The US-Mexican trade deal on Monday, August 27, 2018 triggered a risk-on mood boosting the level of optimism for a potential easing of global trade tensions, although the trade war developments are still in play in the forex market and in the global financial markets. This risk-on investor mood may have an impact at least short-term for some trends related to major currencies such as the US Dollar which depreciated against other major currencies upon the announcement of the US-Mexico trade deal. Today there are many economic data to be released which can move the forex market, such as the US GDP for the second quarter and the Core Personal Consumption Expenditures, the Consumer Confidence in Germany and Japan and the weekly US Crude Oil Stocks Change. Moderate to high volatility should be expected today especially for the US Dollar versus other currencies.

These are the key economic events for today in the forex market, time is GMT:

European Session

Germany: GfK Consumer Confidence, UK: Nationwide Housing Prices (YoY, MoM), France: GDP Growth Rate QoQ (Q2), Switzerland: ZEW Survey Expectations

Time: 06:00, 06:45, 08:00

Higher than expected figures for the Consumer Confidence in Germany and the GDP Growth Rate in France are considered positive for the Euro reflecting a high level of consumer confidence in economic activity which can stimulate economic expansion, while the GDP Growth Rate is considered as a broad measure of economic activity. The Nationwide Housing Prices provide information on the value of the houses prices in UK indicating the current housing market conditions, and the ZEW Survey Expectations for Switzerland show the state of business conditions. High readings for the Nationwide Housing Prices in UK and the ZEW Survey Expectations in Switzerland are considered supportive for the British Pound and the Swiss Franc.

The forecasts are for an unchanged GDP Growth Rate of 0.2% in France for the second quarter, a decrease for the monthly UK Nationwide Housing Prices to 0.1% from 0.6% and an increase for the yearly UK Nationwide Housing Prices to 2.7% from 2.5%.

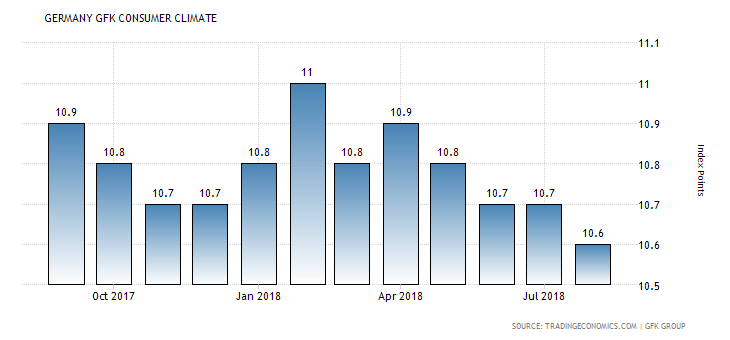

“The GfK Consumer Climate Indicator for Germany edged down to 10.6 heading into August 2018 from 10.7 a month earlier and slightly below market consensus of 10.7. It is the weakest reading since July 2017, as the index measuring economic expectations over the next 12 months dropped 7.6 points to 15.7, the lowest in almost a year and a half, on rising fears that a trade conflict between Europe, the United States and China could lead to a slowdown in German economy. At the same time, the gauge measuring income expectations fell 0.1 points to a solid level of 57.5 and the sub-index assessing consumers’ propensity to buy declined 0.1 points to 56.2, both supported by a stable job market and a low interest rate.”, Source: Trading Economics.

As seen from the chart the German GfK Consumer Climate Indicator after a strong start in early 2018 has been in a downtrend as of April 2018 indicating a weak trend for Consumer Confidence. The forecast is for an unchanged reading of 10.6 for second consecutive month.

American Session

Canada: Current Account (Q2), US: Gross Domestic Product Annualized (Q2), Gross Domestic Price Index (Q2), Personal Consumption Expenditures Prices QoQ (Q2), Core Personal Consumption Expenditures Prices QoQ (Q2), Pending Home Sales MoM, EIA Crude Oil Stocks Change

Time: 12:30, 14:00, 14:30

The Current Account measures the difference in value between exported and imported goods, services and interest payments during any given month, including the Balance of Trade which is the largest component of a country’s current account. For Canada and any other country, a surplus for the Current Account is considered positive indicating capital inflows into the country and increased demand for goods and services denominated in local currency which may lead to the appreciation of the currency versus other currencies. A narrower Current Account deficit is expected to -15.2B Canadian Dollars from -19.5B Canadian Dollars, which should be supportive for the Canadian Dollar expected to witness further volatility later with the release of the US Crude Oil Stocks Change.

A plethora of economic data will be released related to the US economy having the potential to move the US Dollar with the most important one being the Gross Domestic Product Annualized figure, a measure of market economic activity and economic expansion. Higher than expected figures for the GDP Growth Rate, the Personal Consumption Expenditures and the Pending Home Sales are all considered positive for the US economy and US Dollar. They reflect a robust housing market, personal spending which can stimulate economic growth and economic expansion overall.

The forecasts are for unchanged readings of 1.8% and 2.0% for the Personal Consumption Expenditures Prices and Core Personal Consumption Expenditures Prices respectively for the second quarter, and a decrease for the monthly Pending Home Sales to 0.4% from 0.9%.

The (EIA) Crude Oil Inventories measures the weekly change in the number of barrels of commercial crude oil held by US firms, with economic surprises able to move significant the oil prices and the USD/CAD currency pair. If the increase in crude oil inventories is more than expected, then this implies a weaker than expected demand and is considered negative for crude oil prices.

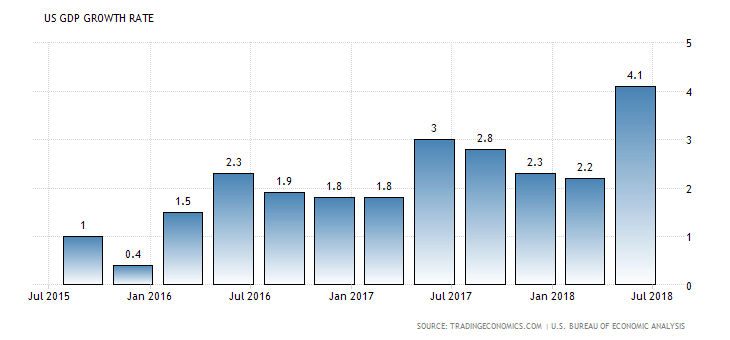

The main economic event of the day, the US annualized GDP Growth Rate for the second quarter is expected to decrease marginally to 4.0% from 4.1%. After a large increase in the previous period over the level of 4.0% for the past two years any economic surprise positive or negative may add further volatility for the US Dollar. In general, a high reading is positive for the US Dollar.

“The US economy advanced an annualized 4.1 percent on quarter in the second quarter of 2018, well above an upwardly revised 2.2 percent expansion in the previous period and in line with market expectations. It is the strongest growth rate since the third quarter of 2014 amid higher consumer spending and soybean exports while business spending slowed, the advance estimate showed.”, Source: Trading Economics.

Pacific Session

Australia: HIA New Home Sales MoM, New Zealand: Building Permits MoM

Time: 22:45

Higher than expected readings for the HIA New Home Sales in Australia and the Building Permits in New Zealand are considered positive for the local currencies reflecting the current housing market conditions an important macroeconomic economic indicator.

Asian Session

Japan: BoJ Suzuki Speech, Consumer Confidence Index, Retail Trades (YoY, MoM)

Time: 01:30, 05:00, 23:50

As mentioned above for the economy of Germany higher than expected readings for the Consumer Confidence in Japan and the Retail Trades can have positive effects on the economy stimulating economic expansion while the Consumer spending is a key important indicator and driver for the economic growth of the Japanese economy measured by the GDP level. The Consumer Confidence is expected to decrease marginally to 43.4 from 43.5 and the yearly Retail Trade figure to decrease to 1.2% from 1.7%, while the monthly Retail Trade figure is expected to decrease to -0.3% from 1.5%.

https://iqoptioncom.com/9f910b90-6763-4e55-9eb2-d3b15bf29a55