The last trading session for the week 24-28 September 2018 today in the forex market has many market-moving economic data amid political worries in the Eurozone. In the spotlight today are the releases of the Inflation Rate in the Eurozone, the Unemployment Rate in Germany, the GDP Growth Rate in UK, and the US Core Personal Consumption Expenditures Index (PCE). With the recent interest rate hike of 25 basis points by the Fed and indicating possibly another increase in December, removing the term “accommodative” monetary policy and raising the forecasts for economic growth next year the US Dollar is expected to exhibit increased volatility today, something that can be said for the Euro, and the British Pound as well.

These are the key economic events today in the forex market today to focus on, time is GMT:

European Session

Germany: Unemployment Rate Harmonized, Unemployment Rate, Unemployment Change, UK: Nationwide Housing Prices (YoY, MoM), Current Account, GDP Growth Rate (YoY Final, QoQ Final), Business Investment (YoY Final, QoQ Final), BoE Ramsden Speech, France: Inflation Rate YoY Prel, Spain: Inflation Rate YoY Prel, GDP Growth Rate ( YoY Final, QoQ Final), Switzerland: KOF Leading Indicators, Eurozone: Core Inflation Rate YoY Flash, Inflation Rate YoY Flash, Italy: Inflation Rate (YoY Prel, MoM Prel)

Time: 06:00, 06:45, 07:00, 07:55, 08:30, 09:00, 13:20

There are several market-moving events in the European Session today, with a focus on the UK GDP Growth Rate amid Brexit developments, the German Unemployment Rate and the Inflation Rate in the Eurozone. For the Euro a lower than expected Unemployment Rate in Germany and a higher than expected Inflation Rate in the Eurozone are positive factors. A high Inflation Rate shows that significant inflationary pressures exist in Eurozone economies, putting pressure on the European Central Bank to raise interest rates. A decrease in the Unemployment Rate has positive implications for consumer spending which can stimulate economic growth.

The forecasts are for an unchanged German Unemployment Rate of 5.2%, and an increase for the yearly Inflation Rate Flash in the Eurozone to 2.1% from 2.0%. Also, an increase is expected for the Core Inflation Rate in the Euro area, calculated as the average of HICP (Harmonized Index of Consumer Price) that does not consider food, tobacco, and energy due to their high volatility.

It is the increase in the general level of prices for goods and services and is a more conservative measure of inflationary pressures in the overall economy. The yearly Core Inflation Flash in the Eurozone is expected to increase marginally to 1.1% from 1.0%. The forex market will weigh on these inflationary readings especially after the recent commentary on prices by the ECB President Draghi.

Other positive and supportive economic data for the Euro will be higher than expected figures for the GDP Growth Rate in Spain, and the Inflation Rate in Italy and France. For the Swiss economy a higher than expected figure for the KOF Leading Indicators is positive for the Swiss Franc, a leading indicator which measures future trends of the overall economic activity, providing important information about the GDP growth and the economic trend in Switzerland. The indicator is expected to increase to 101.0 from 100.3.

The British Pound can move upon the release of the GDP Growth Rate, the Current Account and the Business Investment figures. A large business investment reading is indicative of overall growth in the UK economy, a trade surplus shows capital inflows and increased demand for goods and services denominated in British Pounds which are supportive for the currency, and a high reading for the GDP Growth Rate shows the broad measure of the UK economic activity which is expanding.

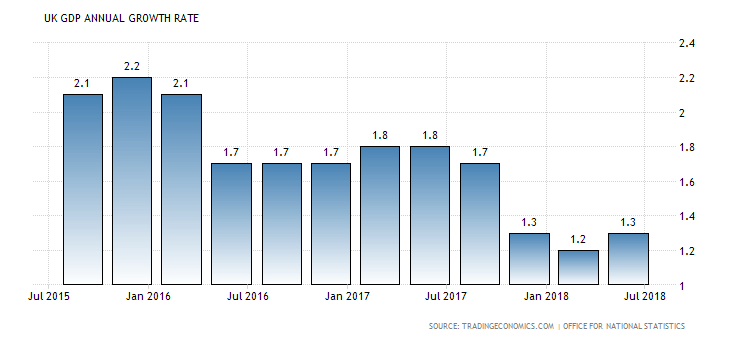

“The gross domestic product in the United Kingdom expanded 1.3 percent year-on-year in the second quarter of 2018, little-changed from a near six-year low of 1.2 percent in the previous period and matching market expectations. Household consumption rose the least since the first quarter of 2012.”, Source: Trading Economics.

From the above chart a downtrend in the UK GDP Annual Growth Rate is evident for the past 12-months. The forecasts are for an increase for the yearly and quarterly UK GDP growth Rate to 1.3% and 0.4% respectively from 1.2% and 0.2% accordingly, a wider Current Account deficit to -19.4B British Pounds from – 17.72B British Pounds and a decrease for the yearly Business Investment reading to 0.8% from 2.0%. On the contrary the quarterly Business Investment figure is expected to increase to 0.55 from -0.4%. Overall mixed economic data is expected for the UK economy.

American Session

Canada: GDP MoM, US: PCE Price Index (YoY, MoM), Personal Income MoM, Personal Spending MoM, Fed Barkin Speech, Chicago PMI, Michigan Consumer Sentiment Final, Fed Williams Speech

Time: 12:30, 13:45, 14:00, 20:45

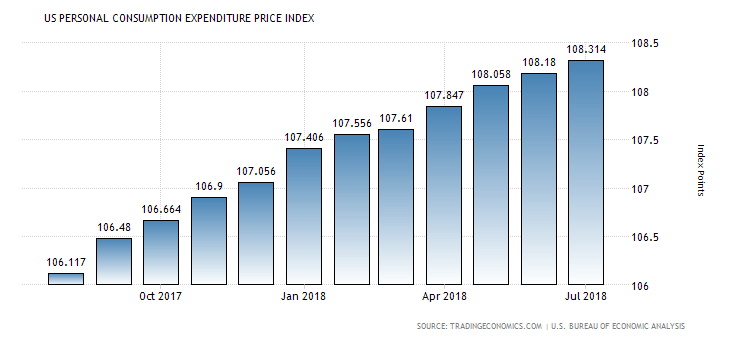

The preferred measure by the Federal Reserve of core inflation in the United States is the change in the core personal consumption expenditures price index (PCE) and is released today.

“The personal consumption expenditures (PCE) price index in the United States increased 0.1 percent month-over-month in July of 2018, the same as in the previous month and matching market expectations. Prices for goods were unchanged after declining 0.1 percent in June, as those of durable goods rebounded (0.4 percent compared to -0.3 percent in June) while non-durables dropped 0.2 percent (0.1 percent in June). Cost of services rose 0.2 percent, the same as in the prior month. Excluding food and energy, PCE prices went up 0.2 percent, higher than a 0.1 percent rise in June and in line with market forecasts. Year-on-year, the PCE price index advanced 2.3 percent, after a 2.2 percent gain in the prior month, and the core index rose 2.0 percent, following a 1.9 percent increase in June.”, Source: Trading Economics.

The interest rate path in the US economy with the most recent interest rate increase of 25 basis points for the Fed funds rate on Wednesday, September 26, 2018 supports the uptrend for the US Personal Consumption Expenditures Price Index. Higher than expected figures for the PCE Price Index are positive for the US Dollar increasing the chances of future interest rate increases by the Fed. The monthly PCE Price Index is expected to increase to 0.2% from 0.1%.

Higher than expected figures for the US Personal Income and Spending, signals higher level of purchases of goods and services by households and higher total income received by individuals which can stimulate economic growth measured by the GDP level. Also, a higher reading for the Michigan Consumer Sentiment Final is positive for the US Dollar reflecting a higher consumer confidence in economic activity. This confidence can have a positive influence on the consumer spending, a key economic indicator for the overall economic growth.

The Chicago PMI measures the business conditions across Illinois, Indiana and Michigan, being an indicator of business trends. High levels indicate expansion in the business conditions, a supportive factor for the US Dollar. The forecasts are for an increase for the Michigan Consumer Sentiment Index Final to 100.8 from 96.2, a decline for the Chicago PMI to 62.5 from 63.6, an increase for the monthly Personal Income to 0.4% from 0.3% and a decline for the monthly Personal Spending to 0.3% from 0.4%.

For the economy of Canada, the GDP is considered as a broad measure of Canadian economic activity and health, with higher than expected readings considered positive for the Canadian Dollar indicating a robust economy which is expanding. An increase for the monthly Canadian GDP is expected to 0.1% from 0.0%.

Pacific Session

Australia: Private Sector Credit (YoY, MoM)

Time: 01:30

The Private Sector is an amount of money that the Australian private sector borrows, showing if the private sector can afford large expenses, which can fuel economic growth, and an indicator of business conditions and the overall economic condition in Australia. Higher than expected figures are positive for the Australian Dollar, and an unchanged monthly figure of 0.4% is expected which should have a neutral effect.

Asian Session

Japan: Housing Starts, Construction Orders

Time: 05:00

The Housing Starts show the strength of the Japanese housing market, while the Construction orders are also a key indicator for the housing market. High readings are considered positive for the Japanese Yen. An increase for the yearly Housing Starts to 0.1% from -0.7% is expected.

Trade Forex Here