluctuate based on market circumstances and account type. The Raw Spread account offers ultra-low spreads starting at 0.0 pips, making it perfect for high-frequency traders and scalpers. Other accounts, such as the Standard and Pro, have significantly bigger spreads, ranging from 0.01 to 0.3 pips. These spreads are tailored to different trading volumes and methods, allowing traders to choose the cost structure that best suits their trading style.

Commission Structure

Commission fees at JustMarkets are limited to the Raw Spread account, where traders pay a cost of $3 per side per lot, totaling $6 per round turn. This setup is useful for traders that prefer to trade with near-zero spreads and are active market participants. Other accounts, like the Standard, Pro, and Cent, offer commission-free trading with broader spreads and no transaction costs.

Additional Trading Costs

Swap fees apply to positions held overnight, with prices ranging according to the instrument and the nature of the position, whether long or short. JustMarkets provides competitive swap rates, which can influence overall trading expenses, particularly for strategies that require holding positions for numerous days. There are no deposit or withdrawal fees, but traders should be mindful of potential additional provider charges based on their payment method for financial transactions.

JustMarkets Spreads, Commissions, and Fees Overall

This trading fee structure ensures that JustMarkets is able to adapt to a wide range of trading preferences, from those who engage in short trading cycles to those who take a systematic approach, while remaining flexible throughout its services.

Trading Platforms at JustMarkets

JustMarkets provides a comprehensive suite of trading platforms to meet a variety of trader needs and techniques. MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are the two platforms offered, with each catering to a distinct trading demand.

MetaTrader 4 (MT4)

Platform Suitability: MT4 is especially popular for Forex trading due to its reliability and widespread usage among the trading community. It's perfect for both new and expert traders.

Features: It includes a wide range of trading tools, including technical indicators, charting tools, and automated trading capabilities via Expert Advisors (EAs). Users can personalize the platform with their own scripts and even incorporate third-party software to improve functionality.

Accessibility: MT4 is available on a variety of devices, including PC, web (WebTrader), and mobile applications for iOS and Android, allowing traders to use their preferred devices without the need for installation.

MetaTrader 5 (MT5)

Platform Advancements: MT5 is a more advanced version of MT4 that includes tools for trading stocks, indices, and other instruments in addition to forex. It is ideal for traders searching for more advanced technical analysis tools.

Enhanced Capabilities: The platform allows for more order types, technical indicators, and advanced charting capabilities. It also offers increased order execution capabilities, making it an excellent choice for expert traders.

Device Compatibility: MT5, like MT4, is available on a variety of devices, including specific programs for PC, Android, and iOS, as well as a web version that allows trading straight from a browser.

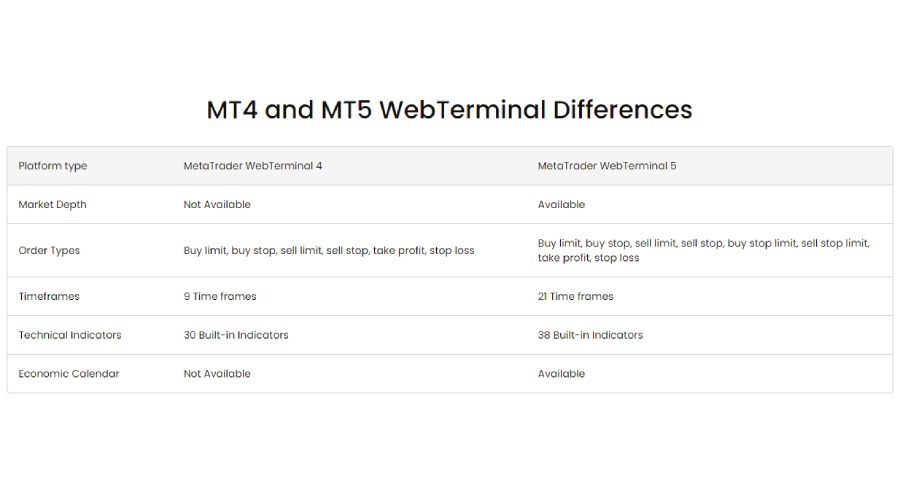

WebTrader

Convenience: The WebTrader versions of MT4 and MT5 allow for browser-based trading, which is ideal for traders who do not want to download or install software. This version is compatible with a variety of operating systems and provides similar functionality to the desktop versions, such as complete charting and one-click trading.

Features: Although it does not allow EAs, WebTrader has advanced charting and analytical features, making it a suitable solution for manual trading techniques.

Mobile Trading

Flexibility: JustMarkets' mobile applications for MT5 allow you to trade and manage your accounts from anywhere. The apps retain the fundamental features of the desktop platforms, such as interactive charts, a complete set of orders, and trading history.

User Experience: The mobile platforms are intended to be intuitive and user-friendly, allowing traders to access their accounts and markets when away from their primary trading setup.

JustMarkets Trading Platforms Overall

These platforms, from desktop to mobile, give JustMarkets' clients with a diverse range of trading alternatives under a variety of conditions and preferences, delivering a seamless trading experience across all devices and platforms.

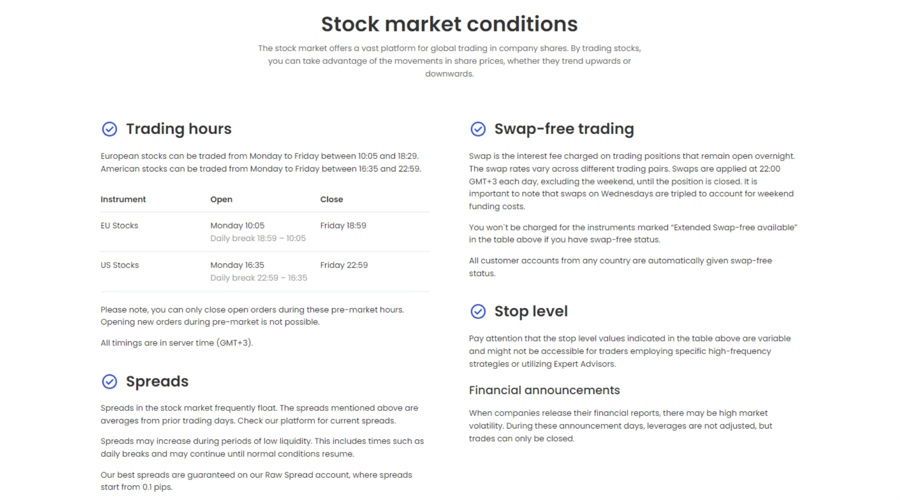

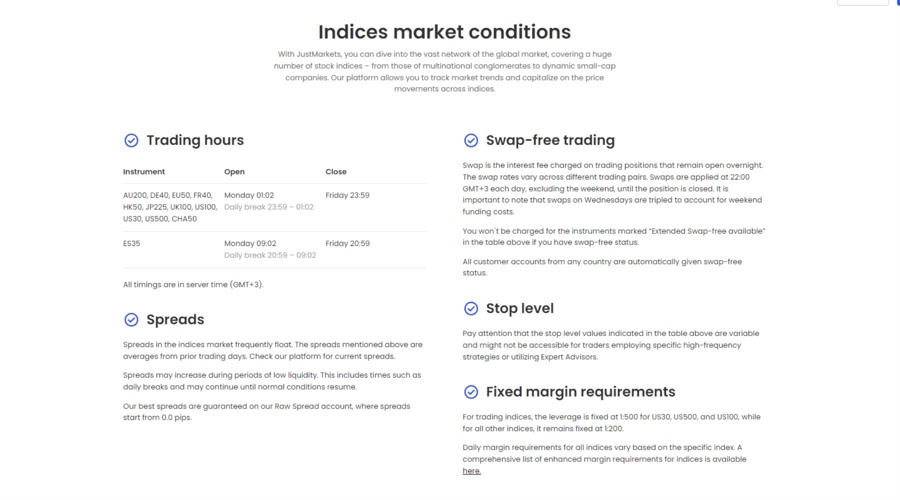

Tradable Instruments at JustMarkets

JustMarkets provides a wide range of trading instruments across many markets, allowing traders to diversify their portfolios and pursue opportunities in a variety of financial landscapes. Here's a more extensive look at each market segment.

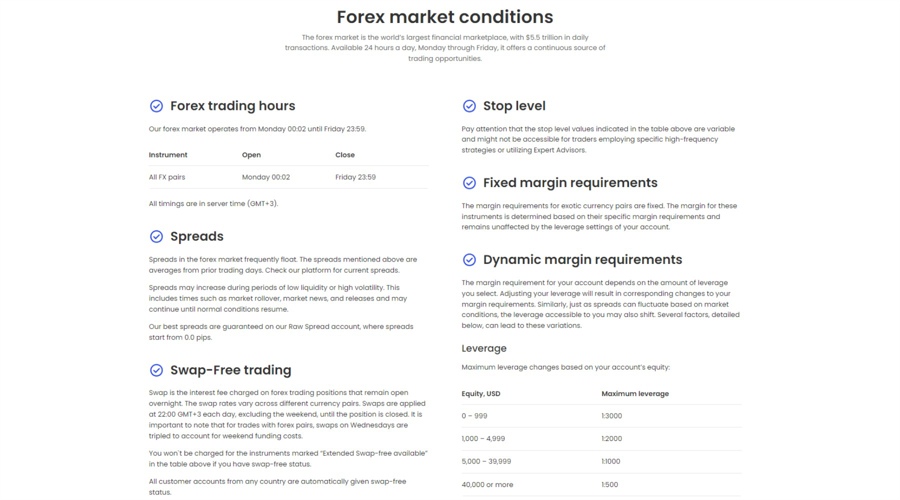

Forex Market:

JustMarkets offers 61 currency pairings, including all main currencies such as the Euro, US Dollar, and Japanese Yen, as well as a number of minor and exotic currencies. This range allows traders to benefit from global economic fluctuations and interest rate differentials. Their forex market is noted for its high liquidity and 24-hour trading, with low spreads and strong trading conditions that cater to methods ranging from day trading to long-term currency investing.

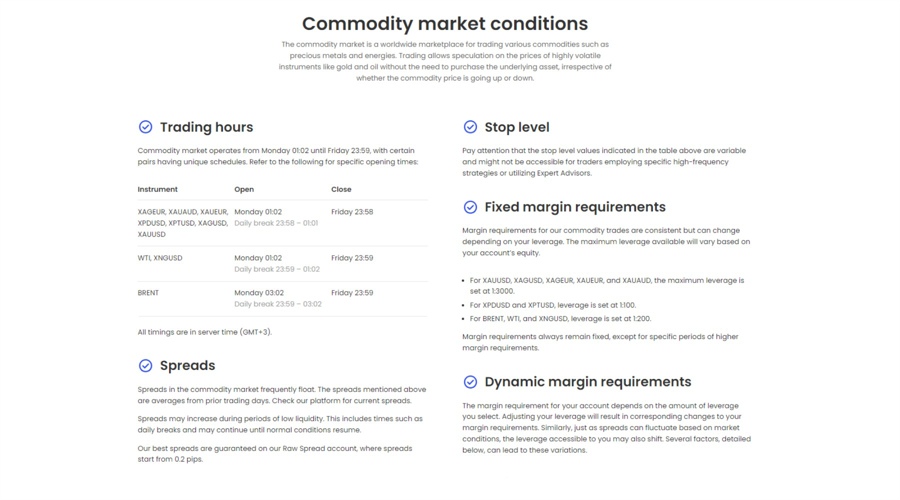

Commodities Market:

Precious metals such as gold and silver, which have traditionally served as safe havens during times of economic turmoil, are traded on JustMarkets. Furthermore, dealers can deal with energy commodities such as crude oil and natural gas. Trading commodities allows participants to hedge against inflation and diversify beyond typical FX and equity markets.

Stocks Market:

Traders can buy and sell shares in big global firms like Apple and Tesla, as well as other key players in fields including healthcare, finance, and consumer goods. JustMarkets gives you direct access to individual business performance, which can be changed by corporate activities, earnings announcements, and changes in industry conditions.

Indices Market:

This area provides traders with exposure to entire sectors or economies via indices such as the US30, the NASDAQ (US100), and other worldwide indexes. These indexes combine the performance of top companies into a single tradable asset, making it easier to speculate on larger market moves without having to maintain multiple stock positions.

JustMarkets Tradable Instruments Overall

Each of these markets is accessible through JustMarkets' advanced trading platforms, MetaTrader 4 and MetaTrader 5, which include powerful analytical tools, automated trading features, and real-time data processing. This integration allows traders to efficiently manage and execute trades, track market trends, and construct sophisticated trading strategies based on current market data.

Deposit and Withdrawal at JustMarkets

Deposit Details:

Methods: Traders can deposit using e-wallets, bank cards, local payment methods, and wire transfers

Supported Currencies: Multiple currencies are accepted, including EUR, USD, MYR, IDR, and GBP based on the chosen payment method.

Minimum Amount: The minimum deposit starts at $10 for Standard and Standard Cent accounts, and $100 for Pro and Raw Spread accounts

Processing Time: Deposits are usually processed instantly but can take up to 1-2 hours if additional verification is needed during business hours depending on the payment provider and bank processing time.

Fees: No fees are charged by JustMarkets for deposits, though external fees from banks or payment providers may apply

Withdrawal Details:

Withdrawal Options: Funds can be withdrawn via the same methods available for deposits, including credit/debit cards, local methods and e-wallets.

Minimum Withdrawal: Withdrawals can be made from as low as $5 depending on the payment method, allowing easy access to funds.

Processing Time: Withdrawals are generally processed within 1-2 hours, but the total time can extend to several days depending on the payment provider and bank processing times.

Fees: There are no JustMarkets fees for withdrawals, but as with deposits, external fees may be applied by banks or payment providers.

The deposit and withdrawal processes are designed to be secure, following Anti-Money Laundering (AML) standards and requiring funds to be withdrawn using the same procedure as deposits whenever possible.

JustMarkets CopyTrading

JustMarkets provides a complete copytrading platform that benefits both traders and investors. Here's an in-depth look at its features:

- For Investors: Investors can easily mimic trades from experienced traders, improving their investing approach without requiring substantial trading skills. The website offers a scoreboard where investors may filter traders based on performance criteria like return rate, risk level, and strategy type. Features like Investment Protection help to reduce risk by pausing copying when necessary.

- For Traders: Traders can make additional revenue by allowing others to copy their trades. They open a CopyTrading account, determine commission rates, and trade as usual. The platform provides extensive statistics on their success, the number of copiers, and the total earnings from being duplicated.

Key Features:

Flexibility: Traders can adjust their strategies, and investors can start or stop copying at any time.

Transparency: Both parties have access to detailed trading data and performance metrics.

Risk Management: Tools like Investment Protection automatically pause copying during unfavorable market conditions.

This CopyTrading system is built within the JustMarkets ecosystem, allowing users to take advantage of market opportunities by replicating successful trades or monetizing their trading skills.

Educational Resources at JustMarktes

JustMarkets offers a comprehensive educational framework aimed at improving the trading knowledge of both new and seasoned traders. Here's a thorough summary of the instructional tools available:

Analytics and Market Overview

JustMarkets provides daily market overviews and forecasts to keep traders aware of major economic events and market movements. This provides insights into numerous markets such as Forex, commodities, equities, and indices, allowing traders to make more informed decisions based on current trends.

Economic Calendar

The economic calendar is an important tool for traders, as it details over 1000 economic events from more than 50 nations, allowing for real-time monitoring and preparation. Traders may tailor this calendar to their own time zones, ensuring they never miss out on market-moving events.

Learning Center and Quick Start

JustMarkets offers a Quick Start guide to help new traders understand the fundamentals of trading. The Learning Center provides in-depth analysis of trading methods, market principles, and advanced trading tools.

Online Webinars and Forex Articles

JustMarkets offers online webinars led by market specialists on a wide range of topics, from basic trading concepts to advanced technical analysis. Furthermore, their collection of Forex articles is an excellent resource for ongoing education, including insights into market psychology, trading platforms, and efficient trading tactics.

Forex Glossary and Educational Videos

A complete Forex dictionary is offered to help traders get familiar with typical trading terms and jargon. Educational videos enhance learning by delivering visual content on trading signals, platform features, and practical trading tips.

Currencies Information

Traders may also get thorough information about all major world currencies, their symbols, and country associations, which is essential for making sound trading decisions in the Forex market.

JustMarkets Educational Resources Overall

These training resources are intended to educate traders with the knowledge and tools they need to successfully navigate the complex world of trading. Whether you're just getting started or want to fine-tune your trading techniques, JustMarkets has a variety of information to help you improve.

Promotions at JustMarkets

JustMarkets provides a number of promos aimed at improving the trading experience and increasing the value for their clients. Here's an overview of the current promotional offers:

Deposit Bonus

JustMarkets provides a tiered deposit bonus which varies depending on the amount deposited:

The bonus is available to all Standard Cent, Pro, and Standard accounts, allowing traders to enhance their trading volume using bonus dollars. To activate the bonus, traders must select the "Get a bonus on deposit" option in the deposit form and agree to its terms.

JustMarkets Promotions Overall

These programs are subject to specific restrictions and conditions, which traders should carefully understand in order to maximize their benefits. Each campaign is intended to appeal to a variety of traders, from those making little deposits to those capable of investing greater amounts and referring new clients.

Partnerships at JustMarkets

JustMarkets provides a comprehensive array of partner programs designed for different types of collaborators. Here's a summary of the cooperation opportunities available:

Introducing Broker (IB)

The Introducing Broker program is suitable for partners who communicate directly with prospective clients. IBs benefit from personal partnership arrangements, which may include greater partner commissions and a personal Key Account Manager, depending on their partner level. The initiative promotes expansion by allowing IBs to manage sub partners under them.

Partner Loyalty Program

This program recognizes and loyal partners for their devotion and long-term success. Partners can advance via the program, unlocking more prestigious awards and bigger commissions. The advancement is based on the trading volume created by the clients they have introduced.

JustMarkets Partnerships Overall

Each program is designed to fit partners' different talents and goals, giving them the tools and incentives they need to succeed. These collaborations are supported by JustMarkets' powerful platform, which provides a solid foundation for expansion.

Customer Service at JustMarkets

JustMarkets is committed to offering thorough customer service to its clients all around the world. The support team is available 24/7, and speaks English, Indonesian, Malaysian, Spanish, Portuguese, and Vietnamese. Clients can contact JustMarkets through several channels:

Email Support: For general inquiries or specific assistance, you can contact JustMarkets at support@justmarkets.com. They offer specialized email support for partnership opportunities as well.

Phone Support: Telephone assistance is available with English language support at +248 4632027 and +230 52970330, though carrier charges may apply.

Messaging and Live Chat Options: JustMarkets supports a range of messaging platforms including Telegram, Viber, Messenger, Line, Instagram, and iMessage. For immediate responses, the live chat feature on the official website is highly accessible.

Callback Service: If you prefer speaking with a customer service representative, you can request a personalized callback from the support team.

JustMarkets Customer Service Overall

This multilingual support architecture ensures that all traders, regardless of location or language preference, have access to competent aid and guidance. The many communication channels are intended to provide seamless and efficient support to improve the trading experience at JustMarkets.

JustMarkets Pros and Cons

Advantages | Disadvantages |

Wide Range of Tradable Instruments: The broker offers over 170 trading instruments, including Forex, commodities, indices, and stocks, allowing traders to diversify their portfolios. | No cTrader or TradingView Support: Unlike some competitors, the broker does not support cTrader or TradingView, which are popular among some traders for advanced charting and strategy development |

High Leverage Options: For non-EU clients, leverage can go up to 1:3000, which is among the highest in the industry, allowing for greater potential profits on smaller deposits | Limited Availability in Certain Regions: They are not available in key regions such as the U.S., U.K., Japan, and some EU countries, limiting its global reach |

Low Minimum Deposit: With a minimum deposit requirement as low as $10 for some accounts, the platform is accessible to traders of all experience levels, especially beginners | |

24/7 Multilingual Customer Support: The company provides around-the-clock support in several languages, ensuring global accessibility and prompt assistance | |

Promotions and Bonuses: JustMarkets offers attractive bonuses, including 50% deposit bonus, providing traders with additional trading capital |

JustMarkets Conclusion

JustMarkets appears as a versatile and comprehensive broker, providing a diverse range of trading instruments, reasonable spreads, and reliable trading platforms like MetaTrader 4 and MetaTrader 5. The broker is ideal for both newbie and expert traders, since it offers high leverage options, minimal minimum deposits, and a wide selection of account kinds. Its regulatory control across various jurisdictions, as well as its emphasis on client fund safety, strengthen its credibility, making it a reliable option for worldwide traders.

However, the lack of support for platforms such as cTrader or TradingView, as well as limited availability in locations such as the United States and the United Kingdom, may be perceived as negatives by certain traders. On the plus side, the broker compensates with a good customer care system that is available 24/7 in different languages, as well as appealing incentives such as deposit bonuses and referral prizes.

Overall, JustMarkets offers a well-rounded trading experience that meets a variety of needs while remaining secure and client-focused.

FAQs

What are the benefits of JustMarkets?

JustMarkets provides various benefits, including access to a diverse choice of trading products such as FX, stocks, indices, and commodities. The platform offers flexible leverage of up to 1:3000, competitive spreads starting with 0 pips, and supports both MetaTrader 4 and MetaTrader 5. Clients benefit from 24/7 customer service in several languages, as well as the security of trading with a regulated broker across multiple jurisdictions.

Can I withdraw the JustMarkets bonus?

Yes, you can withdraw your bonuses from JustMarkets whenever the bonus program's requirements have been satisfied. These restrictions often include a specific level of trading activity or volume that must be completed before the bonus may be fully released for withdrawal.

What is the minimum deposit for JustMarkets?

The minimum deposit at JustMarkets varies according to account type. For Standard Cent and Standard accounts, the minimum deposit is only $10. For Pro and Raw Spread accounts, the minimum deposit is now $100.

How long does withdrawal take on JustMarkets?

Withdrawals at JustMarkets are processed quickly, sometimes within one to two hours. The time it takes for funds to reach your account varies based on the method selected and can be several days depending on the provider chosen.

Where is JustMarkets located?

JustMarkets has various sites due to its global reach. The company is headquartered in Limassol Cyprus and has presence in Seychelles, South Africa, and Mauritius, all of which are regulated by their respective financial regulators.

How to deposit at JustMarkets?

Deposits at JustMarkets can be done via a variety of methods, including e-wallets, bank cards, local payment methods, and wire transfers. The process is intended to be rapid and efficient, with most deposits handled immediately. Additional verification may be required, perhaps leading to a longer processing period of a few hours.

Full Breakdown Filters

Full Breakdown

Full BreakdownCompany Updates

Disclaimer: The contents or products outlined on this page are provided by third parties and do not constitute an endorsement or any opinion by Finance Magnates. Finance Magnates has no control of the contents of this page, nor is responsible for its accuracy or legality and hereby waives any responsibility for this content. Any transactions, investments, or engagement that you enter into with a third party listed on this page or linked from this page are solely between you and such third party and are performed at your own risk. Finance Magnates holds no responsibility for any liability, damages, or losses caused in connection with the use of any content on this page.