Preview Mode

- SEE LESS

- B2B Categories

- Industry Executives (287)

- Industry Websites (59)

- Regulators (23)

- Liquidity Provider (4)

- Payment Processors (3)

- Platforms (3)

- KYC (2)

- Regulation Consulting (2)

- Cryptocurrency Trading Solutions (1)

- CRM (1)

- Tools for Brokers (1)

- SaaS Provider (1)

- MT4/MT5 Bridge Providers (1)

- Platform Providers (1)

- White Label Solutions

- Affiliate Programs

- Cryptocurrency Liquidity Providers

- Translation Services

- Trading Categories

- Subscribe to our Newsletter

- Suggest a company

- Contact Us

- Companies Home

- Company News

- Categories

- Trading News

- Company News

- Videos

- Search

- Add

Company

Full Breakdown Filters

Full Breakdown

Full BreakdownCompany Review

oneZero Review: Global Trading Technology Provider

Founded in 2009, oneZero is a leading global multi-asset class enterprise technology provider. With its headquarters in Boston and development and operations centers across the globe, oneZero offers a wide range of innovative trading technology solutions for retail brokers, institutional brokers, banks, and investors.

Over the past 15 years, oneZero has become a trusted name in financial technology. The solution encompasses the Hub, EcoSystem and Data Source. oneZero is a liquidity-neutral solution for market access, risk management, order routing and execution, trade analytics, and more.

Their technology handles high volumes of orders quickly and easily while reducing latency. They handle more than $100 billion of active day trading volume, 150 billion quotes, and 10 million daily transactions.

Moreover, oneZero is certified to the standards of ISO 27001 in information security management. They have operation centers in Asia, Australia, Europe, and North America. Let's look at all the robust trading solutions from this company:

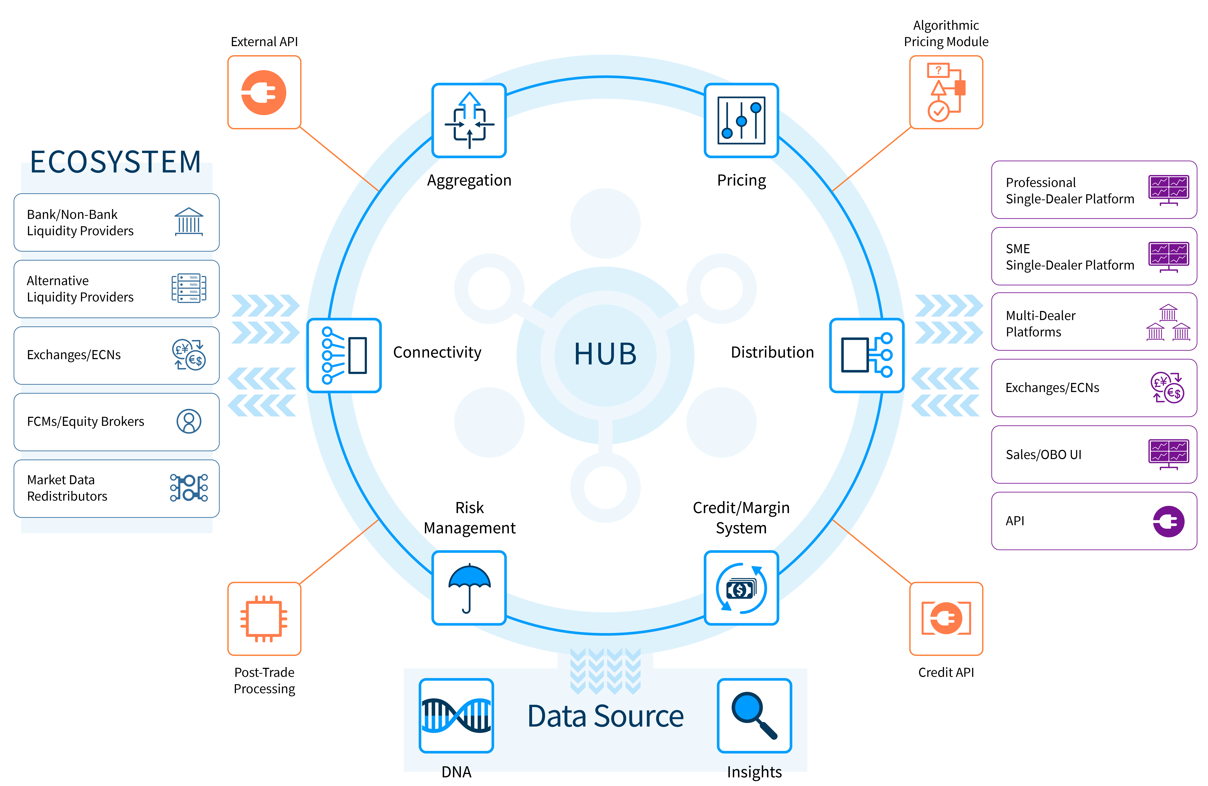

Hub Technology

Their Hub technology is a pricing and risk management system used by clients around the globe to manage and route tens of millions of trades daily. The Hubs are available for different organization types with scalability and reliability.

The Hub advancement is a SaaS solution that allows clients to access low-latency market data, integrated risk management, order routing, and analytics. The Hub technology is secure, reliable, and designed with exceptional features to ensure a seamless trading experience.

Hub technology is available for retail brokers, institutional brokers and banks, and liquidity providers.

Their data centers are co-located with top-tier exchanges and banks, ensuring a low-latency trading environment. It helps in growing the business and minimizing costs. Clients can co-locate their trading platform in NY4, LD4, and TY3 data centers

Types of Hub Technologies from oneZero

For retail brokers

For retail brokers, it's important that their customers receive the best service. oneZero's Hub technology ensures retail brokers can access multiple liquidity providers, execute trades at high speed, and reduce latency.

This technology also provides advanced risk management tools to ensure that their customers’ funds are safe and secure. Additionally, it offers features like pricing, aggregation, warehousing, and allows clients to establish connections to their customers via front-end trading platforms including MetaTrader 4/5, and more.

Retail brokers can deliver quotes and trades to customers with better pricing accuracy, improved risk management capabilities, and increased liquidity. Their Retail Hub offers different customized packages that are tailored to suit different business needs. Their Retail Hub packages are scalable, allowing brokers to upgrade as their business grows.

Hub for institutional brokers and banks

Their Institutional Hub solution is a comprehensive technology platform that offers clients full control of aggregation, pricing, and risk management on a granular level. Institutional brokers get access to real-time market data, integrated risk management solutions, order routing, and analytics.

The Hub also provides a full suite of analytics to track performance and identify issues. The comprehensive trading GUIs offer an intuitive platform for users to manage their trades with ease. Additionally, API support provides users with the option to develop and integrate custom applications.

Brokers and banks can aggregate custom streams from OTC liquidity providers and market data with the Hub. Clients can also use the programmable algorithmic pricing and risk management modules to run their own algorithms in their bespoke Hub. Each Hub is hosted on a dedicated server with a secure connection and the highest level of encryption, ensuring maximum security.

Hub for liquidity providers

Liquidity providers can take full advantage of the widely distributed network with over 200 retail and wholesale brokers. They can connect to the oneZero Hub through their API or FIX protocol and get access to all liquidity takers.

The liquidity provider Hub features ultra-fast low-latency processing of quotes and responses of all instruments. Liquidity providers have access to 200+ global forex brokerages hedging more than 10 billion USD every day.

The bespoke Hub of liquidity providers enables shared and tailored streams with all the takers, allowing for the support of sweepable, full amount, and bespoke streams. The Hub provides real-time risk monitoring and analytics for liquidity providers, helping them make informed decisions quickly.

Overall, oneZero's Hub technology is secure, reliable, and feature-rich, offering a comprehensive solution for retail, institutional, banks and liquidity providers.

EcoSystem solutions

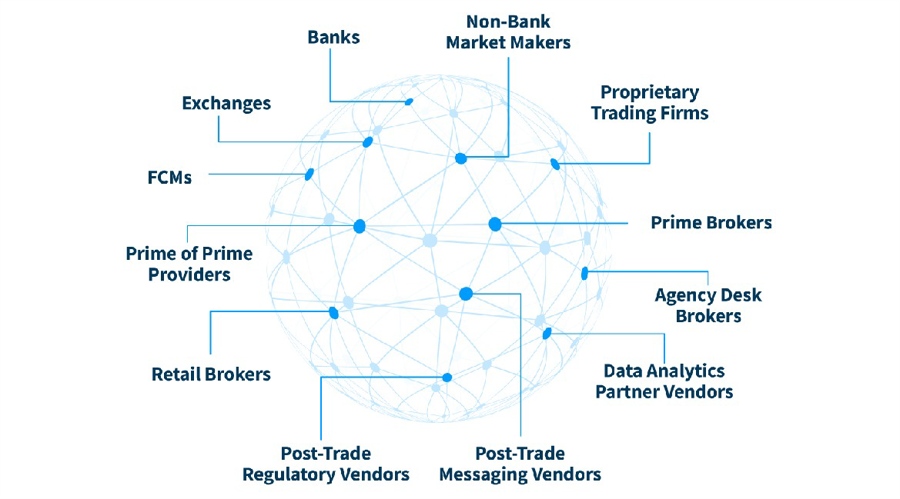

oneZero’s EcoSystem is for market access and their partner network, allowing brokers, banks and liquidity providers to come together for liquidity distribution and access to unique flow. The EcoSystem also provides direct market access to exchanges and clearing providers.

Data Source

Data Source is a next-generation cloud-based business intelligence solution from the technology provider. This toolkit enables its users to gain insights from their data, create advanced analytics, and visualize the results.

Data Source provides its customers with an intuitive interface through which they can access and analyze their data in real-time. Data Source offers a comprehensive set of tools, such as its powerful analytics engine, advanced data visualization and dashboards, dynamic reporting capability, and much more.

Data Source helps businesses gain insights from their data and make informed decisions quickly. With its advanced visualization tools, it provides rich insights into the data and helps businesses to identify trends and anomalies in their data.

Data Source: DNA

Clients can access their Hub’s trade, quote and quote derivative data in real-time, near real-time and historical. oneZero collects and curates client data from multiple data centers and transports it to the cloud via high-speed connection. It’s available whenever clients need it and comes in formats easily accessible to internal users and third-party vendors to analyze, including for compliance reporting

Data Source: Insights

Clients can easily understand their clients' flow and associated hedges, as well as their relationships with liquidity providers, with oneZero's Data Source: Insights tool.

This interactive, visual web-based analytics platform is offered in different packages to its customers, which include essential trade reports, sophisticated maker and taker stream classifications, taker login classifications, maker pool analytics, and more.

Data Source: Insights helps brokers to get a complete picture of their client flow and associated hedges and make informed decisions about their liquidity providers. It also offers advanced analytics, such as graph-based analysis

Simplify regulatory reporting

For retail brokers, institutional brokers, and liquidity providers, it's difficult to keep up with the changing regulatory landscape. oneZero helps you to stay ahead of the curve by providing a streamlined solution for regulatory reporting.

Clients can seamlessly connect with post-trade regulatory vendors that have joined the oneZero EcoSystem. This means clients can use and compare their own internal post-trade reporting solutions with solutions provided by oneZero and by third party regulatory vendors that have all derived from the same underlying data.

Furthermore, oneZero enables its customers to connect with multiple regulatory vendors and manage their reporting in one place.

They've partnered with leading vendors such as Emirep, IHS Markit, Point Nine, SteelEye, TRAction, and Tradefora to provide a comprehensive solution for regulatory reporting

MetaTrader server hosting and platform services

Clients can deploy their trading systems (MT4/MT5) within oneZero’s proven, globally distributed infrastructure, with exceptional operations and administrative support provided 24 hours a day by a team of skilled engineers with decades of front-line support experience

Top-tier partners of oneZero Ecosystem

Please see https://www.onezero.com/ecosystem/ for up to date members of the oneZero network.

Prime of Primes and wholesale brokers

oneZero has partnered with a range of Prime of Primes. The network of Prime of Primes provides brokers with access to tight spreads and deep liquidity at competitive prices.

The Prime of Prime brokers are connected directly to the oneZero Hub, allowing them to access global liquidity and provide clients with deep liquidity across all asset classes.

Crypto liquidity providers and venues

oneZero partners with multiple crypto exchanges, liquidity providers, and venues to offer deeper liquidity for cryptocurrency markets.

Bank and non-bank liquidity providers

Clients have access to bank and non-bank liquidity providers.

OTC trading venues

OTC or Over-the-Counter markets provide a safe and secure trading environment for brokers and liquidity providers. oneZero offers access to OTC markets. See https://www.onezero.com/ecosystem/ for up-to-date venues

Listed futures & equities trade routing venues

The multi-asset class enterprise technology provider offers access to a broad network of listed futures and equities trade routing venues (https://www.onezero.com/ecosystem/).

Market data integration services

Clients have access to more than eight market data integration services. All of these services provide accurate and real-time market data to ensure that clients get the best trading opportunities.

With oneZero's market data integration services, brokers can access real-time streaming quotes, market depth, and trades, enabling them to make informed decisions. They can also access historical data for trend analysis and backtesting

Supported instruments at oneZero

oneZero offers access to global markets, including Foreign Exchange, CFDs, Commodities, Futures, Cash Equities, and Cryptocurrencies. Let's look at all instruments in detail:

Foreign exchange

oneZero offers access to multiple currency pairs, including major, minor, and exotic currencies. Clients get tight spreads, low latency execution speeds, and fast order processing. Moreover, oneZero provides access to bank and non-bank liquidity

CFDs

Contracts for Difference (CFDs) are derivatives that allow traders to speculate on the future price of an underlying asset. oneZero offers access to a wide range of CFDs, including commodities, equities, indices, FX, and more. Brokers can offer robust CFD trading on multiple asset classes with fast execution speeds

Commodities

oneZero offers access to a wide range of commodities, including gold, silver, and oil. With access to the deepest pool of liquidity, clients can take advantage of low spreads and fast execution speeds for their trading needs

Futures

oneZero provides access to a variety of futures contracts, including commodities, metals, energies, and indices.

Cash Equities

oneZero offers direct access to multiple cash equities, including NASDAQ and NYSE. The platform provides low latency execution speeds and tight spreads to ensure traders get the best prices in the market. Furthermore, clients have access to real-time market data and analysis tools to support their trading activities

Cryptocurrencies

The technology provider also offers access to the most popular cryptocurrencies. With oneZero's advanced technology setup, brokers can also offer crypto trading to their clients with superior execution speeds and low latency.

Information security management

When it comes to security, oneZero has taken all necessary steps to ensure the safety of their clients. The platform meets ISO 27001:2013 standards from the International Organization for Standardization (ISO®).

Customer Support

oneZero offers support 24 hours a day, with global support teams, applying a follow the sun model to ensure continuity of service.

Pricing structure

oneZero offers competitive pricing structures for all of its services. The pricing structure is customizable and scalable to meet the needs of various clients. Depending on the business requirements and the size of the client's portfolio, oneZero offers various solutions. The pricing structure ensures that clients get maximum value for their investments.

You can contact their team at info@onezero.com or fill out the form to book a demo to understand more about their solutions and custom pricing for your business

Contact details

You can contact the oneZero team at +1 888 703 4285 or info@onezero.com for more information about their services and solutions. Their team is highly responsive and dedicated to providing the best 24/7 customer service and technical support.

oneZero multi-asset technology provider in a nutshell

oneZero is a multi-asset class enterprise technology provider offering advanced solutions for brokers, banks and liquidity providers. They deliver intelligent performance with turn-key modular solutions for liquidity aggregation, price formation, customized distribution, risk management and quantitative trading analytics. Their award-winning solution encompasses Hub, EcoSystem and Data Source. With access to the deepest pool of banking and non-banking liquidity providers, clients benefit from tight spreads and deep liquidity across all asset classes.

Moreover, they offer access to a broad network of listed futures and equities trade routing venues, as well as market data integration services. oneZero is a full-fledged technology provider with a range of services to meet the needs of various clients.

FAQs

What services does oneZero offer?

oneZero offers advanced and customized solutions for brokers and liquidity providers. Their solution encompasses the Hub, EcoSystem and Data Source.

How do I contact oneZero?

You can contact the oneZero team at +1 888 703 4285 or info@onezero. Their support team will help you with all of your queries and ensure that you get the best solutions for your business.

What is oneZero's pricing structure?

You can contact their support team to book a demo, and their team will first analyze your business requirements and then provide you with a suitable pricing structure.

What is oneZero Hub technology?

oneZero Hub technology is a comprehensive suite of advanced pricing and risk management systems for brokers and liquidity providers. It provides a high-speed trading environment with access to deep liquidity and minimal latency.

What market data integration services does oneZero offer?

oneZero offers access to more than eight market data integration services, including Activ, CQG, IRESS Quanthouse, and more.

Full Breakdown Filters

Full Breakdown

Full BreakdownDisclaimer: The contents or products outlined on this page are provided by third parties and do not constitute an endorsement or any opinion by Finance Magnates. Finance Magnates has no control of the contents of this page, nor is responsible for its accuracy or legality and hereby waives any responsibility for this content. Any transactions, investments, or engagement that you enter into with a third party listed on this page or linked from this page are solely between you and such third party and are performed at your own risk. Finance Magnates holds no responsibility for any liability, damages, or losses caused in connection with the use of any content on this page.