The last trading session of the week 13-17 August 2018 today has important macroeconomic data for the economies of the Eurozone with the release of the Inflation Rate, the economy of Canada also with the Inflation Rate expected and the US with the University of Michigan Sentiment Index. As the risk sentiment with the current financial crisis in Turkey stills weighs on the short-term currency trends this week moderate to high volatility should be expected today for the Euro and the Canadian Dollar. The Canadian Dollar will also probably be affected by the recent 10-week low of oil prices after a large surprise in the US crude oil inventories last week. Any rally in the oil prices and a bounce may be supportive for the Canadian Dollar which has a high and positive correlation with oil prices.

These are the key economic events which can move the forex market today to focus on, time is GMT:

European Session

Eurozone: Inflation Rate (YoY Final, MoM), Core Inflation Rate YoY Final, Russia: Unemployment Rate

Time: 09:00, 13:00

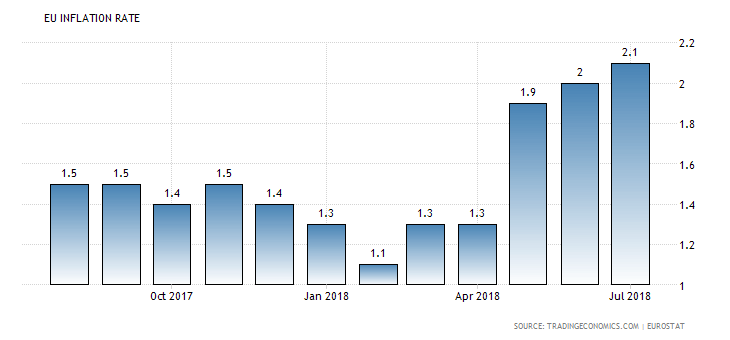

The Inflation Rate in the Eurozone is the highest inflation rate since December of 2012 currently at 2.1%. Higher than expected readings are considered positive for the Euro and in economic theory should weigh on the ECB decision to shift its monetary policy towards a tighter policy with higher future interest rates to fight inflationary pressures in the broader economy. However, the ECB has mentioned that its intention is to keep low interest rates and unchanged until mid-year 2019 so any sustainable inflation readings above the key level of 2.0% may weigh on its decision to change its decision, but not for now. We note that inflation rate has been in an uptrend in 2018 with last three consecutive readings higher than the average readings of past 12-months so this uptrend should be monitored as it may indicate a sooner than expected monetary policy change for the ECB.

“The inflation rate in the Euro Area is expected to edge up to 2.1 percent in July of 2018 from 2 percent in June, beating market expectations of 2 percent. It is the highest inflation rate since December of 2012, mainly boosted by oil prices, flash estimates showed.”, Source: Trading

The forecasts are for an increase for the final yearly Inflation Rate in the Eurozone of 2.1%, higher than the previous reading of 2.0%, a decline for the monthly Inflation Rate with a figure of -0.3% expected compared to the previous reading of 0.1% and an increase for the yearly Core Inflation Final at 1.1%, higher than the previous reading of 0.9%. The Core Inflation Rate is calculated as the average of HICP (Harmonized Index of Consumer Price) that does not consider food, tobacco, and energy due to their high volatility. It is the increase in the general level of prices for goods and services. It is considered a more conservative measure of real inflationary pressures in the broader economy.

The Unemployment Rate in Russia is expected to remain unchanged at 4.7%, a neutral reading as lower than expected readings are considered positive and supportive for the Russian Ruble. Low Unemployment Rates can stimulate economic growth with higher consumer spending.

American Session

Canada: Inflation Rate (YoY, MoM), Core Inflation Rate (YoY, MoM), US: Michigan Consumer Sentiment Index Prel,

Time: 12:30, 14:00

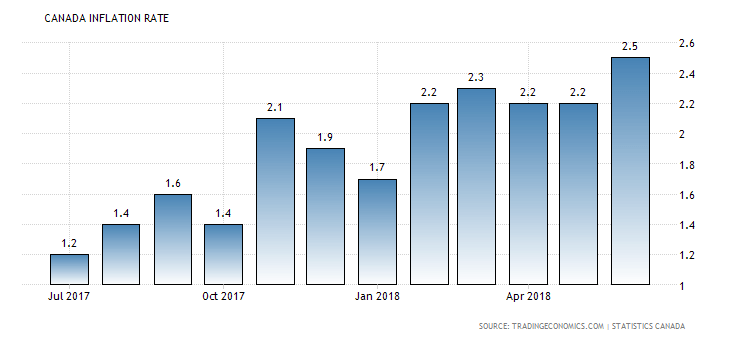

Higher than expected figures for the Inflation Rate in Canada are considered positive for the Canadian Dollar as they may weigh on the Bank of Canada decision to increase future interest rates. The Bank of Canada has mentioned that it aims at an inflation range (1%-3%).

“Canada’s consumer price inflation rose to 2.5 percent year-on-year in June 2018 from 2.2 percent in the previous month, and above market expectations of 2.4 percent. It was the highest rate since February 2012, mainly driven by higher prices for gasoline and food purchased from restaurants.”, Source: Trading Economics.

We note that the Inflation Rate in Canada has been in an uptrend as of January 2018, reaching the lower rate of 1.7% and ever since has risen to the recent rate of 2.5%. The forecasts are for unchanged readings for the yearly and monthly Inflation Rate in Canada at 2.5% and 0.1% respectively, an unchanged reading for the Core Inflation Rate at 1.3% and a decline for the monthly Core Inflation Rate at -0.1%, compared to the previous reading of 0.1%. Any economic surprise either positive or negative may add further volatility and price action for the Canadian Dollar versus other currencies.

The Michigan Consumer Sentiment Index released by the University of Michigan is a survey of personal consumer confidence in economic activity, reflecting the willingness of consumers to spend money. High consumer spending is a key driver to economic growth so higher than expected readings for the Michigan Consumer Sentiment are considered positive for the US Dollar, reflecting a relative level of current and future economic conditions and optimism or not for the economic outlook. The forecast is for a marginal increase of the Index at 98.0 compared to the previous reading of 97.9.

Pacific Session

Australia: RBA Ellis Speech

Time: 07:30

A speech by the Assistant Governor at the Reserve Bank of Australia is important and could move the Australian Dollar should any updated economic data or opinions, projections on the current economic conditions are announced.

Trade Forex