The last trading weekly session for summer 2018 starts today with a light economic calendar but at the same time with important statements which can dictate the short-term trend of the US Dollar extending losses versus other currencies after Fed Chairman Powell Speech at the Kansas City Federal Reserve’s annual monetary policy symposium in Jackson Hole. The forex market perceived the comments by Fed Chairman to be dovish.

“Powell said gradual interest-rates hikes remain appropriate and that there was no risk to the economy overheating, but also that he was prepared to do “whatever it takes” to prevent inflation from becoming unanchored in either direction.”, Source: Marketwatch.

Also Fed Chairman mentioned that “The economy is strong. Inflation is near our 2 percent objective, and most people who want a job are finding one … If the strong growth in income and jobs continues, further gradual increases in the target range for the federal funds rate will likely be appropriate.”, Source: Yahoo Finance.

The forex market today will most probably on the Fed Chairman statements to raise interest rates gradually, being healthy for the economy and signaling more interest rate hikes in the future despite President Donald Trump’s criticism of higher borrowing costs.

Today the key economic events which can move the forex market are the German IFO readings and the US Chicago Fed National Activity Index and Dallas Fed Manufacturing Index.

Key economic events in the forex market today to focus on, time is GMT:

European Session

Germany: IFO Current Assessment, IFO Business Climate, IFO Expectations, Bundesbank Beermann Speech

Time: 08:00, 16:00

Higher than expected figures for all the IFO Indexes are considered positive and supportive for the German economy and the Euro reflecting current conditions and business expectations in Germany at present and near short-term future. Higher than expected reading can contribute to a positive economic growth reflecting optimism for the current and near-term economic outlook.

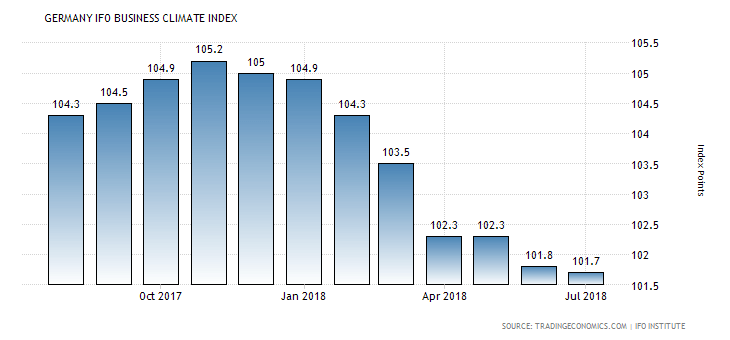

“The IFO Business Climate Index for Germany fell slightly to 101.7 in July 2018 from 101.8 in the previous month. still beating market expectations of 101.5. It was the weakest reading since March 2017 as the gauge of future expectations declined further (98.2 vs 98.5 in June) while the current business conditions sub-index picked up (105.3 vs 105.2 in June). Sentiment worsened among manufacturers (22.4 vs 23.9) and wholesalers, retailers (10.4 vs 11.4), but improved among service providers (26.7 vs 26.0) and constructors (record high of 27.4 vs 19.4).”, Source: Trading Economics.

We note that the Business Climate Index has been weak in 2018, with a high value in January 2018 at 104.9, and a decline ever since. The latest reading of 101.7 in July 2018 was the lowest reading so far in 2018. The forecasts are for increases for all the IFO Indexes. More specifically the IFO Current Assessment, the IFO Business Climate and the IFO Expectations are expected to increase to 105.5, 102.0 and 98.5 respectively from the previous readings of 105.3, 101.7 and 98.2 accordingly.

American Session

US: Chicago Fed National Activity Index, Dallas Fed Manufacturing Business Index

Time: 12:30, 14:30

The Chicago Fed National Activity Index is a monthly index measuring overall economic activity and related inflationary pressures in the overall economy. The Dallas Fed Manufacturing Business Index measures whether important economic indicators such as output, employment, orders, prices decreased or remained unchanged over the previous month. Higher than expected readings for both the Chicago Fed National Activity Index and the Dallas Fed Manufacturing Business Index are considered positive for the US Dollar reflecting increased business activity and expansion in the manufacturing sector.

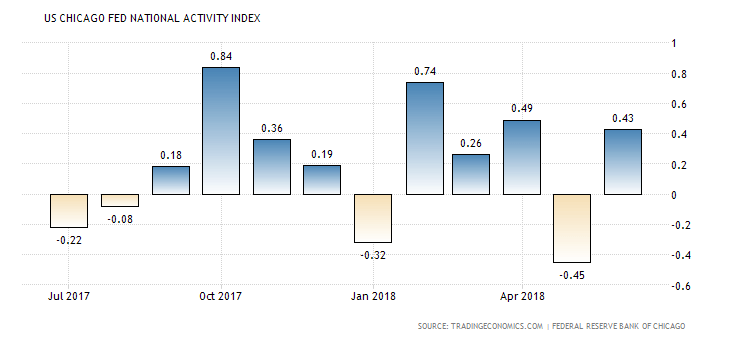

“The Chicago Fed National Activity Index jumped to 0.43 in June 2018 from a downwardly revised -0.45 in the previous month, and above market expectations of 0.25. Production-related indicators contributed +0.36 to the index (vs -0.56 in May), as manufacturing industrial production increased 0.8 percent in June after declining 1 percent in May. Also, the sales, orders, and inventories category contributed of +0.06 to the CFNAI (vs +0.03 in May), and employment-related indicators contributed +0.08 (vs +0.11 in May). Meanwhile, the contribution of the personal consumption and housing category edged down to -0.06 in June from -0.04 in May due to a drop in both housing starts and building permits.”, Source: Trading Economics.

The Chicago Fed National Activity Index as shown from the above chart is very volatile subject to seasonality with significant declines and increases. The forecasts are for a decrease of the Chicago Fed National Activity to 0.13 from 0.43 and an increase for the Dallas Fed Manufacturing Business Index to 36.9 from 32.3. With this mixed economic data expected for the US economy the US Dollar may witness increased volatility as the forex market will focus on the Friday’s statements at Jackson Hall Symposium to determine trends for major currencies in the end of summer 2018.

Trade Forex Now