This new trading session week in the forex market for September 17-21, 2018 the most important releases for the US are building permits and housing starts, existing home sales and flash Markit PMIs. Elsewhere, in the spotlight will be: BoJ interest rate decision, Japan trade and inflation, UK and Euro Area consumer prices and flash Markit PMIs for the Eurozone, France and Germany. For today the key economic event in the forex market is the Inflation Rate in the Eurozone, which may add significant volatility for the Euro versus other major currencies.

These are the key economic events in the forex market today, time is GMT:

European Session

Sweden: Monetary Policy Meeting Minutes, Italy: Balance of Trade, Eurozone: Inflation Rate YoY Final, Inflation Rate MoM, Core Inflation Rate YoY Final, ECB Praet Speech, ECB Mersch Speech, Germany: Bundesbank Monthly Report

Time: 07:30, 08:00, 09:00, 10:00, 11:15, 13:00

The Trade Balance in Italy is a balance between exports and imports of total goods and services. A positive value shows trade surplus, while a negative value shows trade deficit. A trade surplus, i.e. higher exports than imports and capital inflows in the economy of Italy are considered to have positive effect on the Euro which may lead to its appreciation over time. The trade surplus in Italy is expected to narrow to 4.82B Euros from 5.071B Euros.

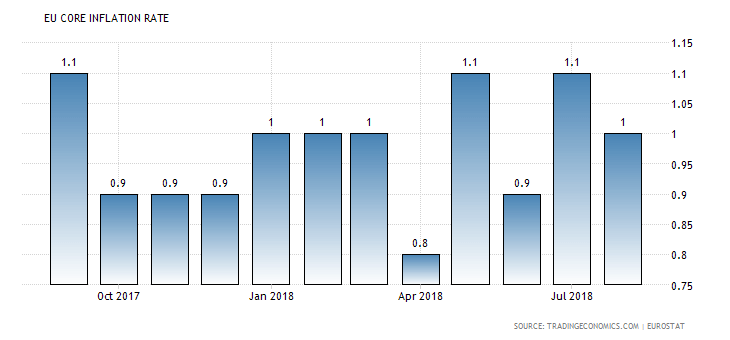

The Core Inflation Rate in the Eurozone is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services excluding the volatile components like food, energy, alcohol and tobacco. Generally, a high reading is positive and supportive for the Euro, increasing the odds of future interest rate increases by the ECB, though it has repeatedly mentioned that the QE program will end by the end of this year and not any interest rate increases should be expected until the mid-year 2019.

“Core consumer prices In the Euro Area increased 1 percent in August of 2018 over the same month in the previous year.”, Source: Trading Economics.

As seen from the chart the Core Inflation Rate in the Eurozone has been in the range 0.8%-1.1% for the past 12-months and a decrease to 1.0% from 1.1% is expected. The yearly Inflation Rate Final in the Eurozone is expected to decrease to 2.0% from 2.1%, while the monthly Inflation Rate is expected to increase to 0.2% from -0.3%.

The Monetary Policy Meeting Minutes by the central bank of Sweden, Sveriges Riksbank will be monitored as it has expressed concerns about the low inflation rate and the possibility of the appreciation of the Swedish Krona, although economic activity is strong, and that monetary policy needs to remain expansionary for inflation to continue to be close to the 2 percent target.

American Session

US: NY Empire State Manufacturing Index

Time: 12:30

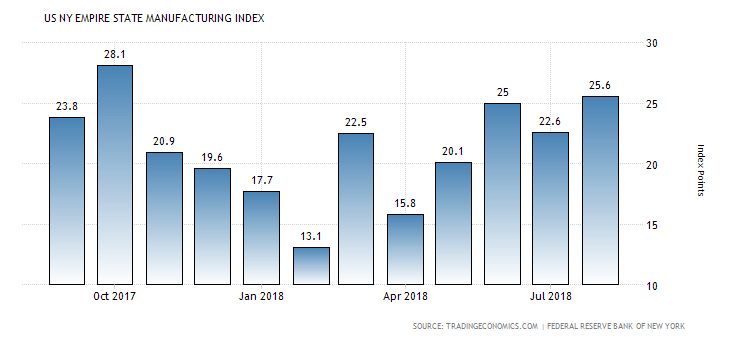

NY Empire State Manufacturing Index measures the general business conditions in the manufacturing sector at the New York State. Higher readings or rising ones indicate improved business conditions and are positive for the US Dollar. Readings that are high but are declining over time may indicate also a declining growth in business conditions and a less positive future economic outlook.

“The New York Empire State Manufacturing Index in the United States grew 3 points from the previous month to 25.6 in August 2018, above market expectations of 20. It is the strongest reading since September 2014. New orders and shipments grew strongly, and firms reported an increase in unfilled orders. Delivery times continued to lengthen, and inventories held steady. Labor market indicators pointed to solid gains in employment and longer workweeks. Price indexes were little changed and remained elevated, indicating ongoing significant price increases. Looking ahead, firms stepped up their capital spending plans and were fairly optimistic about the six-month outlook.”, Source: Trading Economics.

After a relative weak first quarter for 2018, the US NY Empire State Manufacturing Index has been in an uptrend as of May 2018. The forecast is for a decrease to 23 from 25.6 which may influence negatively the US Dollar.

Trade Forex Now