Preview Mode

- SEE LESS

- B2B Categories

- Industry Executives (287)

- Industry Websites (59)

- Regulators (23)

- Liquidity Provider (4)

- Payment Processors (3)

- Platforms (3)

- KYC (2)

- Regulation Consulting (2)

- Cryptocurrency Trading Solutions (1)

- CRM (1)

- Tools for Brokers (1)

- SaaS Provider (1)

- MT4/MT5 Bridge Providers (1)

- Platform Providers (1)

- White Label Solutions

- Affiliate Programs

- Cryptocurrency Liquidity Providers

- Translation Services

- Trading Categories

- Subscribe to our Newsletter

- Suggest a company

- Contact Us

- Companies Home

- Company News

- Categories

- Trading News

- Company News

- Videos

- Search

- Add

Company

Full Breakdown Filters

Full Breakdown

Full BreakdownCompany Review

IC Markets Review 2025: Key Features and Fees

| Regulation and License | ASIC, and FSA Seychelles |

| HQ | Sydney, Australia |

| Founding year | 2007 |

| Leverage range | Max leverage ASIC: 1.30; FSA: 1:500 |

| Min deposit | $200 |

| Platforms | MetaTrader 4, MetaTrader 5, cTrader |

| Tradable Instruments | CFDs on Currency Pairs, Commodities, Indicies, Bonds, Stocks, Futures, Cryptos |

| Demo account | Yes |

| Cryptocurrencies | No - Crypto CFDs only |

| Base Currencies | AUD, USD, EUR, GBP, SGD, NZD, JPY, HKD, CHF, CAD |

| Customer support | 24/7 multilingual support |

| Publicly traded | No |

| Website | https://www.icmarkets.com |

IC Markets broker overview

Founded in 2007, IC Markets is a online trading platform regulated by the Australian Securities and Investments Commissions (ASIC), as well as the Financial Services Authority Seychelles (FSA). The company's headquarters is located in Sydney, Australia.

As one of the leading brokers on the market, IC Markets offers traders a wide range of tradable CFD instruments. These include Forex currency pairs, commodities, indices, bonds, stocks, and futures. In addition, the broker also offers cryptocurrency CFDs and provides traders with the option to trade in ten base currencies.

| Pros | Cons |

| MT4, MT5, cTrader support | US customers cant not access the platform |

| Easy to open account | |

| 2250+ | |

| Wide range of tradable markets | |

| Quick deposit and withdrawal |

Traders can access IC Markets using the most popular trading platforms – MetaTrader 4, its successor platform MetaTrader 5 and cTrader. All platforms offer a range of features and tools to help traders with their trading.

The minimum deposit to open an account with IC Markets is 200 USD. Let's dive into all details of IC Markets and check out what it has in store for traders.

Safety information:

Regarding safety, IC Markets is fully regulated in Australia, and Seychelles. The company is well-known for its adherence to strict security and transparency standards.

The broker also implements a range of measures to ensure the security of its customers' funds, such as segregated banking accounts and secure data encryption. In addition, the broker has implemented modern data protection measures to protect customers' data from unauthorised access and maintains a strict confidentiality policy.

The company also provides retail traders with the benefit of negative balance protection, ensuring that retail traders' account balances never exceed the deposits made. In addition to negative balance protection, IC Markets works with tier-1 banking institutions and does not compromise on its clients' data and funds safety.

Moreover, they have robust KYC (Know Your Customer) checks, AML (Anti Money Laundering)and CTF (Counter Terrorism Financing) measures in place to ensure the safety of customers’ transactions.

Fees details:

| Fees Type | IC Markets |

| Deposit fee | No |

| Withdrawal fee | No, but third party banking fees might apply |

| Inactivity fee | No |

| Fee ranking | Low |

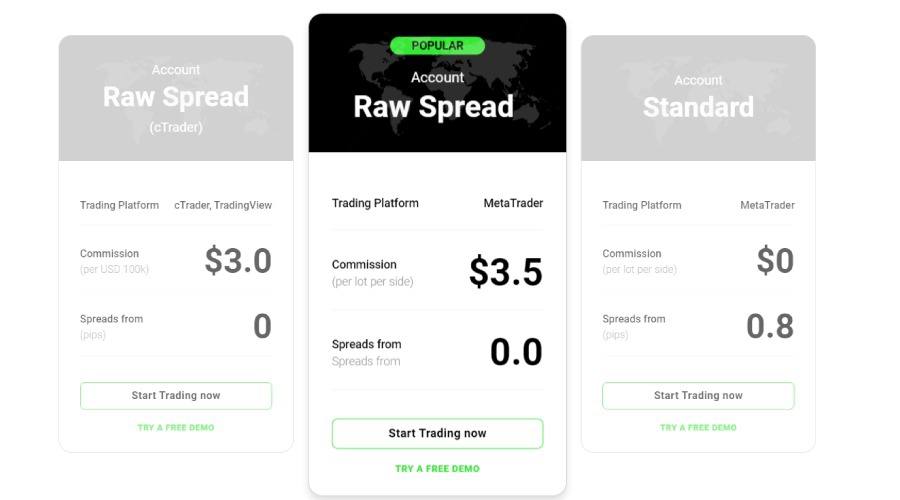

Regarding fees, IC Markets is one of the most competitive brokers on the market. The spreads start from 0.0 pips, and a commission from $3.5 is applied for every standard lot traded on Raw Spread accounts.

IC Markets provides Islamic trading accounts, tailored for clients who are unable to pay interest due to religious reasons, as they still need to pay an overnight position holding fee.

In addition, IC Markets does not charge an inactivity fee which traders are charged for not trading in a set period. It makes the broker attractive as traders can open an account with them and not worry about the fees associated with inactivity.

There are no hidden fees or additional commissions on trades. Overall, IC Markets offers competitive fees that appeal to traders who want access to a wide range of markets with low costs.

Spreads fee:

Spreads are something that brokers charge for access to the markets. IC Markets offers competitive spreads starting from 0.0 pips on all its accounts depending on the asset traded and the account type.

The spreads are as low as 0.0 pips, while on Standard, it starts from 1 pip. IC Markets also offers commission-free trading on all its accounts, except for Raw Spread accounts where a commission from $3.5 per standard lot is charged.

IC Markets low spreads helps traders keep trading costs low. Their spreads are also benchmarked against other industry brokers to ensure they remain competitive.

Deposit and withdrawal options:

The broker offers a variety of payment methods for deposits and withdrawals. These include debit/credit cards, bank wire transfers, Skrill, Neteller and more. Traders should be aware that they may incur fees, such as intermediary fees, on payments to and from some international banking institutions.

Most methods offered including debit/credit cards, Paypal, Skrill, and Neteller, are processed instantly, and the balance is available for trading immediately. However, bank transfers may take up to two to five business days to process.

Traders can fund their accounts with over 10 currency options, being AUD, USD, EUR, GBP, SGD, NZD, JPY, HKD, CHF, CAD. The minimum deposit is 200 USD.

The withdrawal process is also quick, with the funds being processed within 48 hours of request. However, banks may charge additional fees when making international transfers.

The broker takes all the essential steps to ensure the security of their client's funds. These include segregating client funds from company funds and keeping them in secure, regulated financial institutions.

All payment methods are protected with the latest SSL encryption technologies to keep the data secure and transactions safe from unauthorised access. Moreover, customers need to undergo a quick KYC process to verify their identity before starting trading.

Tradable markets:

IC Markets is a multi-asset CFD broker offering traders access to various markets. On the Forex side, you can trade multiple major, minor and exotic currency pairs, including AUD/USD, EUR/GBP, and USD/JPY. Along with this, it also covers major tradable markets to give its customers a wide range of options. Let's explore all the tradable markets available at IC Markets.

Forex:

IC Markets offers more than 60 currency pairs to its customers. These include all major, minor and exotic currency pairs. Popular pairs you can trade on IC Markets are AUD/USD, EUR/GBP, and USD/JPY. In addition, you can also trade minor and exotic pairs like EUR/MXN and USD/TRY.

Commodities:

Traders have the option to trade over 28 commodities to trade including energy, agriculture, and metals. Popular commodities you can trade on IC Markets are Brent Crude Oil, Natural Gas, and Gold. In addition, traders can also trade soft commodities like Corn, Coffee, and Cocoa.

Indices:

With 25 different indices, IC Markets offers a wide range of markets for traders to explore. Popular indices you can trade on IC Markets are S&P 500, DAX30, and Euro 50.

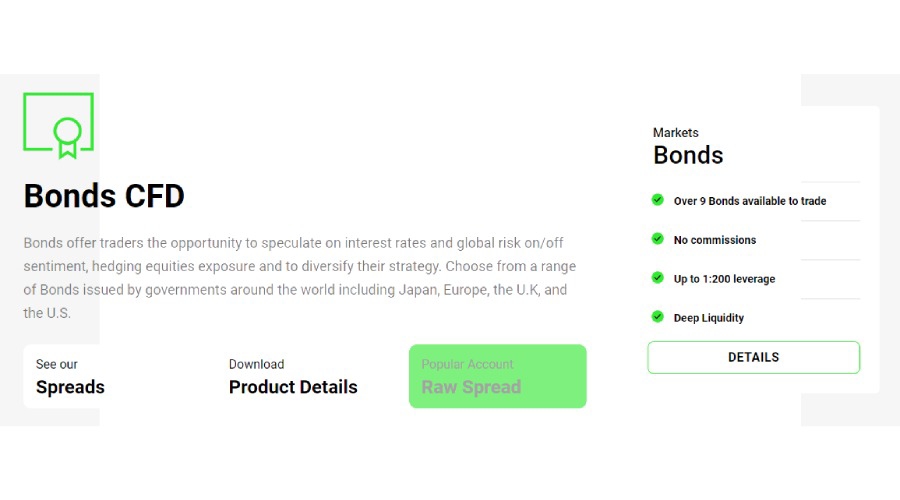

Bonds:

IC Markets also offers traders the option to invest in bonds and fixed-income instruments. On IC Markets, traders have access to 11 different bonds and fixed-income instruments such as US 10-year bonds, UK 10-year bonds, and German 5-Year Bonds. The best part about investing in bonds with IC Markets is that you don't have to pay any commission or fees.

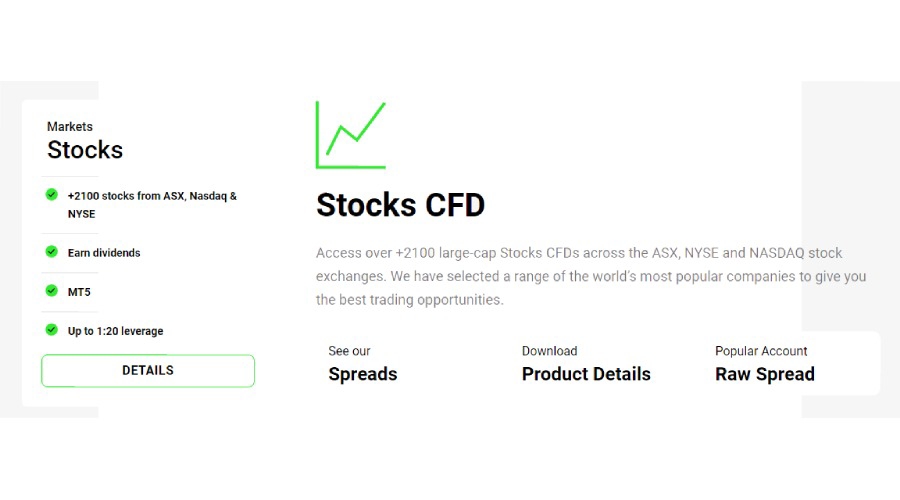

Stocks:

For those who prefer stocks, they have 2100+ stock CFDs to choose from. Popular stock CFDs you can trade on IC Markets are Apple, Amazon, and Alphabet Inc. With competitive leverage, traders can easily access stocks to take advantage of price movements. Stock trading lets traders speculate on stock prices in real-time with IC Markets. Moreover, with ASX stocks CFDs, traders can easily access the Australian stock market.

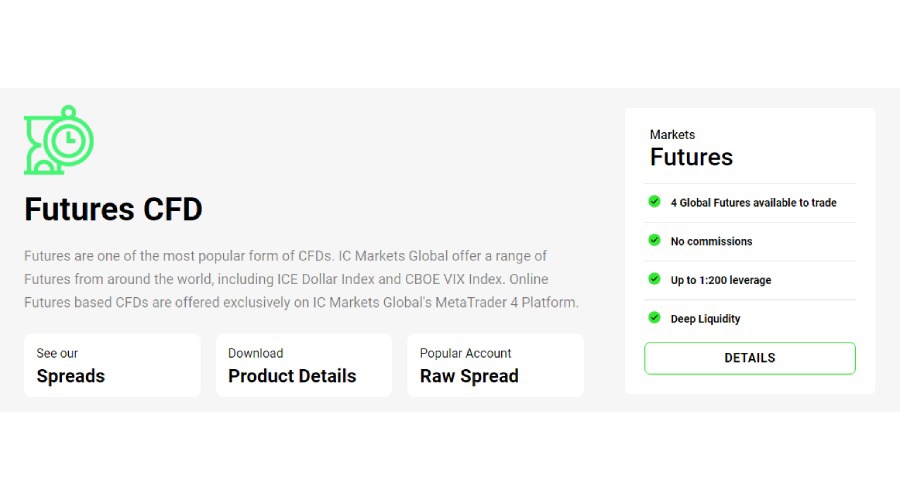

Futures:

IC Markets also allows its customers to trade four Future CFDs, which are ICE Dollar Index Futures, CBOE VIX Index Futures, Brent Crude Oil Futures, and WTI Crude Oil Futures. With Futures CFD, traders can easily make the most out of their investments by taking advantage of price movements.

Trading platforms at IC Markets:

IC Markets supports MetaTrader 4, MetaTrader 5, and cTrader. All these are professionally designed platforms packed with features and tools to help traders. Let's look at all the trading platforms available at IC Markets:

MetaTrader4:

MetaTrader 4 or MT4 is a popular and intuitive trading platform that is suitable for both beginner and advanced traders. The platform offers a range of powerful tools, including charts, indicators, Expert Advisors (EA), and more. It is available for both desktop and mobile devices, giving traders the flexibility to trade from anywhere in the world. With MT4, traders can access the different markets IC Markets offers, including Forex, commodities, indices, and more. The platform also provides a range of order types, enabling traders to quickly implement their strategies. Let's explore some advanced features of MT4:

Advanced position monitoring:

MT4 offers an advanced position monitoring feature, allowing traders to keep track of their open positions and view changes in market prices. The feature also allows traders to manage multiple positions on the same chart. Traders can also use the platform to set Stop Loss and Take Profit orders, limiting losses and maximising profits.

Expert Advisors:

MT4 also comes with an Expert Advisor (EA) feature, which allows traders to automate their trading strategies. Traders can create their own EAs or download ready-made ones from the platform and apply them to their trades. This feature is handy for traders who want to implement their strategies without manually monitoring the markets.

Variety of charts:

MT4 also offers a variety of charts, enabling traders to monitor the markets in real time. Traders can choose from different chart types and customise their charts with various studies and indicators. This feature allows traders to gain valuable market insights and make informed decisions when trading.

Add indicators:

Traders can also add indicators to their charts in MT4. Indicators are important tools that traders use to identify trends and make informed decisions when trading. The platform offers a range of indicators that can be used to identify market trends and make predictions about the future direction of prices.

MetaTrader 5:

MetaTrader 5, or MT5, is the successor to MetaTrader 4. It offers a range of features and tools that are designed to make trading more accessible and more efficient. The platform provides a range of order types, multiple charts, and various analytical tools that can be used to analyse the markets.

MT5 also offers advanced trading features, such as depth of market, one-click trading, and hedge trading. In addition, the platform is available for desktop and mobile devices, allowing traders to trade from anywhere in the world. Let's look at some advanced MT5 features that enhance your trading experience:

Economic calendar:

MT5 offers an economic calendar that helps traders stay updated on market events. The calendar provides detailed information about upcoming events and their potential impact on the markets. This information can be used to make informed decisions when trading and to plan their trades accordingly.

Advanced charts:

MT5 also offers advanced charts that allow traders to monitor the markets in real time. The platform provides a range of chart types, including candle sticks, line graphs, and more. Traders can also customise their charts and indicators, giving them the ability to gain valuable insights into the markets.

Open trades view:

MT5 also offers an open trades view that allows traders to monitor their open positions and view changes in market prices. The feature also allows traders to manage multiple positions on the same chart, making it easier to identify and execute profitable trades. This feature helps traders stay up to date on their positions and make informed decisions when trading.

Docked charts:

MT5 also offers a docked charts feature that lets traders view multiple charts simultaneously. The feature is particularly useful for traders who want to keep track of different markets and make informed decisions when trading.

cTrader:

cTrader is a popular trading platform developed by Spotware Systems. The platform is designed to meet the needs of experienced traders and offers a range of features and tools that make trading more accessible and more efficient.

The platform comes with various order types, multiple chart types, and advanced trading features such as market depth and one-click trading. The platform also offers a range of analytical tools, such as news feeds, technical indicators, and more. First, let's look at some IC Markets cTrader features:

Custom indicators:

cTrader allows traders to create custom indicators to monitor the markets. This feature is particularly useful for traders who want to use their trading strategies. The platform also offers a range of built-in indicators, such as moving averages and Bollinger bands, that can identify trends and make informed decisions when trading.

Algo trading:

cTrader also offers Algo trading, which allows traders to automate their trades. Algo trading will enable traders to set their own trading rules and parameters, which are then executed automatically by the platform. This feature helps traders save time and make informed decisions when trading.

Advanced charts:

cTrader also offers advanced charting tools that allow traders to view the markets in real time. The platform provides a range of chart types, including candle sticks, line graphs, and more.

Trading accounts:

IC Markets offers three types of trading accounts, which are as follows:

Raw Spread (cTrader):

This is the most popular trading account offered by IC Markets. It offers the lowest spreads in the market, starting from 0 pips. The commission per lot is $3.0/per USD 100K ($6.0 round turn). The maximum number of position orders per account is 2000, and the stop-out level is 50%.This Raw Spread account is ideal for traders who want to benefit from low spreads and commissions.

Raw Spread (MetaTrader):

This is an ideal account for EAs & Scalpers. It offers spreads from 0 pips, and the commission per lot is $3.5 ($7.0 per lot round turn). The maximum number of position orders per account here is 200, and the stop-out level is 50%. If you're looking for an account with low commissions, this is the ideal one.

Standard (MetaTrader):

If you are a discretionary trader, this is the account for you. It offers spreads from 1 pip with no commission. The maximum number of position orders per account here is 200, and the stop-out level is also 50%. This account can be excellent if you prefer to trade without commissions, as your costs will be much lower.

How to open an account?

Follow the below steps to open an IC Markets account:

Step 1: Go to the website and click on Open Account.

Step 2: Answer the questions about your personal details, financial status and trading experience .

Step 3: Select your trading account.

Step 4: Choose your deposit method and currency.

Step 5: Enter your investment amount and click on 'Confirm.'

Customer support:

One of the strongest points of IC Markets is its excellent customer service. They offer 24/7 multilingual support, with agents available in various languages such as English, Spanish, French, and German. In addition, traders can contact the customer support team via email, phone, or live chat. Their team is highly knowledgeable and always ready to help with any queries.

Education resources and tools:

IC Markets offers a comprehensive education center for traders, which includes webinars and video tutorials on how to use their platform. The education center also contains articles, news, and market analysis.

On top of that, the broker has an in-depth FAQ page and a glossary of trading terms. You. can also attend the IC Markets podcast that covers trading strategies, market news, and economic Events.

IC Markets in a nutshell:

IC Markets is a regulated broker headquartered in Sydney Australia. The broker offers a wide range of tradable instruments, including forex currency pairs, commodities, indices, bonds, stock CFDs, futures, and cryptocurrency CFDs.

The broker also offers three trading platforms – MetaTrader 4, MetaTrader 5, and cTrader. All of them are designed with a range of features and tools. Overall, IC Markets is a reliable broker offering competitive spreads and a wide range of tradable instruments.

FAQs

What is the minimum deposit on this platform?

The minimum deposit is USD 200.

Do IC Markets offer a demo account?

Yes, IC Markets offers a full-fledged demo account.

Is IC Markets a regulated broker?

Yes, the broker is fully regulated in Australia, and Seychelles.

Do they offer educational content?

Yes, they offer a comprehensive resources and tools section.

Can US residents open accounts with this broker?

US residents can not open an account with this broker.

How can you change my password on this broker platform?

You can change your old password by going to the client portal and clicking on the "change password" button.

What account types do they offer?

They offer three account types — Raw Spread (cTrader), Raw Spread (MetaTrader), and

Standard (MetaTrader).

Is this broker good for scalping?

This broker is suitable for scalping.

What are the deposit and withdrawal methods available?

Multiple deposits and withdrawal methods are available, including wire transfers and credit/debit cards.

How to open your account with the broker?

You can open your account with IC Markets by going to their website and filling out the easy registration form.

Does this platform support MT4 & MT5?

Yes, they support MT4, MT4, and cTrader also.

What are the spreads available on this platform?

The spreads start from 0.0 pips.

What is the minimum trade size for this broker?

The minimum trade size is 0.01 lots.

How to contact customer support?

You can contact their customer support via live chat, email, or call.

Full Breakdown Filters

Full Breakdown

Full BreakdownDisclaimer: The contents or products outlined on this page are provided by third parties and do not constitute an endorsement or any opinion by Finance Magnates. Finance Magnates has no control of the contents of this page, nor is responsible for its accuracy or legality and hereby waives any responsibility for this content. Any transactions, investments, or engagement that you enter into with a third party listed on this page or linked from this page are solely between you and such third party and are performed at your own risk. Finance Magnates holds no responsibility for any liability, damages, or losses caused in connection with the use of any content on this page.