By Giles Coghlan, Chief Currency Analyst at HYCM

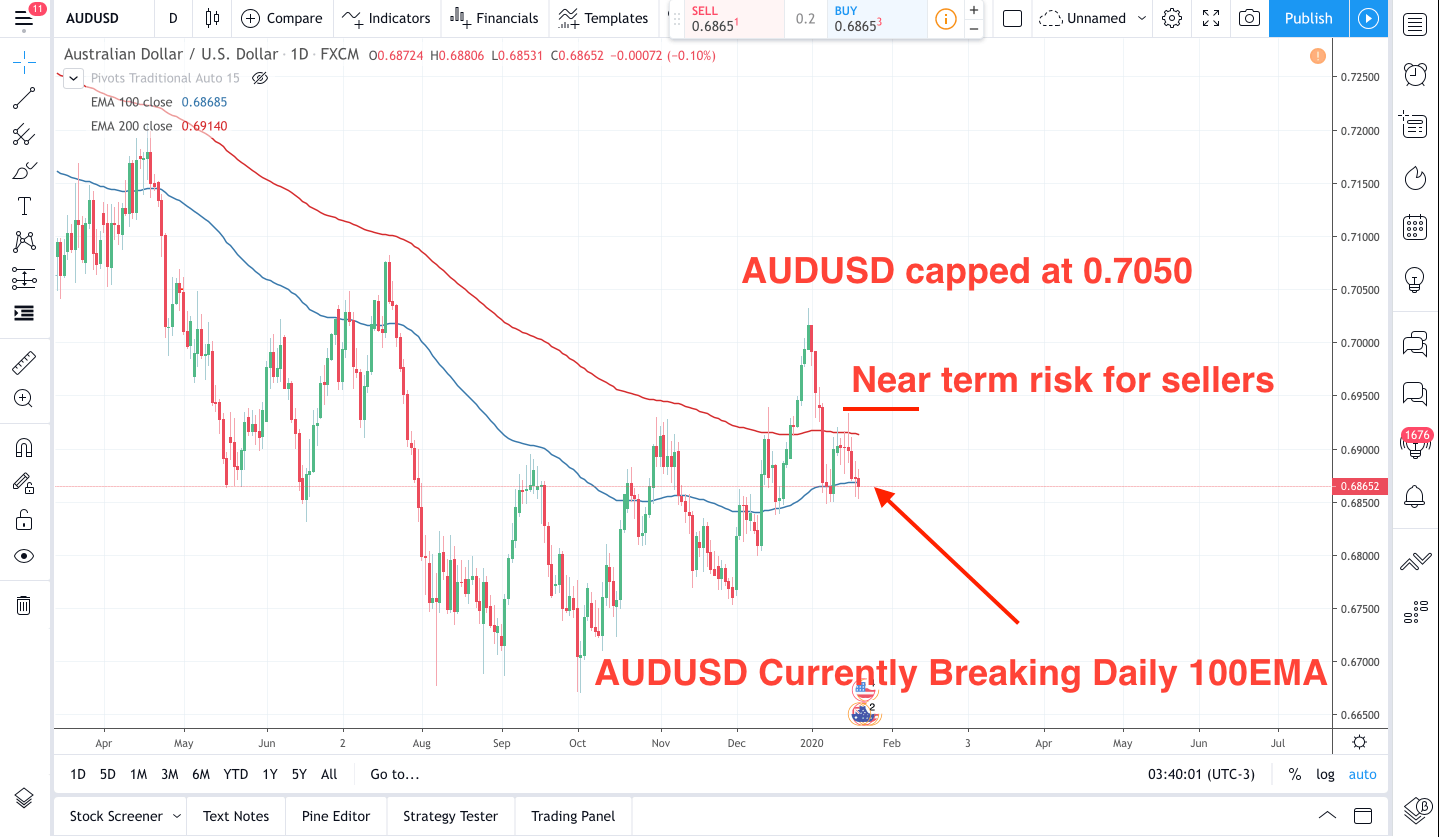

The AUD is continuing to be driven by developments between the US and China on trade and its domestic outlook. Although we have seen some positive AUD strength in the run-up to the signing of the US-China trade deal, the price has been capped underneath the 0.7050 handle. We will need some new, fresh positive US-China trade talk on phase 2 aspect of the deal to see any more AUD strength in the short term. In particular, look for headlines concerning Intellectual Property rights as this is a key issue to be discussed around phase 2 deals.

The monetary policy minutes from the RBA’s December meeting provided a case for rate cuts ahead if incomes remain pressured as the current level of wage growth is not seen to be enough by the RBA to reach their inflation goals. The employment release this week will be important for the AUD going forward and CPI data too out on January 29. Although the positive retail sales released last week have reduced chances of a rate cut in the near term, sadly we can expect some negative data to start coming through due to the devastating Australian bush fires. This will impact Australian employment levels, tourism to the country, and consumption.

Therefore, as a result of a weak Q4 2019 and the expected impact of bush fires the overall outlook for the AUD is bearish. If the RBA cut rates to 0.25% then that is the level at which QE may come into play, so bear that in mind. QE weakens a countries currency and would accelerate AUD downside. Presently, I am expecting AUD sellers on retracements.

Learn more about HYCM