The PMI readings for the manufacturing and services sectors in Germany, the Eurozone and the US, the ECB Monetary Policy Meeting Accounts, the Consumer Confidence in the Eurozone and the Inflation Rate in Japan are among the key economic data to be released today. The forex market will weigh on the ECB Monetary Policy Meeting Accounts which can determine the short-term for the Euro versus other currencies. Moderate to high volatility should be expected for the Euro today.

These are the key economic events in the forex market today, time is GMT:

European Session

Switzerland: Industrial Production (YoY, MoM), Germany: Markit Services PMI, Markit Manufacturing PMI, Markit PMI Composite, Bundesbank President Weidmann Speech, Eurozone: Markit Services PMI, Markit Manufacturing PMI, Markit PMI Composite, ECB Monetary Policy Meeting Accounts, Consumer Confidence

Time: 07:15, 07:30, 08:00, 11:30, 14:00

The Industrial Production shows the volume of production of Industries such as factories and manufacturing and the current performance and state of the industrial sector. Higher than expected readings are considered positive for the Swiss Franc. A yearly decrease to 7.5% is expected for the second quarter compared to the previous reading of 9.0%.

The PMI readings show the performance of the services, manufacturing and composite sectors over time with higher than expected figures considered positive for the Euro reflecting expansion in the sectors and contributing positively to the GDP figures and economic growth. Some mixed economic data is expected for the economies of Germany and the Eurozone with expected increases for the services and composite sectors PMI readings and declines for the manufacturing sectors PMI readings. Any economic surprises may add further volatility for the Euro.

The Euro can also move with the release of the Consumer Confidence which is expected to decrease to -0.7 from the previous reading of -0.6 and the, ECB Monetary Policy Meeting Accounts.

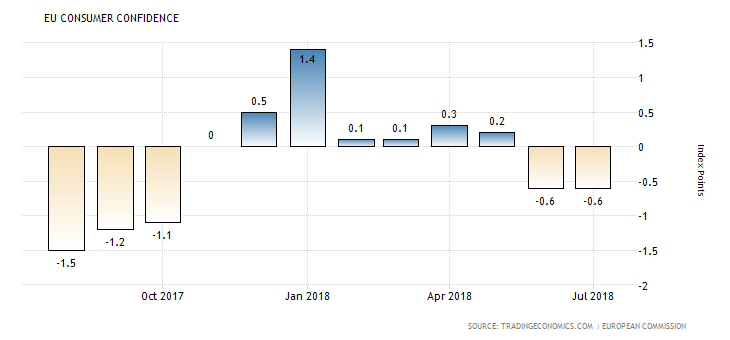

“The consumer confidence index in the Euro Area came in at -0.6 in July 2018, unchanged from the previous month’s eight-month low and in line with the preliminary reading. Assessments of the future general economic situation and of households’ future financial situation were stable, while consumers’ brighter savings expectations were offset by more negative views on future unemployment.”, Source: Trading Economics.

The Consumer Confidence is a leading index that measures the level of consumer confidence in economic activity. Higher than expected figures are considered positive for the Euro as they can lead to higher consumer spending and stimulate economic expansion. As seen from the above chart the Consumer Confidence in the Eurozone after a strong reading of 1.5 in January 2018 has been weak and declined the following months, turning into negative readings for the past two consecutive months. The negative and increasing number expected may weigh negatively on the Euro, while the PMI readings should be supportive.

The ECB Monetary Policy Meeting Accounts provide an overview of financial market, economic and monetary developments. It can move the Euro depending on the level of optimism in the language used by the ECB for current economic conditions and any potential shift in the monetary policy soon.

American Session

US: Continuing Jobless Claims, Initial Jobless Claims, Housing Price Index, Markit Services PMI, Markit Manufacturing PMI, Markit PMI Composite, New Home Sales, Kansas Fed Manufacturing Activity

Time: 12:30, 13:45, 14:00, 15:00

Lower than expected readings for the Continuing Jobless Claims, Initial Jobless Claims and higher than expected readings for all the other economic data are considered positive and supportive for the US Dollar reflecting a strong labor market, expansion in the economic activity for the business sectors, expansion in the current manufacturing activity in the broader Kansas region and strong housing market conditions. Again, some mixed economic data is expected with an increase for the New Home Sales to 0.654M from 0.631M, increases for both the Continuing Jobless Claims and Initial Jobless Claims and a decrease for the Markit Services PMI to 55.9 from 56.0 and an increase for the Markit Composite PMI to 56.3 from 53.7.

Pacific Session

Australia: RBA Boulton Speech, New Zealand Trade Balance

Time: 02:45, 22:45

The Trade Balance is a measure of balance amount between import and export. A positive value shows a trade surplus which is considered positive for the New Zealand Dollar indicating capital inflows in the New Zealand and increased demand for goods and services denominated in New Zealand Dollars which could lead to the natural appreciation of the New Zealand Dollar over time. The trade deficit is expected to widen to -400M New Zealand Dollars from -113M New Zealand Dollars.

Asian Session

Japan: Inflation Rate (YoY, MoM), Core Inflation Rate MoM, Nikkei Manufacturing PMI Flash

Time: 00:30, 23:30

Higher than expected readings for the Inflation Rate and the Nikkei Manufacturing PMI Flash are considered positive for the Japanese Yen reflecting strong business conditions and expansion in the manufacturing sector and inflationary pressures in the broader economy which if are sustainable over tome may weigh on the Bank of Japan to shift its monetary policy from neutral to tighter increasing the interest rates.

“Japan’s consumer price inflation stood at 0.7 percent year-on-year in June of 2018, unchanged from the previous month and below market consensus of 0.8 percent. Food inflation hit its lowest since a deflation in last November while cost of transport rose at a faster pace and cost of housing continued to fall. Core inflation rate, which excludes fresh food, rose to 0.8 percent from 0.7 percent in May and in line with estimates. It is the highest figure since March. Monthly, consumer prices went up by 0.1 percent, the same as in the prior month.”, Source: Trading Economics.

The forecasts are for an increase for the Nikkei Manufacturing PMI Flash to 52.4 from the previous reading of 52.3, a decrease for the yearly Inflation Rate to 0.4% from 0.7% but also an increase for the yearly Core Inflation Rate to 0.9% from 0.8%. The Core Inflation Rate is more representative of the real inflationary pressures in the economy as it excludes the volatile prices of food and energy. These readings may strengthen the Yen amid trade concerns and political risks still in the financial markets.

Trade Forex