By Giles Coghlan, Chief Currency Analyst at HYCM

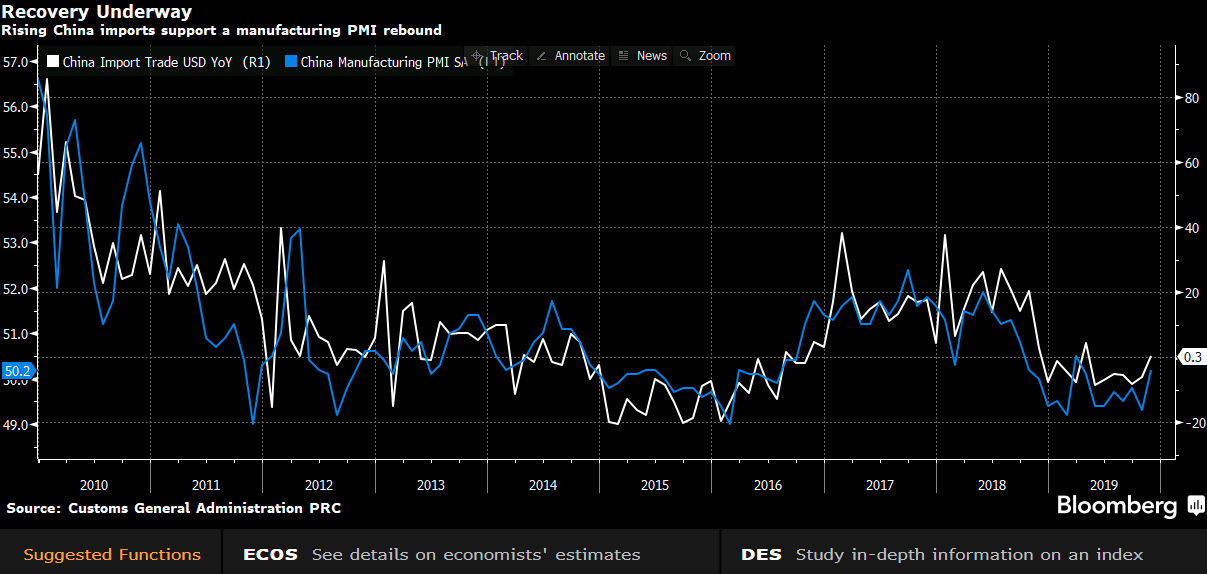

The fact that Chinese imports have been able to rise out of the short term range from the last few months is a positive sign and a number of folks have picked up on it. Exports had fallen as the impact of the US tariffs continued to be felt. However, there were signs that the recent US-China phase one negotiations had been calming purchasing managers which led to a rise in imported raw materials (china’s imports are often tied to raw materials). Imports were +0.3% y/y vs -1.4% and -6.2% prior. See chart below:

Here too is the link between rising imports and a rise in Chinese manufacturing PMI’s in the chart immediately below. The horse are imports and the cart is Chinese PMI’s. Remember too that the official and private PMI’s were both showing a beat this last month.

Dr Copper liked the vital sign of recovery and Shanghai Copper futures rallied 2% on Monday AM. Copper is Dr Copper so called because of its reliability, as an industrial material, in predicting the coming health of the global economy. So, there are some green shoots of recovery here. In order for this to grow in the near term we will need Trump to not put December 15 tariffs into action and further signs of growing imports from China. That will most likely come as long as trade talks keep going along. However, the outcome and progress of the talks are volatile and hard to forecast. Our inclination is that President Trump is quite happy with tariffs and is in no hurry whatsoever to make peace with China. China, on the other hand, is probably taking the long view and hoping to ride out Trump’s term or terms of office.

Learn more about HYCM