By Dmitriy Gurkovskiy, Chief Analyst at RoboForex

Early in another August week, the British Pound is slowly falling against the USD. GBP/USD remains under pressure within the mid-term downtrend and is mostly trading at 1.3847.

The GDP statistics for the second quarter of 2021 published by the United Kingdom were pretty much as expected, so market players switched their attention to local events. We remind you that the British economy expanded by 4.8% q/q in April-June after losing 1.6% q/q in the first quarter. As one can see, the economy is recovering and the positive report surprised no one and didn’t become a trigger for long-term confidence.

Right now, the Pound is pressured by the USD strength. Investors are pretty sure that the US Federal Reserve System will reduce its QE program sooner than expected due to strong numbers. It’s a great support to the “greenback”, which puts serious pressure on other traded currencies.

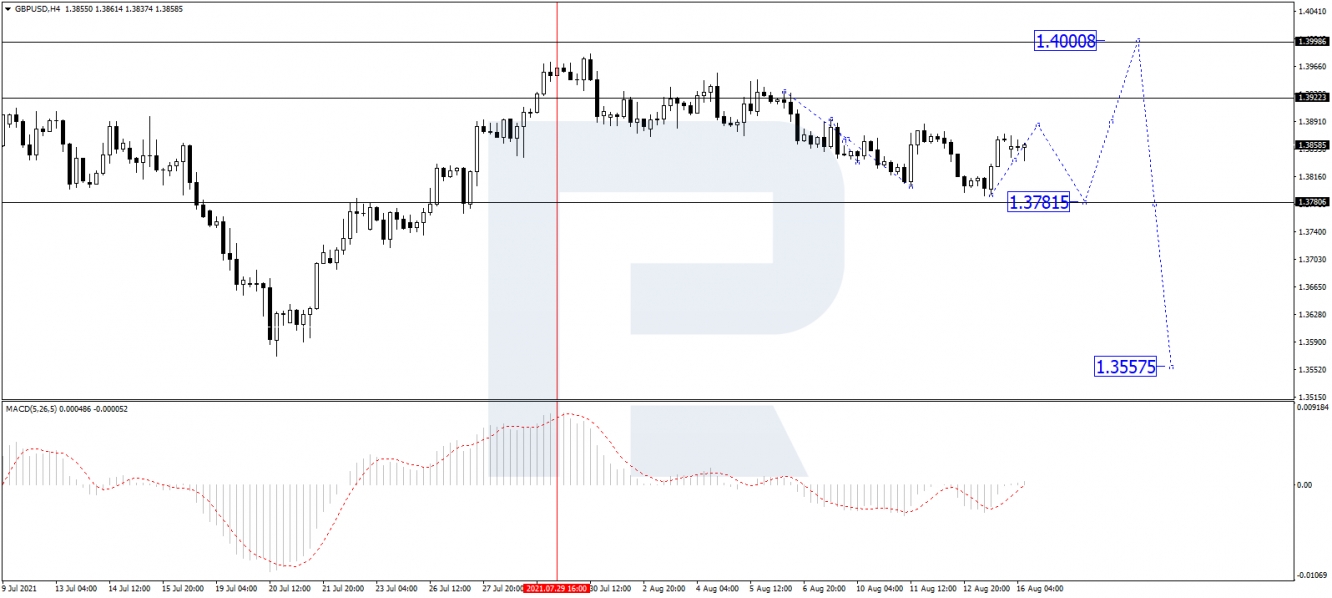

As we can see in the H4 chart, after rebounding from 1.3990, GBP/USD is correcting with the target at 1.3781; it has already completed the descending structure at 1.3790 and is currently growing towards 1.3875. Later, the market may fall towards the above-mentioned target and then complete the correction by reaching 1.4000. After that, the instrument may resume trading within the downtrend towards 1.3750. From the technical point of view, this scenario is confirmed by MACD Oscillator: its signal line is rising towards 0, a breakout of which may boost the price chart growth. On the other hand, if the line rebounds from 0, it will resume falling towards the lows and the price chart will update its lows as well.

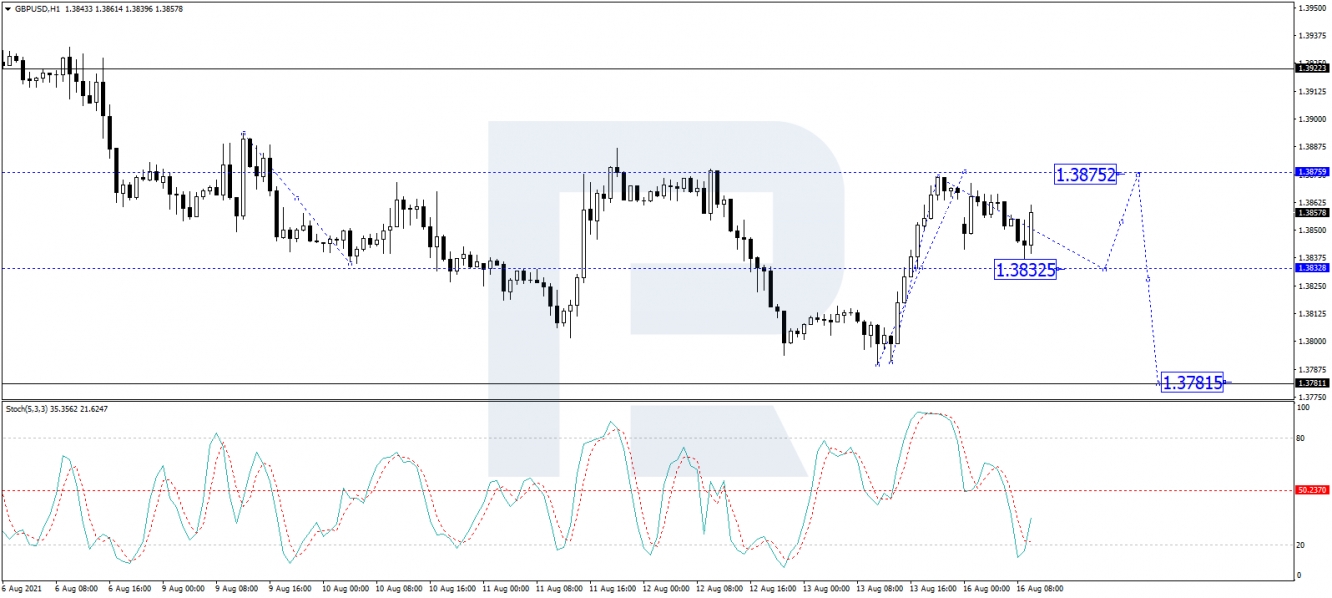

In the H1 chart, GBP/USD is correcting downwards. Possibly, the pair may form a new descending structure towards 1.3832. After that, the instrument may grow to reach 1.3875 and then fall to return to 1.3832. In fact, the asset is expected to consolidate around 1.3832. If the price breaks the range to the downside, the market may resume falling within the downtrend with the target at 1.3750; if to the upside – extend the ascending wave up to 1.4000. After reaching 1.4000, the pair may form a reversal pattern and start a new decline. From the technical point of view, this scenario is confirmed by the Stochastic Oscillator: its signal line is trading to rebound from 20 to the upside and grow towards 50, a breakout of which may lead to further growth to reach 80.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.