Preview Mode

- SEE LESS

- B2B Categories

- Industry Executives (287)

- Industry Websites (59)

- Regulators (23)

- Liquidity Provider (4)

- Payment Processors (3)

- Platforms (3)

- KYC (2)

- Regulation Consulting (2)

- Cryptocurrency Trading Solutions (1)

- CRM (1)

- Tools for Brokers (1)

- SaaS Provider (1)

- MT4/MT5 Bridge Providers (1)

- White Label Solutions

- Affiliate Programs

- Platform Providers

- Cryptocurrency Liquidity Providers

- Translation Services

- Trading Categories

- Subscribe to our Newsletter

- Suggest a company

- Contact Us

- Companies Home

- Company News

- Categories

- Trading News

- Company News

- Videos

- Search

- Add

Company

Full Breakdown Filters

Full Breakdown

Full BreakdownCompany Review

EC Markets Review 2025: All You need to know!

Introduction

Category | Details |

Regulation and License | FCA (UK), ASIC (Australia), FSA (Seychelles), FSC (Mauritius), FMA (New Zealand), FSCA (South Africa) |

Founding Year | 2012 |

Leverage Range | Up to 1:1000 |

Platforms | MetaTrader 4, MetaTrader 5 (Desktop, Web, Mobile) |

Demo Account | Yes |

Base Currencies | USD |

Customer Support | Available during business hours (No 24/7 support) |

Crypto Trading | Yes (Cryptocurrency CFDs) |

Established in 2012, EC Markets is a globally recognized multi-asset broker offering traders access to over 100 financial instruments, including forex, precious metals, crude oil, indices, and cryptocurrency CFDs. The broker is committed to providing optimized trading conditions, featuring fast and reliable execution, highly competitive spreads starting from 0.0 pips, and leverage up to 1:1000. With a focus on both beginner and professional traders, the broker delivers seamless, lightning-fast, and robust solutions tailored to meet diverse trading objectives.

In this detailed review of EC Markets, we will explore its regulation, trading platforms, fees, tradable markets, and customer support services, helping traders determine if this broker aligns with their trading goals.

EC Markets Regulation and Security

EC Markets operates under a strong regulatory framework, ensuring a safe and transparent trading environment. The broker is authorized and regulated by multiple reputable financial authorities:

Regulator | License Number |

Seychelles Financial Services Authority (FSA) | SD009 |

Financial Conduct Authority (FCA) | 571881 |

Mauritius Financial Services Commission (FSC) | GB2100130 |

Australian Securities and Investments Commission (ASIC) | 414198 |

New Zealand Financial Markets Authority (FMA) | FSP197465 |

South Africa Financial Sector Conduct Authority (FSCA) | 51886 |

EC Markets’ commitment to strict security and transparency standards is reinforced by these multiple regulatory licenses. The broker follows rigorous compliance policies, ensuring all client funds are held in segregated accounts with reputable banks.

To enhance client safety, the broker also provides negative balance protection, shielding traders from excessive losses due to sudden market movements. Additionally, the broker employs advanced SSL encryption to secure client data and financial transactions, further strengthening its commitment to a secure trading environment.

EC Markets Trading Fees and Costs

EC Markets offers a transparent and cost-effective fee structure across its three account types: ECN Account and Standard (STD) Account. Below is a breakdown of the trading costs associated with each account type:

Fee Structure Overview

Fee Type | ECN Account | STD Account | PRO Account |

Spreads | From 0.0 pips | From 1.0 pips | As low as 0.0 pips |

Commission | $1.5 per lot per side | None | None |

Deposit Fees | None | None | None |

Withdrawal Fees | None (may vary by payment provider) | None (may vary by payment provider) | None (may vary by payment provider) |

Inactivity Fees | None | None | None |

EC Markets is known for its low trading costs and tight spreads, which can start as low as 0.0 pips on the ECN Account. Traders using the ECN Account are charged a commission of $3 per lot per side, while the Standard Account is commission-free, making it a cost-effective choice for traders who prefer spread-based pricing.

Additionally, EC Markets does not charge deposit or withdrawal fees, although traders should be aware that third-party payment providers or banks may impose their own fees for international transactions. The broker also does not impose inactivity fees, allowing traders the flexibility to take breaks without incurring additional costs.

EC Markets Trading Platforms

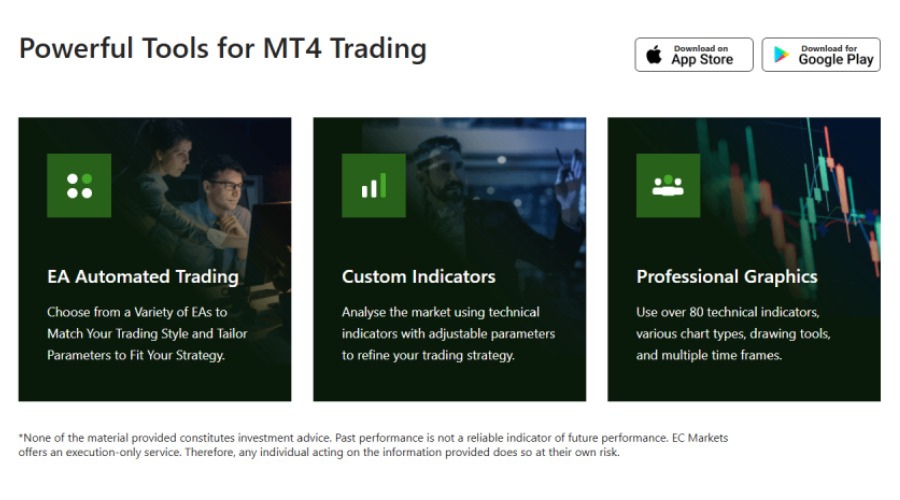

MetaTrader 4 (MT4)

Because of its sophisticated functionality and dependability, MetaTrader 4 (MT4) is still one of the most widely used trading platforms on the market. It has features like these and is made for both inexperienced and seasoned traders.

- Customizable Charting Tools: Advanced charting options with multiple timeframes.

- Technical Indicators: Access to over 30 built-in indicators to analyze price movements.

- Automated Trading: Support for Expert Advisors (EAs), enabling algorithmic trading.

- One-Click Trading: Quickly execute trades to take advantage of market opportunities.

- Cross-Device Compatibility: Available for desktop, web, and mobile, ensuring traders can monitor and trade anytime, anywhere.

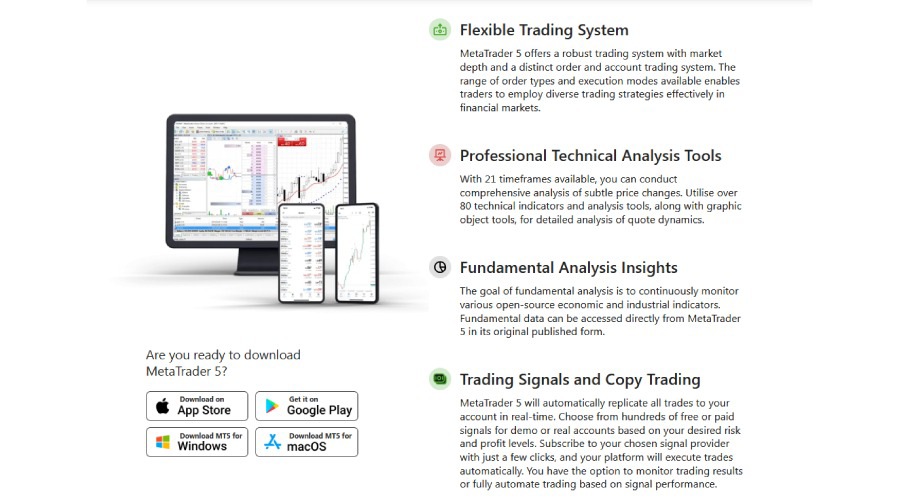

MetaTrader 5 (MT5)

Building on MT4's benefits MT5 offers more features for users looking for more sophisticated tools and asset classes. Key features include:

- Expanded Market Coverage: Trade a wider variety of instruments, including stocks and ETFs.

- Depth of Market (DOM): Real-time data on market liquidity and pricing.

- Enhanced Charting: More chart types and analytical tools than MT4.

- Economic Calendar: Integrated tools to stay informed on market-moving events.

- Multi-Device Access: Available on desktop, web browsers, and mobile applications.

EC Markets Tradable Instruments

EC Markets offers a diverse range of financial products, enabling traders to diversify their portfolios across various asset classes. The broker provides access to over 150 tradable instruments, accommodating a variety of trading styles and preferences.

Available Asset Classes

- Forex: EC Markets supports trading in major, minor, and exotic currency pairs, including popular pairs such as EUR/USD, GBP/USD, and USD/JPY. The broker offers competitive spreads, starting from 0.0 pips, depending on the selected account type.

- Precious Metals: Traders can engage in trading precious metals like gold and silver. These instruments are often chosen by those looking to hedge against economic volatility or seeking alternatives to traditional assets.

- Indices: The broker provides access to leading global indices, such as the FTSE 100, DAX 30, and S&P 500. These instruments allow traders to speculate on the overall performance of stock markets.

- Cryptocurrencies: For those interested in digital assets, EC Markets offers cryptocurrency CFDs, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP). These markets are known for their volatility and are frequently traded by investors seeking significant price movements.

- Commodities: In addition to precious metals, EC Markets offers trading in commodities such as crude oil. This asset class is influenced by global supply-demand dynamics, geopolitical developments, and economic conditions.

Key Features

- Spreads: Depending on the account type, spreads can start from 0.0 pips, offering potentially lower trading costs.

- Deposit Fees: The broker does not charge fees for deposits, which can be advantageous for traders.

- Withdrawal Processing: Withdrawals are processed within 2 hours, allowing relatively quick access to funds.

- Leverage: Flexible leverage options are available, up to 1:1000, depending on the asset class and jurisdiction.

EC Markets' diverse range of instruments and favorable trading conditions provide traders with flexibility as they explore various markets. Understanding the specific characteristics and associated costs of each asset class is crucial for those considering trading with this broker.

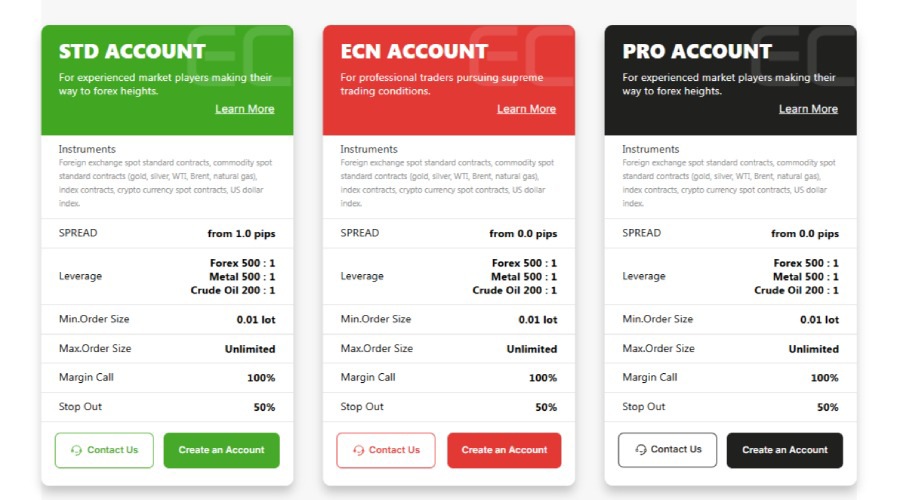

EC Markets Account Types

EC Markets provides three main account types to cater to different trading styles and experience levels. Each account type offers distinct benefits, including competitive spreads, high leverage, and optimized execution speeds.

Feature | |||

Spreads | From 1.0 pips | From 0.0 pips | From 0.0 pips |

Commission | None | $3 round turn | None |

Leverage | Up to 1:1000 (depending on the asset) | Up to 1:1000 (depending on the asset) | Up to 1:1000 (depending on the asset) |

Minimum Order Size | 0.01 lot | 0.01 lot | 0.01 lot |

Maximum Order Size | Unlimited | Unlimited | Unlimited |

Margin Call Level | 50% | 50% | 50% |

Stop-Out Level | 30% | 30% | 30% |

Standard (STD) Account

The Standard Account is designed for traders who prefer a spread-based, commission-free trading structure. It is an excellent choice for beginners and those who prioritize simplicity and convenience.

- Spreads: From 1.0 pips.

- Commission: No commission charges.

- Leverage: Up to 1:1000 for Forex and Metals; up to 1:200 for Crude Oil.

- Trading Instruments: Forex, Metals, Indices, Crude Oil, and Cryptocurrencies.

- Features: Low-cost trading with no commission, ideal for those starting out or preferring a straightforward cost structure.

ECN Account

The ECN Account is tailored for professional traders looking for the tightest spreads and direct market access. This account is perfect for scalping and high-frequency trading.

- Spreads: Starting from 0.0 pips.

- Commission: $3 round turn

- Leverage: Up to 1:1000 for Forex and Metals; up to 1:200 for Crude Oil.

- Trading Instruments: Forex, Metals, Indices, Crude Oil, and Cryptocurrencies.

- Features: Direct access to liquidity providers, ultra-tight spreads, and optimized execution speed for professionals.

PRO Account

The PRO Account is built for high-volume traders and institutions that require superior trading conditions, including zero commissions and tight spreads.

- Spreads: Starting from 0.0 pips.

- Commission: No commission charges.

- Leverage: Up to 1:1000 for Forex and Metals; up to 1:200 for Crude Oil.

- Trading Instruments: Forex, Metals, Indices, Crude Oil, and Cryptocurrencies.

- Features: Designed for traders who require deep liquidity, fast execution, and cost-effective trading with no commissions.

The broker ensures that each account type offers optimal trading conditions, giving traders the flexibility to choose an account that aligns with their trading style.

How to Open an Account

- Visit the EC Markets website and select the desired account type under "Open Account."

- Complete the registration form with your personal and financial details.

- Submit required verification documents to comply with KYC regulations.

- Choose a funding method and deposit funds to start trading.

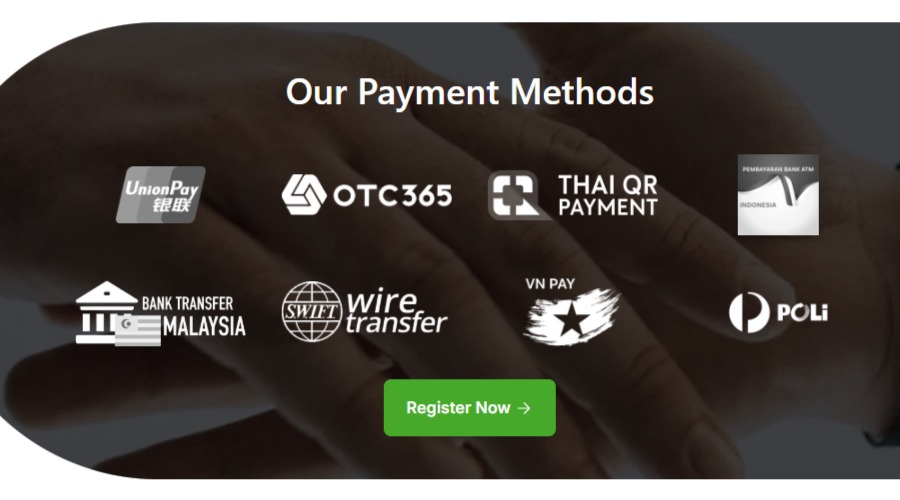

EC Markets Deposit and Withdrawal Methods

EC Markets offers a variety of convenient deposit and withdrawal methods to accommodate traders from different regions. The broker emphasizes efficiency and transparency in its funding processes, ensuring that clients can manage their accounts with ease.

Deposit Methods

The following deposit methods are available:

Payment Method | Processing Time | Deposit Fee | Account Currency |

UnionPay | Instant | 0% | CNY |

IndonesiaPay | Instant | 0% | IDR |

MalaysiaPay | Instant | 0% | MYR |

ThailandPay | Instant | 0% | THB |

VietnamPay | Instant | 0% | VND |

PoliPay | 30 minutes | 4% | NZD |

Note: Processing times and fees are subject to change. It's advisable to check the latest information on the official EC Markets website.

Withdrawal Methods

Withdrawals are processed efficiently, with the following details:

Payment Method | Processing Time | Exchange Rate | Account Currency |

UnionPay | Less than 2 hours (9:00 to 18:00, GMT+8); outside these hours: T+1 | Bank of China real-time exchange rate | CNY |

IndonesiaPay | T+1 | Real-time rate | IDR |

MalaysiaPay | T+1 | Real-time rate | MYR |

ThailandPay | T+1 | Real-time rate | THB |

VietnamPay | T+1 | Real-time rate | VND |

PoliPay | T+5 | Real-time rate | NZD |

Note: "T+1" indicates that the transaction will be processed on the next business day, while "T+5" indicates processing within five business days.

Key Features

- No Deposit Fees: EC Markets does not charge fees for deposits, allowing traders to fund their accounts without incurring additional costs.

- Fast Withdrawals: Withdrawals are credited within 2 hours on average during business hours, providing quick access to funds.

- Multiple Payment Options: A variety of payment methods are available to cater to traders from different regions, enhancing convenience and accessibility.

EC Markets Education Resources and Tools

EC Markets is dedicated to providing traders with a robust selection of educational resources and analytical tools designed to enhance trading knowledge and improve decision-making. These resources cater to traders of all experience levels, from beginners learning the fundamentals to advanced traders refining their strategies.

Educational Resources

Resource | Description |

A detailed glossary defining essential trading terms and financial jargon to help traders understand industry terminology. | |

Structured courses covering market fundamentals, technical analysis, risk management, and trading strategies, designed for traders at all levels. |

Trading Tools

Tool | Description |

A regularly updated news section that provides insights into global economic events, financial trends, and potential trading opportunities. | |

A real-time event tracker that displays upcoming economic announcements, helping traders anticipate market volatility and adjust their trading strategies accordingly. | |

A plugin that enhances the MetaTrader 4 platform with advanced indicators like Analyst Views, Adaptive Candlesticks, and Adaptive Divergence Convergence for better market analysis. |

EC Markets ensures that traders have access to comprehensive learning materials and analytical tools, allowing them to stay informed, refine their strategies, and make well-informed trading decisions.

EC Markets Partnership Program

EC Markets offers a comprehensive Partnership Program designed to provide competitive commissions, flexible cooperation models, and instant payment processing, making it an attractive choice for introducing brokers (IBs) and affiliates. The program is backed by dedicated account managers and marketing teams, ensuring strong business growth and long-term collaboration.

Types of Partnerships

Partnership Type | Description |

Introducing Broker (IB) Program | A partnership designed for individuals and businesses looking to refer clients in exchange for a highly competitive rebate structure. IBs earn commissions based on their referred clients' trading volume. |

Affiliate Program | A partnership for digital marketers, website owners, and social media influencers who can drive traffic. Affiliates receive performance-based commissions with the potential to scale earnings. |

Key Benefits of the EC Markets Partnership Program

- Flexible Commission Structures – Partners can choose a rebate-based model or a customized plan, ensuring the best fit for their business strategy.

- Instant Payments – EC Markets offers real-time commission settlements, allowing partners to receive earnings without delays.

- No Limits on Earnings – There is no cap on commission payouts, meaning the more clients a partner refers, the higher the potential earnings.

- Advanced Tracking System – Partners gain access to a real-time analytics dashboard that tracks client activity, commissions, and trading volume.

- Marketing Support – EC Markets provides customized promotional materials, including banners, landing pages, and multilingual marketing assets.

- Dedicated Account Management – Each partner is assigned an experienced account manager to assist with strategy, business development, and client retention.

How to Become a Partner

- Sign Up – Register as an IB or affiliate through the EC Markets Partner Portal.

- Receive Your Referral Link – Get a unique referral link to start attracting clients.

- Grow Your Network – Refer traders using customized marketing tools and tracking systems.

- Earn Commissions – Receive instant commission payouts based on client trading activity.

EC Markets' highly rewarding Partnership Program ensures that affiliates and IBs can maximize their earnings while benefiting from transparent commission structures, advanced tracking tools, and dedicated support.

EC Markets Customer Support

EC Markets is committed to providing exceptional customer support to assist traders with their inquiries and ensure a seamless trading experience. The broker offers multiple channels for clients to reach out to their support team.

Contact Information

- Telephone: +248 422 4099

- Email: support@ecmarkets.com

- Live Chat: Available on the website for real-time support

Clients can contact customer service via telephone or email for prompt assistance with their trading accounts, platform issues, or any other concerns.

Feedback and Inquiries

EC Markets values client feedback and encourages traders to share their experiences, suggestions, or questions. A contact form is available on their website for submitting inquiries directly to the support team.

By offering these support channels, the broker ensures that clients have access to timely and effective assistance, enhancing their overall trading experience.

Pros | Cons |

Regulated Broker: Overseen by multiple authorities (FSA, FCA, FSC, ASIC, FMA, FSCA), ensuring trader security. | No weekend customer support, which may be inconvenient for some traders. |

MT4 and MT5 Platforms: provides access to MetaTrader 4 and MetaTrader 5, two of the most widely used trading platforms with advanced tools and automation features. | No proprietary trading platform for tailored experiences. |

Diverse Instruments: Offers Forex, metals, crude oil, indices, and cryptocurrency CFDs, allowing traders to diversify their portfolios. | Does not include direct stock or ETF trading. |

Competitive Trading Conditions: Features tight spreads (as low as 0.0 pips on ECN accounts), high leverage up to 1:1000, and fast execution speeds. | |

Fast Withdrawals: Withdrawals are processed within 2 hours during business hours, ensuring quick access to funds. |

Conclusion

EC Markets has positioned itself as a fully regulated and comprehensive trading broker, offering a secure and transparent trading environment. With over a decade of experience, the broker provides traders access to a diverse range of financial instruments, including Forex, metals, crude oil, indices, and cryptocurrency CFDs, allowing traders to implement various trading strategies.

To accommodate different trading styles, EC Markets offers three account types—Standard, ECN, and PRO—ensuring that traders can choose an account that aligns with their experience level and trading preferences. The availability of MetaTrader 4 and MetaTrader 5 enhances the trading experience, providing advanced charting tools, automation features, and real-time market analysis.

The broker also stands out for its educational resources and trading tools, including a Forex glossary, structured online courses, an economic calendar, financial news updates, and MT4 indicator plugins. These tools empower traders to make informed trading decisions and improve their market analysis skills.

EC Markets prioritizes efficiency and security in fund management, offering fast deposit and withdrawal processing times, with most withdrawals completed within 2 hours during business hours. The broker maintains a straightforward pricing structure with low trading costs, tight spreads (as low as 0.0 pips on ECN accounts), and no deposit or withdrawal fees from their side (though third-party fees may apply).

Additionally, the broker ensures strong customer support, offering 24/5 assistance through live chat, email, and phone. Traders can reach out anytime during trading hours for help with account issues, platform support, or general inquiries.

FAQs

Is EC Markets a regulated broker?

Yes, EC Markets is overseen by reputable financial authorities. The broker follows stringent regulatory guidelines to ensure transparency, fund safety, and compliance with international standards.

What types of accounts does EC Markets offer?

EC Markets offers three main account types to cater to different trading styles and experience levels:

- ECN Account – Features spreads starting from 0.0 pips with a fixed $3 commission per lot per side. This account is ideal for experienced traders, scalpers, and algorithmic traders who require tight spreads and direct market access.

- Standard (STD) Account – Offers spreads starting from 1.0 pips with no commission, making it a suitable choice for beginners and discretionary traders who prefer simplified cost structures.

- PRO Account – Provides spreads as low as 0.0 pips with zero commissions, making it a great option for high-volume traders and institutional clients seeking deep liquidity and cost-effective trading conditions.

Does EC Markets provide a demo account?

Yes, EC Markets provides a demo account for traders to practice strategies and become familiar with the platform. The demo account is loaded with virtual funds and simulates live market conditions.

What trading platforms does EC Markets support?

EC Markets supports the popular MetaTrader 4 (MT4) platform. MT4 provides advanced charting tools, automated trading via Expert Advisors (EAs), and support for desktop, web, and mobile devices.

What financial instruments can I trade with EC Markets?

EC Markets provides access to over 150 financial instruments, including:

- Forex currency pairs

- Precious metals like gold and silver

- Crude oil

- Global indices

- Cryptocurrencies via CFDs

What are the deposit and withdrawal options available at EC Markets?

EC Markets offers a variety of deposit and withdrawal options, including:

- Bank transfers

- UnionPay

- E-wallets like Skrill and Neteller

- Local payment options for select regions

Withdrawals are processed in as little as 2 hours during business hours.

Does EC Markets charge deposit or withdrawal fees?

EC Markets does not charge deposit fees for the majority of payment methods. While the broker does not charge any withdrawal fees, traders should be aware that third-party providers or intermediary banks may charge additional fees.

Does EC Markets offer educational resources?

Yes, EC Markets provides a range of educational materials, including:

- Online courses for traders at all levels

- A detailed Forex glossary

- Regular market updates and analysis

- An economic calendar and MT4 indicator plugins for enhanced decision-making

Is EC Markets suitable for beginners?

Yes, EC Markets provides beginner-friendly features like the Standard Account, educational resources, and a demo account for practice. The platform's user-friendly design and 24-hour customer support also make it appropriate for new traders.

How can I contact EC Markets customer support?

EC Markets provides 24/5 customer support through:

- Live Chat: Available on the website for real-time assistance

- Email: support@ecmarkets.com

- Phone: +248 422 4099

Additionally, traders can use the contact form on the website for inquiries.

Does EC Markets offer a partnership program?

Yes, EC Markets has a Partnership Program that includes flexible commission structures, professional marketing support, and automated settlement systems. The program is designed to help partners grow their business and earn competitive rewards.

Can I trade cryptocurrencies on EC Markets?

Yes, EC Markets provides cryptocurrency CFDs, which enable traders to speculate on the price movements of popular digital currencies such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP).

Full Breakdown Filters

Full Breakdown

Full BreakdownDisclaimer: The contents or products outlined on this page are provided by third parties and do not constitute an endorsement or any opinion by Finance Magnates. Finance Magnates has no control of the contents of this page, nor is responsible for its accuracy or legality and hereby waives any responsibility for this content. Any transactions, investments, or engagement that you enter into with a third party listed on this page or linked from this page are solely between you and such third party and are performed at your own risk. Finance Magnates holds no responsibility for any liability, damages, or losses caused in connection with the use of any content on this page.