One day after the key economic event of Interest Rate Decision by the Fed, the forex market economic calendar today is very rich with a plethora of economic data. The focus today is on the Business Confidence in the Eurozone and the Consumer Confidence in Germany and in UK, the US Durable Goods Orders and the GDP Growth Rate for the second quarter, the Inflation Rate in Germany and the Unemployment Rate in Japan.

Elsewhere there are speeches by senior central bank officials which should be monitored. Due to the many economic events today moderate to high volatility should be expected for the Euro, the US Dollar, the Japanese Yen and the British Pound. Gold and crude oil prices may also exhibit volatility mainly due to the recent FOMC decision.

These are the key economic events 0today in the forex market, time is GMT:

European Session

Germany: GfK Consumer Confidence, Inflation Rate YoY Prel, UK: Nationwide Housing Prices (YoY, MoM), BoE Haldane Speech, BoE Gov Carney Speech, GfK Consumer Confidence, Eurozone: ECB General Council Meeting, ECB Economic Bulletin, Services Sentiment, Industrial Sentiment, Business Confidence, Economic Sentiment, ECB President Draghi Speech, ECB Praet Speech, Italy: Business Confidence, Consumer Confidence, Spain: Business Confidence

Time: 06:00, 08:00, 09:00, 10:15, 11:45, 12:00, 13:30, 14:00, 16:00, 23:01

Numerous economic data related to the Eurozone and major economies in the Eurozone is to be released today which can move the Euro. The German GfK Consumer Confidence is a leading index measuring the level of consumer confidence in economic activity. A high level of consumer confidence in general stimulates economic expansion and is positive for the Euro. For the Eurozone the Business Confidence Indicator measures the state of the businesses and its coming prospects. It is based on a questionnaire filled by companies and it measures production trends, order books, inventories, backlog etc. The indicator is positively correlated with business activity. A high level indicates an upswing in activity and an improvement in the business climate which is positive for the Euro. An unchanged reading of 10.5 for the German GfK Consumer Confidence is expected.

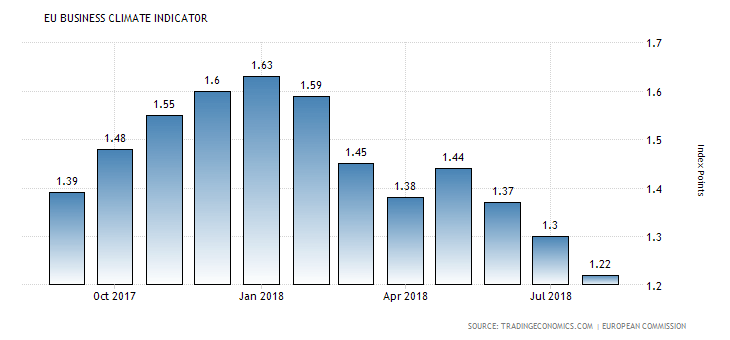

“The business climate indicator for the Euro Area fell by 0.08 points from a month earlier to 1.22 in August 2018, missing market expectations of 1.28. It was the lowest reading since August last year, as managers’ appraisals of their overall order books and past production worsened markedly, while their views on export order books and the stocks of finished products merely edged down. By contrast, managers’ production expectations improved.”, Source: Trading Economics.

From the above chart a clear downtrend for the Euro area Business Climate Indicator is evident. After the peak price of 1.63 in January 2018 the trend is weak and the most recent value of 1.22 is the lowest reading for the past 12-months. The forecast for the Euro area Business Climate Indicator is a decline to 1.19 from 1.22.

For the Euro higher than expected readings for the Economic Sentiment, Services Sentiment and Industrial Sentiment in the Eurozone, the Business Confidence in Italy and Spain, the Consumer Confidence in Italy and the Inflation Rate in Germany are positive. High levels of all mentioned economic indicators can stimulate economic expansion plus reflect inflationary pressures in the overall economy, which after the recent hawkish comments by the ECB President Draghi may weigh on the ECB decision to shift its monetary policy into tighter conditions sooner than expected. The forecasts are for an unchanged yearly German Inflation Rate set at 2.0%, and a decline for the Euro area Services Sentiment, Economic Sentiment and Industrial Sentiment to 14.6, 111.2 and 5.1 respectively from 14.7, 111.6 and 5.5 accordingly, which may influence negatively the Euro.

The Business Confidence in Italy is expected to decline to 104.5 from 104.8, the Consumer Confidence in Italy is expected to decline to 114.9 from 115.2 while the speeches by ECB President Draghi and ECB Praet, member of the Executive Board of the ECB, can also have an impact on the Euro with any updated economic projections or statements related to current economic conditions in the Eurozone.

The GfK Consumer Confidence Index for the economy of UK is a leading index that measures the level of consumer confidence in economic activity and as mentioned above a high level of consumer confidence can stimulate economic expansion and is considered positive for the British Pound, something that applies also for higher readings of the Nationwide Housing Prices Index, providing information about the housing market conditions in UK. The UK GfK Consumer Confidence Index is expected to decline to -8 from -7, while the yearly the Nationwide Housing Prices Index is expected to decline to 1.9% from 2.0% and the monthly UK Nationwide Housing Prices Index is expected to increase to 0.2% from -0.5%. Overall some mixed economic data is expected for the UK economy. The BoE Governor Carney Speech can also move the British Pound with updated commentary on economic conditions and any Brexit news are for the moment in the spotlight as well.

American Session

US: UN General Assembly, GDP Growth Rate QoQ Final, Core PCE Prices QoQ Final, PCE Prices QoQ Final, Corporate Profits QoQ Final, Durable Goods Orders MoM, Durable goods Orders Ex Transp MoM, GDP Price Index QoQ Final, Wholesale Inventories MoM Adv, Pending Home Sales (YoY, MoM), Kansas Fed Manufacturing Index, Fed Kaplan Speech, Fed Chair Powell Speech, Canada: Governor Poloz Speech

Time: 00:00, 12:30, 14:00, 15:00, 16;30, 20:30, 21:45

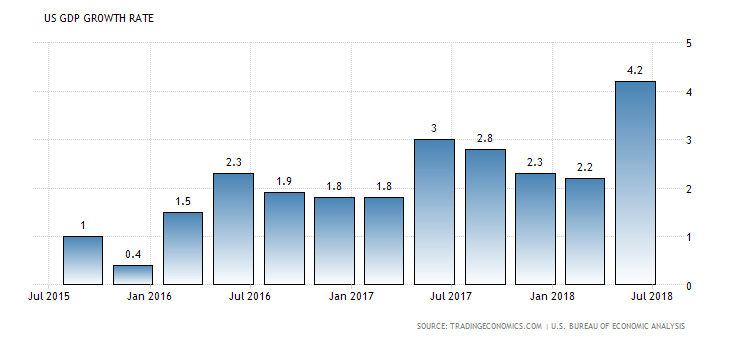

Plenty of high-importance economic data will be released today about the US economy with a focus on the GDP Growth Rate and the Durable Goods Orders. The GDP Growth Rate is a measure of market activity reflecting the pace at which a country’s economy is growing or decreasing, and the Durable Goods Orders measure the value of orders placed for relatively long-lasting goods, more than three years and are sensitive to economic changes. Any prolonged uptrend or downtrend for the Durable Goods Orders may indicate changes in economic cycles for the US economy.

“The US economy advanced an annualized 4.2 percent on quarter in the second quarter of 2018, slightly higher than a preliminary reading of 4.1 percent, beating market forecasts of 4 percent, the second estimate showed. The reading primarily reflects upward revisions to nonresidential fixed investment and private inventory investment that were partly offset by a downward revision to personal consumption expenditures (PCE). Imports, which are a subtraction in the calculation, were also revised down.”, Source: Trading Economics.

The forecast is for an increase for the US GDP Growth Rate annualized for the second quarter to 4.2% from 2.2% and the monthly Durable Goods Orders are expected to increase to 2% from -1.7%.

Higher than expected readings for the US Personal Consumption Expenditures (PCE) Prices, the Corporate Profits, Pending Home Sales and GDP Price Index and lower than expected for the Wholesale Inventories are considered positive for the US Dollar. The Pending Home Sales is a leading indicator of trends of the housing market in the US. The yearly Pending Home Sales are expected to increase to 0.9% from -2.3% and the monthly Pending Home Sales to increase to -0.4% from -0.7%, a negative but still improved reading. Overall mixed economic data is expected for the US economy, but the focus will be on the GDP figure as any miss or beat on the estimate could add increased volatility and price action for the US Dollar. The Fed Chair Speech is also a key economic event to monitor for commentary on economic conditions, something that is also true for the Bank of Canada Governor Speech as well.

Asian Session

Japan: BoJ Governor Kuroda Speech, Unemployment Rate, Retail Sales, BoJ Summary of Opinions, Industrial Production (YoY, MoM)

Time: 06:35, 23:30, 23:50

Bank of Japan Governor Kuroda Speech about monetary policy, and the figures for the Unemployment Rate, Retail Sales and Industrial production in Japan can move the Japanese Yen. Lower than expected readings for the Unemployment Rate and higher than Expected for the Retail Sale and the Industrial Production are considered positive for the Japanese Yen, indicating a strong labor market, increased consumer spending which is a key important indicator for the Japanese economy and a robust manufacturing sector, also a key sector the Japanese economy. An unchanged rate of 2.5% for the Unemployment Rate, a decline for the yearly Industrial Production to 1.5% from 2.2% and an increase for the yearly Retail Trade figure to 2.2% from 1.5% are expected.

Start Trading Forex