The Reserve Bank of Australia (RBA) interest rate decision, the Inflation Rate in Switzerland, the Construction PMI in UK and the US ISM Manufacturing and Employment figures are in focus today in the forex market as some of the important macroeconomic data to be released. Still other factors such as Brexit developments and the investors risk-on or risk-off sentiment can also set new trends for major currencies. Today moderate to high volatility should be expected mainly for the Australian Dollar and the US Dollar.

These are the key economic events for today in the forex market, time is GMT:

European Session

Spain: Unemployment Change, Switzerland: Inflation Rate YoY, UK: Construction PMI, BOE’s Carney, Haldane, Tenreyro, and Saunders Speeches

Time: 07:00, 07:15, 08:30, 12:15

The Unemployment Change in Spain is an economic report on the number of people that are unemployed and seeking for work. A lower value reflects on a strong labor market, adding to consumer spending, economic growth and the possibility of a rate hike by central banks. For Switzerland the Inflation rate reflects a decline in the purchasing power of the Franc, where each Franc buys fewer goods and services in the local economy. Higher than expected readings for the Inflation Rate have a negative effect for the real buying consumer power but at the same time a positive effect on the currency as the it can weigh on the Swiss National Bank decision to raise interest rates with the aim to manage inflation and slow economic growth. The yearly Inflation Rate in Switzerland is expected to remain unchanged at 1.2%. The UK Construction PMI measures the performance of the construction sector and is derived from a survey of 170 construction companies. A value above 50.0 indicates industry expansion and below indicates contraction. The forecast is for a decrease of the UK Construction PMI to 54.9 from 55.8.

American Session

Canada: Markit Manufacturing PMI, US: Markit Manufacturing PMI Final, ISM Manufacturing Employment, Construction Spending MoM, IBD/TIPP Economic Optimism, ISM Manufacturing PMI, Fed Evans Speech, Total Vehicle Sales

Time: 13:45, 14:00, 14:30, 19:30

Markit Manufacturing PMI is based on a survey with data compiled from monthly replies to questionnaires sent to purchasing executives in over 400 industrial companies. An index reading above 50.0 indicates an expansion for the manufacturing sector and is considered positive for the Canadian Dollar while readings below 50.0 an overall decrease in economic activity. An increase to 57.1 from 56.9 is expected for the Canadian Markit Manufacturing PMI.

A plethora of important economic data related to the US economy will be released today which can move the US Dollar providing latest information on the state of the overall economy, especially for the manufacturing and construction sectors. Higher than expected readings for all the economic indicators mentioned are considered positive and supportive for the US Dollar, reflecting strong economic conditions and activity in the manufacturing and construction sectors and optimism for the economic outlook in the short-term period. This optimism for the economic outlook can have positive effects on the growth in domestic demand and stimulate the broader economy.

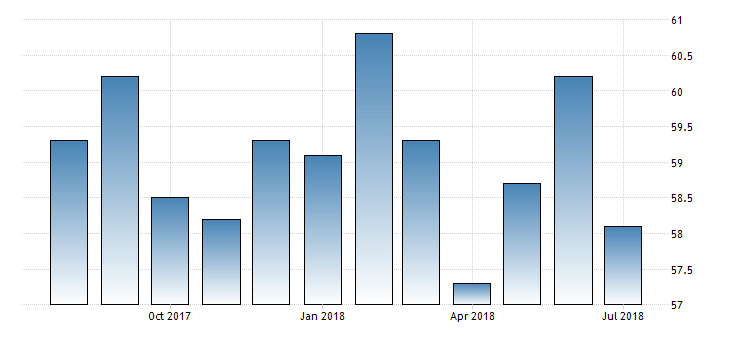

Some mixed economic data is expected for the US economy as the Markit Manufacturing PMI is expected to remain unchanged at 54.5, the monthly Construction Spending is expected to increase to 0.5% from -1.1% and the ISM Manufacturing PMI and IBD/TIPP Economic Optimism are expected to decrease to 57.7 and 57.8 respectively compared to the previous readings of 58.1 and 58.0 accordingly. By monitoring the ISM Manufacturing Index, investors can understand and evaluate national economic and business conditions as higher readings can have positive influence on the investors and business confidence.

“The Institute for Supply Management’s Manufacturing PMI in the US fell to 58.1 in July of 2018 from 60.2 in the previous month, below market expectations of 59.5. The reading pointed to the weakest expansion in the manufacturing sector in three months amid a slowdown in new orders, export orders and production. Demand remains robust, but manufacturers keep showing concerns about how tariff-related activity, including reciprocal tariffs, will continue to affect their business.”, Source: Trading Economics.

As seen from the chart another lower than expected reading will be the second consecutive month of weaker expansion in the manufacturing sector, a trend that must be monitored as trade war concerns are also in focus.

Pacific Session

Australia: RBA Interest Rate Decision, RBA Rate Statement, RBA’s Governor Philip Lowe Speech, AiG Performance of Services Index

Time: 04:30, 09:30, 22:30

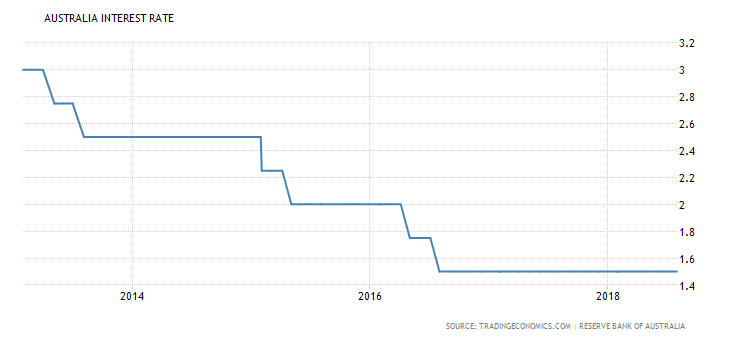

The first out of two interest rate decisions this week from central banks is announced today by the Reserve Bank of Australia. If the RBA is hawkish or optimistic about the inflationary and economic outlook and rises the interest rates it is positive for the Australian Dollar. However, the statements made by the RBA can move the Australian Dollar more than the actual number, as the forecast is for the RBA to keep the key interest rate unchanged at 1.5%. Any statements that point to increased odds of a tighter monetary policy soon and interest rate hikes should provide support for the Australian Dollar. Recently the Inflation Rate in Australia rose to 2.1 year-on-year in the second quarter of 2018, the highest rate since the first quarter 2017, a trend which should be monitored indicating inflationary pressures started to increase in the Australian economy.

“The Reserve Bank of Australia left the cash rate unchanged at a record low of 1.5 percent for two years running at its August meeting. It is the longest policy pause in the central bank’s modern history, amid sluggishness in inflation and wages.”, Source: Trading Economics.

AiG Performance of Services Index presents business conditions in the Australian service sector, providing an assessment of a large group of companies on business situation including indicators such as employment, production, orders. A result above 50 is positive for the Australian Dollar indicating expansion in the services sector.

Trade Forex Now