Back to a normal economic calendar today in the forex market with several important economic data to be released such as the GDP Growth Rate for Germany and the Eurozone, the Unemployment Rate in UK, the NAB Business Confidence in Australia and the weekly API Crude Oil Stock Change. Moderate to high volatility should be expected today for the Euro, the British Pound and the Australian Dollar. Geopolitics concerns are also in play and may affect the short-term trend for currencies.

These are the key economic events which can move the forex market today, time is GMT:

European Session

France: Unemployment Rate, Germany: GDP Growth Rate (YoY Flash, QoQ Flash), Inflation Rate YoY Final, ZEW Current Conditions, ZEW Economic Sentiment Index, UK: Average Earnings incl. Bonus, Unemployment Rate, Claimant Count Change, Employment Change, Eurozone: Industrial Production (YoY, MoM), GDP Growth Rate (YoY 2nd Est, QoQ 2nd Est), ZEW Economic Sentiment Index

Time: 05:30, 06:00, 08:30, 09:00

The Euro has been lately under severe selling pressure due to geopolitics concerns and the financial crisis in Turkey with risk-off sentiment prevailing for now over risk-on sentiment. However important fundamental data will be released today related to the Eurozone and depending on the actual versus expected figure there may be support for the Euro. A lower than expected figure for the Unemployment Rate in France, and higher figures for the GDP Growth Rate and Inflation Rate in Germany, the ZEW Economic Sentiment Indexes for Germany and the Eurozone and mainly the GDP Growth Rate and the Industrial Production in the Eurozone are considered positive and supportive for the Euro.

The ECB has mentioned recently that the key interest rate in the Eurozone will remain at low levels until mid-year 2019, but this monetary policy may change depending on the future economic conditions. Increased and sustained inflationary pressures in the Eurozone may weigh on the ECB Decision to make its monetary policy tighter increasing the key interest rate.

Some mixed economic data is expected for the Eurozone with forecasts for lower yearly GDP Growth Rate In Germany at 2.1% compared to the previous figure of 2.3%, a lower yearly Inflation Rate in Germany at 2.0%, lower than the previous rate of 2.1%, a higher yearly Industrial Production in the Eurozone at 2.5% marginally higher than the previous figure of 2.4% and a lower yearly GDP Growth Rate in the Eurozone at 2.1% compared to the previous figure of 2.5%.

“The Euro Area economy grew 2.1 percent year-on-year in the second quarter of 2018, easing from a 2.5 percent expansion in the previous period and missing market expectations of 2.2 percent, a preliminary flash estimate showed. GDP Annual”, Source: Trading Economics.

As seen from the above chart after a strong start in 2018 and economic expansion in the Eurozone, the GDP Growth Rate appears until now to have an economic slowdown with two consecutive lower figures.

The ZEW Economic Sentiment Indexes for Germany and the Eurozone reflect the level of optimism for current and short-term economic conditions with a higher than expected figure considered to be positive for the Euro showing increased optimism for the economic outlook. For Germany the ZEW Current Conditions sentiment is expected to decline marginally at 72.3 compared to the previous reading of 72.4 while the ZEW Economic Sentiment index figures for Germany and the Eurozone are expected to show an improvement with expected figures at -20.0 and -16.4 respectively, higher than the previous figures of -24.7 and -18.7 accordingly.

For the UK economy higher than expected figures for the Average Earnings including Bonus and the Employment Change and lower than expected for the Unemployment Rate and the Claimant Count Change are considered positive for the British Pound. The Claimant Count Change measures the number of people who claim unemployment benefits, but actively seeking work. Higher job growth measured by a low Claimant Count Change, high Employment Change and a low Unemployment Rate typical lead to economic expansion and inflationary pressures in the broader economy showing a robust labor market.

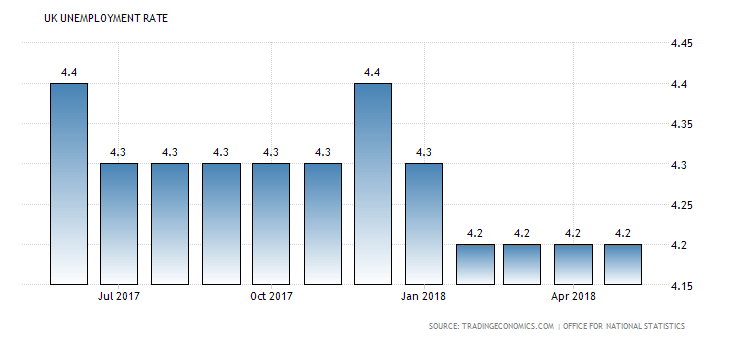

The forecasts are for an unchanged Unemployment Rate of 4.2% in UK but also for a very large difference for the Claimant Count Change expected at 73.7K, much higher than the previous figure of 7.8K.

“The jobless rate in the UK stood at 4.2 percent in the three months to May, its joint-lowest since 1975. The number of unemployed declined by 12,000 from the December to February period while 137,000 jobs were created, bringing the employment rate to a record high of 75.7 percent. Still, wage growth eased to a six-month low.”, Source: Trading Economics.

For the past four consecutive months the Unemployment Rate in UK has stabilized at the rate of 4.2% and it may be the fifth consecutive month if the forecast is true.

American Session

US: Import Prices MoM, Export Prices MoM, API Crude Oil Stock Change

Time: 12:30, 20:30

The API Crude Oil Stock Change figure shows the inventory levels of US crude oil, gasoline and distillates stocks, providing an overview of US petroleum demand. If the increase in crude inventories is more than expected, the this it implies a weaker than expected demand and is considered negative for crude oil prices. The Import and Export Prices measure changes in imported goods and services and export goods with higher than expected figures considered to be positive for the US Dollar reflecting inflationary pressures.

Pacific Session

Australia: NAB Business Confidence

Time: 01:30

A survey of the current business condition in Australia indicating the performance of the overall Australian economy in a short-term time frame with higher than expected figures considered positive for the Australian Dollar as they can lead to positive economic growth for example due to higher change in employment to support economic and business expansion activity. The forecast is for an unchanged reading of 6.

Asian Session

Japan: Industrial Production (YoY, MoM)

Time: 01:30

The Industrial Production measures the outputs of the Japanese factories and mines. Changes in industrial production are a major indicator of strength in the manufacturing sector which is very important for the Japanese economy. High readings are considered positive for the Japanese Yen. The forecasts are for a lower yearly figure of -5.0% compared to the previous figure of -1.2% and an unchanged monthly reading of -2.1%, which may influence negatively the Yen reflecting weak business conditions in the industrial sector.

Start Trading Forex