- Fed commits to current pace of QE until it sees “substantial further progress”

- Dollar jumps on modest tweak, rosy outlook before being pummelled by dovish Powell

- Pound continues to soar on Brexit deal optimism, euro climbs new highs too

- Aussie and kiwi on a roll as strong data, US stimulus hopes maintain bullish momentum

Fed disappoints before Powell has to reassure

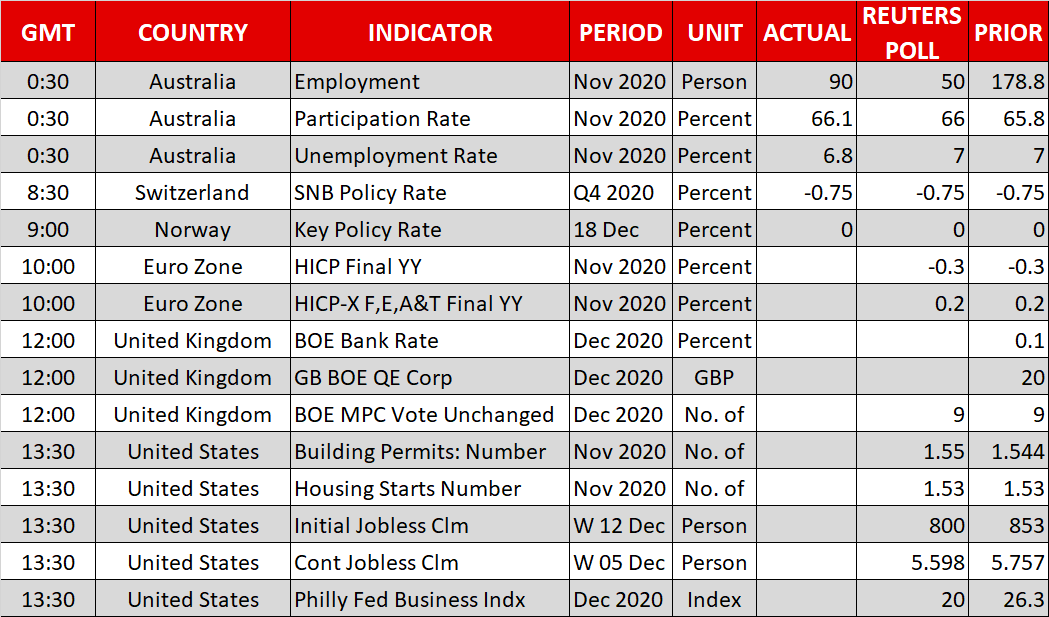

The Federal Reserve pledged on Wednesday to keep buying bonds at the existing pace of $120 billion per month even as it revised up its growth forecasts and lowered its projections for unemployment for the next three years. However, the central bank for the first time tied the timeframe for its purchases to economic conditions as it promised to maintain that pace until “substantial further progress has been made” toward its maximum employment and inflation goals.

The decision disappointed some who had been expecting the Fed to take a more aggressive stance against the current weakening economic backdrop by focusing more of its purchases on longer-term bonds. A poor set of retail sales numbers out of the United States yesterday served as a reminder of the growing challenges for consumers and retailers amid surging virus cases and tighter restrictions.

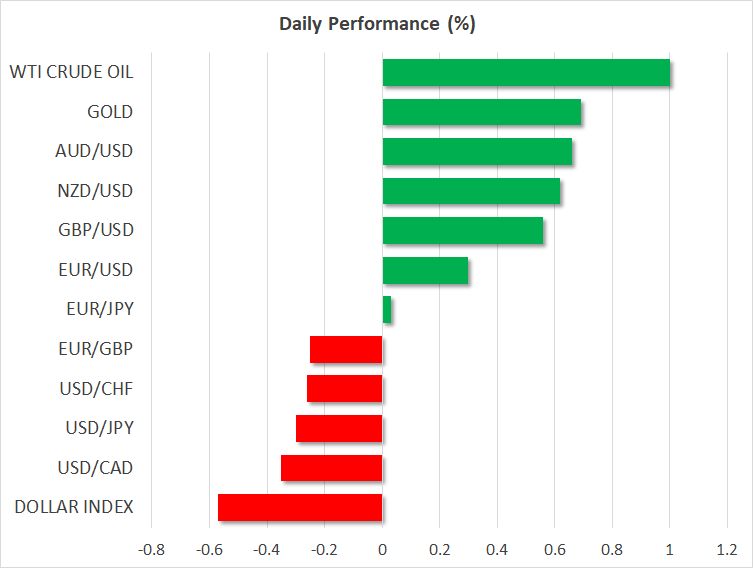

Dollar resumes slide after brief Fed scare

By buying more long-maturity bonds, long-term interest rates would be kept low. But in the absence of such a commitment, the US dollar initially shot higher, along with 10-year Treasury yields. However, a few soothing words from the Fed chief soon put a stop to all that and the dollar came crashing back down.

Chair Powell attempted in his press conference to balance the optimistic medium-term forecasts with a somewhat more downbeat assessment of the near-term prospects for the economy. More significantly, Powell kept the door open to both the possibilities of increasing the size of asset purchases as well as buying more longer-dated bonds.

At the end of it, not a lot had changed to trigger a shift in the markets’ perception of where yield spreads are headed, which means the greenback is likely to stay on a downward course for a while yet. The dollar index slid to a 32-month low today, suggesting investors were satisfied with Powell’s dovish tone.

Pound extends rally on Brexit progress

The dollar’s broad-based selloff meant all other currencies were winners on Thursday, but the usual standouts were the pound and the antipodean pairs. Cable has its sights set on the $1.36 level as Britain and the European Union make progress in their negotiations to reach a post-Brexit trade deal before the transition period ends on December 31.

While the two sides reportedly now see a ‘landing zone’ for an agreement on a level playing field, difficulties over fisheries are likely to drag the talks into the weekend. The UK government dashed hopes of an imminent deal by pressing ahead with plans for Parliament to go into recess from today, but should it be suddenly recalled, this would signal that a deal is near.

The euro also scaled new heights on Thursday, extending its gains above the $1.22 level, though it slipped versus the pound.

New records for Wall Street, aussie and kiwi surge

The mood elsewhere was buoyant too as equities were lifted from growing signs that US lawmakers are close to striking a deal on a new virus relief bill. The latest reports indicate congressional leaders are eyeing a $900 billion package that will include stimulus checks of between $600 and $700. If all goes well, voting could begin as early as today.

Wall Street indices, with the exception of the Dow Jones Industrial Average, closed at record highs on Wednesday and equity futures were pointing to a positive start for today. European stocks were also up, along with major commodity prices, boosting the aussie and kiwi.

The Australian dollar was additionally bolstered by stronger-than expected employment figures out of Australia today, pushing the currency above $0.76 for the first time since June 2018. The New Zealand dollar also celebrated upbeat data as New Zealand’s economy recouped all of the lost output from the pandemic to stand marginally in growth territory over the year to September. The kiwi is climbing to more than 2½-year highs following the GDP report and the Fed’s decision.

Coming up later today, the Bank of England will announce its latest policy decision at 12:00 GMT, followed by the Bank of Japan early on Friday, though both are anticipated to be non-events.