- Equities sink, dollar jumps as President Trump gets coronavirus

- How does this affect election dynamics? Is Biden bad for markets?

- Sterling trades like a pinball machine amid conflicting Brexit headlines

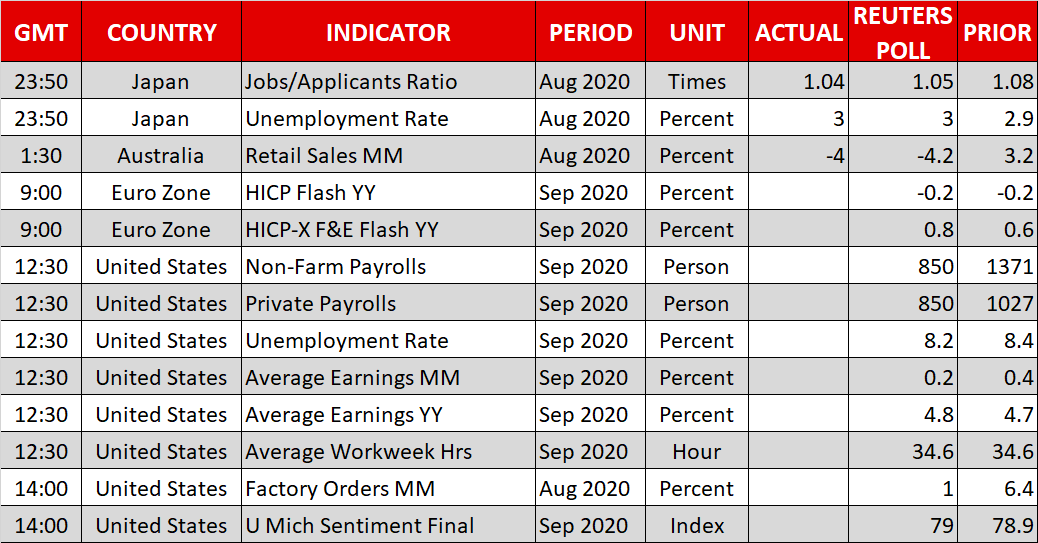

- US jobs report is the main event today, European inflation data too

Trump throws markets into disarray

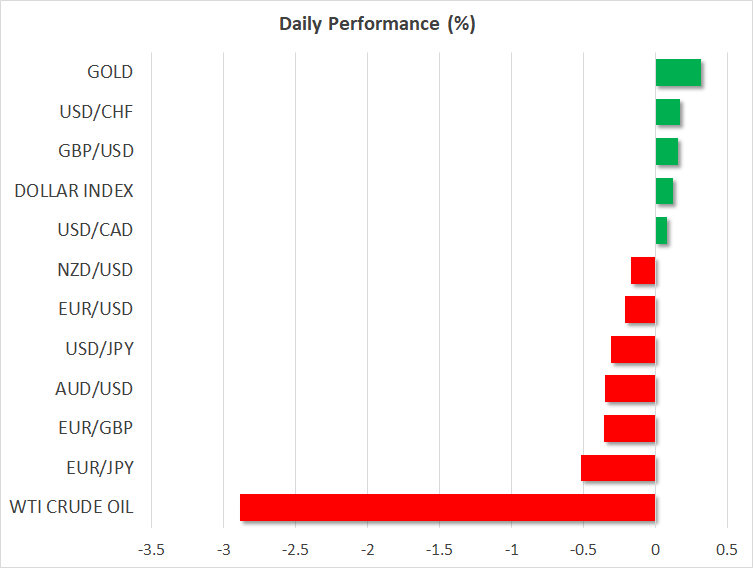

Global markets are tanking on Friday after US President Trump confirmed he has tested positive for covid-19, injecting another dose of uncertainty into election dynamics. Wall Street futures were already flashing red because the stimulus negotiations have yet to bear fruit, and the Trump news accelerated the sell-off. E-mini futures currently point to a 1.3% drop for the S&P 500 at the open today.

Across the risk spectrum, all the traditional safe havens are having a good day. The Japanese yen, Swiss franc, gold, bonds, and to a smaller extent the reserve currency itself are shining as investors seek shelter from the political storm.

The question is, how does this play out with voters? Does Trump get some sympathy vote out of it, or does the lack of campaigning ultimately hurt his chances? The only thing that seems certain is that there won’t be any more debates, which leaves fewer things to move the needle in opinion polls over the next month, allowing Biden to solidify his lead.

Separately, since Trump and Republican senators have been meeting with Supreme Court nominee Amy Coney Barrett all week, will half the Senate now go into quarantine? If so, that may diminish the chances of any stimulus deal passing before the election as the Senate does not currently allow voting by proxy for floor votes.

For now, the uncertainty could overshadow everything else as this is a market that runs almost entirely on emotion, keeping the risks to the downside, especially if Trump is hospitalized.

Is the market telling us Biden is bad for stocks?

One could read the sell-off as a signal that this diminishes Trump’s chances, and that Biden is bad for stocks. However, that may be a premature conclusion. If the Democrats manage a clean sweep, where they take the White House and both chambers of Congress, that could be great news for investors.

Many believe a Biden presidency threatens markets because he will raise taxes on corporations and capital gains. Yet, the Democrats would also deliver massive fiscal stimulus, which may neutralize the negative impact of tax hikes.

Even better, considering that raising taxes in the middle of a recession would be risky, one could argue the Democrats may deliver on the massive spending but not lift taxes significantly, which is a very market-friendly mix.

Sterling all over the place

The British pound is trading like a pinball machine, amid a flurry of conflicting Brexit headlines. Cable dropped yesterday after the EU launched legal action against the UK, then soared on reports of progress in Brexit talks, then stumbled again after the EU denied those, and today it is rising on news that Boris Johnson will speak with EU President von der Leyen.

The volatility is likely to continue over the coming weeks as sentiment swings between ‘deal’ to ‘no deal’, though sterling’s overall trajectory will also depend on how global risk appetite fares.

Nonfarm payrolls dominate the agenda

The main event today will be the US employment report for September. Forecasts point to another solid report, with nonfarm payrolls expected at 850k, pushing the unemployment rate down to 8.2%. The ADP report, Markit PMIs, and jobless claims all support the rosy forecasts.

Note though, that NFP reports only tend to be an intraday volatility event nowadays, not a trend-setter for markets. The initial reaction typically fades within a few minutes.

Elsewhere, if inflation in the euro area disappoints today, the ECB may have to roll out bigger guns soon.