Preview Mode

- SEE LESS

- B2B Categories

- Industry Executives (287)

- Industry Websites (59)

- Regulators (23)

- Liquidity Provider (4)

- Payment Processors (3)

- Platforms (3)

- KYC (2)

- Regulation Consulting (2)

- Cryptocurrency Trading Solutions (1)

- CRM (1)

- Tools for Brokers (1)

- SaaS Provider (1)

- MT4/MT5 Bridge Providers (1)

- Platform Providers (1)

- White Label Solutions

- Affiliate Programs

- Cryptocurrency Liquidity Providers

- Translation Services

- Trading Categories

- Subscribe to our Newsletter

- Suggest a company

- Contact Us

- Companies Home

- Company News

- Categories

- Trading News

- Company News

- Videos

- Search

- Add

Company

Minimum Deposit

- 0-50

Leverage

- 30:1

- 100:1

- 400:1

- 200:1

- 20:1

- 1000:1

- 500:1

- 300:1

Regulation

- BVI FSC

- BaFIN

- CIMA- Cayman Islands Monetary Authority

- FIU

- FSC

- SCA

- CySec

- VFSC

- ASIC

Full Breakdown Filters

Full Breakdown

Full BreakdownCompany Review

MultiBank Review: Everything You Need To Know!

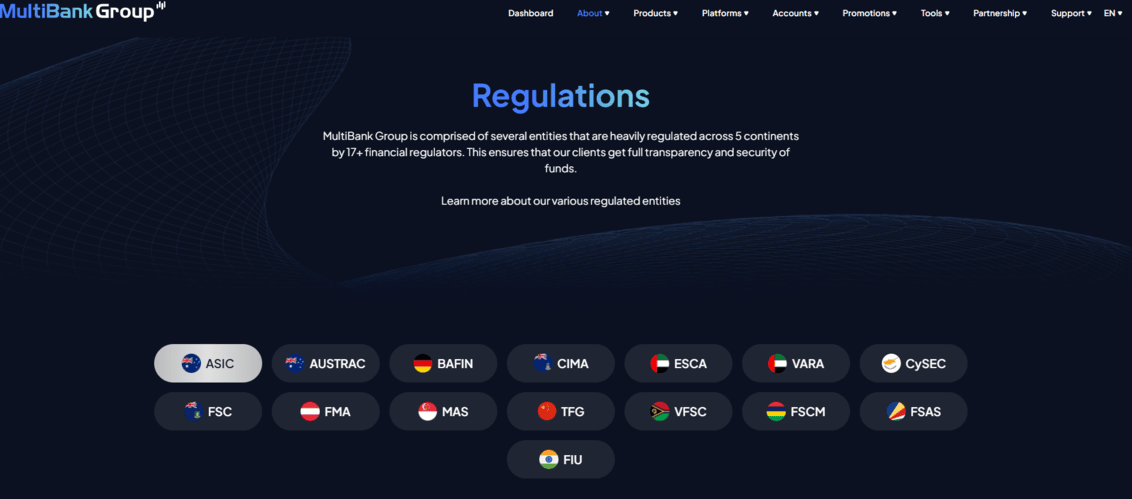

Regulation and License | ASIC, BAFIN, CySEC, CIMA, ESCA, FSC, MAS, FMA, TFG, AUSTRAC, VFSC, FSCM, FSAS, FIU |

HQ | Dubai, UAE |

Founding year | 2005 |

Leverage range | Up to 1:1000 |

Min Deposit | $50 |

Platforms | MT4, MT5, Multibank-Plus, Desktop, Mobile, and Social trading |

Demo account | Yes |

Base Currencies | Support multiple currencies |

Customer support | 24/7 multilingual support |

Publicly traded | No |

Crypto | Yes |

Website | https://www.multibankfx.com/en |

Pros & Cons

Pros | Cons |

Offers multiple accounts | Lack of micro accounts |

Competitive forex fees | |

Leverage up to 1:1000 | |

Offer popular MT4 & MT5 platforms | |

24/7 multilingual customer support | |

Trading on scalping |

Overview

MultiBank Group is a popular international Forex and multi-asset broker that offers trading in a wide range of financial markets. The company is headquartered in Dubai and has over 20 branches worldwide.

The broker is comprised of several entities that are heavily regulated by several financial regulators, including ASIC, BaFin, CySEC, CIMA, ESCA, FSC, MAS, FMA, TFG, AUSTRAC and VFSC, TFG,VFSC, FSCM, FIU and FSAS. It offers leverage of up to 1:500 and has a minimum deposit of $50.

The broker provides access to the markets through the MetaTrader 4, MetaTrader 5 and desktop trading platforms, as well as mobile and social trading apps. MultiBank Group offers to trade 20,000+ products across six asset classes including Forex, metals, shares, indices, commodities, and cryptocurrencies. In addition, they provide a free demo account in which traders can test the trading platforms and tools.

The Group caters to a significant client base of over 1,000,000 clients by being a heavily-regulated broker, providing a wide range of tradable instruments, first-class customer support, and multiple trading platforms.

MultiBank Group offers zero-commission trading with negative balance protection and segregated client accounts. It's a good choice for both beginners and advanced traders who are looking for a well-regulated broker with a wide range of tradable assets, multiple trading platforms, and excellent customer support. In addition, they offer margin calls at 50%.

In this review of Multibank Group, we will dive deep into the features offered, trading fees, account types, available trading platforms, and their customer support. This will provide traders with the knowledge needed to evaluate this forex broker and determine if it meets their needs.

Safety Information

MultiBank Group provides fully segregated client accounts and negative balance protection. In addition, it guarantees the highest levels of security to protect client funds and information. All clients under MEX Atlantic are covered by an Excess Loss Insurance Policy fom Lloyd's of London, protecting their funds up to $1,000,000 per account.

The broker uses high-end SSL encryption to protect client information and funds. All the financial transactions are processed through Tier-1 banks. Both the withdrawal and deposit processes are protected with the latest security measures. With the support of SSL, MultiBank Group has been able to create a safe and secure trading environment for its clients.

They have also implemented Know Your Customer (KYC) and Anti-Money Laundering (AML) policies to ensure the safety of client funds. To open a live account with them, you need to submit personal information, including your full name, date of birth, email address, and phone number.

You will also be required to submit a valid ID document such as your passport, national ID, or driving license. KYC ensures that only legitimate clients can open an account.

AML policies are designed to prevent money laundering and terrorist financing. The AML Department monitors all the financial transactions. The transaction will be immediately flagged and reported to the relevant authorities if any suspicious activity is detected.

Moreover, MultiBank Group has also implemented two-factor authentication in which you need to enter a code that is sent to your phone or email to log in to your account. It makes it impossible for anyone to hack into your account even if they know your password.

In addition, they offer 24/7 multilingual customer support to resolve any issue that you may have. They are a highly-regulated and reliable broker that offers a wide range of tradable assets, multiple trading platforms, and excellent customer support.

Fee structure

MultiBank Group offers three different accounts, and the trading fees vary according to the account type. The minimum deposit on the Standard account starts at $50 with leverage of up to 1:500. The Standard account doesn't charge any commission fees.

They do not charge a fee for deposits or withdrawals, but your bank or payment processor may charge a fee.

The broker also has an Islamic account for those who wish to trade in accordance with Sharia law. With this account, you don't have to pay swap or rollover fees. Moreover, you need to keep in mind that there is a $60 inactivity fee if you don't use your account for three months or more. Overall, we can say that the fees at MultiBank Group are reasonable when compared to other brokers.

Fees Type | Multibank Group |

Deposit fee | No |

Withdrawal fee | No |

Inactivity fee | Yes |

Fee ranking | Low/Average |

Spreads fee details

The spreads at MultiBank Group start at 0.0 pips, depending on the account. Below is the spread information regarding every account:

Standard — 1.5 pips.

Pro — 0.8 pips.

ECN — 0.0 pips.

The broker has not mentioned whether the spreads are floating or fixed. Floating spreads are those which change according to the market conditions, while fixed spreads remain constant even during high-impact news events.

Another Feature is that the broker offers spreads on gold and major FX Pairs from 15 cent $, and a 25% Deposit Bonus up to $40,000.

Deposit And Withdrawal Options

MultiBank Group is among the leading forex brokers that offer a wide range of deposit and withdrawal options. You can deposit and withdraw funds through bank transfers, credit/debit cards, and online payment processors like Skrill, Neteller, and UnionPay. Compared to other brokers, deposits and withdrawals are made significantly faster and with fewer fees.

MultiBank Group doesn't charge for deposits or withdrawals, but your bank or payment processor may charge a fee. For withdrawal, you need to log into your account and click on the 'Withdrawal' button. You will then be required to fill out a withdrawal form and submit it for approval. Once your withdrawal request is approved, the funds will be transferred to your chosen payment method within 24 hours.

The broker has not mentioned anything about the minimum withdrawal amount. However, you need to keep in mind that your bank or payment processor may charge a withdrawal fee.

In addition, to comply with the regulations, you will need to go through the KYC (Know Your Customer) process before you can withdraw funds from your account.

Compared to other brokers, the minimum deposit required for an account is quite low, making it suitable for both beginner and experienced traders. Moreover, as it's a regulated broker, you can be sure that your funds are safe and secure with them.

Tradable Instruments

MultiBank Group is a multi-asset broker that offers over 20,000 tradable assets across different financial markets, including forex, metals, energies, indices, shares, and cryptocurrencies.

Forex

The broker offers leverage up to 100:1 for Forex, among the highest levels of leverage available. They also provide some of the tightest spreads in the industry, starting from 0.0* pips.

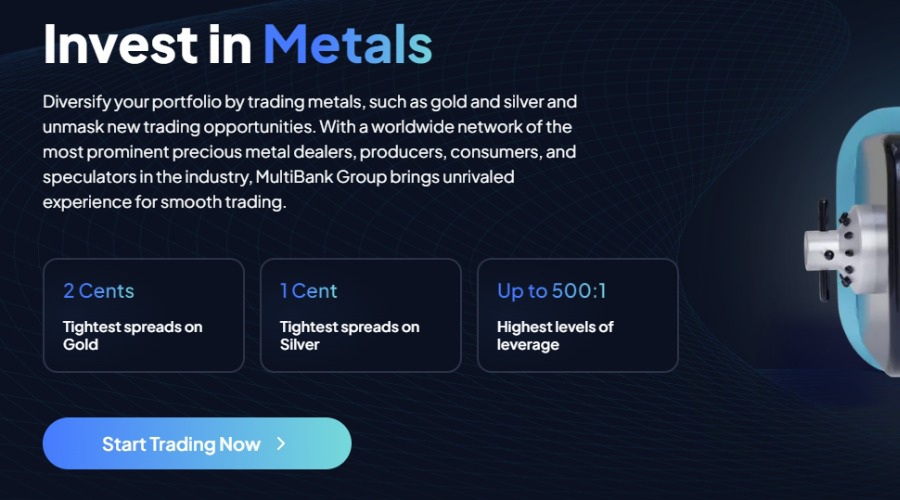

Metals

They also offer extremely competitive spreads for Metals, including 2 cents on Gold and 1 cent on Silver, recognized as the tightest spreads for these metals. Additionally, leverage of up to 500:1 is available, matching the highest levels provided in forex trading.

Indices

For indices, the broker offers leverage up to 100:1 along with the lowest spreads in the market. Similar to shares, trading indices comes with 0% commission, enhancing the trading experience with cost efficiency.

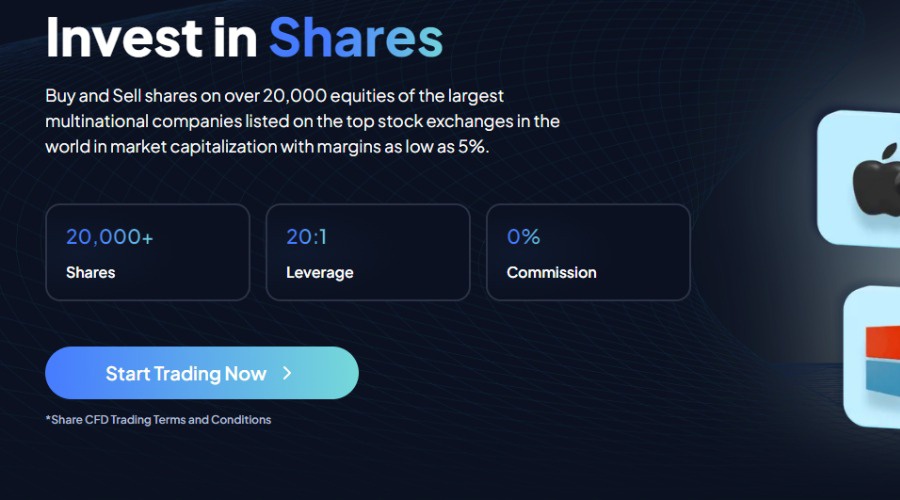

Shares

MultiBank Group provides access to over 20,000 shares with a leverage of 20:1. They offer 0% commission on share trading, making it an attractive option for trading equity.

Commodities

Trading commodities with features no commission charges and the tightest spreads. The platform also offers low margin requirements on all commodities, which allows for more accessible trading positions.

Cryptocurrency

The cryptocurrency market is one of the most popular markets at, with multiple cryptocurrencies available for trading CFDs. Bitcoin, Ethereum, Bitcoin Cash, Litecoin, Dogecoin, Polkadot, Ripple, and others. With a margin call at 50%, a stop-out level at 50%, and leverage of up to 1:20, MultiBank is a suitable broker for both beginner and experienced traders.

Moreover, there are no restrictions on Expert Advisors. You can use all the advanced features of these trading platforms for your benefit. The mobile and web-based versions of these trading platforms are also available.

Leverage information

You need to be careful while trading with leverage. Trading with leverage gives the opportunity of earning higher profits but can also mean higher losses if not managed correctly. MultiBank Group offers one of the highest levels of leverage, up to 500:1. You can adjust your level of leverage on your account Settings.

Available Trading Platform

MultiBank Group is a popular choice for beginners and advanced traders looking for a well-regulated broker with a broad range of tradable assets, multiple trading platforms, and good customer support. The broker offers three different account types: Standard, Pro, and ECN.

MetaTrader 4

It is a widely used electronic trading platform for retail foreign exchange traders. It was developed by MetaQuotes Software and released in 2005. MT4 is considered to be one of the best trading platforms that offer a wide range of technical analysis tools and advanced charting features. The platform also allows the use of automated trading systems (trading robots) and copy trading.

The MT4 platform offers good security as it uses 128-bit encryption for data protection. The platform is available in 45 languages. MultiBank Group provides the MetaTrader 4 web trading platform that can be accessed from any web browser, or you can also download it to use as desktop software.

The best part about MT4 is that it can be easily customized according to your trading needs and preferences. You can also use a wide range of indicators and EAs (Expert Advisors) on the MT4 platform. The platform is suitable for both beginner and advanced traders.

MetaTrader 5

MetaTrader 5 is the successor of the popular MetaTrader 4 trading platform. It was developed by MetaQuotes Software and released in 2010. The MT5 platform is an all-in-one trading platform that offers a wide range of features and tools for both beginner and advanced traders.

The platform supports multiple order types, advanced charting features, and a wide range of technical analysis tools. It also allows the use of automated trading systems and copy trading. The platform is available in 32 languages.

The MT5 platform is user-friendly and can be easily customized according to your trading needs and preferences. You can also use a wide range of indicators and EAs on the MT5 platform.

MultiBank-Plus

MultiBank-Plus is a state-of-the-art trading platform designed to provide stability and enable real-time trading. This platform offers a seamless trading experience through both its web app and mobile app, catering to traders' needs for accessibility and functionality.

The MultiBank-Plus web app delivers a next-generation trading experience with a simple and easy-to-use interface that can be accessed from any web browser. The platform ensures high-level security for data protection and is customizable to meet individual trading preferences. It includes advanced charting features, technical analysis tools, and supports automated trading systems, allowing traders to execute trades efficiently and effectively.

The MultiBank-Plus mobile app enables traders to manage their investments on the go. Available for download on both the App Store and Google Play, the mobile app offers real-time trading capabilities, ensuring traders can respond to market movements wherever they are.

MultiBank Group mobile trading platform

MutiBank Group supports MT4 and MT5. These can be downloaded for free from the App Store and Google Play Store. All MultiBank Group’s mobile applications allow you to trade with real-time market quotes, advanced charting features, and a wide range of technical analysis tools.

Available Trading Accounts

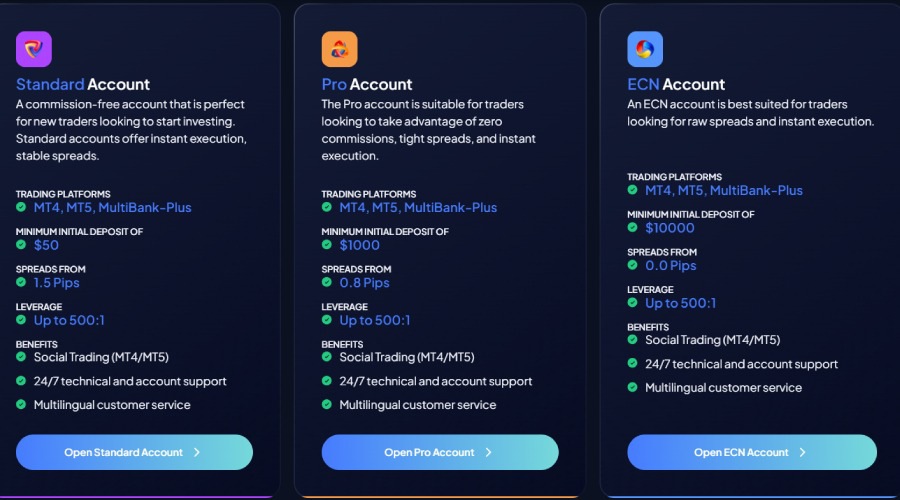

All MultiBank Group accounts support MT4 and MT5 trading platforms, 24/7 multilingual customer and technical support. The following are the different types of accounts:

Standard account

A commission-free account that is perfect for new traders looking to start investing. With a minimum deposit of $50, spreads from 1.5 pips, leverage of up to 500:1, and social trading option, the Standard account offers instant execution and stable spreads.

Pro account

The Pro account is suitable for traders taking advantage of zero commissions, tight spreads, and instant execution. It has a minimum deposit of $1000, spreads from 0.8 pips, and a leverage of up to 1:500. Social trading is available with this account.

ECN account

An ECN account is best suited for traders looking for raw spreads and instant execution. The minimum deposit for this account is $5000, spreads from 0.0 pips and leverage of up to 1:500. Social trading is available with this account.

MultiBank Group also offers Islamic accounts in which there are no interest charges on overnight positions. In these accounts, you can trade with leverage of up to 1:500. The minimum deposit for these accounts is $50.

How to open an account with MultiBank Group

Opening an account is straightforward. Below are the required steps that you need to take for opening a trading account with MultiBank Group:

- Visit the official website of MultiBank Group and click on ‘Open Live Account’.

- Fill in the online registration form with your details.

- Choose your account type, leverage, and deposit amount.

- Upload the required documents for account verification.

- Once your account is verified, you can start trading.

Customer Support information

MultiBank Group offers customer support in multiple languages, including English, Spanish, French, German, Italian, Arabic, Chinese, and many more. You can contact the customer support team through email, phone, or live chat available 24/7. With dedicated customer service, they can respond to queries efficiently within a few minutes.

Available Research Tools

MultiBank Group offers its clients a wide range of research tools and resources. These research tools and resources are useful for beginners and experienced traders. Below are the following research tools:

Economic Calendar

An economic calendar is a tool that provides all the latest news and events related to the financial markets. The economic calendar is available on the official website. The economic calendar comes in handy, especially for those who trade the news.

The economic calendar can help traders take advantage of the market-moving events or make trading decisions. In addition, the economic calendar also helps traders to stay up-to-date with the latest news and events related to the financial markets.

Whether you are a fundamental trader or a technical trader, the economic calendar is a valuable tool to help you in your trading.

MAM/PAMM

PAMM means Percentage Allocation Management Module, and it is a system that allows traders to invest in the accounts of other traders. The PAMM system is available on the MetaTrader 4 trading platform of MultiBank Group.

In addition to the PAMM system, they also offer MAM (Multi-Account Manager) accounts. MAM accounts allow money managers and fund managers to trade on multiple accounts simultaneously from a single platform. The advantage of PAMM and MAM is that they offer great flexibility and convenience to traders.

VPS Service

MultiBank Group offers VPS (Virtual Private Server) service to its clients. The VPS service of MultiBank is quite reliable, and it allows you to trade without any interruption. The advantage of using a VPS is that it can help you execute your trades faster and more accurately.

Social trading

MultiBank Group has a social trading platform. The Social trading is a great way to connect with other traders. It is also a great way to learn from other traders. The social trading platform allows you to copy the trades of other traders.

You can choose from a wide range of traders whose performance you want to copy. You can also use it to connect with other traders and share your trading ideas and thoughts.

Fix API

MultiBank Group offers its clients FIX API (Financial Information Exchange Application Programming Interface). The advantage of using FIX API is that it allows you to trade with more accuracy and faster speed.

Expert advisors

Expert advisors are a great way to automate your trading. Expert advisors can help you trade with more accuracy and at a faster speed. In addition to this, expert advisors can also help you manage your risk. There are no restrictions on EAs with MultiBank Group.

Educational Materials

MultiBank offers a wide range of educational content for beginners and advanced traders. In a dedicated blog section, you can find articles on various topics such as trading strategies, technical analysis, market news, crypto and more. The Educational blog section covers some of the following topics:

Trading

They offer comprehensive educational materials on various topics such as forex trading, CFD trading, and more. You can find articles on issues on both beginner and advanced levels. You can also find detailed articles on various technical analysis tools and techniques such as moving averages, support and resistance levels, Fibonacci levels, etc.

Cryptocurrencies

You can find many articles on cryptocurrencies such as Bitcoin, Ethereum, Litecoin, Dogecoin, and more. These articles will provide you with detailed information on trading cryptocurrencies, the benefits of trading cryptocurrencies, and more. Thus, while investing in cryptocurrencies, you will better understand the market.

Market News

MultiBank’s market news section provides you with the latest updates from the financial markets. In addition, you can find articles on various topics such as economic indicators, central bank announcements, and more. This will help you stay up to date with the latest developments in the financial markets.

Educational content

MultiBank offers a wide range of educational content for beginners and advanced traders. In addition, they have a dedicated blog section where you can find articles on various topics such as trading strategies, technical analysis, market news, and more.

MultiBank Review in a nutshell

MultiBank is a leading online forex and multi-asset broker that offers a wide range of tradable assets, tight spreads, fast execution, and 24/7 customer support. The broker is regulated by top-tier financial authorities such as the ASIC, BaFin, FMA, and more. The broker also offers a wide range of educational content for beginners and advanced traders.

As the broker offers multilingual support, you can contact a customer support representative in your native language. We rate them as a trustworthy and reliable online broker.

FAQ

What is the minimum deposit at MultiBank Group?

The minimum deposit is $50 for the Standard account. For the Pro account, the minimum deposit is $1000, and for the Multibank ECN account is $5000. In addition, MultiBank also offers Islamic trading accounts in which you don't have to pay swap or rollover fees. Every account has a different spread fee, and the leverage is the same across all the MultiBank Group accounts.

What is the maximum leverage offered by MultiBank?

The maximum leverage offered is 1:500 but you can adjust it. While trading with leverage, you have to consider both the risks and rewards. Higher leverage can help you make more profit, amplifying your losses. Therefore, you should always use leverage cautiously on MultiBank or any other trading platform.

Does MultiBank offer a demo account?

The broker offers a free demo account with $100,000 in virtual money. The demo account is an excellent way to test the trading platforms and tools offered by them. The demo account of MultiBank is easy to use, and it can help you learn about forex trading before you start trading with real money.

Is MultiBank Group a regulated broker?

Yes, MultiBank Group is a regulated broker. The MultiBank Group is regulated by over 10 regulators across 5 continents, including the Australian Securities and Investments Commission (ASIC), Bafin, AUSTRAC, among others. MultiBank is a highly-regulated broker, it is a safe and secure choice for forex trading.

What are the deposit methods at MultiBank Group?

The deposit methods at MultiBank Group include bank wire transfer, credit/debit card, and e-wallets such as Neteller, Skrill, and others. The deposit methods are different for different countries. You can check the deposit methods available in your country on the MultiBank Group website. The deposit methods are highly-secure, and your money is safe with MultiBank Group.

What are the withdrawal options at MultiBank Group?

The withdrawal options at MultiBank Group include wire transfer, credit/debit card, and e-wallets such as Neteller and Skrill. The withdrawal options are different for different countries. Check MultiBank Group’s website for the withdrawal option available in your country. The withdrawal process at MultiBank Group is simple and easy. You can withdraw your money anytime you want without any hassle.

How do I open an account with MultiBank Group?

Opening an account with MultiBank Group is straightforward and easy. You just have to fill out the online form on the MultiBank website and submit it. After your account is approved, you will be able to start trading with them. However, as MultiBank has also implemented Know Your Customer (KYC) and Anti-Money Laundering (AML) policies, you will have to submit some documents to verify your identity.

Does MultiBank Group support MT4 and MT5?

Yes, MultiBank Group supports MT4 and MT5. You can download the MT4 or MT5 platform on your computer or mobile device and start trading with them. Both the platforms are user-friendly and offer a wide range of features and tools for forex trading. You can also use the MT4 and MT5 mobile applications to trade with the broker and stay updated with the latest market news and prices.

What are the spreads at MultiBank?

The spreads at MultiBank Group start from 0.0 pips. The ECN account has the lowest spreads, but it also has a commission fee. The Standard account has a spread of 1.5 pips, the Pro account has a spread of 0.8 pips, and Spreads on Gold and Major FX Pairs from 15 cent $, and a 25% Deposit Bonus up to $40,000.

What is the minimum trade size at MultiBank?

The minimum trade size is 0.01 lots. The ECN account has no minimum trade size, but it has a commission fee. Therefore, the minimum trade size at MultiBank allows you to trade with a small amount of money.

How to contact Multibank Group customer support?

Customer support at MultiBank Group is available 24/7. You can contact customer support through live chat, email, or telephone. The customer support team is highly-skilled, and they will be able to answer all your queries. MultiBank Group is a reliable and secure choice for forex trading as they offer priority support to all their customers.

Does MultiBank Group offer educational content?

Yes, MultiBank offers a wide range of educational content for forex and other types of trading. The educational content includes a dedicated blog covering a wide range of trading topics. The educational content at MultiBank is beneficial, and it will help you improve your trading skills.

Can US residents open accounts at MultiBank Group?

US residents cannot open accounts at MultiBank as the broker is not regulated by the US Securities and Exchange Commission (SEC). However, Non-US residents can open accounts at MultiBank as the broker is regulated by other regulators across 5 continents.

How can I change my password at MultiBank Group?

You can change your password at MultiBank by logging into your account and going to the ‘Profile’ section, where you will find the option to change your password. You can also change your password by contacting customer support. The customer support team will help you change your password and provide you with a new password.

Can I trade with MultiBank Group on my mobile phone?

Yes, you can trade with MultiBank Group on your mobile phone as the broker offers MT4 and MT5 mobile trading applications for both Android and iOS devices. The mobile trading applications are user-friendly and offer a wide range of features and tools for forex trading. You can also use mobile trading applications to stay updated with the latest market news and prices.

Does MultiBank Group offer social trading?

Yes, MultiBank offers social trading. You can follow other traders and copy their trades on MultiBank Group. Social trading can help you diversify your investment portfolio, and it is a good way to learn from other experienced traders.

What are the documents required for account verification at MultiBank?

The documents required for account verification at MultiBank include a valid ID document such as a copy of your passport, national ID, or driving license. In addition, you will need to provide a Proof of Residence (POR), such as a copy of your utility bill or bank statement, issued in the last 3 months. You can check the document requirements depending on your country on the MultiBank website.

How long does it take to verify my account at MultiBank Group?

The account verification process at MultiBank Group is fast and efficient. It can take up to 1-2 business days to verify your account. Once your account is verified, you can start trading.

Does MultiBank offer Islamic accounts?

Yes, MultiBank Group offers Islamic trading accounts for Muslim traders. The Islamic accounts at MultiBank are compliant with Sharia law, and they offer swap-free trading. You can open an Islamic trading account by contacting customer support.

Are there any inactivity fees with MultiBank Group?

Yes, you can be charged a fee of $60 per month if the account is inactive for three months. This fee is charged to keep your account active and cover the costs associated with it. Charging an inactive fee is a common practice among brokers.

Can I get a refund if I am not satisfied with MultiBank Group?

You cannot get a refund if you are not satisfied with MultiBank, as the broker does not offer refunds. However, you can cancel your account if you are not happy with the broker.

What is the maximum withdrawal limit at MultiBank Group?

There is no information available on the maximum withdrawal limit at MultiBank Group. However, you can check with customer support for more information on the withdrawal limit.

What indices can you trade on MultiBank Group?

You can trade major global indices, such as the Dow Jones Industrial Average (DJIA), the Nasdaq Composite Index, the S&P 500 Index, and the Russell 2000 Index. You can trade these indices on the MT4 and MT5 trading platforms.

What currency pairs can you trade with MultiBank Group?

You can trade 55+ currency pairs with MultiBank including major, minor, and exotic pairs. The major pairs include EUR/USD, USD/JPY, GBP/USD, and USD/CHF, among others. The minor pairs include EUR/GBP, EUR/JPY, and GBP/JPY. The exotic pairs include AUD/JPY, NZD/JPY, and USD/TRY. You can trade currency pairs on MT4 and MT5 trading platforms, or web browser.

Does MultiBank Group offer bonuses?

Yes, MultiBank Group offers bonuses and promotions for both new and existing traders. However, the bonuses offered by MultiBank Group are subject to change. You can check the latest bonuses and promotions on the broker’s website.

Full Breakdown Filters

Full Breakdown

Full BreakdownCompany Updates

MultiBank Group Wins ‘Top Regulated Forex Broker’ Award at Money Expo India 2024 MultiBank Group

Forex BrokersMultiBank Group Named ‘Most Reputable Forex Broker 2025’ at Money Expo MultiBank Group

Forex Brokers- MultiBank Group

MultiBank Group Partners with Khabib to Tokenize Sports Worldwide

MultiBank Group Partners with Khabib to Tokenize Sports Worldwide

Disclaimer: The contents or products outlined on this page are provided by third parties and do not constitute an endorsement or any opinion by Finance Magnates. Finance Magnates has no control of the contents of this page, nor is responsible for its accuracy or legality and hereby waives any responsibility for this content. Any transactions, investments, or engagement that you enter into with a third party listed on this page or linked from this page are solely between you and such third party and are performed at your own risk. Finance Magnates holds no responsibility for any liability, damages, or losses caused in connection with the use of any content on this page.