Dow ends further away from 20000 level

US stocks ended lower on Wednesday led by technology stocks. The dollar continued the uptrend. The live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, closed 0.2% higher at 103.223. The S&P 500 closed 0.8% lower at 2249.92, led by losses in financial and materials stocks with all eleven main sectors finishing lower. The Dow Jones industrial average ended 0.6% lower at 19833.68, trading within 20 points of the psychologically important 20000 milestone but still failing to break above. Losses in biotechnology shares pulled down the high tech index Nasdaq 0.9% to 5438.56.

Mining stocks lead European markets higher

European stocks advanced on Wednesday led by mining stocks. Both the euro and the British Pound weakened against the dollar. The Stoxx Europe 600 extended gains rising 0.3%. Germany’s DAX 30 edged up 2.75 points to 11474.99. France’s CAC 40 slipped 0.01% and UK’s FTSE 100 index outperformed gaining 0.5% to 7106.08.

Drop in Toshiba shares pulls Nikkei down

Asian stocks are mixed today as the decline on Wall Street weighed on market sentiment. Nikkei fell 1.3% to 19145.14 to three-week low with yen growing stronger against the dollar. Shares of Toshiba fell 17%, on uncertainty how much loss Toshiba would have to record and how much it would need to raise to restore its capital base. The Hong Kong’s Hang Seng index is up 0.1% while the Shanghai Composite Index is down 0.2% weighed by declines in financial stocks. Australia’s All Ordinaries Index gained 0.3% while the Australian dollar edged higher against the dollar.

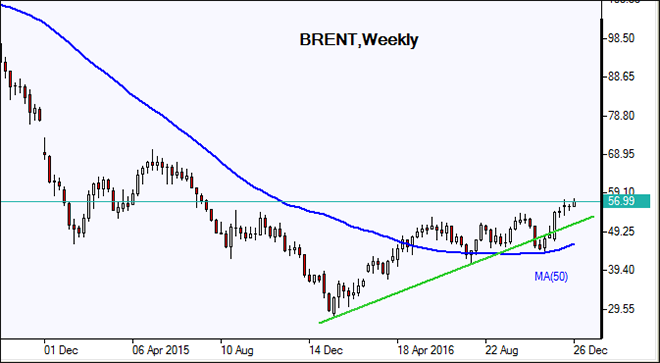

Oil prices rise despite surprise US inventory build

Oil futures prices are rising today despite a surprise build in US crude inventories. The American Petroleum Institute private industry group reported on Wednesday that US crude oil inventories rose 4.2 million barrels in the latest week. Official inventory data from the Energy Information Administration will be released today at 16:30 CET. Analysts surveyed by The Wall Street Journal expect a 1.4 million barrel decline in crude supplies. February Brent crude closed 0.2% higher at $56.22 a barrel on Wednesday on London’s ICE Futures exchange.