InterTrader's CEO Shai Heffetz explains the firm's expansion in Eastern Europe and the impact of volatility in 2017.

2017 is already being billed as a big year for the financial services industry, with the influence of Donald Trump and other market phenomena in Europe likely dictating trading volumes and volatility. In light of the shifting market dynamic, InterTrader’s CEO Shai Heffetz outlines the spread betting and contract-for-difference (CFD) provider’s expansion in Eastern Europe as well as its market-neutral model.

Please tell us about yourself and how you reached your current role.

I’ve spent my whole career in e-commerce. After graduating in Industrial Engineering at the Shenkar Institute for Engineering and Design in Israel, I started out with Spark Networks, the online dating provider. I was then Head of Business Development for Empire Online, the online gaming company that was acquired by PartyGaming in 2007.

After a year as Head of CRM with PartyGaming, I was tasked with driving their expansion into financial services. This led to the creation of the award-winning InterTrader.com, followed by our service for more experienced traders, InterTrader Direct. We have now consolidated these successful services into one brand: InterTrader.

Throughout this time I have been managing director of InterTrader Ltd, which is now owned and controlled by GVC Holdings PLC, the multinational sports betting and gaming group.

What are your goals for the company over the next few years?

Our primary goal is to help our clients improve their trading performance and become more profitable traders. We want our traders to know that we are on their side, rather than simply on the other side of their trade.

We’ll do so by focusing on our education programme and our decision-support tools, and by keeping the cost of trading as low as possible. While our comprehensive package appeals to entry-level traders, our market-neutral model combined with exceptional liquidity also makes us the broker of choice for many high-value traders.

With the impact of Donald Trump’s presidency, I expect a very volatile 2017 across all asset classes from bonds through equities to foreign exchange. The next few years could be characterised by uncertainty, both in the US and worldwide. I can’t predict where the market will go, but I’m sure it will be a bumpy ride.

Uncertainty is both an opportunity and a threat to traders. Our service equips traders to take advantage of market opportunities, while our market-neutral model eliminates a level of threat – as we offset all our market risk we are not at the mercy of extreme market forces. Our traders know they are trading with a broker with substantial corporate backing and a robust business model.

In 2017 we expect to increase our efforts in the Polish market. We’ll learn more about the market and find the best ways to serve our Polish clients, providing a truly localised trading experience. We may also enter more Eastern European markets, but this will depend on wider market conditions and many other factors.

Ultimately, we aim to expand our diverse client base in a rapidly changing marketplace by giving traders a fair and comprehensive service.

What do you think sets you apart from the competition?

One thing that clearly sets us apart from our competition is that we are a 100% market-neutral broker. This means that we hedge every trade a client makes with us in full in the underlying market, so we are never carrying any market risk.

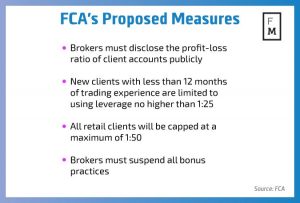

The FCA’s recent consultation paper has highlighted abuses of the ‘matched principal’ model by certain brokers – where market risk isn’t truly offset and prices are provided by a single market counterparty, raising concerns about best execution.

This is often combined with excessive reliance on outsourced and ‘off-the-shelf’ solutions – the minimum operational resource to service a high churn of clients. By contrast, we have multiple market counterparties to secure best execution for our clients, our own in-house trading platform and mobile apps, and our own experienced customer support team.

And significantly, our entire market risk is hedged externally – rather than with other internal or affiliated entities – so we really are market-neutral.

What this means in practice is that we have absolutely no vested interest in whether our clients are winning or losing. In fact, we want our clients to win as much as possible, to encourage them to trade more. It’s a win-win relationship: they can make money from their trades and we can make money from our dealing charge.

So this distinction is in our very business model, at the heart of everything we do. Until now the industry has been held back by the conflict of interest between a trader and their broker – incentivising bad practice on the broker’s part to generate higher revenues.

With our market-neutral model we’re saying to traders that this isn’t the way it has to be. Your broker can be on your side. This then leads naturally on to our educational programme and suite of free trading tools, all designed to give our traders a better chance of success.

For our institutional partners, what sets us apart is that we offer an impeccable trading environment for managing their clients’ funds. And as our own profit model is based solely on trading volumes, we’re uniquely placed to deliver performance to their clients and growth to InterTrader.

We can also offer a turnkey white-label solution to partners wishing to build their own brokerage. This is a fully integrated package, providing exceptional liquidity, our multi-asset-class platform, our payments services, and our CRM technology (Salesforce). As we develop our technology in-house we have no problems with full service integration.

How do you view the current state of the industry?

The industry is clearly maturing and as part of this process I expect to see consolidation in the market. Smaller brokers more concerned with a high turnover of clients will be side-lined by new regulatory measures and more effective competition.

Up to now different brokers’ hedging policies have been a matter for discussion solely within the industry. However, this debate is starting to widen out and, as traders themselves become more aware of the issue of conflict of interest, they’ll be seeking out brokers whose financial incentives are aligned with their own.

We’ve already set ourselves apart in this regard and, quite frankly, I’d expect our market-neutral model to be adopted by other brokers over the coming years. As financial regulators crack down on bad practice the question of fairness and divided loyalties will only become more prominent.

While excessive levels of leverage become prohibited in different territories, our job is to show traders that leverage is only one part of the package. Without fast and reliable execution, tight spreads and superior trading technology, you can’t hope for success in the long term.

Over the past year, we’ve particularly invested in our mobile trading apps, as this is a significant area of client demand. Today’s traders want to be able to conduct all their trading and research activity on their phone or tablet, with no loss of speed or performance. We want to make traders aware of our leading-edge mobile trading capability in 2017.

Meanwhile I expect that political and economic uncertainty in 2017 and beyond will translate into significant market volatility. This will provide encouragement for traders looking for short-term opportunities, while increasing the focus on safe trading in turbulent market conditions.

What new fields or opportunities do you see as growth potential in the market?

Our unique business model provides a key advantage within the community of professional traders, money managers and alternative investment fund managers. By providing a boutique trading service, we are actively seeking high-value traders who are looking for something more than traditionally offered by retail brokers.

In a fast-changing trading environment, we offer 100% safety of client funds. This is backed by an innovative guarantee from our parent company bwin.party Holdings Ltd, part of the multinational group GVC Holdings PLC (which has a current market cap of around £1.9 billion). Also, as we hedge every trade we take, we are not exposed to the risk of extreme market events. This could be a key factor heading into an uncertain 2017.

InterTrader has built a large portfolio of global traders, introducing brokers and money managers. Our partners include FCA-regulated asset managers and Swiss and Belgian investment funds, all attracted by our access to large ECN liquidity pools of tier 1 financial institutions.

In 2017 we intend to increase our penetration in the Far East, and to leverage our technological and operational infrastructure both in Europe and beyond. To this end we are looking to focus on our growing B2B offering, developing our network of partners worldwide

We have highly attractive trading conditions we can offer to money managers and trading funds; a direct API connection to the popular MT4 platform; generous rebates for introducing agents and brokers; plus our flexible white-label trading package.

As traders everywhere become more aware of the limitations of the traditional broker-client relationship – as highlighted by successive regulatory restrictions – we believe there will continue to be a fast-growing market for our unique market-neutral model. Through our direct client base and our partner network we are setting the benchmark for fair and reliable trading in 2017.