By Dmitriy Gurkovskiy, Chief Analyst at RoboForex

Gold prices are going down again. On Monday April 29th, the troy ounce of this precious metal costs 1283.30 USD. It might well be that the instrument may plunge even more unless some significant news appear on the market.

The driver that may support Gold is investors’ possible risk aversion. There may be several reasons for that, starting from the US Federal Reserve’s decision to keep the key rate unchanged for a long period of time and to breakdown of US-China trade talks. There are some other things, for example the Middle East factor or a “bubble” on global capital markets. These drivers don’t influence market players at the moment, but in the mid-term they may surely “push” financial markets.

At the same time, physical demand for Gold remains rather cautious, so it doesn’t make any sense to find any support here.

So far, the year of 2019 is going poorly for Gold, but the situation may change quite soon.

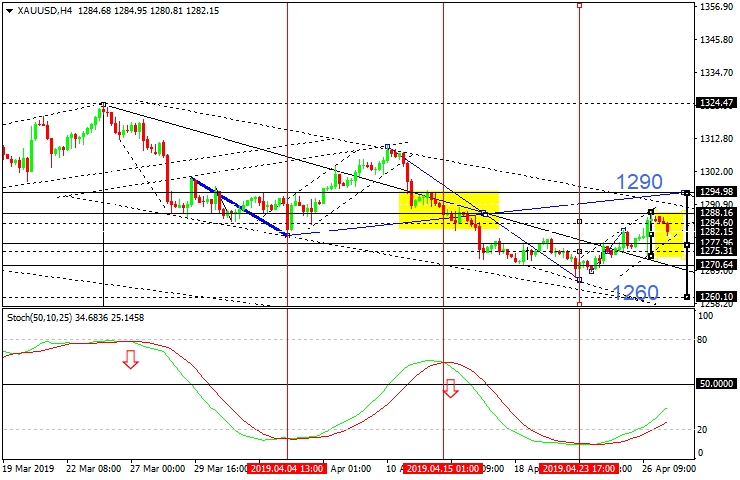

As we can see in the H4 chart, Gold is trading below 1290.00; it has reached the downside target at 1266.00 and right now is being corrected. After breaking the correctional channel, the price may start a new decline, which is confirmed by Stochastic Oscillator: so far, it’s signal line confirms the correction continuation. After completing the correction, the instrument may resume trading inside the downtrend with the target at 1260.00.

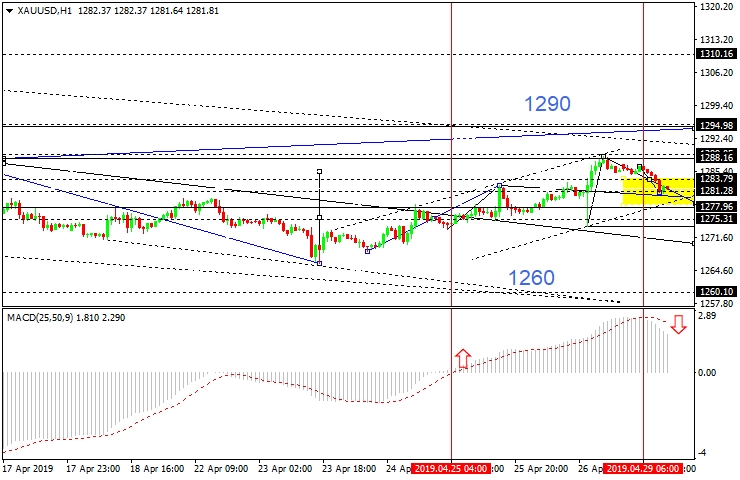

In the H1 chart, the price is being corrected and may resume falling towards 1277.00. However, another scenario implies that the correction may yet continue to reach 1290.00. In case the correctional channel is broken, the downtrend may continue to reach 1260.00, which is confirmed by MACD Oscillator; its signal line is reversing from the “overbought zone”. After breaking 1275.00, the downtrend may speed up.

Disclaimer

Any predictions contained herein are based on the authors' particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.