Preview Mode

- SEE LESS

- B2B Categories

- Industry Executives (287)

- Industry Websites (59)

- Regulators (23)

- Liquidity Provider (4)

- Payment Processors (3)

- Platforms (3)

- KYC (2)

- Regulation Consulting (2)

- Cryptocurrency Trading Solutions (1)

- CRM (1)

- Tools for Brokers (1)

- SaaS Provider (1)

- MT4/MT5 Bridge Providers (1)

- White Label Solutions

- Affiliate Programs

- Platform Providers

- Cryptocurrency Liquidity Providers

- Translation Services

- Trading Categories

- Subscribe to our Newsletter

- Suggest a company

- Contact Us

- Companies Home

- Company News

- Categories

- Trading News

- Company News

- Videos

- Search

- Add

Company

Full Breakdown Filters

Full Breakdown

Full BreakdownCompany Review

Peaksight Ltd. Broker Review (2025) – Regulation, Fees, Platform & More

Introduction

Peaksight Ltd. is a Cyprus-based online broker that specializes in Contracts for Difference (CFDs). Established in 2023, the firm is licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC), under license number 440/23. Operating from Limassol, the broker follows a Straight-Through Processing (STP) model, which allows for direct order execution without dealing desk intervention.

The company provides trading services to clients across the European Economic Area (EEA) and Switzerland, excluding the United Kingdom. Its product offering includes more than 160 CFD instruments, covering forex pairs, stock indices, commodities, equities, and cryptocurrencies.

Trading is facilitated through Peaksight’s proprietary WebTrader platform. This web-based system runs in modern browsers and supports cross-device compatibility. Functionalities include order types such as stop-loss, take-profit, and limit orders, as well as technical analysis tools and real-time charting.

In terms of regulatory compliance, Peaksight adheres to the European Securities and Markets Authority (ESMA) standards. It maintains client fund segregation and participates in the Investor Compensation Fund (ICF). Leverage is capped at 1:30 for retail clients, while eligible professional clients may access leverage up to 1:400.

Regulation and Client Protection

Peaksight Ltd. is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 440/23, operating as a Cyprus Investment Firm (CIF). CySEC operates under the framework of the European Union's Markets in Financial Instruments Directive II (MiFID II), requiring firms to adhere to standards related to transparency, operational integrity, and investor protection.

As part of its regulatory obligations, Peaksight participates in the Investor Compensation Fund (ICF), which may offer compensation to eligible retail clients if the firm becomes insolvent. The company also enforces client fund segregation, holding assets in separate accounts at tier-1 financial institutions to ensure they remain distinct from corporate funds.

In line with European Securities and Markets Authority (ESMA) rules, the broker offers negative balance protection for retail accounts and applies leverage caps—up to 1:30 for retail clients and up to 1:400 for those classified as professional, subject to eligibility.

Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures are applied at account registration and during ongoing client interaction to comply with financial regulations and reduce the risk of fraudulent activity.

Trading Platform and Available Tools

Peaksight Ltd. offers a proprietary web-based trading platform known as Peaksight WebTrader. The platform is designed for accessibility and compatibility across modern browsers and devices, including desktops, tablets, and smartphones. It operates without the need for installation or downloads.

WebTrader features a user-friendly interface and includes a range of tools for trading and analysis:

Live pricing across all supported CFD instruments

Interactive charts with adjustable timeframes and a range of technical indicators

Order types such as market, limit, stop-loss, and take-profit

Margin and exposure monitoring tools for risk management

Secure data transmission via 128-bit SSL encryption

The platform provides access to trade history, performance statistics, and one-click trade execution. It is suitable for users at various experience levels, although it may be limited for those who prefer industry-standard platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5), which are not supported.

While the absence of third-party platforms may restrict customizability for some traders, the WebTrader platform focuses on delivering core trading functionalities within a secure and streamlined environment.

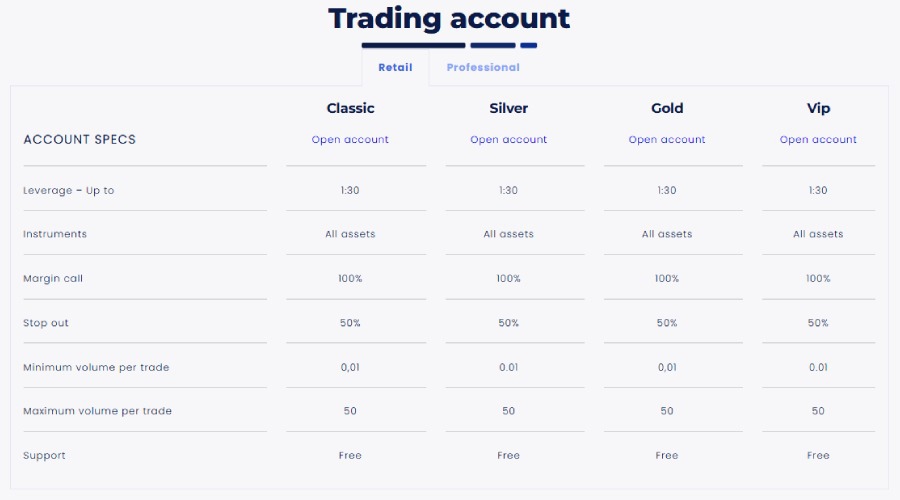

Account Types

Peaksight Ltd. offers two primary account categories: Retail and Professional. Each account type is structured according to regulatory guidelines and intended trading profiles.

Retail Account

The Retail Account is designed for individual traders who do not qualify as professionals under CySEC criteria. It complies with ESMA regulations and includes the following features:

Maximum leverage of 1:30

Negative balance protection

Access to all available CFD instruments

Segregated client funds

Coverage by the Investor Compensation Fund (ICF)

Standard spreads and margin requirements

This account is aligned with risk-mitigation protocols suitable for non-professional investors.

Professional Account

Traders who meet the eligibility requirements for professional status under CySEC rules may access the Professional Account. This account offers:

Leverage up to 1:400

Reduced spreads

Lower margin requirements

Full access to the same instruments and tools as the Retail Account

However, it excludes negative balance protection and ICF coverage. The Professional Account is intended for experienced traders who understand the risks associated with higher leverage.

All account holders receive access to the Peaksight WebTrader platform, a multilingual support service available Monday through Friday, and a client portal for managing account documentation and funds.

Available Trading Instruments

Peaksight Ltd. provides access to over 160 CFD instruments across multiple asset classes. The offering includes forex, indices, commodities, stocks, and cryptocurrencies, enabling users to implement a range of trading strategies within a single platform.

Forex

The broker offers more than 40 currency pairs, including major (e.g., EUR/USD), minor (e.g., GBP/JPY), and exotic pairs. Forex trading is available five days per week, with variable spreads and real-time execution through the WebTrader platform.

Indices

Clients can trade leading global indices such as the S&P 500, DAX 40, and FTSE 100. These CFDs allow for leveraged speculation on broader market trends and economic developments without exposure to individual stocks.

Commodities

The platform supports CFDs on key commodities, including precious metals (gold, silver) and energy products (crude oil, natural gas). These instruments are often used for diversification or as part of hedging strategies.

Equities (Stocks)

Stock CFDs include major companies listed on U.S., European, and international exchanges. Traders can speculate on price changes without owning the underlying equity, with access to real-time charts and risk management tools.

Cryptocurrencies

Digital assets such as Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC) are available as CFDs. These products allow for trading without the need to maintain a crypto wallet or register on an exchange.

All instruments are accessible via the WebTrader platform, with integrated charting, order types, and real-time market data.

Fees and Trading Costs

Peaksight Ltd. applies a commission-free pricing model based on variable spreads. The structure is intended to offer cost transparency for both retail and professional account holders.

Spreads

Forex: Spreads start at approximately 0.8 pips for major currency pairs such as EUR/USD, under typical market conditions.

Indices and Commodities: Spread levels fluctuate based on asset liquidity and market volatility, with competitive pricing maintained across product categories.

Cryptocurrencies: Spreads tend to be wider due to elevated volatility but remain consistent with industry averages.

Commissions

No additional commissions are charged on trades. Trading fees are embedded in the bid-ask spread, which may simplify cost calculations, particularly for lower-volume or frequent trades.

Additional Fees

Deposits: No deposit fees are applied by Peaksight Ltd.

Withdrawals: Fees may be charged by external payment service providers; Peaksight itself does not apply internal withdrawal fees. Only on wire transfers we charge a fee of 30 usd/eur/gbp

Inactivity: No fees are levied on inactive accounts for the first 3 months, which may benefit users with intermittent trading activity. After 3 months the inactivity fee is 30 usd/eur/gbp

This fee structure aims to provide a straightforward overview of trading costs without imposing hidden charges.

Deposit and Withdrawal Options

Peaksight Ltd. supports multiple payment methods for account funding and withdrawal. All transactions are processed through secure channels and are subject to standard regulatory safeguards.

Deposit Methods

Clients can fund trading accounts using the following options:

Credit/Debit Cards (Visa, MasterCard)

Bank Wire Transfers

E-wallets (availability may vary by region)

Deposits are processed via encrypted channels. Most methods allow for near-instant account funding, while bank transfers may take 2 to 5 business days depending on the originating financial institution. No deposit fees are charged by the broker.

Withdrawal Methods

Withdrawals are processed using the same method as the initial deposit, in line with Anti-Money Laundering (AML) regulations. Available withdrawal channels include:

Credit/Debit Card refunds

Bank Wire Transfers

Supported e-wallets

Processing Times

Internal review: Up to 24–48 hours

Bank/payment provider timeframes: 1–5 business days

Fees and Conditions

Peaksight does not charge internal withdrawal fees. However, external providers—particularly for international transactions—may apply additional charges.

Security Protocols

All financial operations are secured using 128-bit SSL encryption. Identity verification under Know Your Customer (KYC) requirements must be completed before initiating withdrawals.

Customer Support and Service

Peaksight Ltd. provides customer support services during standard market hours and offers multilingual assistance for users in the European Economic Area and Switzerland.

Availability

Operating Hours: Monday to Friday, aligned with global trading sessions

Languages Supported: Multilingual service available, depending on region

Contact Channels

Clients can contact Peaksight’s support team through the following methods:

Live Chat: Available on the broker’s official website

Email: Inquiries can be sent to support@peaksightltd.com

Contact Form: Online submission form for general questions or account-related issues

Support Scope

Support agents are trained to assist with:

Account setup and verification

Platform navigation

Technical issues

Deposit and withdrawal guidance

In addition to direct support, clients have access to a secure online portal for managing account details, submitting documents, and tracking trading activity.

Advantages and disadvantages

Pros | Cons |

CySEC-Regulated Broker (License 440/23) | No Support for MT4 or MT5 Platforms |

STP Execution Model with No Dealing Desk | Services Not Available to UK Clients |

Proprietary WebTrader Platform, No Downloads Required | Professional Accounts Lack Negative Balance Protection and ICF |

Access to 160+ CFDs: Forex, Indices, Commodities, Stocks, Crypto | Customer Support Not Available on Weekends |

Commission-Free Trading with Competitive Spreads | |

Client Funds Held in Segregated Tier-1 Bank Accounts | |

Retail Leverage up to 1:30; Professional Leverage up to 1:400 | |

Multilingual Customer Support (24/5) | |

No Inactivity or Deposit Fees |

Conclusion

Peaksight Ltd. is a Cyprus-regulated CFD broker operating under the oversight of CySEC and compliant with MiFID II standards. Its services are available to retail and professional clients within the European Economic Area and Switzerland, excluding the United Kingdom.

The broker offers access to over 160 CFD instruments across forex, indices, commodities, stocks, and cryptocurrencies. Trading is conducted through a proprietary WebTrader platform that emphasizes accessibility and ease of use, though it does not support third-party platforms like MT4 or MT5.

The fee structure is based on variable spreads without commission charges, and account types are clearly differentiated between retail and professional classifications, with corresponding risk protections and leverage limits. Operational safeguards include fund segregation, KYC/AML compliance, and participation in the Investor Compensation Fund for eligible clients.

While Peaksight lacks certain features—such as weekend support and platform flexibility—its regulated status, transparent cost structure, and broad market access position it as a viable option for traders looking for a broker within the European regulatory framework.

Overall, Peaksight Ltd. is a compelling choice for traders seeking a regulated, user-friendly, and cost-effective CFD trading environment within Europe.

Full Breakdown Filters

Full Breakdown

Full BreakdownDisclaimer: The contents or products outlined on this page are provided by third parties and do not constitute an endorsement or any opinion by Finance Magnates. Finance Magnates has no control of the contents of this page, nor is responsible for its accuracy or legality and hereby waives any responsibility for this content. Any transactions, investments, or engagement that you enter into with a third party listed on this page or linked from this page are solely between you and such third party and are performed at your own risk. Finance Magnates holds no responsibility for any liability, damages, or losses caused in connection with the use of any content on this page.