The release of the Swiss GDP Growth Rate, Factory Orders and Construction PMI in Germany, weekly US labor market data and US Durable Goods Orders, US Weekly Crude Oil Stocks Change and the Australian Trade Balance will be making headlines in the forex market today. Moderate to high volatility should be expected for the Swiss Franc, the US Dollar and the Australian Dollar. A mix of economic, political, and seasonal factors can weigh on the forex market to form new trends for major currencies while the prices of oil and gold can also influence the forex market participants sentiment and their risk-on or risk-off preference.

These are the main economic events which can move the forex market today, time is GMT:

European Session

Switzerland: GDP Growth Rate (YoY, QoQ), SNB Zurbrugg Speech, Germany: Factory Orders MoM, Construction PMI, Sweden: Riksbank Rate Decision, Monetary Policy Report, Russia: Foreign Exchange Reserves, Eurozone: ECB Lautenschlager Speech

Time: 05:45, 06:00, 07:30, 12:45, 13:00, 16:30

The Gross Domestic Product is a measure of the total value of all goods and services produced by Switzerland and is considered as a broad measure of Swiss economic activity. A rising trend is considered to have a positive effect on the Swiss Franc reflecting an expansion in overall economic growth. An increase to 2.4% from 2.2% for the yearly Swiss GDP Growth Rate is expected, and a marginal decrease to 0.5% from 0.6% for the quarterly Swiss GDP Growth Rate.

The Factory Orders in Germany is an economic indicator that includes shipments, inventories, and new and unfilled orders. An increase in the Factory Orders indicates an expansion in the German economy, and is considered positive for the Euro, as also an increase in the German Construction PMI is considered positive indicating an expansion in the construction sector with readings above the 50.0 level. An increase for the monthly German Factory Orders is expected to 1.8% from -4.0%, a very significant change.

In Sweden the central bank is expected to keep the key interest rate unchanged at -0.5%, with the central bank having mentioned that it expects to begin slowly raising the repo rate in the middle of 2018. Having already passed this period the forex market participants will weigh on whether there are significant odds for any monetary policy change in Sweden for the rest of 2018. This steady interest rate if there are no surprises should have a neutral effect on the Swedish Krona. In Russia, Foreign Exchange Reserves are money or other assets that are held by the central bank or other monetary authority for liabilities to be paid. Any significant change may have an influence on the Russian Ruble as Foreign Exchange Reserves are also used to provide currency and financial stability.

American Session

US: ADP Employment Change, Unit Labour Costs QoQ Final, Nonfarm Productivity QoQ Final, Markit Composite PMI Final, Markit Services PMI Final, Fed Williams Speech, Factory Orders MoM, ISM Non-Manufacturing Employment, ISM Non-Manufacturing PMI, EIA Crude Oil Stocks Change, EIA Gasoline Stocks Change, Canada: BoC Wilkins Speech

Time: 12:15, 12:30, 13:45, 14:00, 15:00, 18:45

A rich economic calendar in the forex market today with a lot of important US economic data to be released which can move the US Dollar. The ADP Employment Change is a measure of the change in the number of employed people in the US, the nonfarm private employment excluding also the government sector. In general, a rise in this indicator has positive implications for consumer spending, stimulating economic growth. The Unit Labour Costs measure the annualized change in the price businesses pay for labor, excluding the farming industry, considered to be also a leading indicator of consumer inflation. Higher than expected readings for the ADP Employment Change, the Unit Labour Costs and all the other economic data related to the US economy is positive and supportive for the US Dollar, reflecting a strong labor market, increased productivity, inflationary pressures in the overall economy and a strong industrial sector plus strong business conditions in the US non-manufacturing sector.

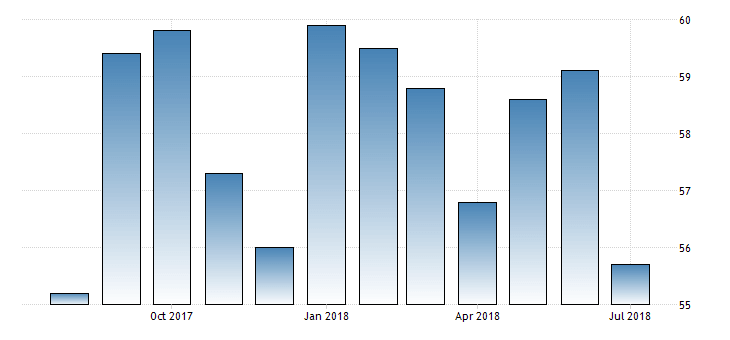

“The ISM Non-Manufacturing PMI index for the United States fell to 55.7 in July of 2018 from 59.1 in June, well below market expectations of 58.6. It is the lowest reading since August of 2017. Although most firms remain positive about business conditions and the economy, tariffs and deliveries are an ongoing concern.”, Source: Trading Economics.

As seen from the above chart the trade war concerns had a major effect on the ISM Non- Manufacturing PMI most recent figure. This trend will be important soon until there are some definite trade war decisions to pose and end on tariffs.

Some mixed economic data is expected for the US economy, with a decrease for the ADP Employment Change, Unit Labour Costs, Markit Composite PMI Final, Markit Services PMI Final and Factory Orders to 190k, -0.9%, 55.0, 55.2, -0.6% respectively from 219K, 3.4%, 55.7, 56, 0.7% accordingly. However, the ISM Non-Manufacturing PMI is expected to increase to 56.8 from 55.7.

The weekly US Crude Oil Inventories measure the weekly change in the number of barrels of commercial crude oil held by US firms, with an influence on the price of petroleum products and on inflation. If the increase in crude inventories is more than expected, then this implies a weaker than expected demand and is negative for crude oil prices.

Pacific Session

Australia: Trade Balance, AiG Performance of Construction Index

Time: 01:30, 22:30

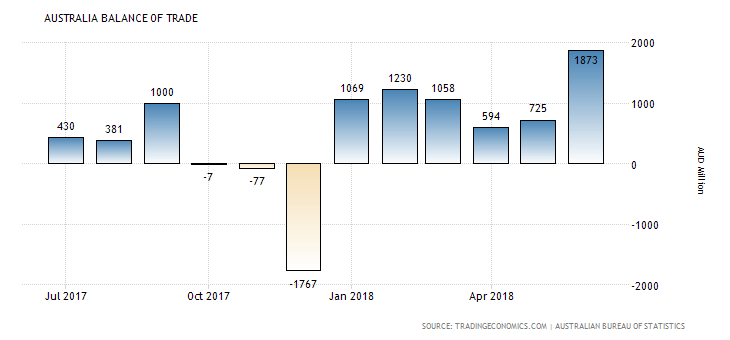

The trade balance is the difference in the value of its imports and exports of Australian goods. A trade surplus meaning that there are more exports than imports is positive for the Australian Dollar, reflecting capital inflows in the country and increased demand for goods and services denominated in Australian Dollars which over time may lead to the natural appreciation of the local currency versus other currencies.

“Australia’s trade surplus widened sharply by 158 percent to AUD 1.87 billion in June of 2018 from a downwardly revised AUD 0.73 billion in the prior month and far above market expectations of a AUD 0.9 billion surplus. It is the largest trade surplus since May last year, as exports rose to an all-time high while imports declined.”, Source: Trading Economics.

As seen the Trade Balance in Australia is highly volatile, mostly having a trade surplus. The forecast is for a narrower trade surplus of 1,400M Australian Dollars compared to the previous figure of 1,873M Australian Dollars. A higher than expected figure for the AiG Performance of Construction Index which measures the conditions on the short and medium term in the construction market is positive for the Australian Dollar reflecting a strong construction sector considering economic indicators such as production, employment and inventories.

Asian Session

Japan: Overall Household Spending YoY

Time: 23:30

The Overall Household Spending measures the total expenditure by households. The level of spending is an indicator of consumer optimism and at the same time a measure of economic growth. The consumer spending is a key driver of economic growth, with higher than expected readings for the Overall Household Spending considered positive for the Japanese Yen.

Trade Forex Now