Preview Mode

- SEE LESS

- B2B Categories

- Industry Executives (287)

- Industry Websites (59)

- Regulators (23)

- Liquidity Provider (4)

- Payment Processors (3)

- Platforms (3)

- KYC (2)

- Regulation Consulting (2)

- Cryptocurrency Trading Solutions (1)

- CRM (1)

- Tools for Brokers (1)

- SaaS Provider (1)

- MT4/MT5 Bridge Providers (1)

- White Label Solutions

- Affiliate Programs

- Platform Providers

- Cryptocurrency Liquidity Providers

- Translation Services

- Trading Categories

- Subscribe to our Newsletter

- Suggest a company

- Contact Us

- Companies Home

- Company News

- Categories

- Trading News

- Company News

- Videos

- Search

- Add

Company

Minimum Deposit

- 0-50

Leverage

- 400:1

- 2000:1

- 500:1

- 200:1

- 3000:1

- 100:1

- 600:1

- 300:1

- 1000:1

- 20:1

- 30:1

Regulation

- CySec

- FSA

- FSCA

- FCA

Full Breakdown Filters

Full Breakdown

Full BreakdownCompany Review

Exness Review: Should They Be Your Broker?

| Regulation and License | FCA(United Kingdom), CySEC(Cyprus), FSCA(South Africa), FSSA(SC)(Seychelles), CBCS(Curacao and Sint Maarten), FSC(Mauritius), FSC(BVI) |

| Headquarters | Cyprus |

| Founding year | 2008 |

| Leverage range | Fixed Leverage depending on cryptocurrency |

| Min deposit | $10 |

| Platforms | MT4,MT5,Exness Terminal, Exness mobile app |

| Tradable Instruments | CFDs on Cryptocurrencies, currencies, energies, metals, Indices, Stocks |

| Demo account | Yes |

| Base Currencies | AED, ARS, AUD, AZN, BDT, BHD, BND, BRL, CAD, CHF, CNY, EGP, EUR, GBP, GHS, HKD, HUF, IDR, INR, JOD, JPY, KES, KRW, KZT, MAD, MXN, MYR, NGN, NZD, OMR, PHP, PKR, QAR, SAR, SGD, THB, UAH, UGX, UZS, VND, XOF, ZAR |

| Customer support | 24/7(English, Chinese, Thai) |

| Sun 18:00 - Fri 18:00(Indonesian, Arabic, Hindu, Urdu, Bengali, French, Spanish, Portuguese) | |

| Sun 18:00 - Fri 12:00(Vietnamese) | |

| Sun 18:00 - Fri 10:00(Japanese) | |

| Sun 22:00- Fri 06:00 (Korean) | |

| Mon - Fri 00:00 - 16:00(Russian) | |

| Active Clients | 301,575 (March 2022) |

| publicly traded | No |

| Crypto | Yes |

| Website | https://www.exness.com/ |

Introduction

Exness is a forex and multi-asset broker that offers services in most countries except the US and some other jurisdictions. It is able to maintain this global presence thanks to a network of no less than six offices around the world. This broker was founded by Igor Lychagov and Petr Valov back in 2008, giving it a long history.

It stands out among CFD brokers by having several offices around the world and several licenses and regulations by various authorities. Over the years, the broker has garnered a solid reputation with its clients and the global base of traders, primarily due to its data-driven approach to designing products and its ethical approach to doing business.

| Pros | Cons |

| Instant withdrawals | No trading or welcome bonus |

| Transparency (tick history, etc.) | No proprietary Exness EAs |

| Wide range of payment systems in local currencies | Partner reward is lower compared with other brokers |

| Highly regulated | No ECN accounts |

| Excellent customer service | No education for newbie traders |

The broker provides traders worldwide with new opportunities to improve their trading skills and a chance to experience new financial products and services. Keep reading to learn more on what we found during our review of Exness forex broker.

Trading at Exness is done via its proprietary Exness Terminal, or clients can opt to use the famous MetaTrader 4 and MetaTrader 5 platforms. The company, at the time of writing, offers 97 currency pairs, 98 stocks, 10 indices, 27 cryptocurrencies, and 7 metals and energies, with its assets offering constantly expanding. It has a low minimum deposit of $10

and is one of the few brokers that accept cryptocurrencies. A lack of non-trading fees is another bonus of trading through them. Let’s take a deeper look through our Exness broker review.

Exness Safety Review

As part of our general review, we determined that the forex broker has licenses and regulations through a number of leading international governing bodies, assuring its traders that their trading activity and funds are fully protected and secured.

- Exness (SC) Ltd is a Securities Dealer registered in Seychelles with registration number 8423606-1 and authorized by the Financial Services Authority (FSA) with license number SD025.

- Exness B.V. is a Securities Intermediary registered in Curaçao with registration number 148698(0) and authorized by the Central Bank of Curaçao and Sint Maarten (CBCS) with license number 0003LSI.

- Exness (VG) Ltd is authorized by the Financial Services Commission (FSC) in BVI with registration number 2032226 and investment business license number SIBA/L/20/1133.

- Exness ZA (PTY) Ltd is authorized by the Financial Sector Conduct Authority (FSCA) in South Africa as a Financial Service Provider (FSP) with registration number 2020/234138/07 and FSP number 51024.

Risk Warning: The Exness services relate to complex derivative products (CFDs) traded outside an exchange. These products come with a high risk of losing money rapidly due to leverage and thus are not appropriate for all investors. Under no circumstances shall they have any liability to any person or entity for any loss or damage in whole or part caused by, resulting from, or relating to any investing activity.

Exness Fees

Our Exness review found no inactivity fee, and there are no withdrawal fees, the deposit fee however depends on payment system.

Are Fees at Exness Competitive?

We consider the fees at Exness to be competitive. In addition, the broker deserves credit for having minimal non-trading and swap fees.

| Fees Type | Standard | Raw Spread | Zero | Pro |

| Deposit Fee | Depends on payment system | Depends on payment system | Depends on payment system | Depends on payment system |

| Withdrawal Fee | No | No | No | No |

| Commision Fee | No | $3.50 each side per lot | $0.2 each side per lot | No |

| Swap Fee | *Available | *Available | *Available | *Available |

*No swap fee on indices, stocks, cryptocurrencies and the following: AUD/NZD, AUD/USD, EUR/CHF, EUR/USD, GBP/JPY, GBP/USD, NZD/USD, USD/CAD, USD/CHF, USD/JPY, USOIL, AUD/CHF, AUD/JPY, EUR/AUD, EUR/CAD, EUR/GBP, EUR/JPY, EUR/NZD, GBP/CHF, GBP/NZD, NZD/JPY, NZD/CAD, XAU/USD

Exness Spread Overview

Spreads were important to us when we decided to review Exness. The broker advertises low spreads in all its asset classes, with forex spreads on its Zero account beginning at 0 pips and spreads for other asset classes remaining competitive within the industry.

Looking through the available data on spreads at Exness through their Standard account, we did find most spreads are reported to be within the normal ranges you will find throughout the industry. For example, spreads on the heavily traded EUR/USD pair seem to remain at the 1 pip level.

In contrast, the more lightly traded GBP/JPY pair will typically see spreads of 2 pips. Spreads for most stocks are under 1 pip and can be as low as 0.1 pip, which is quite good. Spreads for oil and gold are also very competitive. The outlier is in index trading, where we encountered spreads above 6 pips for the DAX and over 7 pips for the Dow 30.

Overall we feel that the spreads at Exness for most asset classes are quite competitive within the forex and CFD industry. It is worth noting that they utilises algorithms and data science to constantly improve its commissions being offered and always provide low and stable spreads even at times of volatility.

Exness Swap Rates

Our Exness forex review determined that clients can trade stocks, crypto, indices, gold, and some popular currencies free of swap fees. This will also depend on the trader’s account settings. In addition, clients, even in non-Muslim countries, trade swap-free accounts which are separated into the Standard and the Extended swap-free levels. The difference between the two is the number of instruments that can be held overnight free of swap fees.

The standard swap-free level applies strictly to stocks, cryptocurrencies, indices, and XAU/USD. However, all other instruments do have swap fees.

The extended swap-free level gives trades access to all the following currency pairs free of swap fees: AUD/NZD, AUD/USD, EUR/CHF, EUR/USD, GBP/JPY, GBP/USD, NZD/USD, USD/CAD, USD/CHF, USD/JPY, USOIL, AUD/CHF, AUD/JPY, EUR/AUD, EUR/CAD, EUR/GBP, EUR/JPY, EUR/NZD, GBP/CHF, GBP/NZD, NZD/JPY, NZD/CAD, XAU/USD In addition, there are no swap fees for indices, cryptocurrencies, and stocks. However, swap fees are charged for all other instruments on the platform.

All clients trade on an Extended swap-free account, and based on their trading behavior, they can either keep their status or switch to the Standard.

Exness Deposit and Withdrawal

Deposits and withdrawals are always a tricky subject when dealing with brokers. Of course when we chose to review Exness we took a close look. Everyone expects these transfers to be immediate, but in reality, the payment processors often determine the speed at which funds are transferred.

In addition, traders sometimes feel as if they are being charged hidden fees, however, these fees are also often from the payment processor. the broker charges no deposit or withdrawal fees, but cannot guarantee that these payment processors do not have their own transaction fees.

Deposit and Withdrawal Methods

Our Exness broker review found that they provide a good variety of deposit and withdrawal options. These include all the following:

- USDT/Tether

- Bitcoin

- Bank Card

- Perfect Money

- Neteller

- Web Money

- Skrill

- SticPay

- Internal Transfer

One of Exness’ core advantages is the wide list of payment providers it offers in different regions. Each trader will see the available deposit and withdrawal methods in their own Personal Area within the trading platform. There are also minimums for all the deposit and withdrawal methods, which we cover in greater detail below.

The processing time of the deposits and withdrawals will depend on the method used. It is worth mentioning that all withdrawal requests on Exness’ side are processed within a few seconds and any delays are subject to the payment provider of choice.

This does not guarantee that a withdrawal will complete instantaneously, but that the process is begun instantly. If a deposit or withdrawal is not carried out instantly, it will be completed within 24 hours (or at a different timeframe as provided on the Company’s website).

Below is a chart showing the processing times for withdrawals from the providers’ side.

- Instant: Perfect Money, Neteller, WebMoney, Skrill

- Up to 4 hours: Bitcoin

- Up to 72 hours: Both Internet Banking as well as USDT/Tether

- 3 – 5 business days: Bank Card

Minimum and Maximum Deposit and Withdrawal

As seen above they have a good variety of deposit and withdrawal methods, and an acceptable Exness withdrawal period, making both funding accounts and withdrawing profits convenient for traders. Another benefit of a number of the deposit and withdrawal methods is that they are done without manual processing involved, allowing them to move forward even on weekends. And of course, there are no deposit fees or withdrawal fees. All of this weighed positively in this part of our Exness withdrawal review.

| Deposit/Withdrawal Method | Minimum Deposit | Minimum Withdrawal |

| Tether | $10 | $0 |

| Bitcoin | $10 | Blockchain fee |

| Bank Card | $10 | $3 |

| Skrill | $10 | $10 |

| Neteller | $10 | $4 |

| Perfect Money | $10 | $2 |

| StickPay | $10 | $1 |

| WebMoney | $10 | $1 |

Exness Tradable Markets and Products

The available assets for trading can have a large impact on the decision on whether a broker is suitable for a trader. In this section will take a look at the offerings at Exness, including the variety of the available asset classes and instruments. Traders can look here to see if the brokers' markets offer the instruments they are wishing to trade.

In general, we did find that they have a solid range of instruments available, including forex, stocks, indices, metals, energies, and cryptocurrencies. That said, you will find other brokers who have a larger range of available instruments, however, it is difficult to find a broker of this caliber specifically on the ethical way it does business and the quality of its products.

Note: that the products offered by the Exness broker are CFDs (Contract for Differences). These are financial derivative products. They allow traders to speculate in various markets without owning the underlying assets. The instruments available for trading include the following:

- Currency Pairs CFDs: Over 97 different currency pairs are available, which includes all the major and minor pairs, along with a healthy number of exotic pairs.

- Indices CFDs: 10 of the leading global stock indices are available on the Exness platform.

- Cryptocurrencies CFDs: The broker offers 27 different cryptocurrencies, which is one of the largest offerings you’ll find at a CFD broker.

- Stock CFDs: There are 98 stock CFDs on offer at Exness. Remember that when trading stock CFDs you are only speculating on the price of the underlying stock, you do not have any ownership interest in the companies.

- Commodity CFDs: They offer 7 commodity CDFs in the metals and energy complexes.

Please note that the list of assets being offered by them is constantly expanding.

Exness Leverage Offered

Leverage is what allows a trader to get exposure to a much larger position than they might have the available capital for in their account. Leverage can greatly increase the profit potential for any trade, however, the reverse is also true, it magnifies the potential losses if the trade goes against the trader.

At Exness broker, traders can take advantage of unlimited leverage in some cases, however, the amount of leverage available is limited in many cases by a number of factors. These include regulatory requirements, the trader’s jurisdiction, the size of the trader’s account, and the asset being traded. Because leverage has the potential to magnify both profits and losses, traders should always take care to use the appropriate amount of leverage in line with their trading experience and their risk profile.

The forex broker offers unlimited leverage on all accounts and gives its clients access to a calculator that works out the maximum leverage and margin requirements according to the trader’s current level of account equity.

| Equity | Maximum available leverage |

| USD $0 - $999 | 1:unlimited |

| USD $1,000 - $4,999 | 1:2000 |

| USD $5,000 - $ 29,999 | 1:1000 |

| USD $30,000 or more | 1:500 |

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Available Exness Trading Platforms and Tools

Trading platforms are where trades are carried out, making them a critical part of the broker experience. Platforms must be secure, fast, and accessible while offering all the tools necessary to succeed in the fast-paced world of financial trading. Our review found that they offer their proprietary Exness Terminal platform, which is both feature-rich and user-friendly.

In addition, MetaTrader 4 and MetaTrader 5, which offer a broader range of order types and systematic trading are also available. Below is a more detailed description of all of these trading platforms. Note that there are no fees for using any of the trading platforms.

Exness Terminal

The Exness Terminal is a web app requiring no download. Traders can easily access it through all the major internet browsers. Built with the latest HTML 5 technology, it offers traders an intuitive interface and popular features such as watchlists, 1-click trading, and trading from the chart. The well-known TradingView service provides charting capabilities and traders will find that the platform is robust, with 50 drawing tools, 100 indicators, 9 time-frames, and 7 chart types.

There are also a wide variety of order types available within the platform, allowing each trader to customize their entry and exit strategy. Available order types include market orders and pending orders (buy limit, buy stop, sell limit, sell stop, buy stop limit, sell stop limit, take profit and stop loss). Unfortunately, trailing stop orders and time in force orders (such as GTC) are not available on the Exness Terminal.

Traders will appreciate some of the unique features baked into Exness Terminal, such as a sentiment indicator that tells you the percentage of buy and sell orders that were recently opened by traders using them. Testing this platform was a satisfying part of our review.

MetaTrader 4 & MetaTrader 5

Experienced traders will likely be pleased to find that the broker offers the world-class MetaTrader 4 and MetaTrader 5 platforms for desktop. These two platforms are extremely well-known and extensively used throughout the forex and CFD industry. They also include advanced functions such as copy trading and automated trading.

MetaTrader 5 is available in 31 languages. The platform provides powerful features such as:

- Trading from the chart: Traders are able to easily take advantage of the convenience of trading directly from their charts.

- One-click trading: With this feature traders can execute their orders with a single click, saving precious time. This is especially useful for short-term trades, where every tick is of importance.

- Alerts: Traders can set custom alerts in the platform that will alert them when an instrument reaches the specified price level. Furthermore, alerts can be delivered via audio, email, or push notification to a mobile device.

- Watchlists: MetaTrader 5 includes the ability for traders to set watchlists of their favourite instruments. They can also follow live quotes in a panel called Market Watch.

Order Types

MetaTrader 4 and MetaTrader 5 offer a wide range of order types to make trading more effective. The following order types are available:

- Market Order: This is an order to buy or sell an instrument at the current best available price.

- Limit Orders: This is a type of pending order set in a direction opposite to what is profitable to increase profits.

- Stop Order: This is a type of pending order set in the profitable direction of an order allowing a trader to test if the trend of the market is profitable. This includes Trailing Stop Orders that can be set at a defined percentage or dollar amount away from the instrument's current market price and it’s useful for securing profits when the trader is in a winning trade, while not having to exit the position.

Charting

Charting is crucial for identifying key technical levels, entry levels, and exit levels. MetaTrader offers the following charting features:

- 38 technical indicators: These include classic trend indicators, volume indicators, and oscillators.

- 44 analytical objects: These include lines, channels, Gann, and Fibonacci tools.

- 21 time frames: Each instrument can be displayed in nine-time frames, from one minute to one month.

- 3 chart types: Traders can choose between Bar Charts, Japanese Candlestick Charts, and Line Charts.

Mobile Trading

Besides offering MetaTrader 4 and 5 for mobile, the broker also offers their proprietary mobile app, Exness Trader.

The Exness Trader app is available for iOS and Android and provides access to over 200 instruments. The interface of the app is both user-friendly and intuitive, making it perfect for beginners and experienced traders alike. The app provides access to instant deposits and withdrawals and 24/7 customer support.

The app features two chart types (line and candle), 7 timeframes (M1, M5, M15, M30, H1, H4, D1) and classic indicators such as Moving averages, Bollinger Bands and Parabolic SAR. Order types within the app include market orders and pending orders such as limit orders and stop loss orders. Exness Trader also features an economic calendar, market news and trade ideas from Trading Central, making it an extremely powerful app.

Exness Account Types

Our research found that they follow the trend in forex and CFD brokers by making a number of account types available to its clients. This means that there’s an account that’s suitable for any level or type of trader.

The various accounts come with their own rules regarding margin calls, commission, and fees, among other conditions. Traders choose their account type during the registration process.

Here are the 4 types of accounts at the Exness broker:

- Standard

- Raw Spread

- Zero

- Pro

Standard

The Exness Standard account is the base account that’s been created for everyone from beginners to expert traders. The broker states that roughly 80% of its clients opt for the Standard account. Here are some of the features and conditions involved with the Standard account:

- Minimum deposit of $10.

- Minimum trading volume of 0.01 lots.

- Spreads start at 0.3 pips for major currency pairs.

- No commission fees.

- Unlimited leverage.

- Market order execution.

Raw Spread Account

The Raw Spread account resembles the Zero account in a number of ways, however, the spreads are not as low, and Exness commission fees are a bit higher. Here are some of the features and conditions involved with the Raw Spread account:

- Minimum deposit of $200*.

- Minimum trading volume of 0.01 lot.

- Spreads start at 0 pips for major currency pairs.

- Commission up to $3.50 for each side per lot.

- Unlimited leverage.

- Market order execution.

Zero

The Zero account connects traders to a top-notch professional trading experience. It gains its “Zero” designation because it comes with spreads that approach zero. It’s an ideal trading account for expert traders looking to get the most from the markets. Here are some of the features and conditions involved with the Zero account:

- Minimum deposit of $200*.

- Minimum trading volume of 0.01 lots.

- Spreads start at 0 pips for major currency pairs.

- Commission from $0.2 each side per lot.

- Unlimited leverage.

- Market order execution.

Pro Account

The Pro Account takes things to the next level and is considered to be the best choice for experienced and professional forex traders. The Pro Account brings a number of generous trading conditions for Exness clients. Here are some of the features and conditions involved with the Pro account:

- Minimum deposit of $200*

- Minimum trading volume of 0.01 lots.

- Spreads start at 0.1 pips for major currency pairs

- No commission fees

- Unlimited leverage

- Instant order execution for forex, metals, energies, stocks, indices, and market orders for crypto

*Based on the region.Refer to the company’s website for up-to-date information.

Exness Account Registration

We’ve opened an account as part of our Exness broker review and found that registering an account at Exness couldn’t be simpler. The steps to follow are just four:

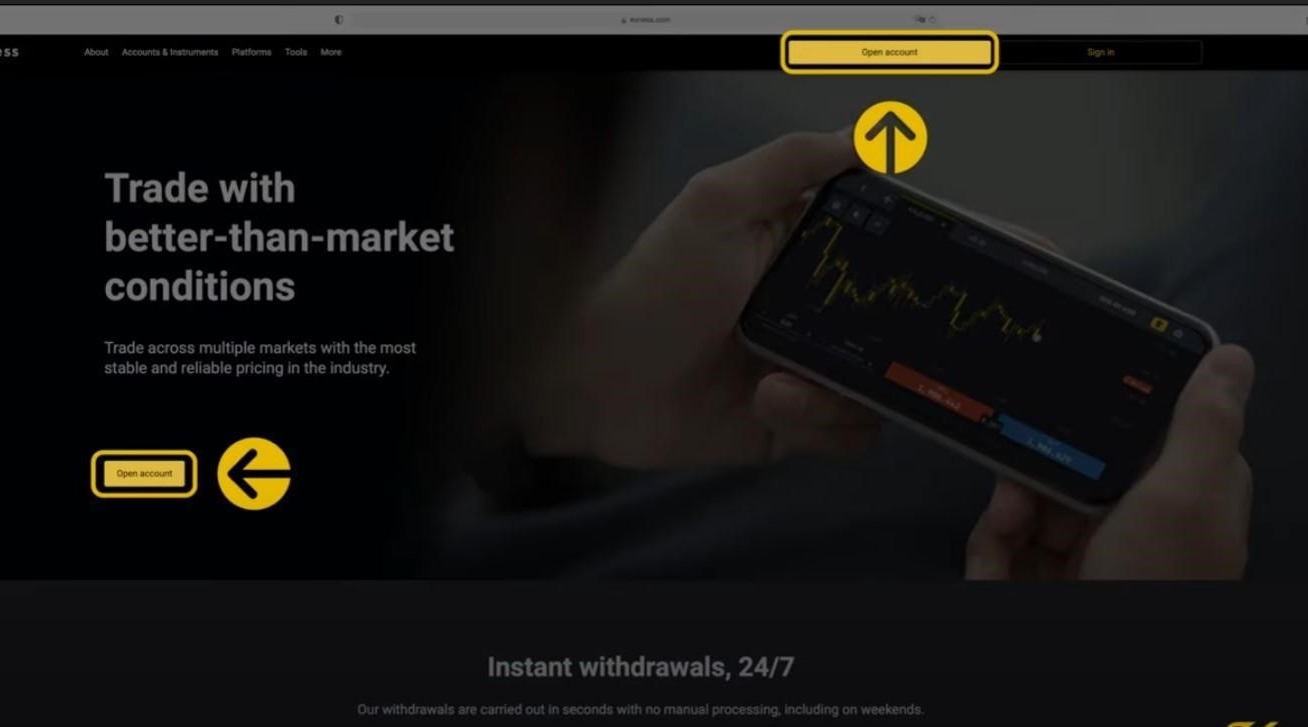

Step 1: Go to the Exness website at https://www.exness.com/. Click on the yellow

“Open Account” button at the top right of the page.

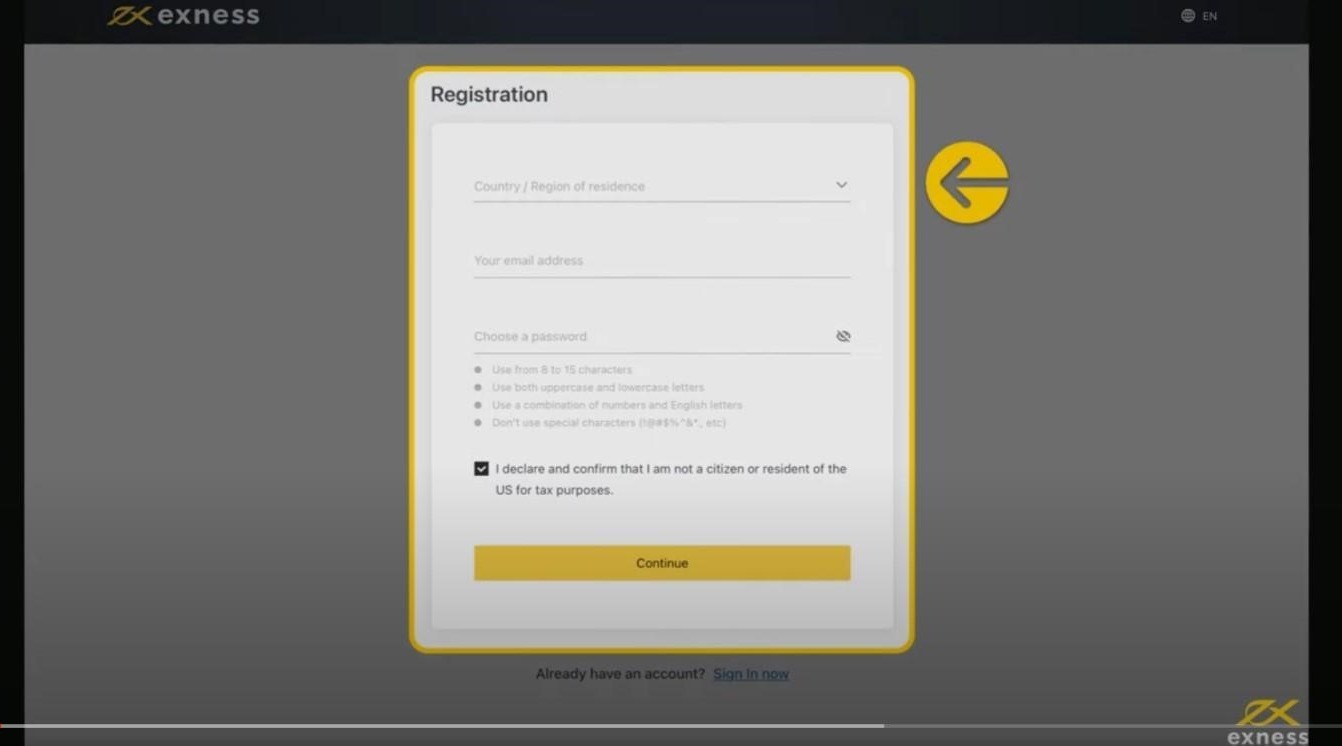

Step 2: You will be required to fill country of residence, email, and passwordwhile registering. Do note down the email which you used along with the password as the same would be required later on the Exness website and the Exness Trader app. Next, you would be required to fill in your personal details.

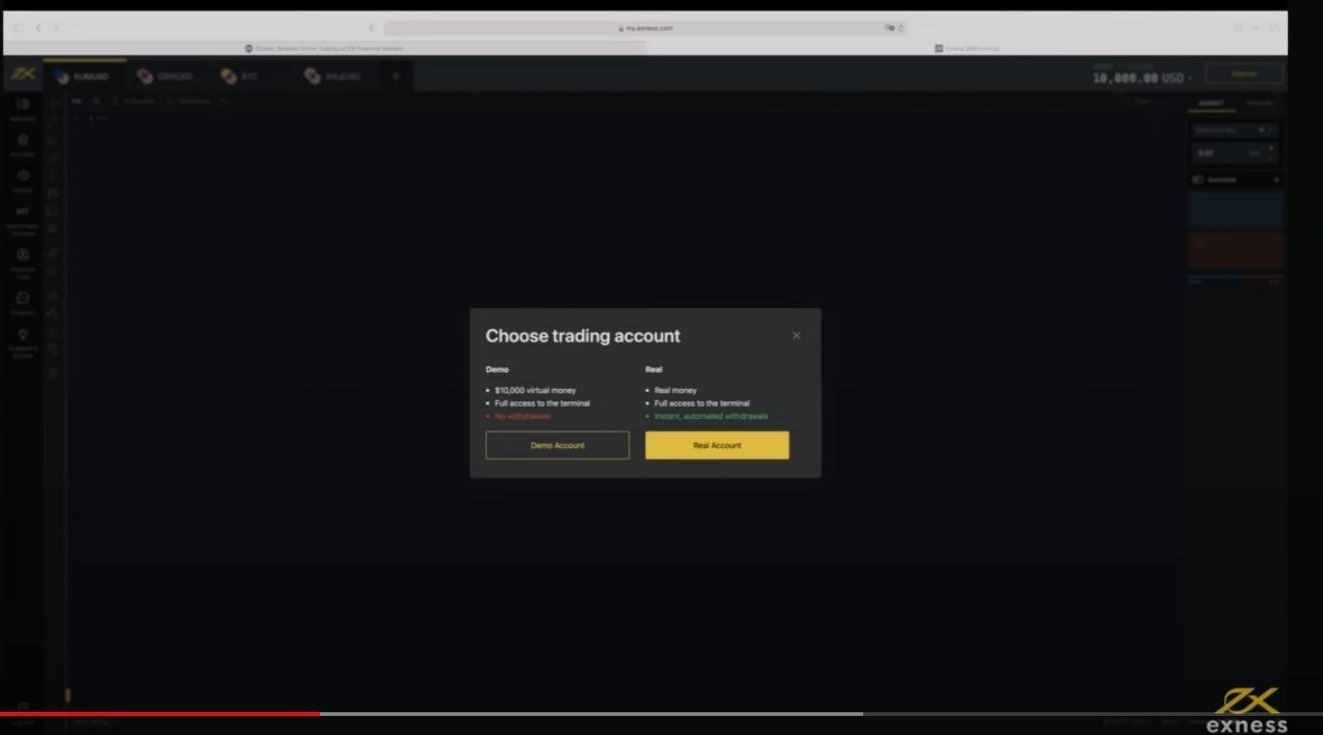

Step 3: Once the personal details are submitted the applicant will move to the next page where they can choose between a demo account and a real money account. If the real money account is chosen then they will have to select the account type.

Note: Users can create multiple accounts, and with each new account different account type can be selected by the trader based on currency, leverage, and more.

Step 4: For complete access to the trader account, an investor or trader would need to complete KYC and submit documents as required for onboarding.

Exness Customer Support

When we decided to review Exness, customer support was actually one of our first points of focus. While you might not think customer support is an important consideration, we’re sure you’ll quickly change your mind when you encounter a situation where customer support is needed. Our review takes this seriously, which is why we’ve taken the time to investigate the support methods and times, as well as the responsiveness and professionalism of the customer support team.

Their support is somewhat unique in the broker industry as it’s available 24 hours a day, seven days a week. Compare that with the majority of brokers who only offer support Monday through Friday. Exness also goes the extra mile by offering support in 15 different languages. Support can be reached via email, chat, and phone.

When you contact support via chat you’ll start out with a chatbot. If the bot is unable to answer your question or resolve your concern you’ll be sent to a live representative. When we tested the live chat functionality we waited less than one minute to be connected. We asked a variety of questions and received polite, knowledgeable responses in all cases. We also tested email support and found it takes several days to receive a reply in some cases. If you need immediate assistance we recommend you use either online chat or the telephone option.

Research Tools Offered by Exness

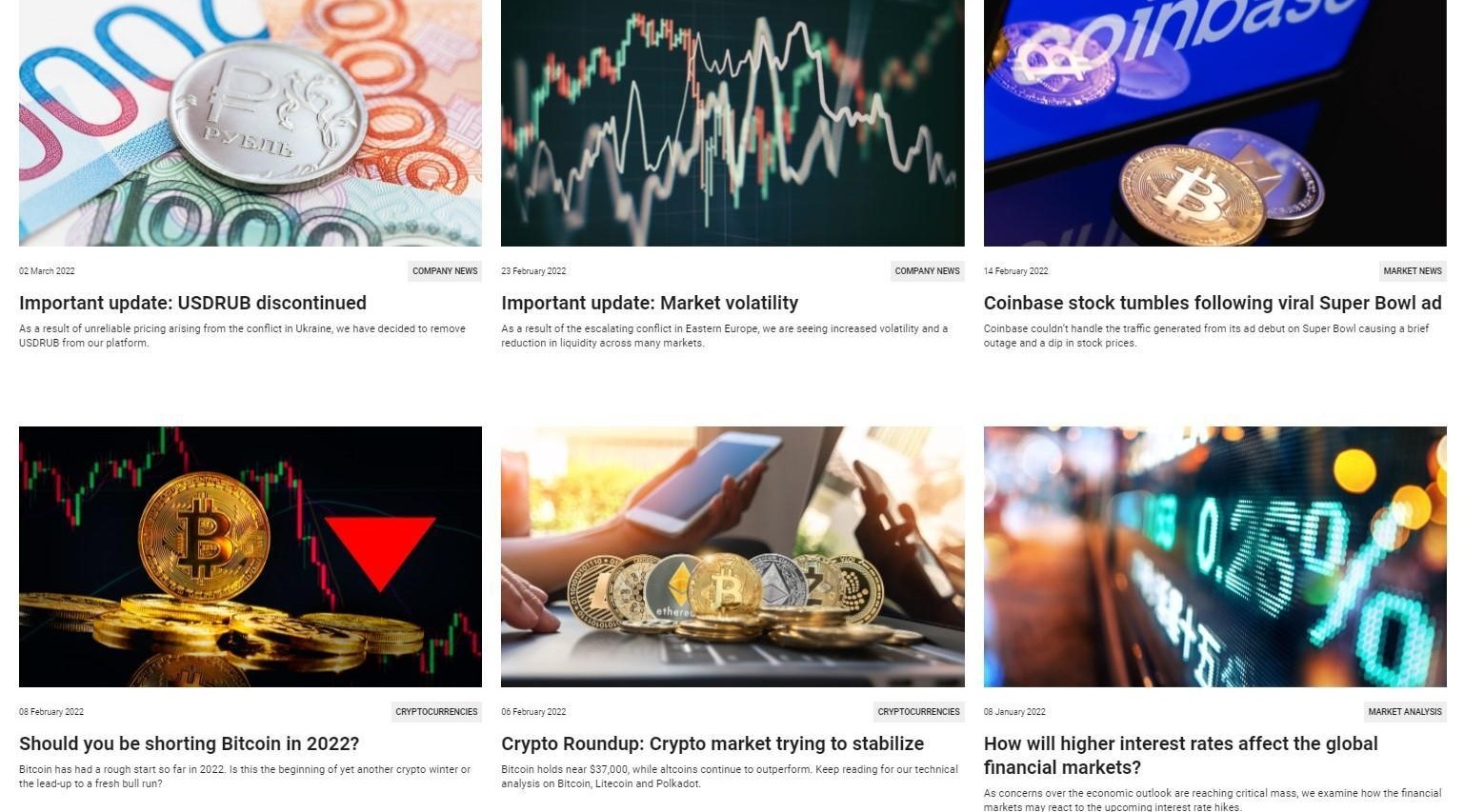

It’s true that you can get research at a number of places online, but it’s always convenient when your broker offers a research package. Having research embedded in your trading platform might mean you don’t ever miss important news or other announcements that could impact your trading. As part of our Exness general review, we found that they fulfill this need by offering a broad range of research materials both in the Exness Terminal platform and the Exness Trader App.

Traders have access to breaking market news right within their Personal area. This is a real-time news feed that includes all the updates from the FXStreet Insights Team. The stories break down the key themes and also offer technical insight in the form of major support and resistance areas.

In addition, traders can stay on top of key economic events with the economic calendar on their website. The calendar shows the expected impact of the economic release, the actual figure, the analyst forecast, and the figure from the prior release.

Exness clients can also take advantage of trading signals by Trading Central. These are located in the Personal Area of the trading platform in a section called Analyst Views. The area is broken down into sections for all the major asset classes. Analysis draws from technical analysis, giving traders major support and resistance areas that can be used to help determine entry and exits for trades. The trading data presented can be used in either intra-day trading or longer trades.

Trading Central WebTV is also available via their website. Daily videos provide market commentary and trading ideas, along with news coming directly from the floor of the New York Stock Exchange.

Educational Tools Offered by Exness

Often overlooked, education is a cornerstone of success when it comes to trading. That’s why our review takes a look at the educational offerings at the broker. What we found is that they offer little in the way of education for traders. There is a blog, but it is infrequently updated and not the best educational resource.

While Exness’ education resources are limited it is worth noting that the forex broker targets more experienced traders overall.

Exness Unique Features and Awards

Awards

With a history stretching back to 2008, it should come as no surprise that Exness has often found itself being recognized and awarded for various aspects of its business as a broker. When outside organizations decide to review brokers, Exness often comes out on top. The most recent awards we could find:

- Best Customer Support Award at Financial Markets Expo Cairo 2021.

- Premium Loyalty Program Award at Financial Markets Expo Cairo 2021.

- Most Innovative Broker at Dubai Expo 2021.

- Most People-Centric Broker at Traders Summit 2022.

- Global Broker of the Year at Traders Summit 2022.

Exness Partnership

The Exness Partnership Program allows anyone to create a passive income stream by referring others to trade with them.

Simply go to https://www.exnessaffiliates.com/, choose the program you prefer, and create an account. Once the account is created, you receive a unique partner link to use for referrals. Below are the various types of partnerships available with them.

Partners

- Trading partner: A partner’s main task is to sign up as many clients as possible using their partner link.

- Advanced Partner: partners who receive an increased reward when their clients trade under Standard Cent and Standard accounts. The reward size is 25% for such trades.

- Introducing Broker: More experienced partners attracting a large number of clients can achieve Introducing Broker (IB) status. IB is eligible for rewards from level I and II. The reward size is from 33% - 40% for level I and 3%-7% for level II.

- Regional representative: IBs can apply to become Regional Representatives (RR). The requirements for becoming RR ensures that RRs already have a base of clients who have a high trading volume.

Affiliates

- CPA: Cost per action (first time deposit)

- CPL: Cost Per Lead (new client verified registration)

Exness Review Final Thoughts

Exness is a well established broker, with a long history and some unique offerings. The limited swap fees are certainly attractive, and clients surely appreciate the ability to make instant withdrawals from their accounts, which is something you won’t find at many brokers. In addition to the basic MetaTrader platforms, the broker has also taken the time and expense of creating their own powerful and user-friendly platform.

And the inclusion of multiple account types and strong research tools makes this a broker that’s suitable for beginners, intermediate traders, and professionals. Advanced traders should be particularly drawn to the massive leverage available, along with the tight spreads and advanced tools. We were pleased to review Exness, and hope you’ve found it useful.

FAQ

Is Exness a good forex broker?

Based on our review we believe that Exness is a good broker offering a wide range of asset classes beyond just forex. This is based on their excellent conditions, low spreads and fees, unique offerings, and regulation through major global regulators. Their claims of a frictionless trading experience do not fall short or disappoint. Others agree, and most of the Exness forex broker reviews we found give them a high rating.

Does Exness have Nasdaq?

When looking at the indices offered at Exness and examining access to Nasdaq 100, we see that they offer the US TECH 100 index rather than the Nasdaq 100.

Is Exness regulated?

Exness is regulated by a number of global regulators. These regulating bodies and jurisdictions are FCA (United Kingdom), CySEC (Cyprus), FSCA (South Africa), FSA (Seychelles), CBCS (Curaçao and Sint Maarten), FSC (Mauritius), and FSC (BVI).

Is Exness regulated in South Africa?

When looking at regulating bodies we can see that Exness is regulated in South Africa by the Financial Sector Conduct Authority.

Exness scam or legit?

Based on the length of time the broker has been in business, the multiple regulatory oversights, and the mostly positive reviews from others we can confidently say that the broker is legit and Exness is not a scam.

Is Exness an ECN broker?

No, Exness is a market maker. Looking into the professional accounts available to clients, the broker offers tight spreads and trading commission per lot all handled by them.

When is Exness customer support available?

Exness customer support is available 24 hours a day and seven days a week. 24/7 support is provided in English, Chinese, and Thai with a number of other languages available on different time schedules. Support is available via online chat, telephone, or email.

Is Exness good for beginners?

While Exness’ minimum deposit of $10 and its strong suite of research tools can be suited to beginners, they generally targets a more seasoned client base.

Is Exness trustworthy?

There’s always the question of trustworthiness when it comes to CFD brokers. People always want to know if the broker they are considering is a scam. This is understandable, and we can say that based on its regulation and longevity, Exness is a trustworthy broker. Of course, the final decision should always be made based on your own review of the broker’s trading conditions and terms.

How long does it take to withdraw from Exness?

The length of time to process withdrawals from Exness will depend on the payment processor used. At Exness, withdrawals on the broker’s side are instant with potential delays happening from the client’s chosen payment method.

What is Exness all about?

Exness is all about providing traders with access to CFDs on a wide range of financial assets. The broker prides itself on its transparency and compliance with a number of global regulatory firms.

Does Exness offer a demo account?

Yes, our Exness review found that the broker offers demo accounts for both their proprietary Exness Terminal platform and for the MetaTrader 4 and MetaTrader 5 platforms.

Does Exness have a ZAR account?

If you are looking for a broker who offers accounts denominated in the South African rand (ZAR), then Exness is a broker that offers ZAR accounts. They also offer many other global currencies as base currencies for accounts.

What is the minimum deposit for Exness?

The Exness broker minimum deposit is $10 for a Standard Account and starting from $200 for any of the three Pro Accounts.

What types of accounts are available on Exness?

Exness offers the Standard and Standard Cent accounts that are considered best for less-experienced traders. They also offer the Pro, Zero and Raw spread accounts for more experienced, professional traders.

What type of broker is Exness?

Exness is a market maker.

Does Exness accept Paypal?

Exness does not offer Paypal as a deposit or withdrawal method, however, they do offer a wide variety of other payment platforms for deposits and withdrawals.

Is Exness safe?

Exness is considered to be a safe CFD broker due to its regulation by multiple global regulators. However, if you open an account that’s overseen by an offshore regulator you will have limited protections. Overall we feel that they are a safe broker.

Does Exness have VIX75?

The VIX 75 is a volatility index, however, Exness does not offer a CFD to trade the VIX 75.

Does Exness have US30?

The US30 index is also known as the US Wall Street 30 index. Exness does offer trading in a CFD covering the US30 index.

Does Exness allow scalping?

Although it isn’t explicitly stated in the Exness Help documentation, we do believe that Exness allows scalping based on the ability to use MetaTrader Expert Advisors (EAs) when trading with them.

Does Exness offer a bonus?

At the time of writing Exness does not offer any bonuses for registering, depositing or trading.

How long does Exness deposit take?

Deposits at Exness are mostly instant for the majority of payment methods. Online e-wallet transfers are credited instantly. Internet banking and cryptocurrency transfers can take up to 72 hours.

Full Breakdown Filters

Full Breakdown

Full BreakdownDisclaimer: The contents or products outlined on this page are provided by third parties and do not constitute an endorsement or any opinion by Finance Magnates. Finance Magnates has no control of the contents of this page, nor is responsible for its accuracy or legality and hereby waives any responsibility for this content. Any transactions, investments, or engagement that you enter into with a third party listed on this page or linked from this page are solely between you and such third party and are performed at your own risk. Finance Magnates holds no responsibility for any liability, damages, or losses caused in connection with the use of any content on this page.