- Dollar capitalizes on rare selloff in US equity markets

- Chinese and Japanese stocks go their separate ways

- Crucial US data and election polls to drive markets this week

Autumn blues for Wall Street?

The relentless rally in US stock markets took a breather last week. Wall Street suffered a rare pullback as investors took some profits off the table, positioning for a new regime of fading central bank liquidity, moderating growth, and higher taxes.

Sure, the selloff was pretty shallow and equity traders are already in a better mood this week, but looking into the autumn, there are several risks that could play havoc with markets. The obvious boogeyman is the Fed and the push to slash asset purchases this year. While the threat of tapering alone was clearly not enough to scare markets, it might be if it’s accompanied by tax increases.

The Democrats are trying to pay for their gargantuan $3.5 trillion investment plan by raising corporate and capital gains taxes, as well as introducing a 2% tax on stock buybacks. That would be a triple-whammy that capital markets cannot ignore, even if the overall package raises the productive capacity of the economy in the longer run.

Therefore, the next few months could be challenging for equity markets, with the Fed closing the liquidity taps while Congress goes after businesses and investors in an environment where growth is already losing speed and valuations are unforgiving. Of course, any weakness could ultimately present another buying opportunity as the macro landscape remains solid.

Asian markets diverge, dollar shines

Meanwhile, the regulatory drama in China continues to torment local bourses. The Hang Seng lost another 1.75% today after news that Beijing will break up Alipay, the payments app owned by Ant Group. Regulators also took another shot at their tech giants, saying they have to stop blocking each other’s links on their sites.

In contrast, the gravy train keeps on rolling in Japanese equities. The Topix index hit a new three-decade peak today, supercharged by hopes that the next Prime Minister will embark on a powerful spending spree to battle the virus and chronic deflation.

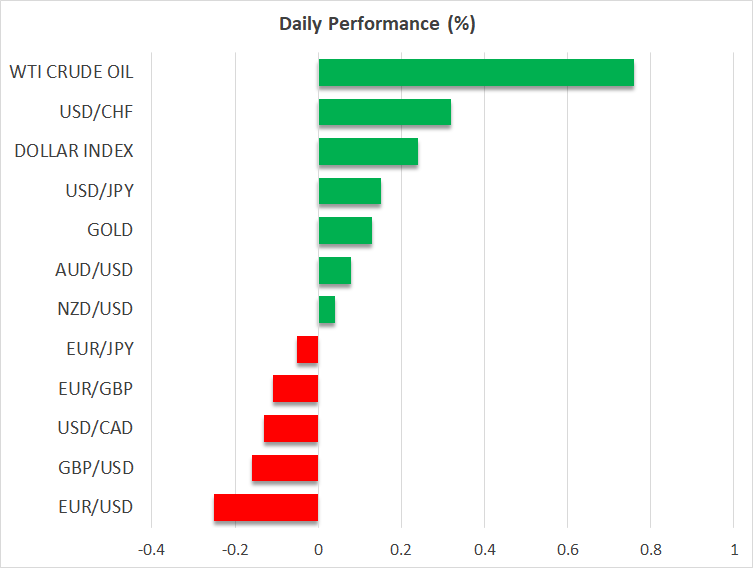

The atmosphere was calmer in the FX battleground. The only real mover has been the US dollar, which drew power from the recent defensive tones and some minor gains in Treasury yields. With the Fed now in its blackout period, the greenback’s fortunes hang on the upcoming US inflation and retail sales numbers this week.

Inflation in particular will pique the market’s interest as it increasingly seems that price pressures won’t cool as quickly as the Fed thinks. Business surveys like the PMIs continue to stress that supply chain problems aren’t getting any better thanks to the shutdowns in Asia and container shipping costs have absolutely exploded this year.

Oil prices and elections

In the energy sphere, oil prices managed to defy the cautious mood on Friday and are heading even higher on Monday, capitalizing on the fallout from Hurricane Ida that has left a lot of production offline in the Gulf of Mexico.

Politics will likely become a bigger theme moving forward, with crucial elections scheduled in Canada, Germany, and Japan. Their respective currencies could become more sensitive to incoming opinion polls as we approach these elections, since surveys conducted just a few days ahead of the vote may carry more weight in the eyes of investors.

Options traders suggest the German election will be a muted affair for the euro, with implied volatility in euro/dollar being relatively low despite a Fed meeting being in close proximity. Still, the outcome could be crucial for European economic policy and for unlocking the door towards a fiscal union.