- Stocks retreat, sterling tanks as new virus strain spreading in UK wreaks havoc

- US Congress reaches stimulus deal, but news unable to counter the gloom

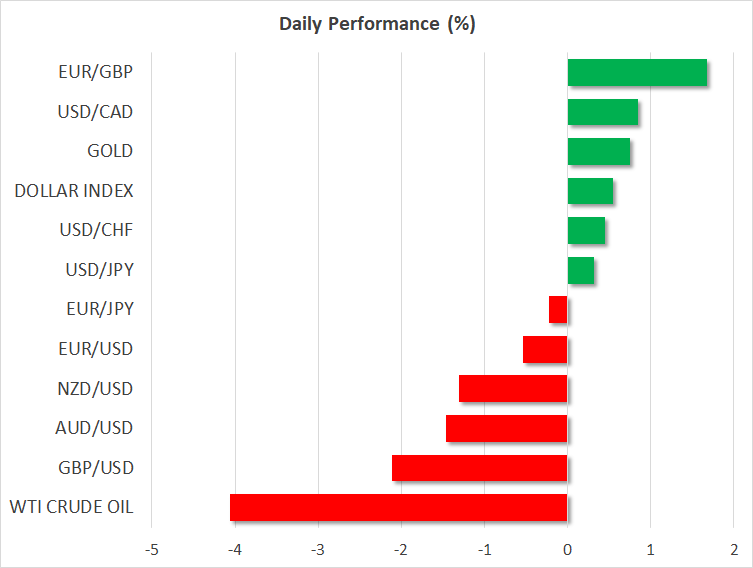

- Dollar and gold capitalize on the nerves, crude oil and commodity FX hit hard

- Bleeding may continue as traders lock profits, but bigger picture unchanged

Sterling tanks as health crisis compounds Brexit crisis

A new strain of covid-19 that is far more infectious is spreading like wildfire across the UK, forcing local authorities to ‘cancel Christmas’ by enacting stricter shutdowns and several European countries to shut their borders to British travelers. The news could not have come at a worse time, since in some cases the travel ban also encompasses cargo ships, threatening to wreak havoc on UK businesses as they stockpile inventory ahead of another Brexit deadline.

The pound was devastated. It opened with a large downside gap against its major peers on Monday and continued to drift lower, with the absence of any tangible progress in the trade negotiations compounding the virus gloom.

Let’s hope that this latest misfortune will inject a new sense of urgency into the Brexit talks. The negotiations are now stuck on fishing rights, which is a thorny political issue, but quite insignificant economically. It’s a close call, but a last-minute deal still seems like the most likely finale. Both sides desperately want to avoid a deeper economic shock, and it is difficult to imagine a deal falling apart because of fisheries of all things.

The real question may be whether a Brexit deal can turn the tide for sterling here. It probably can, especially if it lands over the coming few days when liquidity will be in short supply, amplifying any moves. Still, it may take a while longer until we get there, so the pound may stay under pressure for now, before a last-second agreement comes to the rescue.

Broader market nervous too, despite US stimulus deal

Beyond the pound, a sense of caution has also engulfed stock markets, commodities, and risk-linked currencies. Most of these assets rallied powerfully in recent weeks as the vaccine-driven exuberance joined the avalanche of liquidity, so investors may have taken this opportunity to lock in some profits and steer clear of a deeper correction.

It is striking that even a stimulus agreement from the US Congress was unable to lift this gloom. Political leaders clinched together a new package worth $900bn, which includes $600 cheques to Americans and $300 in extra unemployment benefits.

It does appear that this package was fully priced into the markets following several weeks of reports about its contents, giving investors yet another excuse to book profits, especially since its overall size did not exceed expectations.

Dollar and gold shine, but does this change anything?

Across the risk spectrum, the US dollar has been the main beneficiary as investors look for shelter from what could turn into a storm. Markets are still trying to decipher what the new virus mutation implies, whether it could escalate into prolonged lockdowns across Europe, and whether it may be resistant to vaccines.

Gold is back in vogue as well, despite a resurgent dollar. Beyond all the nervousness, sinking US real yields have given the yellow metal the kiss of life. The outlook for bullion still seems favorable heading into next year, in an environment where inflation may start accelerating but central banks keep a ceiling on yields.

Overall, even if this risk-off episode persists for now, it is difficult to argue with the cheerful narrative for next year. Vaccines are already being deployed, central banks will keep their foot on the gas, and governments could continue to spend like drunken sailors. Unless something derails this entire narrative, investors may simply view any selloffs as better entry points. It’s surreal, but as we learned this year, even a global pandemic is no match for lavish public spending and ultra-low interest rates.