Two interest rate decisions today in the forex market economic calendar, from the ECB and the BoE are the key economic events to focus on and although no economic surprises are expected, the statements following the interest rate decisions may offer increased volatility for the Euro and the British Pound. The British Pound is also subject o additional volatility as Brexit headlines appear, while the US Inflation Rate is also expected later today, which can also move the US Dollar. Elsewhere the Unemployment Rate in Australia is expected early in the morning. Overall moderate to high volatility should be expected today in the forex market for major currencies such as the Euro, British Pound and US and Australian Dollar. And trade war concerns with the recent move by China to file to the World Trade Organization (WTO) complaint over the United States’ tariff measures on Chinese goods is another factor which can set trends based on risk-on or risk-off investors sentiment.

These are the key economic events and reports today in the forex market, time is GMT:

European Session

Germany: Inflation Rate YoY Final, Sweden: GDP Growth Rate (YoY Final, QoQ Final), France: IEA Oil Market Report, UK: BoE Interest Rate Decision, BoE Quantitative Easing, Eurozone: ECB Interest Rate Decision, ECB Press Conference

Time: 06:00, 07:30, 08:00, 11:00, 11:45, 12:30

The Inflation Rate in Germany measures the average price change for all goods and services purchased by households for consumption purposes. Higher than expected figures in the largest economy of the Eurozone, Germany is considered positive for the Euro as it has significant weight on the Eurozone’s total Inflation Rate. An unchanged figure of yearly Inflation Rate of 2.0% is expected. The Euro market-moving event today is the ECB Interest Rate Decision. In general, if the ECB is hawkish or optimistic about the inflationary outlook of the economy and rises the interest rates it is positive for the Euro, but no economic surprises are expected with a steady key Interest rate at 0.0% and unchanged Deposit Facility Rate at -0.40%. What may move the Euro maybe the statements later in the ECB Press Conference and any changes to the quantitative easing program set to end in December 2018.

For the economy of Sweden, a higher than expected GDP Growth Rate, which measures the total economic activity and performance of the broader economy in Sweden is supportive and positive for the Swedish Krona. An increase for the quarterly GDP Growth Rate to 1% from 0.8% is expected and an unchanged yearly GDP Growth Rate of 3.3%. The IEA Oil Market Report can move the oil prices releasing estimates on demand and supply for the global oil market, and additional external factors such as the monthly report from OPEC and worries about hurricane Florence and its effects on the oil supply will be monitored as they can have an influence on the oil prices and the USD/CAD currency pair.

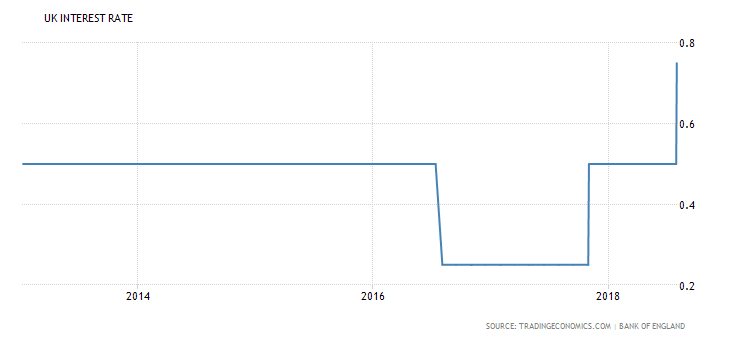

The BoE Interest Rate Decision and the Brexit developments can add increased volatility for the British Pound. “The Bank of England voted unanimously to raise the Bank Rate by 25bps to 0.75 percent on August 2nd, saying recent data appeared to confirm that the dip in output in the first quarter was temporary and that the labour market has continued to tighten and wage growth has firmed. Also, the bank reiterated that an ongoing tightening of monetary policy over the forecast period will be appropriate to return inflation sustainably to the 2 percent target.”, Source: Trading Economics.

Any economic surprise and a new interest rate hike will most probably be supportive for the British Pound although the forecast is for a steady key interest rate set at 0.75%. The economic projections by the BoE on GDP Growth, Inflation Rate, labor market and Brexit references on the economic outlook may move the British Pound rather than the actual Interest Rate Decision. In general, if the BoE is hawkish and optimistic about the inflationary outlook for the economy, this most probably will increase the possibility of a rate increase soon, which should be positive for the British Pound.

American Session

Canada: New Housing Price Index (YoY, MoM), US: Inflation Rate (YoY, MoM), Core Inflation Rate (YoY, MoM), Fed Quarles Testimony and Speech, Fed Bostic Speech, Monthly Budget Statement

Time: 12:30, 14:00, 16:30, 18:00

The New Housing Price Index (NHPI) in Canada is a monthly series that measures changes over time in selling prices of new residential houses, reflecting the growth rate of the housing market which is highly correlated to the broader economy and indicating the level of inflationary pressures. Higher than expected readings are considered positive for the Canadian Dollar with an expected unchanged reading for the monthly New Housing Price Index at 0.1%.

For the economy of US, a higher than expected reading for the Inflation Rate will most probably make a certain fact the interest rate hike by the Fed later this month and should be supportive for the US Dollar as it will indicate the presence of sustained inflationary pressures in the economy. “US annual inflation rate stood at 2.9 percent in July 2018, unchanged from the previous month and slightly below market expectations of 3 percent. Still, inflation remained at its highest level since February 2012.”, Source: Trading Economics.

The above chart shows that the US Annual Interest Rate has been increasing for the past 12-months and the low rate of 1.9% to the high rate of 2.9% for the past two consecutive months. The Core Inflation Rate which excludes the volatile prices of food and energy is a more conservative and indicative measure of the inflationary pressures in the broader economy and the expectations are for an unchanged yearly reading of 2.4% and a monthly figure of 0.2%. The yearly US Inflation Rate is expected to decrease marginally to 2.8% from 2.9% and the monthly Inflation Rate to increase to 0.3% from 0.2%.

The Monthly Budget Statement summarizes the financial activities of federal entities, and Federal Reserve banks with a positive budget statement considered to be positive for the US Dollar. The forecast is for wider budget deficit to -156.5B US Dollars from -77B US Dollars.

Pacific Session

Australia: Employment Change, Unemployment Rate, Participation Rate, New Zealand: Business NZ PMI

Time: 01:30, 22:30

For the economy of Australia higher than expected figures for the Participation Rate and the Employment Change and lower than expected for the Unemployment Rate are considered positive for the Australian Dollar indicating a robust labor market, an important fundamental driver to economic growth. The Participation Rate is the percentage of the total number of people of labor-force over 15 years old that is in the labor force. The forecasts are for an unchanged Unemployment Rate at 5.3%, a marginal increase for the Participation Rate to 65.6% from 65.5% and an increase for the Employment Change to 15.0K from -3.9K. The Business NZ PMI shows the business conditions in New Zealand, an important indicator of the overall economic condition. In general values above 50 reflect expansion in business conditions and are positive for the New Zealand Dollar.

Trade Forex Here