By Giles Coghlan, Chief Currency Analyst at HYCM

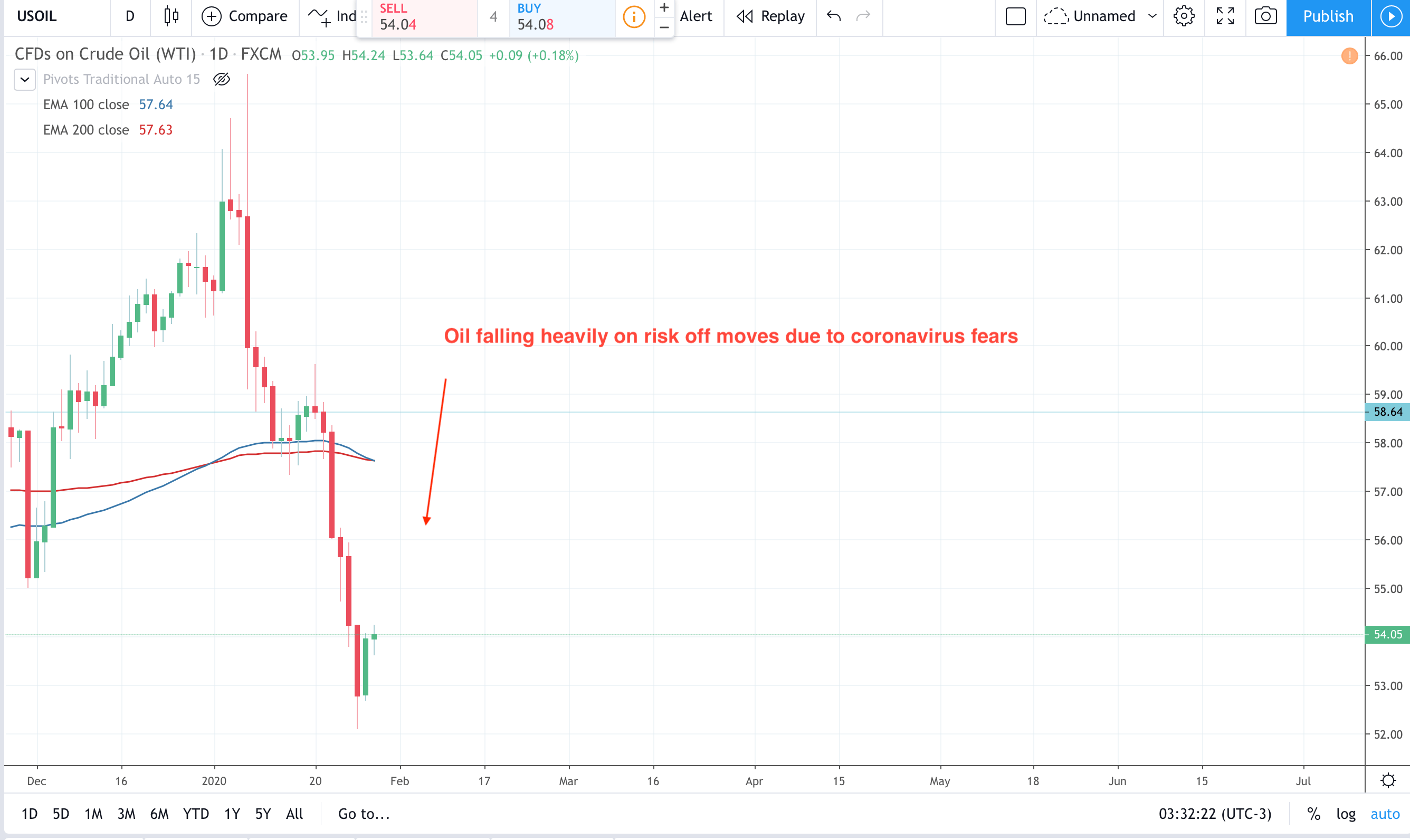

Oil has been heavily pressured lately on the coronavirus fears. The concern has been that a global pandemic will restrict the demand for oil. Less construction, air flights canceled, tourism reduced and cities on lockdown would all dampen the need for oil. This has, on top of an already well-supplied oil market, caused oil to fall as you can see in the chart below.

However, it is worth being aware of three factors that could support oil in the medium term:

1. There is a desire for by the OPEC- Russia partnership to agree to longer production cuts. These may even extend to 2020. Saudi Arabia always has the potential to talk up the price of oil by hinting at potential further cuts.

2. The People’s Bank of China is offering support when trading begins again on February 03 for local assets. So, this boost from the PBOC could well translate into a risk-on mood for US oil.

3. The geopolitical difficulties in Libya could halt production (causing oil prices to climb), Venezuela is thinking on a plan to privatise some oil assets. Iraq is volatile with a rocket attack this last week on Baghdad’s Green Zone.

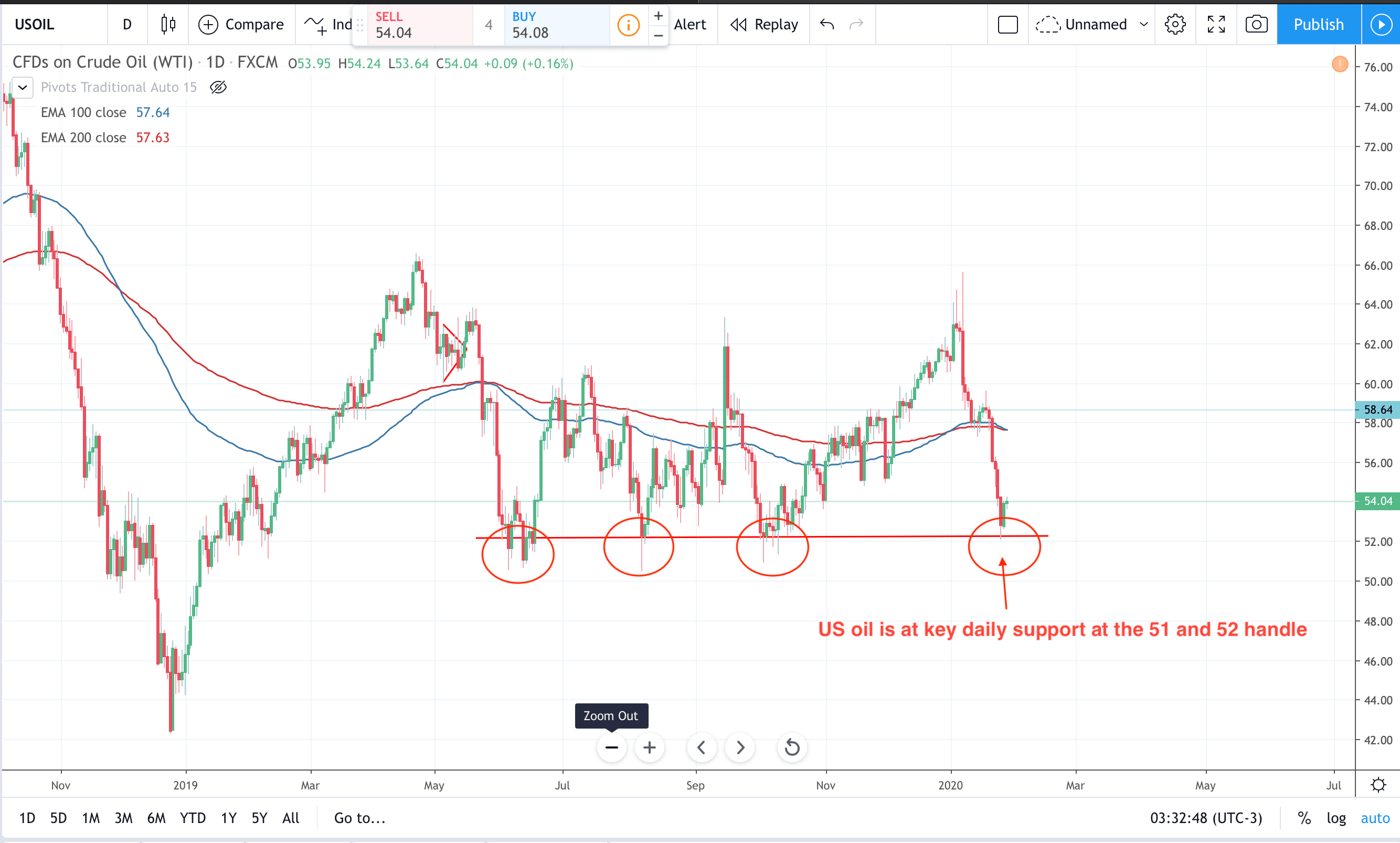

US oil at daily support

With US Oil at a key daily support level there is a technical place for oil longs should any of these factors above start to support oil prices. If coronavirus fears start to recede, then expect oil to be bought on a return to risk on growth.