The investors today will assess macroeconomic events and reports such as the UK labor market conditions and the Unemployment Rate, the ZEW Economic Sentiment Index in Germany and in the Eurozone, the Housing Starts in Canada and the US JOLTS Job Openings. Moderate to high volatility should be expected today for the British Pound, the Euro and the Canadian Dollar.

These are the most important macroeconomic events and reports today in the forex market, time is GMT:

European Session

UK: Unemployment Rate, Claimant Count Change, Employment Change, Average Earnings incl. Bonus, Eurozone: Employment Change (YoY, QoQ), ZEW Economic Sentiment Index, Germany: ZEW Economic Sentiment Index, ZEW Current Conditions, Russia: Balance of Trade

Time: 08:30, 09:00, 13:00

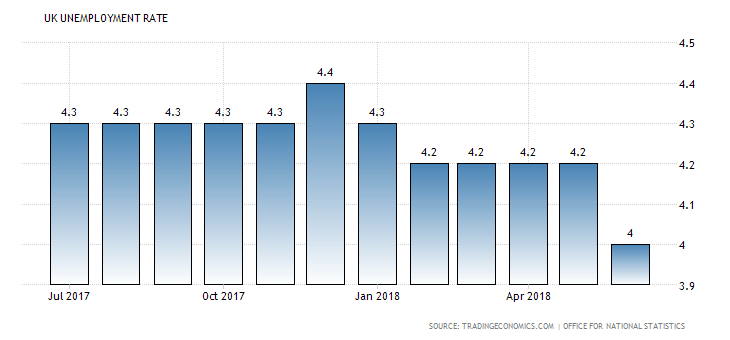

With the UK Unemployment Rate at 42-Year Low and amid Brexit developments and news the labor market in UK is showing great strength. Lower than expected figures for the Unemployment Rate and Claimant Count Change, and higher than expected for the Employment Change and Average Earnings including Bonus are positive and supportive for the British Pound reflecting a robust labor market and economy. The Claimant Count is a very important measure of unemployment about the number of people who claim unemployment benefits, but at the same time are actively seeking work. The Claimant Count could be characterized as a barometer for the health of the UK labor market. Higher job growth accompanies economic expansion and could spark inflationary pressures which may weigh on the BoE decision to raise the key interest rate is the future.

“The unemployment rate in the UK fell to 4 percent in the three months to June 2018, the lowest level since the December 1974-February 1975 period and below market consensus of 4.2 percent. The number of unemployed declined by 65,000 from the January to March period while employment rose by 42,000. Still, annual wage growth eased to a nine-month low.”, Source: Trading Economics.

The latest figure of 4.0% for the UK Unemployment Rate is as mentioned before at historically very low levels, a 42-year low reading. The forecasts for the UK economy are for an unchanged Unemployment Rate of 4.0%, a decrease for the Claimant Count Change and the Employment Change to 3.6K and 27K respectively from 6.2K and 42K accordingly, and an increase for the Average Earnings including bonus to 2.5% from 2.4%.

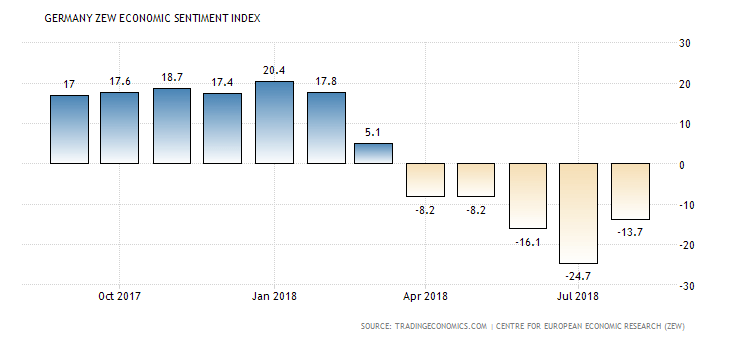

The Euro can move upon the release of the Employment Change in the Eurozone and the ZEW Economic Sentiment Index readings for the Eurozone and Germany. The Economic Sentiment Index and ZEW Current Conditions Index measure the institutional investor sentiment, reflecting the level of optimism for the current and short-term economic outlook. A higher than expected reading should be taken as bullish for the Euro, while a lower than expected reading should be taken as bearish for the Euro. Increased optimism about the economic outlook can stimulate the economy having positive effects on key economic indicators such as employment, business investing and consumer spending.

“The ZEW Indicator of Economic Sentiment for Germany rose by 11 points from the previous month to -13.7 in August of 2018, above market expectations of -20.7. A trade deal between the US and the EU after a tariff dispute eased concerns and was the main driver of the increase in expectations. Yet, the economic outlook of the country deteriorated compared to six months ago. Also, the assessment of the current economic situation in the country increased slightly by 0.2 point to 72.6.”, Source: Trading Economics.

We can see that as of April 2018 the ZEW Economic Sentiment Index in Germany has turned negative from positive. The forecasts are for an increase for the ZEW Economic Sentiment Index in Germany and in the Eurozone to -13.4 and -10.9 respectively from -13.7 and -11.1 accordingly, and a marginal decrease for the German ZEW Current Conditions reading to 72.0 from 72.6. The Employment Change in the Eurozone is expected to remain unchanged both on a quarterly and yearly basis.

For the economy of Russia, a trade surplus is considered positive for the Russian Ruble reflecting capital inflows in Russia and high demand for goods and services denominated in local currency which may lead to the appreciation of the Russian Ruble over time. A decrease to 14.4B US Dollars from 15.56B US Dollars is expected.

American Session

Canada: Housing Starts, US: JOLTS Job Openings, Wholesale Inventories, API Weekly Crude Oil Stock

Time: 12:15, 14:00, 20:30

The Housing Starts shows the number of new single-family homes or buildings constructed, indicating the strength of the Canadian housing market, a very important indicator for the broader economy which can anticipate changes in the business cycles. A high reading is seen as positive for the Canadian Dollar, and an increase to 210.0K from 206.3K is expected.

The Wholesale Inventories in the US economy measure the change in the total value of goods held in inventory by wholesalers. A high inventory figure suggests economic slowing in the US, that is seen as negative for the US Dollar. Higher than expected figures for the JOLTS Job Openings are positive for the US Dollar reflecting the number of job vacancies, a reading which is important after the strong labor market report in US on Friday, September 7, 2018. The forecasts are for an increase for the JOLTS Job Openings to 6.68M from 6.62M and an unchanged reading of 0.7% for the Wholesale Inventories.

The weekly API Crude Oil Stock gives an overview of US petroleum demand. If the increase in crude inventories is more than expected, then this implies a weaker than expected demand and is negative for crude oil prices.

Pacific Session

Australia: NAB Business Confidence

Time: 01:30

The Business Confidence indicates the current business conditions and the performance of the overall Australian economy in a short-term period. A higher than expected figure is positive for the Australian Dollar as it can lead to positive economic growth and economic expansion stimulating the employment and business investments. A decrease to 5.0 from 7.0 is expected.

Asian Session

Japan: Machine Tool Orders, Tertiary Industry Index

Time: 04:30, 06:00

THE Tertiary Industry Index evaluates the monthly change in output produced by Japan’s service sector, with a focus on important economic indicators such as retail trade, financial services, health care and utilities. A higher than expected readings is positive for the Japanese Yen reflecting a strong services sector. The forecast is for a monthly increase to 0.1% from -0.5%. The Preliminary Machine Tool Orders figure indicates business conditions and the overall economic condition in Japan. Again, a higher than expected readings is positive for the Japanese Yen indicative of stronger business confidence and positive effects on capital spending and employment, both factors can stimulate the economic growth.

Trade Forex Here