The FOMC Rate Decision is the key economic event today in the forex market which can set a trend for the US Dollar for the rest of the week and probably even on a much longer-term period as well. Brexit news and development, trade war tensions and ECB President Mario Draghi comments that inflationary pressures are rising, and wages are picking up added volatility in the forex market, which is expected to be present also today, mainly for the US Dollar. The ECB President comments which were hawkish raised the chances of a quicker pace of rate hikes in the Eurozone, as opposed to the former scenario of unchanged key interest rates until mid-year of 2019.

These are the key economic events today in the forex market, time is GMT:

European Session

France: Consumer Confidence, Unemployment Benefit Claims, Eurozone: ECB Non-Monetary Policy Meeting, UK: Finance Mortgage Approvals, Switzerland: SNB Quarterly Bulletin

Time: 06:45, 08:00, 08:30, 10:00, 13:00

The Consumer Confidence Index measures level of confidence consumers have for the broader economy rating business conditions, labor market conditions and prospects for job and income growth. The Unemployment Benefit Claims measures the number of people that filed for unemployment benefits for the first time. An increasing figure signals for a deteriorating labor market. For the economy of France higher than expected figures for the Consumer Confidence and lower than expected for the Unemployment Benefit Claims are considered positive for the Euro, reflecting a robust labor market and an optimistic economic outlook. The Consumer Confidence index in France is expected to remain unchanged at 97.

The ECB Non-Monetary Policy Meeting provides an overview of taken decisions is published after the meeting on various issues such as external economic relations, market infrastructure and payments, law, supervision of banks, corporate governance. The decisions taken could indirectly influence the Euro.

The Swiss National Bank Quarterly Bulletin includes two important reports, the Monetary policy report and the report on Business cycle trends. It can move the Swiss Franc with the recent Swiss government news working on EU relationship framework.

For the British Pound the Mortgage Approvals measure the number of home loans issued by the British Banker’s Association (BBA) during the previous quarter. It is considered as a leading indicator of the UK Housing Market. Higher than expected figures reflect a mortgage growth and a healthy housing market that can stimulate the broader UK economy, a positive factor for the British Pound. Also, the state of the housing market is often signaling potential shifts in the economic cycles.

“British banks approved 39,584 mortgages for new house purchase in July 2018, fewer than downwardly revised 40,330 in June and down 4.3 percent compared with a year ago, data from trade association UK Finance showed. The figure came in below market expectations of 40,600 despite appetite for remortgaging ahead of an expected Bank of England rate rise. Meantime, approvals of loans secured on dwellings for remortgaging decreased to 26,757 in July from 28,840 in June, and the number of approvals for other purposes declined to 8,569 from 9,052. Net mortgage lending increased by GBP 1.720 billion in July, the smallest rise since February.”, Source: Trading Economics.

From the above chart after a peak in January of 2018 and a weakness for the first three months of 2018, the UK Finance Mortgage Approvals have started to rise and in general exhibit an uptrend so far in 2018.

American Session

US: UN General Assembly, New Home Sales, New Home Sales MoM, EIA Crude Oil Stocks Change, EIA Gasoline Stocks Change, FOMC Economic Projections, Fed Interest Rate Decision, Fed Press Conference

Time: 00:00, 14:00, 14:30, 18:00, 18:30

New Home Sales is an indicator that measures the number of new single-family homes that were sold during the previous calendar month. Housing industry is one of the pillars of the American economy. Real estate market is tightly connected to the economic conditions. Higher than expected figures for the New Home Sales reflect a robust housing market and are positive for the US Dollar. The monthly New Home Sales are expected to increase to 0.5% from -1.7%.

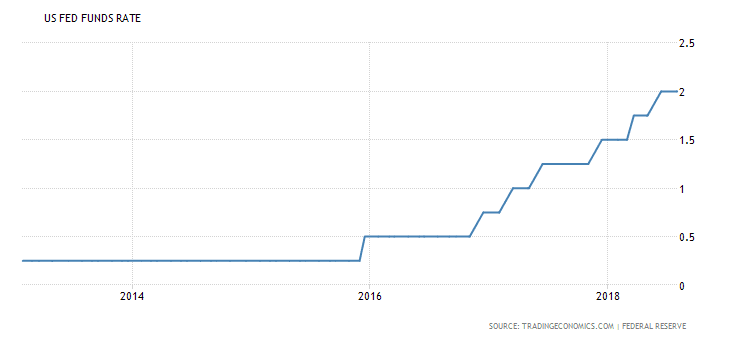

The key economic event for today in the forex market is the Fed Interest Rate Decision with the expectation of a 25-basis points interest rate increase setting the lower and upper bound for the Fed funds rate to 2.00-2.25% from 1.75%-2.00%. This should be positive and supportive for the US Dollar, and the forex market participants will focus on any clues indicating another interest rate hike by the end of 2018, probably in December.

“The Federal Reserve kept the target range for the federal funds rate at 1.75 percent to 2 percent during its August 2018 meeting, in line with market expectations. Policymakers said the labor market has continued to strengthen and economic activity has been rising at a strong rate, suggesting a rate hike at its next meeting in September is likely.”, Source: Trading Economics.

The economic projections by the Fed can also move the US Dollar, with mentions to economic growth, inflation rate, employment and if the tighter monetary policy will further continue.

With oil prices at multi-year high the Energy Information Administration’s (EIA) Crude Oil Inventories report which measures the weekly change in the number of barrels of commercial crude oil held by US firms, adding also inflationary pressures in the economy can be a market-moving economic data. If the increase in crude inventories is more than expected, then this implies a weaker than expected demand and is considered negative for crude oil prices, something that also can be said if a decline in crude oil inventories is less than expected.

Pacific Session

New Zealand: RBNZ Interest Rate Decision

Time: 21:00

The Reserve Bank of New Zealand is expected to keep unchanged the key interest rate at 1.75%. Any economic surprise and either a hawkish or dovish language used by the RBNZ may add volatility for the New Zealand Dollar versus other currencies. In the absence of any surprises a neutral move for the currency should be expected.

Trade Forex Here