The Bank of Canada (BoC) monetary policy decision today is most probably the key economic event in the forex market economic calendar which can move the Canadian Dollar in combination with the fact that NAFTA concerns continue whether Canada will agree or not to join the recent US-Mexico trade deal and the oil prices momentum trading at relative high levels. Elsewhere in the economic calendar there is important economic data to be released, such as the GDP Growth Rate in Australia, the Markit Services PMI in Germany, UK and in the Eurozone, and the Trade Balance in US and Canada. Moderate to high volatility should be expected for the Canadian, Australian and US Dollar plus the Euro.

These are the key economic events for today in the forex market, time is GMT:

European Session

Spain: Markit Services PMI, Italy: Markit/ADACI Services PMI, UK: Markit/CIPS Services PMI, Eurozone: Retail Sales YoY, ECB Praet Speech, Russia: Inflation Rate YoY

Time: 07:15, 07:45, 08:30, 09:00, 09:30, 13:00

The PMI service released by the Markit Economics is an indicator of the economic situation in the services sector, providing information on important economic indicators such as sales and employment. A reading above 50 signals expansion in the services sector and is considered positive for the local economy and currency. A decrease for the Markit Services PMI is expected for Spain and Italy, to 52.1 and 53.1 respectively from 52.6 and 54.0 accordingly, and an increase for the Markit/CIPS UK Services PMI to 53.9 from 53.5.

The Euro has another key economic data to be released, the Retail Sales in the Eurozone, a measure of changes in sales of the Euro zone retail sector, showing the performance of the retail sector in the short term and an indicator of consumer spending. Higher than expected readings for the Retail Sales in the Eurozone are considered positive for the Euro as the Retail Sales are a key driver to economic growth measured by the GDP Growth Rate. The yearly reading for the Retail Sales in the Eurozone is expected to increase to 1.3% from 1.2%.

The yearly Inflation Rate in Russia is expected to increase to 3.2% from 2.5%, which indicated inflationary pressures in the Russian economy, a positive factor for the Russian Ruble, as this large increase of the Inflation Rate may weigh on the Central Bank of Russia to increase the key interest rates soon, applying a tighter monetary policy.

American Session

Canada: Balance of Trade, BoC Interest Rate Decision, BoC Press Conference, US: Balance of Trade, Fed Williams Speech, Fed Kashkari Speech, API Crude Oil Stock Change, Fed Bostic Speech

Time: 12:30, 14:00, 15:00, 19:00, 20:00, 20:15, 20:30, 22:30

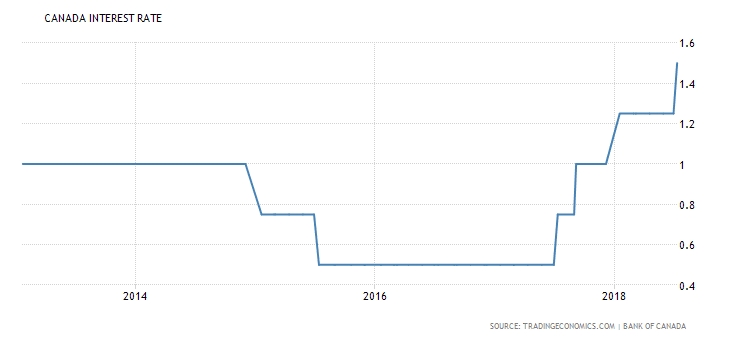

In general interest rate increases by central banks tend to slow down inflation but hamper growth. Because the decision itself is usually anticipated, the wording of the BOC statement is usually as important if not even more important than the actual interest rate move made by the central bank, as the statement contains the Bank’s economic outlook as well as hints about future monetary policy and inflation rate projections. If the BoC is hawkish or optimistic about the inflationary outlook of the economy and economic growth an interest rate increase should in most cases be considered positive for the Canadian Dollar.

“The Bank of Canada hiked its key overnight rate by 25bps to 1.5 percent on July 11th 2018, in line with market expectations. It is the second rate increase so far this year, as inflation is expected to edge up further to about 2.5 percent before settling back to the 2 percent target by the second half of 2019. The Bank Rate is correspondingly 1.75 percent and the deposit rate is 1.25 percent.”, Source: Trading Economics.

As seen from the chart the BoC has increased its key rate by 25bps to 1.5%, the highest since 2008, the second increase in 2018. The forecast is for an unchanged key interest rate of 1.5%, but any economic surprise most probably will add additional volatility and price action for the Canadian Dollar. The trade deficit for Canada is expected to widen to -1.13B Canadian Dollars from -0.63B Canadian Dollars, which is considered negative for the Canadian Dollar reflecting capital outflows from Canada and higher imports than exports or in general lower demand for goods and services denominated in Canadian Dollars.

The US API weekly report can also move the USD/CAD currency pair as oil is a very important economic factor for the GDP Growth in Canada. The API report provides information about the state of the total petroleum industry in US.

The US trade deficit in the Balance of Trade is also expected to widen to -50.1B US Dollars from -46.3B US Dollars, and as is the case of Canada mentioned above this is considered as negative for the US Dollar for the same reasons as described. The USD/CAD currency pair with all this economic data to be released today should exhibit increased volatility. There are several speeches by central bank officials, mainly Fed officials which should be monitored as any new information on economic projections or statements on trade wars have the potential to move the US Dollar as well.

Pacific Session

Australia: Gross Domestic Product (YoY, QoQ) (Q2)

Time: 01:30

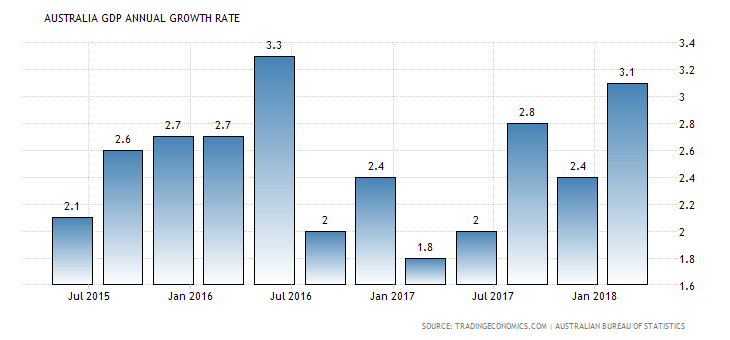

The Gross Domestic Product is a measure of the total value of all goods and services produced by Australia and is considered as a broad measure of economic activity. Higher than expected figures are positive for the Australian Dollar reflecting economic expansion and a robust economy.

“The Australian economy grew an annual 3.1 percent in the first quarter of 2018, following a 2.4 percent expansion in the prior quarter and above expectations of a 2.8 percent growth. It is the fastest annual growth rate since Q2 2016.”, Source: Trading Economics.

As seen from the chart the first quarter of 2018 the Annual GDP Growth Rate in Australia increased significantly reaching almost the high-value of 3.3% back in 2016. The forecasts are for decreases for the yearly and quarterly GDP Growth Rate for the second quarter of 2018 to 2.8% and 0.7% respectively, from 3.1% and 1.0% accordingly. Seasonality may be an important economic factor for this large increase of the GDP during the previous period.

Asian Session

Japan: Markit Services PMI

Time: 00:30

The Services Purchasing Managers Index (PMI) measures the business conditions in the services sector. The Services PMI is an important indicator of the overall economic conditions in Japan, with values over the 50.0 level indicating expansion for the sector considered to be positive for the Japanese Yen. The forecast is for an increase to 51.7 from 51.3.

Trade Forex Here