By RoboForex Analytical Department

The crude oil market began the week with a crash. A Brent barrel is falling to 86.75 USD and looks very week.

Curiously, nothing has changed on the hews horizon.

On the one hand, the market is reacting negatively to the news about the coronavirus spreading in China. The country remains the main importer of crude oil. Any COVID-19 bound limitations might shorten the industrial demand for energy carriers. On the other hand, investors are caring for the comments of the US Federal Reserve System about further interest rate strategy.

Moreover, information has spread about a surplus of crude oil at European oil plants.

All this taken together is dragging the barrel price down.

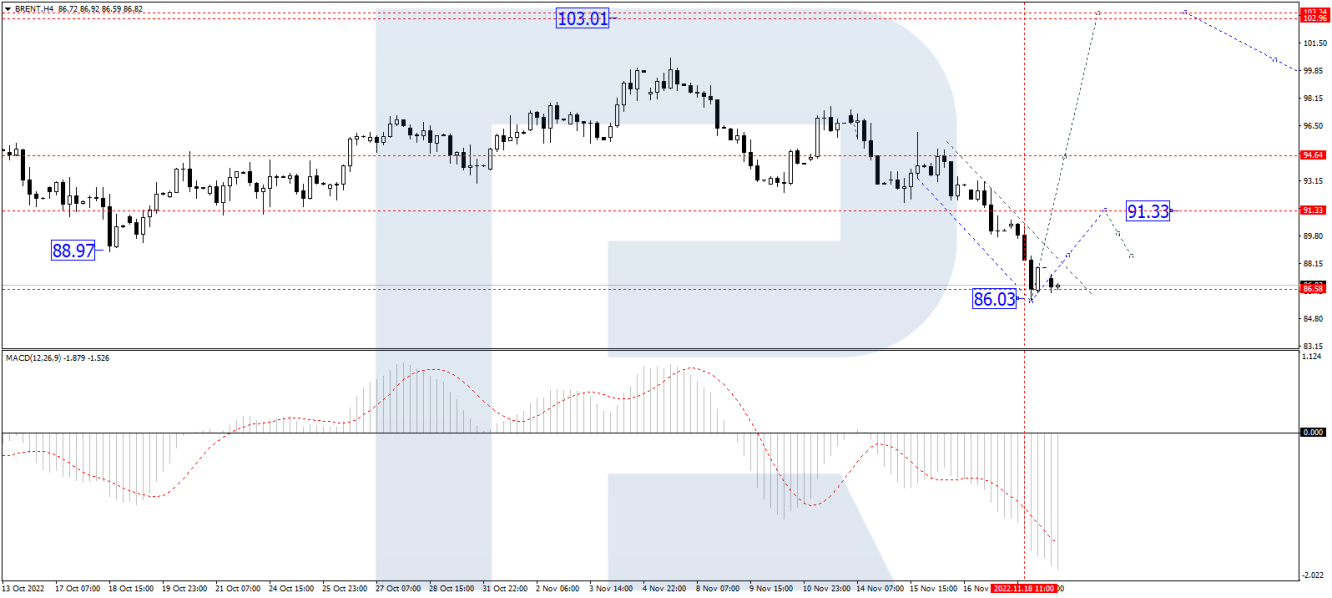

On H4, Brent corrected to 86.00 and started developing a consolidation range. At the moment, the quotes performed and corrected an impulse of growth. Practically, they have set the borders of the range. With an escape upwards, a new wave of growth to 94.75 may start. The goal is first. Technically, the scenario is confirmed by the MACD. Its signal line is at the lows, getting ready to start growing to zero.

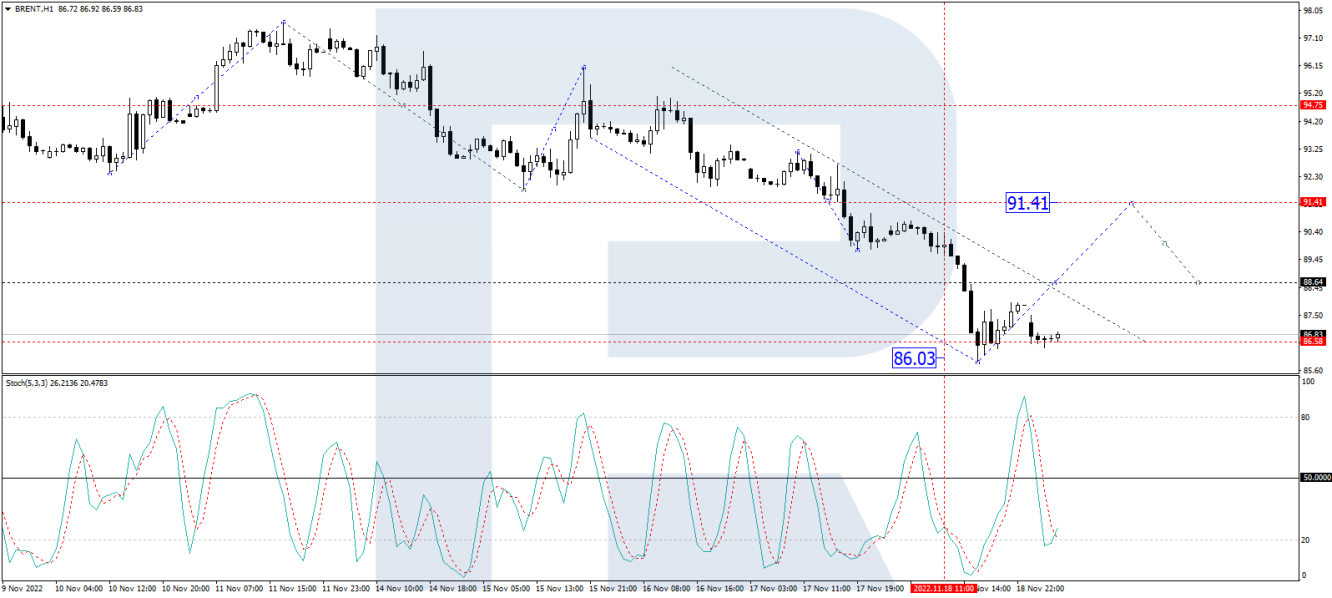

On H1, with a breakaway of 91.41, oil declined and extended the wave to 86.00. At the moment, the market completed an impulse of growth to 87.90 and a correction to 86.55. Another wave of growth is going to develop to 88.66. With a breakaway of this level upwards, a pathway to 91.41 should open. Technically, this scenario is confirmed by the Stochastic oscillator. Its signal line is under 50, aiming strictly upwards. Growth of the indicator to 80 is expected.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.